CGFX

الملخص:CGFX, also known as Commercial Group FX, is an online trading broker that provides access to the popular MT5 platform. It offers a variety of trading instruments across different asset classes.

| CGFX Review Summary | |

| Founded | 2011 |

| Registered Country/Region | Mauritius |

| Regulation | FSC (Offshore) |

| Market Instruments | Forex, Metals, Indices, Shares and Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | From 0.0 pips |

| Trading Platform | MT5 |

| Social Trading | ✅ |

| Min Deposit | $50 |

| Customer Support | 24/6 multilingual support |

| Live chat, contact form | |

| Tel: +1 (650) 491-9997, +44 204 571 6608 | |

| WhatsApp: +1 (650) 491 - 9997 | |

| Email: info@cgfx.com | |

| Social media: Facebook, Instagram, YouTube, Linkedin, WhatsApp | |

| Address: Suite 305, Griffith Corporate Centre, Pobox 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines | |

| Premier Business Center, 10th Floor, Sterling Tower, 14 Poudriere St., Port Louis, Republic of Mauritius | |

| Regional Restrictions | The United States, Iran, Syria, and North Korea |

CGFX, also known as Commercial Group FX, is an online trading broker that provides access to the popular MT5 platform. It offers a variety of trading instruments across different asset classes.

The company was originally established as Commercial Group for Trading in International Markets (CGTIM) in 1998 and was the first of its kind to be registered in the Hashemite Kingdom of Jordan. In 2011, CGTIM underwent rebranding and expansion efforts, leading to its current name, Commercial Group FX (CGFX).

Pros and Cons

| Pros | Cons |

| Various trading assets | Offshore FSC regulation |

| Demo accounts offered | Regional restrictions |

| Multiple account types | |

| Commission-free account offered | |

| Tight spreads | |

| Popular trading platform MT5 | |

| Social trading | |

| Low minimum deposit | |

| Multiple payment options | |

| Live chat support | |

| 24/6 multilingual support |

Is CGFX Legit?

CGFX states that they have implemented safeguards such as Segregation of accounts, Banking relations, and secure technologies and services to protect their clients.

However, it is offshore regulated by the Financial Services Commission (FSC). Therefore, investing with CGFX carries a certain level of risk.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| The Financial Services Commission (FSC) | Offshore Regulated | CG Global Ltd | Retail Forex License | GB22200249 |

What Can I Trade on CGFX?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Commodities | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

CGFX offers three account types: CG-Plus, CG-PRO and CG Prime. Demo accounts, swap-free accounts are also offered.

| Account Type | Min Deposit |

| CG-Plus | $50 |

| CG-PRO | $250 |

| CG Prime | $1 000 |

Leverage

CGFX's leverage is capped at 1:400. Note that high leverage not only brings high profits but also high losses.

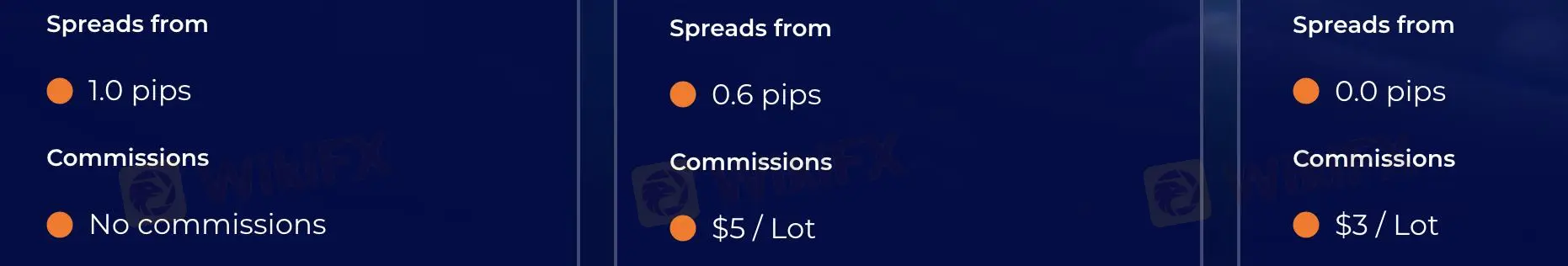

Spread and Commission

CGFX's spreads and commissions both vary by accounts.

| Account Type | Spread | Commission |

| CG-Plus | From 1.0 pips | ❌ |

| CG-PRO | From 0.6 pips | $5/lot |

| CG Prime | From 0.0 pips | $3/lot |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC and Mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

