2025-02-17 21:53

الصناعةIgnoring proper stop loss placement

#forexrisktip

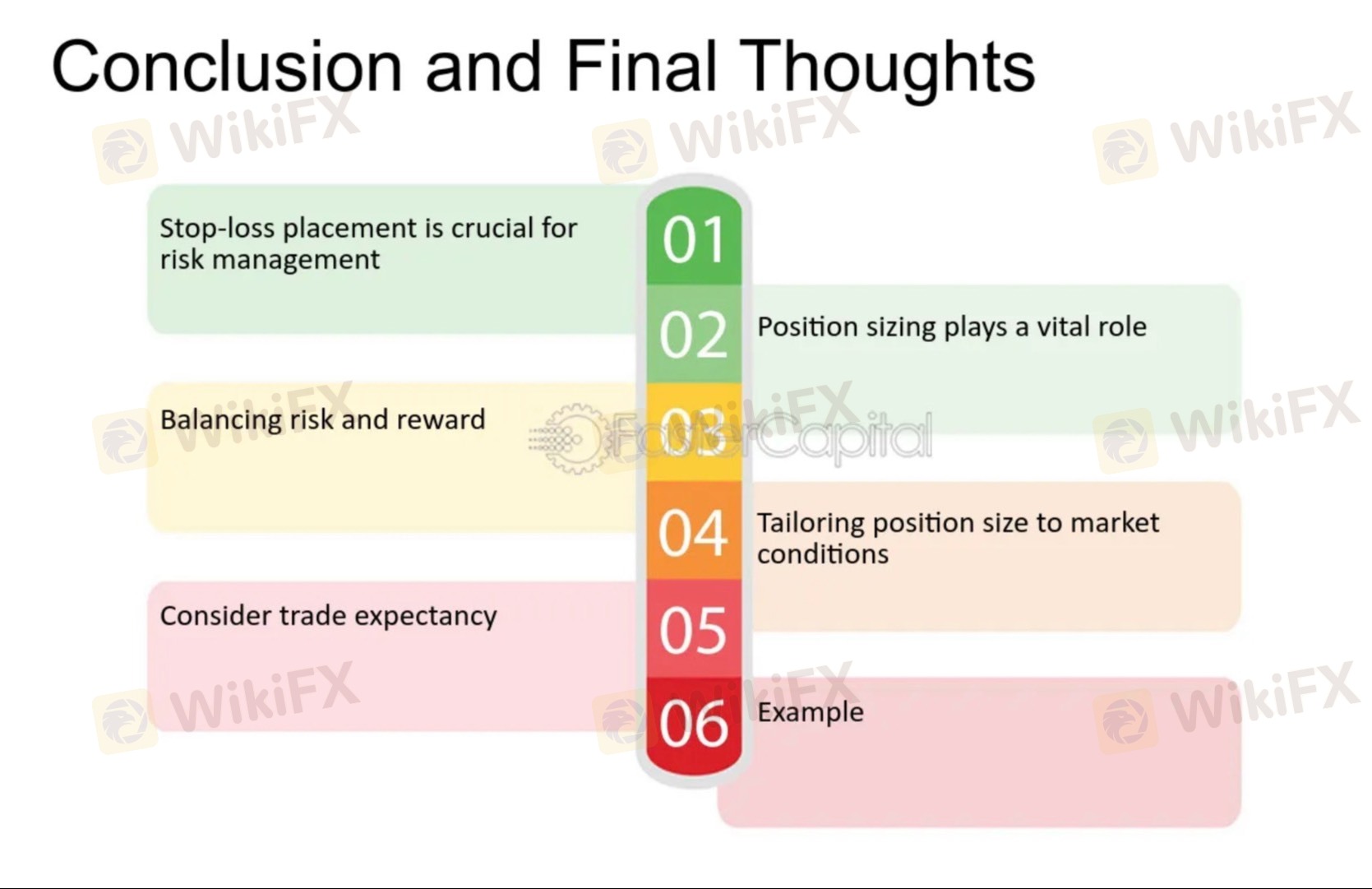

Ignoring proper stop-loss placement is a critical mistake in trading and investing, as it significantly increases risk exposure. Here are the key consequences and best practices to avoid them:

Consequences of Ignoring Stop-Loss Placement:

1. Unlimited Loss Potential: Without a stop-loss, losses can accumulate rapidly if the market moves against your position, leading to significant capital erosion.

