LCM -Overview of Minimum Deposit, Spreads & Leverage

الملخص:LCM, also known as London Currency Markets, is an offshore ECN/STP broker registered in Turkey, and advertises that it offers trading in FX, Commodities, Indices and Stock CFDs through the MT5 platform. However, LCM currently doesn’t hold any valid regulatory license to operate financial services.

General Information

| LCM Review Summary in 10 Points | |

| Founded | N/A |

| Registered Country/Region | Turkey |

| Regulation | No license |

| Market Instruments | FX, commodities, indices and stock CFDs |

| Demo Account | N/A |

| Leverage | 1:1000 |

| EUR/USD Spread | From 1.2 pips (Std) |

| Trading Platforms | MT5 |

| Minimum Deposit | N/A |

| Customer Support | 24/7 multilingual live chat, phone, email, online messaging, Messenger |

What is LCM?

LCM, also known as London Currency Markets, is an offshore ECN/STP broker registered in Turkey, and advertises that it offers trading in FX, Commodities, Indices and Stock CFDs through the MT5 platform. However, LCM currently doesnt hold any valid regulatory license to operate financial services.

Pros & Cons

| Pros | Cons |

| • Wide range of market instruments | • Lack of regulation |

| • Multiple account types | • Reports of potential withdrawal issues and scams |

| • Provision of demo accounts | • Residents of North Korea, United States, Puerto Rico, Canada, Japan, Iran, Iraq, Lebanon, and Turkey are excluded |

| • Competitive spreads | • No info on minimum deposit |

| • Commission-free accounts available | |

| • Availability of MT5 trading platform | |

| • Popular payment methods supported | |

| • Fee-free funding options | |

| • 24/7 multilingual customer support |

Is LCM Safe or Scam?

As LCM lacks valid regulation. The absence of regulation means there is no independent entity monitoring LCM's operations, compliance with industry standards, and client fund protection. This increases the risk for traders, as there may be a lack of transparency and accountability. It is essential for traders to carefully evaluate and consider the risks associated with trading on an unregulated platform like LCM before making any investment decisions.

Market Instruments

LCM offers traders a comprehensive range of market instruments across different asset classes. In the foreign exchange (FX) market, traders can access a wide variety of currency pairs, including major, minor, and exotic pairs. This allows for diverse trading opportunities and the ability to capitalize on global currency movements.

In addition to FX, LCM provides access to various commodities. Traders can participate in the commodities market by trading popular assets such as gold, silver, crude oil, natural gas, and agricultural products. These commodities offer opportunities for hedging against inflation, diversification, and speculation based on supply and demand dynamics.

LCM also offers trading in indices, which represent the performance of a basket of stocks from a specific market or sector. Traders can speculate on the movement of major indices such as the S&P 500, FTSE 100, DAX 30, and others. Trading indices allows investors to take positions on broader market trends and potentially benefit from the performance of multiple companies within a specific market.

Furthermore, LCM provides stock CFDs (Contracts for Difference) that allow traders to speculate on the price movements of individual stocks without owning the underlying asset. This provides flexibility and the opportunity to trade stocks from various global exchanges, including major companies in the US, Europe, and other regions.

