ProRealTime-Overview of Minimum Deposit, Spreads & Leverage

الملخص:ProRealTime Trading is the trading name of ProRealTime SAS, which is an investment company registered in France. In fact, ProRealTime Trading is a technical analysis platform similar to Tradingview.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Registered Country/Region | France |

| Regulation | Suspicious clone |

| Market Instrument | stocks, futures, forex, CFDs, gold & silver, commodities, rates & bonds, and options |

| Account Type | 1st, 2nd and 3rd |

| Demo Account | yes |

| Minimum Deposit | €1,000 |

ProRealTime Trading is the trading name of ProRealTime SAS, which is an investment company registered in France. In fact, ProRealTime Trading is a technical analysis platform similar to Tradingview.

Here is the home page of their official site:

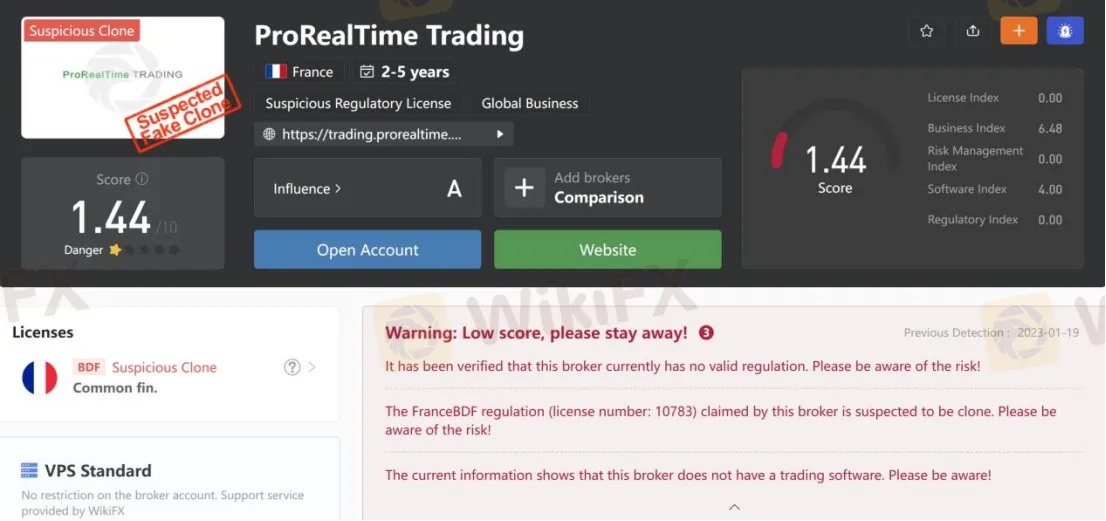

It is important to note that although ProRealTime SAS claims to be a dealer authorized and regulated by the French Prudential Supervision Authority (ACPR), it actually currently holds a license that is labelled as a cloned risk entity.

Note: The screenshot date is January 19, 2023. WikiFX gives dynamic scores, which will update in real time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

Users can use ProRealTime Trading for analysis and automated trading of a wide range of assets, including stocks, futures, forex, CFDs, gold & silver, commodities, rates & bonds, and options.

Account Types

Apart from free demo accounts, ProRealTime Trading claims to offer 3 types of trading accounts, namely 1st, 2nd and 3rd, with minimum initial capital requirements of €1,000, €3,000 and €3,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Brokerage Services

ProRealTime Trading works with leading brokers to execute orders for clients, including Saxo Bank, Interactive Brokers, and IG, allowing users to trade with a variety of brokers depending on their needs.

Trading Tools

ProRealTime Trading provides users with over 100 trading tools for technical analysis, charting, market scanning, automated trend detection, quote and volume analysis, market alerts, and more.

How to use

Users can download ProRealTime Trading for unlimited use from their computers, and the platform also offers a mobile app for iOS and Android devices.

Customer Support

ProRealTime Trading provides users with a dedicated account manager who can be contacted directly by phone: +44 (0)20 3868 8510, email: broker@prorealtime.com or send messages online. You can also follow this broker on social networks such as Twitter, Facebook and YouTube. Company address: 30 avenue Edouard Belin 92500 Rueil-Malmaison - FRANCE. In addition, the platform supports multiple language services including German, English, Spanish, French, Italian, and Dutch.

Pros & Cons

| Pros | Cons |

| • Rich trading instruments | • Suspicious clone |

| • Demo trial available |

Frequently Asked Questions (FAQs)

| Q 1: | Is ProRealTime Trading regulated? |

| A 1: | No. It has been verified that ProRealTime Trading is a suspicious clone. |

| Q 2: | Does ProRealTime Trading offer demo accounts? |

| A 2: | Yes. |

| Q 3: | What is the minimum deposit for ProRealTime Trading? |

| A 3: | The minimum initial deposit at ProRealTime Trading to open an account is €1,000. |

| Q 4: | Is ProRealTime Trading a good platform for beginners? |

| A 4: | No. ProRealTime Trading is not a good choice for beginners. Not only because of its suspicious clone condition, but also because of its extremely high initial deposit requirement. |

قراءة المزيد

"إكسبريس إلى مركز العاصفة! معرض Wiki FINANCE EXPO 2024 محطة طوكيو" لمحة عن قائمة الضيوف

الملخص: سيتم عقد "إكسبريس إلى مركز العاصفة! معرض Wiki FINANCE EXPO 2024 محطة طوكيو" في 22 يونيو 2024، في طوكيو، اليابان.

تراجع قياسي مستمر.. سعر الدولار في سوريا اليوم الأثنين 16 أكتوبر 2023

ينشر موقع ويكى اف اكس لقراءه متوسط أسعار صرف الدولار والعملات في سوريا خلال تعاملات اليوم الأثنين 16 أكتوبر 2023، حيث ارتفع سعر الأخضر، في المصرف المركزي والسوق الموازية.

تحقيق (WikiFX) عن الوسيط (Amtop Markets Ltd) : استنساخ مريب ، هكذا حذرت منه (FCA) .

أصدرت هيئة السلوك المالي البريطانية ( FCA) تحذيراً من التعامل مع الوسيط (Amtop Markets Ltd) في 17 يناير الحالي .

(WikiFX) : ما يجب ان تعرفه عن لوسيط الفوركس (USG) بكلمة واحدة ( احذر !!!)

أصدرت هيئة السلوك المالي البريطانية ( FCA) تحذيراً من التعامل مع الوسيط (USG) في 29 ديسمبر الحالي .

وسيط WikiFX

أحدث الأخبار

شركة Valuta Markets المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

هادي بوم.. الشيطان المُضلِّل لـ Expert Option | كيف يُباع الوهم تحت ستار "الثراء السريع"؟

شركة Cyberex Ltd المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

حساب النسبة