2025-02-06 23:38

الصناعةCORRELATION BETWEEN FOREX PAIRS

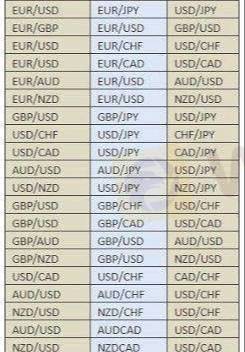

Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

إعجاب 0

BeastBoy2159

المتداول

مناقشة حية

الصناعة

NFP updates URDU

الصناعة

دوج كوين

الصناعة

دوجكوين

الصناعة

صعود الذهب

الصناعة

لقاحات كورونا

الصناعة

السيارات

فئة المنتدى

منصة

المعرض

الوكيل

التوظيف

استيراتيجية التداول التلقائي

الصناعة

السوق

المؤشر

CORRELATION BETWEEN FOREX PAIRS

الجزائر | 2025-02-06 23:38

الجزائر | 2025-02-06 23:38Correlation Between Forex Pairs

In forex trading, correlation refers to the relationship between two currency pairs and how they move in relation to each other. A positive correlation means both pairs move in the same direction, while a negative correlation means they move in opposite directions.

Types of Correlation:

1. Positive Correlation – Pairs like EUR/USD and GBP/USD tend to move together because both are often affected by the US dollar.

2. Negative Correlation – Pairs like EUR/USD and USD/CHF usually move in opposite directions since the Swiss franc often strengthens when the US dollar weakens.

Why Correlation Matters:

Helps traders diversify their positions and reduce risk.

Prevents overexposure to the same market move.

Can be used for hedging strategies to protect against losses.

Traders often use correlation coefficients (ranging from -1 to +1) to measure the strength of the relationship between pairs. A value close to +1 indicates strong positive correlation, while a value near -1 suggests strong negative correlation.

#firstdealofthenewyear-Bronz

إعجاب 0

أريد أن اترك تعليق

تقديم

0تعليقات

لا توجد تعليقات حتى الآن ، كن أول شخص يعلق

تقديم

لا توجد تعليقات حتى الآن ، كن أول شخص يعلق