Accounts

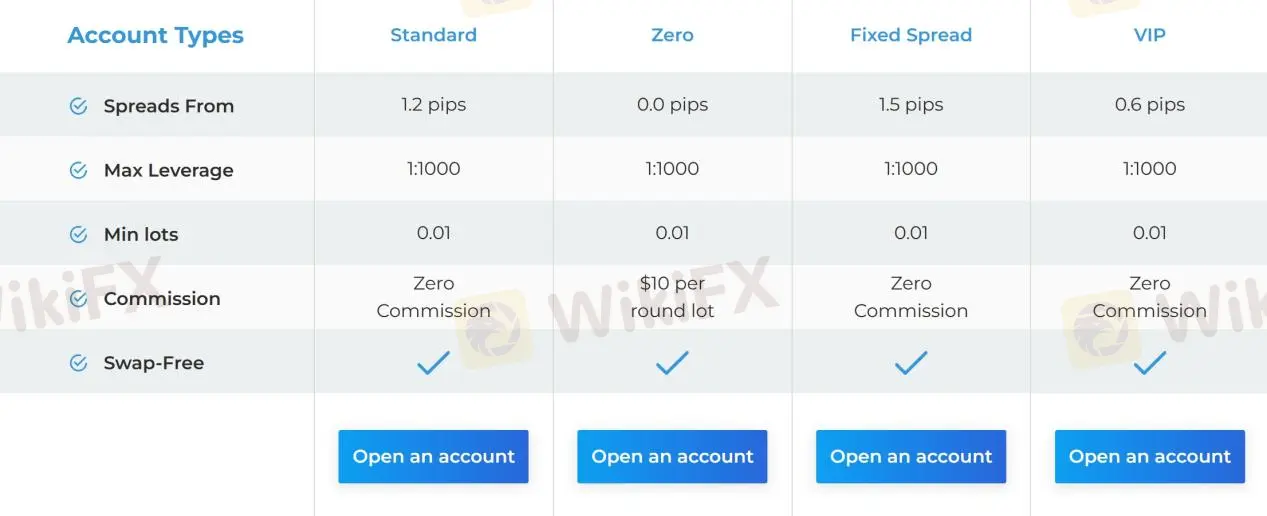

LCM offers a range of account types to cater to the diverse needs and preferences of traders. The account types available include Standard, Zero Spread, Fixed Spread, and VIP accounts, all of which are swap-free, making them suitable for traders adhering to Islamic principles.

The Standard account is designed for traders who prefer a traditional trading experience. It provides access to a wide range of trading instruments and typically offers competitive spreads.

The Zero Spread account is tailored for traders seeking low-cost trading. It offers tight spreads with no additional commission charges. This account type is suitable for traders who value transparency and want to minimize trading costs.

The Fixed Spread account is suitable for traders who prefer stability in their trading costs. It offers fixed spreads on trading instruments, allowing traders to know their costs upfront. This account type may be preferred by traders who want consistency in their trading expenses, regardless of market volatility.

LCM also offers a VIP account for high-volume traders or those with larger account sizes. The VIP account provides additional benefits, such as personalized services, dedicated account managers, and tailored trading conditions. This account type is designed to meet the specific needs of experienced and professional traders.

While the minimum deposit requirement for the LCM account types is not mentioned, it is common for brokers to have varying minimum deposit requirements for each account type. Traders are advised to contact LCM directly or refer to their official website for precise details regarding the minimum deposit requirement for each account type.

Leverage

The leverage LCM offers, however, is not okay - 1:1000 is too much for retail traders, as a majority of the regulatory bodies out there have ruled. Leverage is a tool that allows traders to control larger positions in the market with a smaller amount of capital. For example, with a leverage ratio of 1:1000, traders can control a position that is 1000 times larger than their actual account balance.

The availability of high leverage can be appealing to traders who seek the potential for higher returns on their investments. It allows them to trade larger volumes and potentially amplify their profits. However, it's important to note that leverage is a double-edged sword. While it can magnify gains, it can also amplify losses. Traders must exercise caution and have a solid risk management strategy in place when utilizing high leverage.

It's worth mentioning that trading with high leverage requires a good understanding of the market, risk management techniques, and a disciplined approach to trading. Traders should carefully consider their risk tolerance, financial situation, and trading experience before utilizing high leverage.

Spreads & Commissions

The spread and commission vary on the account type. The spread refers to the difference between the bid and ask price of a financial instrument, and it represents the cost of trading for traders. LCM provides competitive spreads across its different account types.

For the Standard account, the spread starts from 1.2 pips, but no additional commission charges. The Fixed Spread account offers spreads starting from 1.5 pips, and also, commission is free.

The Zero account stands out with its spread starting from 0.0 pips, which indicates tighter spreads and potentially lower trading costs. However, it's important to note that this account type charges a commission of $10 per round lot. Traders who value tighter spreads and are comfortable with paying a commission might find the Zero account appealing.

Lastly, the VIP account offers competitive spreads starting from 0.6 pips, providing traders with potentially lower trading costs compared to the other account types. Importantly, there are no additional commissions charged for trades made with the VIP account, making it an attractive option for traders looking for tight spreads without commission fees.

| Account Type | Standard | Zero | Fixed Spread | VIP |

| Spreads from | 1.2 pips | 0.0 pips | 1.5 pips | 0.6 pips |

| Commission | $0 | $10 per round lot | $0 | $0 |

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commission (per lot) |

| LCM | 1.2 (Std) | No commission (Std) |

| OANDA | 0.9 | No commission |

| FOREX TB | 1.0 | $6 |

| Markets.com | 0.6 | No commission |

Trading Platforms

LCM provides its clients with access to the popular MetaTrader5 (MT5) trading platform. MT5 is a widely recognized and trusted platform in the industry, known for its advanced features and user-friendly interface. With MT5, traders have the flexibility to access their trading accounts on various devices and operating systems, ensuring convenience and seamless trading experiences.