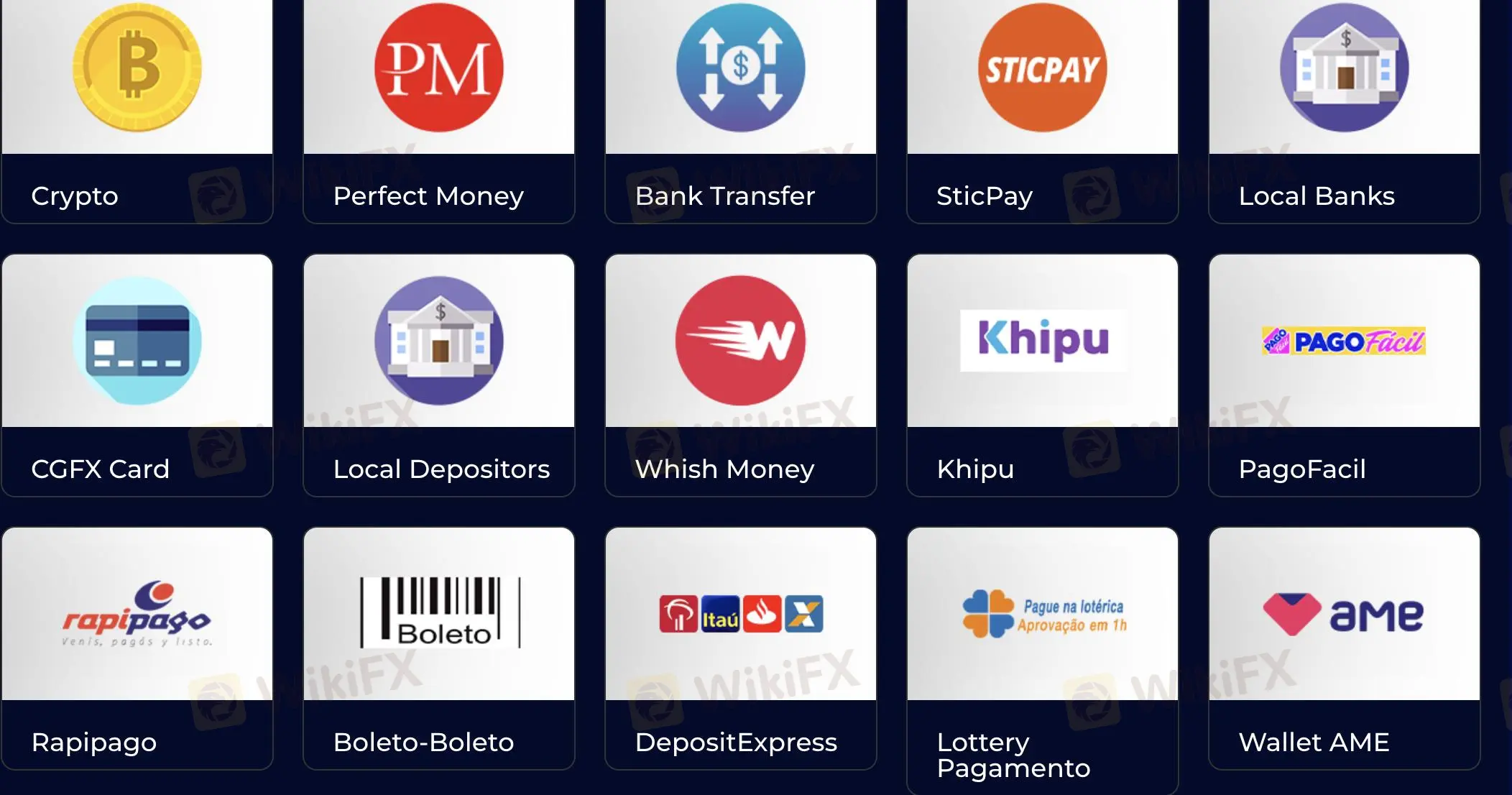

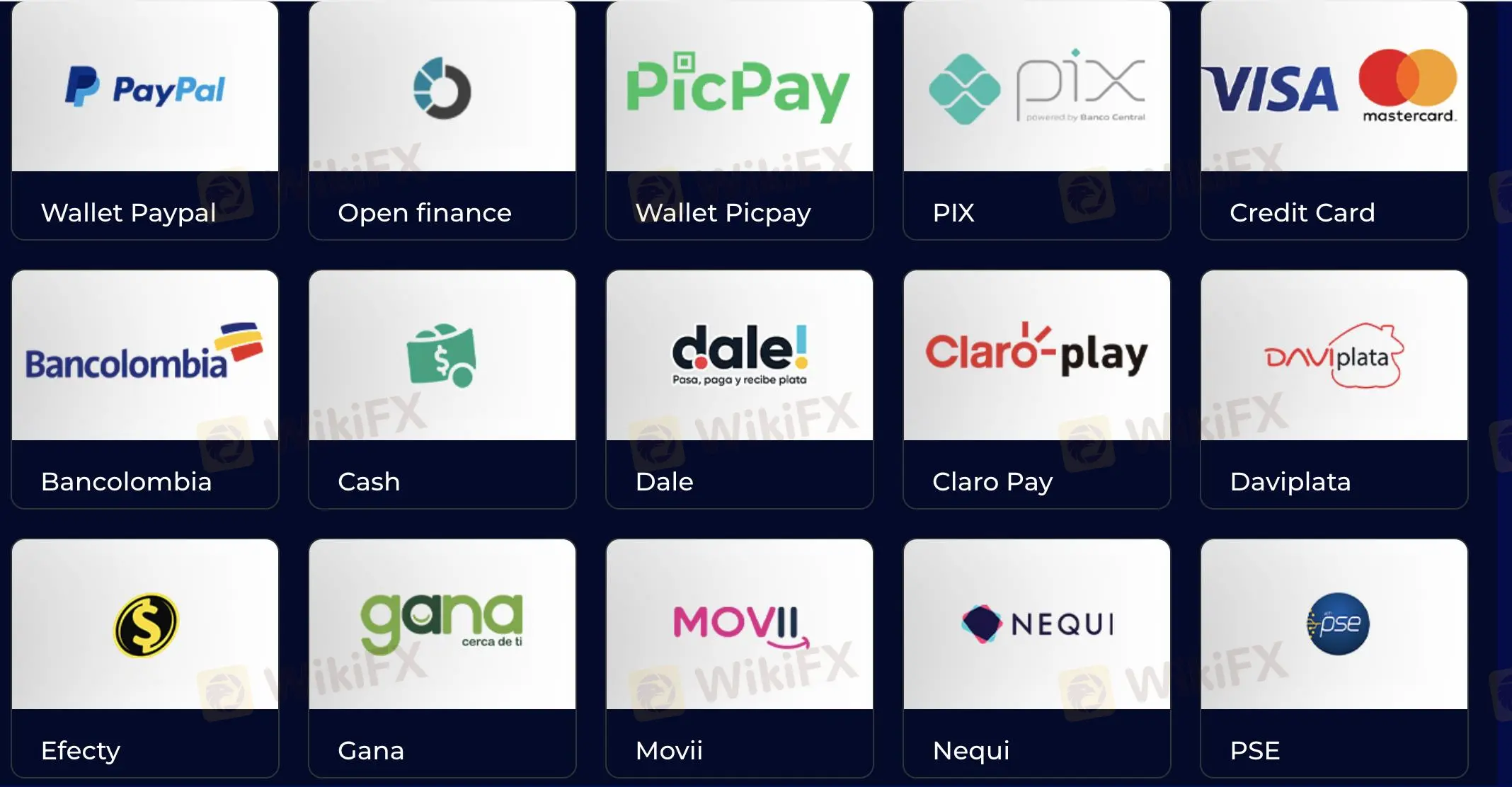

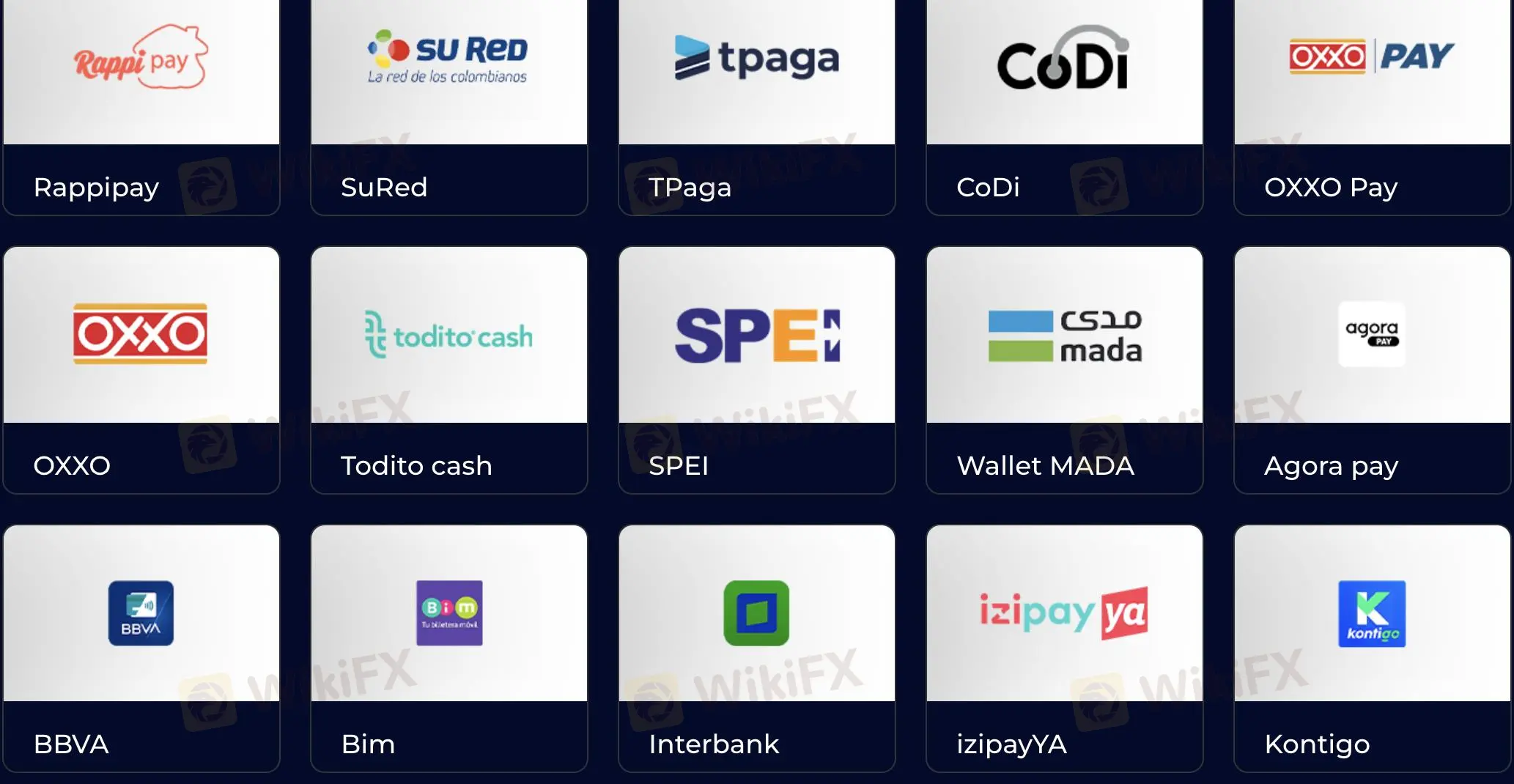

Deposit and Withdrawal

CGFX accepts deposits and withdrawals via Crypto, Perfect Money, Bank Transfer, SticPay, Local Banks, CGFX Card, Local Depositors, Whish Money, Khipu, PagoFacil, Rapipago, Boleto-Boleto, Lottery Pagamento, Wallet AME, DepositExpress, Wallet Paypal, Open finance, Wallet Picpay, РІХ, Credit Card, Bancolombia, Cash, Dale, Claro Pay, Daviplata, Efecty, Gana, Movii, Nequi, PSE, SuRed, CoDi, Rappipay, TPaga, OXXO Pay, OXXO, Todito cash, SPEI, Wallet MADA, Agora pay, BBVA, Bim, Interbank, izipayYA, Kontigo, Ligo,Mobile card, Plin, Scotiabank, Sodexo, Tunki, Tarjeta W, Wallet diners, Yape, M-Pesa, Eazy, ΜΤΝ, Airtel Money, Tigo Pesa, Zamtel, Halo Pesa, and Vodacom Mpesa.

وسيط WikiFX

أحدث الأخبار

أفضل 5 شركات فوركس بدون عمولة في 2025

"خسرت 1000 دولار بسبب هذا الوسيط" ~ صرّح الضحية

شكوى ضد GlobTFX

شركة FXEM المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

شركة Duttfx Markets المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

الفوركس في 2025 | استراتيجيات لتحقيق النجاح في سوق متقلب

حساب النسبة