UniCredit Bank

الملخص:UniCredit Bank is a bank, which offering a range of banking and financial services. Headquartered in Budapest, Hungary, the bank operates across multiple countries, providing various services such as borrowing, banking, savings, insurance, and digital banking solutions. With a strong presence in the financial sector, UniCredit Bank has been known for its diverse portfolio of products and its commitment to delivering quality customer service.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| UniCredit Bank Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Hungary |

| Regulation | No regulation |

| Services | Borrowing, banking, savings, insurance, digital services |

| Customer Support | telephone, Linkedin |

What is UniCredit Bank?

UniCredit Bank is a bank, which offering a range of banking and financial services. Headquartered in Budapest, Hungary, the bank operates across multiple countries, providing various services such as borrowing, banking, savings, insurance, and digital banking solutions. With a strong presence in the financial sector, UniCredit Bank has been known for its diverse portfolio of products and its commitment to delivering quality customer service.

We will examine this broker's attributes from a variety of angles in the following post, giving you clear and organized information. Please continue reading if you're curious. To help you quickly comprehend the broker's qualities, we will also provide a concise conclusion at the end of the piece.

Pros & Cons

| Pros | Cons |

| • Diverse range of financial services | • Lack of valid regulation |

| • Lack of live chat support |

Is UniCredit Bank Safe or Scam?

UniCredit Bank is a bank which has a head office in Budapest, Hungary. However, this bank currently has no valid regulation, it is crucial for customers and potential clients to exercise extreme caution before engaging with the bank. It is recommended to seek advice from financial experts and consult with relevant financial regulatory authorities in the country where the bank operates to verify its legitimacy and safety. Additionally, customers should consider moving their funds to a properly regulated and supervised institution to ensure the safety of their deposits and financial transactions.

Services

UniCredit Bank is a bank that offers a wide range of services to its customers. Here is a brief summary of the key services provided by UniCredit Bank:

Borrowing: UniCredit Bank offers various lending solutions, such as personal loans, home loans, car loans, and business loans. These loans cater to the diverse needs of individuals and businesses, providing them with the necessary funds to meet their financial goals.

Banking: UniCredit Bank provides traditional banking services, including current accounts, savings accounts, and fixed deposits. These accounts enable customers to manage their day-to-day finances and earn interest in their savings.

Savings: UniCredit Bank offers various types of savings accounts, each tailored to meet different customer needs. These accounts typically provide a secure and accessible way for individuals to save money while earning interest in their balances.

Insurance: UniCredit Bank provides a range of insurance products, including life insurance, health insurance, property insurance, and other coverage options to protect individuals and businesses from unforeseen risks and events.

Digital Services: UniCredit Bank embraces technology and offers a suite of digital banking services. This includes online and mobile banking platforms, allowing customers to access their accounts, make transactions, and manage their finances conveniently from anywhere.