For Windows and OS X users, LCM offers a downloadable version of the MT5 platform. This allows traders to install the software directly on their computers and access a comprehensive set of tools and features. The desktop version provides real-time price quotes, advanced charting capabilities, multiple timeframes, and a wide range of technical indicators for in-depth market analysis.

LCM also offers the MT5 WebTrader, which is a web-based platform accessible through a web browser. This allows traders to access their accounts and trade from any device with an internet connection, without the need for downloading or installing any software. The WebTrader retains most of the functionalities available in the desktop version, enabling traders to monitor their positions, place trades, and analyze markets conveniently.

For traders who prefer to trade on the go, LCM provides MT5 mobile applications for Android and iOS devices. These mobile apps offer a user-friendly interface and allow traders to access their accounts, monitor the markets, execute trades, and manage positions from their smartphones or tablets.

Deposits & Withdrawals

LCM provides its clients with a convenient and hassle-free deposit and withdrawal process. The broker offers a variety of fee-free funding options, ensuring that traders can easily add funds to their trading accounts. Clients can choose from options such as local transfers, Visa, MasterCard, Neteller, Skrill, Qiwi wallet, and Fasapay. These options cater to different preferences and allow for quick and secure transactions. However, a 10% transfer fee will be charged for withdrawals. Traders should consider this fee when planning their withdrawals.

Customer Service

LCM offers 24/7 multilingual support, ensuring that traders can seek assistance at any time, regardless of their geographical location. The support team can be reached through various channels, including live chat, phone, email, online messaging, and Messenger, allowing for quick and convenient communication.

In addition to direct contact options, LCM maintains an active presence on various social networks, including Twitter, Facebook, Instagram, YouTube, and LinkedIn. This enables clients to stay updated with the latest news, market insights, and educational content provided by the broker. The FAQ section available on the website serves as a valuable resource, offering answers to commonly asked questions and providing self-help solutions.

Overall, LCM demonstrates a strong commitment to customer service by offering round-the-clock support, multiple communication channels, and an engaging presence on social media platforms. The broker's customer-centric approach ensures that clients can receive prompt assistance, stay informed, and have a positive trading experience.

User Exposure at WikiFX

On our website, you can see that reports of unable to withdraw, severe slippage and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

قراءة المزيد

تعرّف على سعر الذهب اليوم في العراق الأربعاء 14 فبراير 2024

حقق سعر الذهب اليوم في العراق، الأربعاء 14 فبراير، انخفاض نسبي في مستهل جلسات التداول، تزامناً مع تراجع سعر الذهب في البورصة العالمية، حيث سجلت العقود الآجلة عند مستوى 1,992.74 دولار للأوقية، ومن خلال السطور التالية سنتعرف على متوسط سعر الذهب اليوم في العراق لجميع أعيرة الذهب بالدينار العراقي (IQD).

سعر الذهب اليوم في العراق 11 يناير 2024

متوسط اسعار الذهب اليوم بأسواق المال في العراق بالدينار العراقي

متوسط اسعار الذهب اليوم بأسواق المال في العراق بالدينار العراقي

سعر الذهب اليوم في العراق

أسعار الذهب مستهل تعاملات اليوم الخميس 23 نوفمبر 2023

ننشر أسعار الذهب مستهل تعاملات اليوم الخميس 23 نوفمبر 2023، حيث سجل جرام الذهب عيار 21 وهو العيار الرئيسي لسوق الذهب في مصر 2725 جنيها، مقابل 2800 جنيها للجرام

وسيط WikiFX

أحدث الأخبار

اكتشف سبب تصنيف Trendo كأحد أخطر الوسطاء في 2025

تقييم شركة Zenstox | هل هي شركة تداول موثوقة أم عملية احتيال؟

5 أشياء لم يخبرك بها أحد عن Forex Iraq

شركة MBFX المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

كم تعرف حقًا عن وسطاء التداول؟ شارك رأيك واربح

فضيحة ضمان ماركتس | تجربة متداول يكشف التأخير في سحب الأموال وممارسات مشبوهة

منصة بوكيت أوبشن Pocket Option – تسرق 115,000,000 دولار من متداول يمني

شركة FXGiants المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

شركة XHK المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

حساب النسبة