2. Emotional Decision-Making: When no predefined exit is set, traders often hold onto losing positions out of hope, fear, or greed, worsening losses.

3. Margin Calls and Account Blowouts: For leveraged positions, failing to use stop-losses can lead to margin calls or even a complete account wipeout if the market moves sharply.

4. Disruption of Risk Management: Proper stop-loss placement is integral to effective risk management. Ignoring it undermines the risk-reward ratio and overall trading strategy.

5. Psychological Stress: Watching a losing position without a planned exit can cause stress and anxiety, impairing decision-making for future trades.

Best Practices for Effective Stop-Loss Placement:

1. Determine Risk Tolerance: Set a maximum loss per trade (e.g., 1-2% of total capital) to limit risk exposure.

2. Technical Analysis: Use technical levels such as support and resistance, moving averages, or trend lines for strategic stop-loss placement.

3. Volatility Consideration: Adjust stop-losses based on market volatility. Use indicators like the Average True Range (ATR) to set dynamic stops that account for price swings.

4. Position Sizing: Calculate position size relative to the stop-loss distance to ensure risk is kept within acceptable limits.

5. Avoid Emotional Adjustments: Once placed, avoid moving stop-loss orders based on emotional reactions. Stick to the initial risk management plan.

6. Use of Trailing Stops: Consider using trailing stop-loss orders to lock in profits as the trade moves in your favor while protecting against reversals.

7. Backtesting and Optimization: Test different stop-loss strategies using historical data to find the most effective approach for your trading style and market.

Would you like help calculating stop-loss levels or guidance on using technical indicators for better placement?

إعجاب 0

FX1172222260

Nhà đầu tư

مناقشة حية

الصناعة

NFP updates URDU

الصناعة

دوج كوين

الصناعة

دوجكوين

الصناعة

صعود الذهب

الصناعة

لقاحات كورونا

الصناعة

السيارات

فئة المنتدى

منصة

المعرض

الوكيل

التوظيف

استيراتيجية التداول التلقائي

الصناعة

السوق

المؤشر

Ignoring proper stop loss placement

الهند | 2025-02-17 21:53

الهند | 2025-02-17 21:53#forexrisktip

Ignoring proper stop-loss placement is a critical mistake in trading and investing, as it significantly increases risk exposure. Here are the key consequences and best practices to avoid them:

Consequences of Ignoring Stop-Loss Placement:

1. Unlimited Loss Potential: Without a stop-loss, losses can accumulate rapidly if the market moves against your position, leading to significant capital erosion.

2. Emotional Decision-Making: When no predefined exit is set, traders often hold onto losing positions out of hope, fear, or greed, worsening losses.

3. Margin Calls and Account Blowouts: For leveraged positions, failing to use stop-losses can lead to margin calls or even a complete account wipeout if the market moves sharply.

4. Disruption of Risk Management: Proper stop-loss placement is integral to effective risk management. Ignoring it undermines the risk-reward ratio and overall trading strategy.

5. Psychological Stress: Watching a losing position without a planned exit can cause stress and anxiety, impairing decision-making for future trades.

Best Practices for Effective Stop-Loss Placement:

1. Determine Risk Tolerance: Set a maximum loss per trade (e.g., 1-2% of total capital) to limit risk exposure.

2. Technical Analysis: Use technical levels such as support and resistance, moving averages, or trend lines for strategic stop-loss placement.

3. Volatility Consideration: Adjust stop-losses based on market volatility. Use indicators like the Average True Range (ATR) to set dynamic stops that account for price swings.

4. Position Sizing: Calculate position size relative to the stop-loss distance to ensure risk is kept within acceptable limits.

5. Avoid Emotional Adjustments: Once placed, avoid moving stop-loss orders based on emotional reactions. Stick to the initial risk management plan.

6. Use of Trailing Stops: Consider using trailing stop-loss orders to lock in profits as the trade moves in your favor while protecting against reversals.

7. Backtesting and Optimization: Test different stop-loss strategies using historical data to find the most effective approach for your trading style and market.

Would you like help calculating stop-loss levels or guidance on using technical indicators for better placement?

إعجاب 0

أريد أن اترك تعليق

تقديم

0تعليقات

لا توجد تعليقات حتى الآن ، كن أول شخص يعلق

تقديم

لا توجد تعليقات حتى الآن ، كن أول شخص يعلق