2024-07-22 11:35

الصناعةAUDUSD H4 Report - 22 July 2024

combined with selling pressure following a rebound in the yen, have dampened bullish sentiment on the Australian dollar (AUD). Although Australia's employment market data should have boosted the AUD, the market reaction has been subdued. Futures suggest only a 20% chance of an interest rate hike by the Reserve Bank of Australia (RBA) at its August meeting. The data failed to provide upward momentum for the AUD. Additionally, the strong rebound of the US dollar (USD) on the day, which rose to 104.4, continued to exert downward pressure on the AUD. President Biden’s withdrawal from the election increased risk aversion, but the upcoming US GDP and PCE data releases this week could result in significant volatility for the AUD.

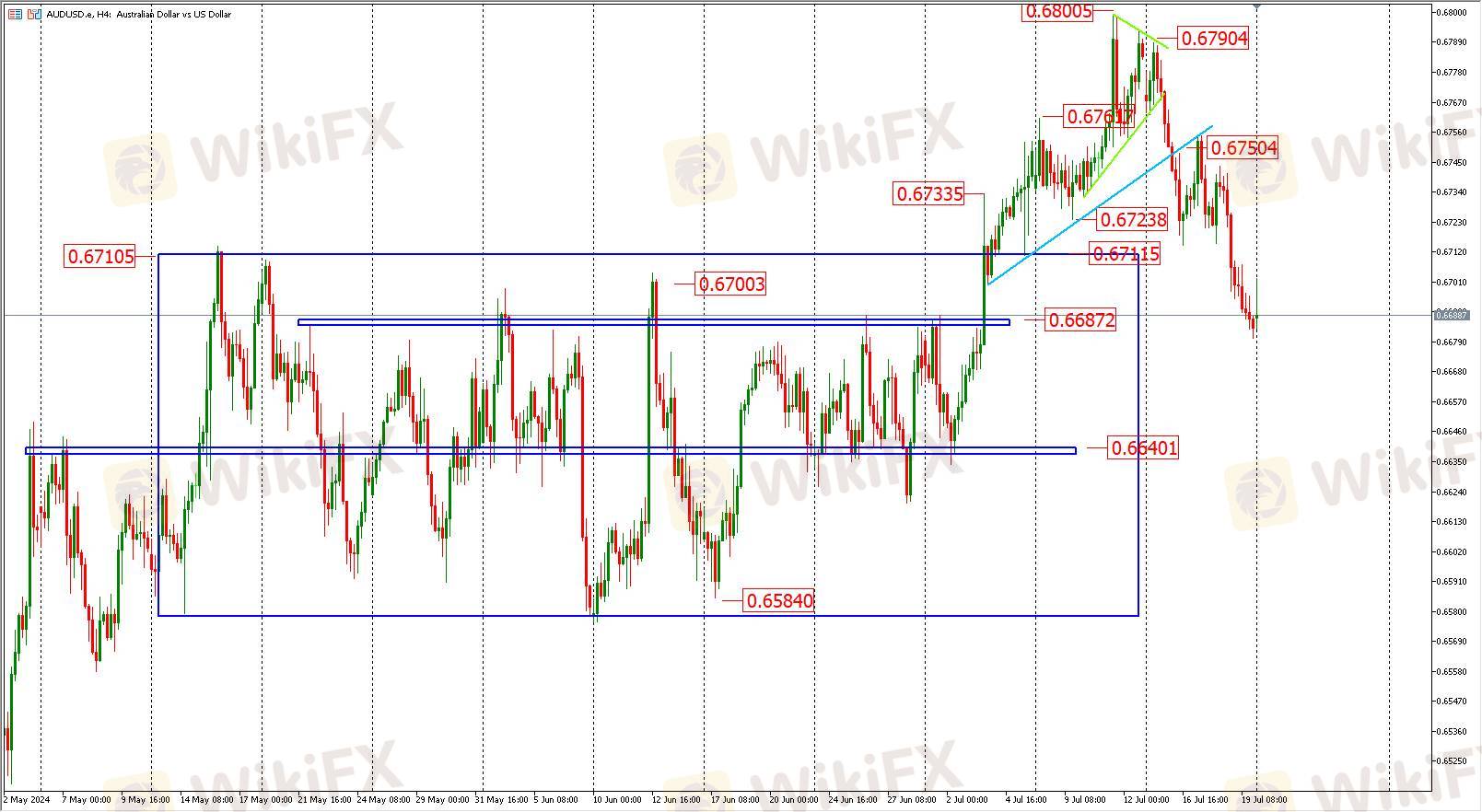

Technical Analysis:

The AUD’s decline last week wiped out the gains from the previous two weeks, closing near the high of the last week of June around 0.668, which serves as the second support platform from the past eight weeks of fluctuations. Close attention should be paid to the support level at 0.668. If this level is breached, the AUD may fluctuate within the 0.668-0.664 range. If the 0.668 support holds, the AUD may continue to trade within the 0.668-0.671 range.

Key Levels:

Resistance: First level at 0.670, second level at 0.671, third level at 0.673.

Support: First level at 0.668, second level at 0.666, third level at 0.664.

إعجاب 0

FPGv 我baconjellyy

交易者

مناقشة حية

الصناعة

NFP updates URDU

الصناعة

دوج كوين

الصناعة

دوجكوين

الصناعة

صعود الذهب

الصناعة

لقاحات كورونا

الصناعة

السيارات

فئة المنتدى

منصة

المعرض

الوكيل

التوظيف

استيراتيجية التداول التلقائي

الصناعة

السوق

المؤشر

AUDUSD H4 Report - 22 July 2024

| 2024-07-22 11:35

| 2024-07-22 11:35combined with selling pressure following a rebound in the yen, have dampened bullish sentiment on the Australian dollar (AUD). Although Australia's employment market data should have boosted the AUD, the market reaction has been subdued. Futures suggest only a 20% chance of an interest rate hike by the Reserve Bank of Australia (RBA) at its August meeting. The data failed to provide upward momentum for the AUD. Additionally, the strong rebound of the US dollar (USD) on the day, which rose to 104.4, continued to exert downward pressure on the AUD. President Biden’s withdrawal from the election increased risk aversion, but the upcoming US GDP and PCE data releases this week could result in significant volatility for the AUD.

Technical Analysis:

The AUD’s decline last week wiped out the gains from the previous two weeks, closing near the high of the last week of June around 0.668, which serves as the second support platform from the past eight weeks of fluctuations. Close attention should be paid to the support level at 0.668. If this level is breached, the AUD may fluctuate within the 0.668-0.664 range. If the 0.668 support holds, the AUD may continue to trade within the 0.668-0.671 range.

Key Levels:

Resistance: First level at 0.670, second level at 0.671, third level at 0.673.

Support: First level at 0.668, second level at 0.666, third level at 0.664.

إعجاب 0

أريد أن اترك تعليق

تقديم

0تعليقات

لا توجد تعليقات حتى الآن ، كن أول شخص يعلق

تقديم

لا توجد تعليقات حتى الآن ، كن أول شخص يعلق