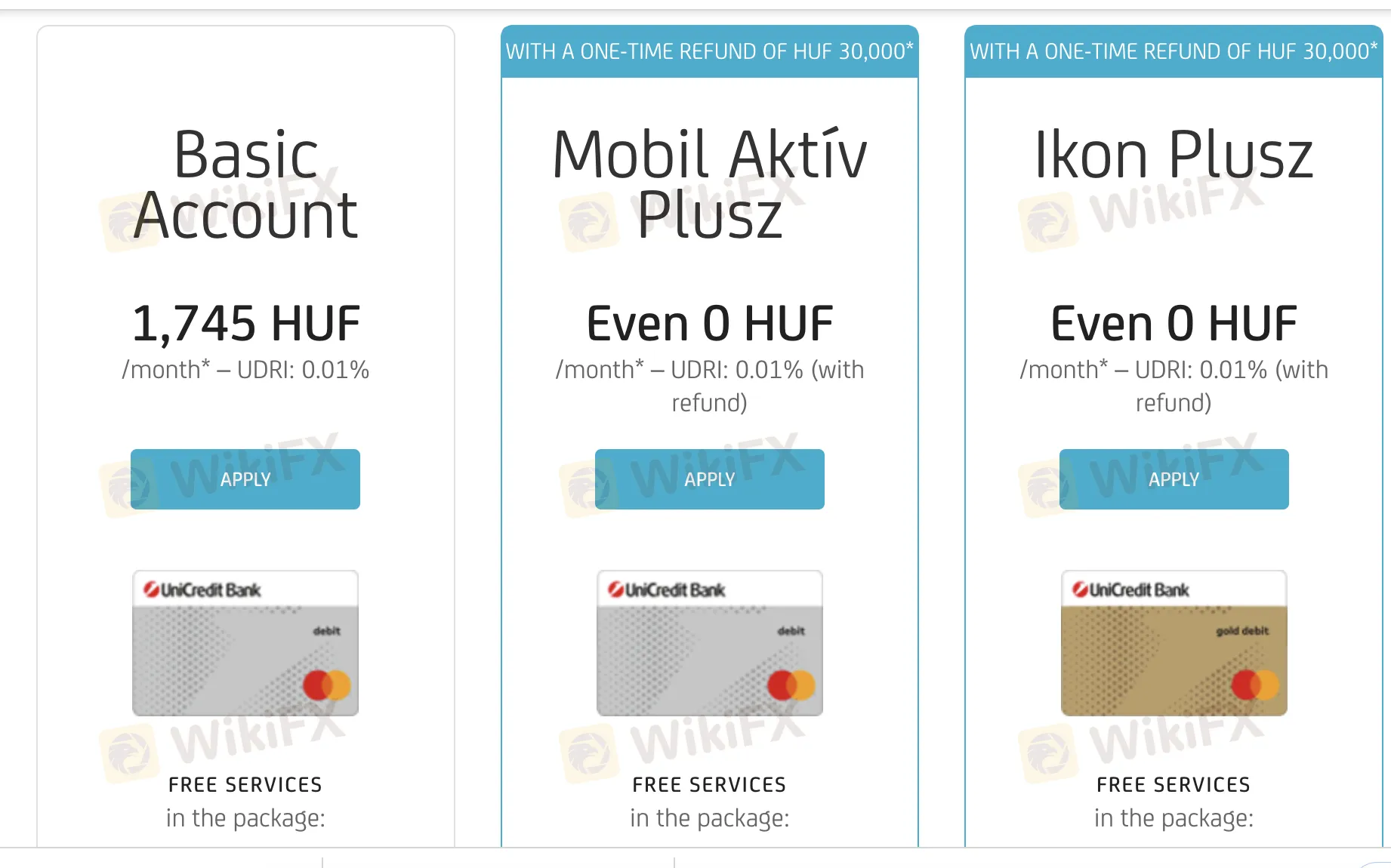

Bank Accounts

UniCredit Bank offers three types of accounts. They are Basic accounts, which serve as standard savings accounts for customers, Mobil Aktiv Plusz accounts, and Ikon Plusz accounts. These accounts are designed to be accessible and easy to use, making them suitable for individuals looking to save money without any complicated features. The interest rate on all types of accounts, represented by the UDRI (Unione di Banche Italiane Deposit Rate), is 0.01%. This means that customers will earn a small amount of interest in their balances.

Customer Service

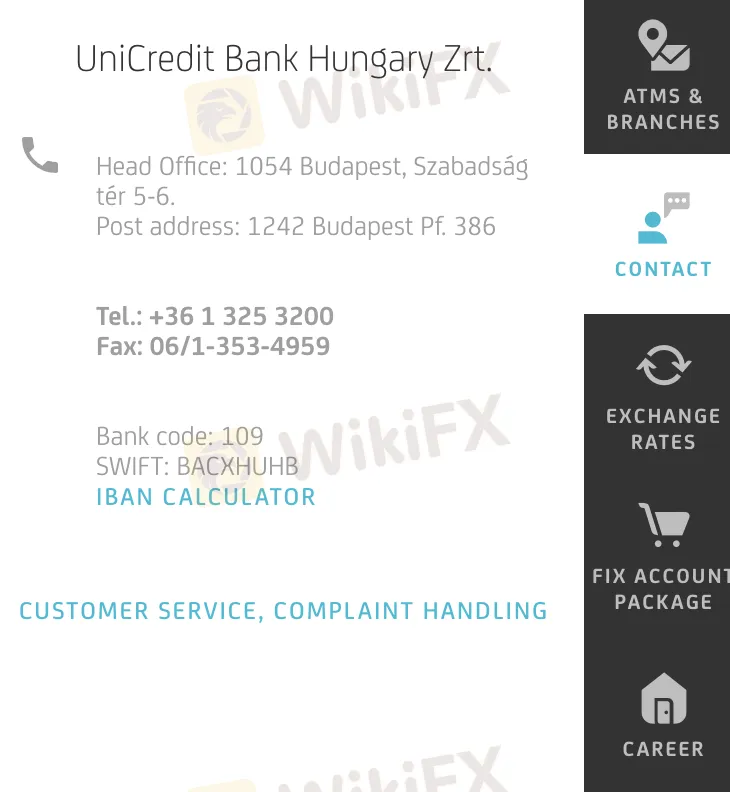

UniCredit Bank offers customer service support through a dedicated telephone line with the number +36 1 325 3200. Customers can call this number to seek assistance, make inquiries, or resolve any issues related to their accounts or banking services. UniCredit Bank also provides customer service support through their presence on social media platforms, specifically on LinkedIn.

Head Office Address: 1054 Budapest, Szabadsagter 5-6.

Post Address: 1242 Budapest Pf. 386.

Conclusion

Despite UniCredit Bank's wide array of services, there are significant concerns regarding its safety and legitimacy. As mentioned, the lack of valid regulation is a critical issue that raises red flags about the bank's operations. The absence of regulatory oversight poses potential risks to customers, including the lack of consumer protection mechanisms, uncertainty about financial stability, and vulnerability to fraud or scams.

In conclusion, UniCredit Bank's current situation calls for prudence and careful consideration. While the bank has been a prominent player in the financial industry, the lack of valid regulation casts doubts on its safety and legitimacy. Customers are advised to seek advice from financial experts and relevant regulatory authorities, ensuring they make informed decisions about their banking needs and security.

Frequently Asked Questions (FAQs)

Q1: What is UniCredit Bank, and what services does it offer?

A1: UniCredit Bank is a financial institution with a presence in multiple countries. It offers a comprehensive range of services, including borrowing, banking, savings, insurance, and digital banking solutions.

Q2: Where is UniCredit Bank headquartered?

A2: UniCredit Bank is headquartered in Budapest, Hungary, specifically located at Szabadsagter 5-6, 1054 Budapest.

Q3: Does UniCredit Bank offer customer service support?

A3: Yes, UniCredit Bank provides customer service support through a dedicated telephone line (+36 1 325 3200) and has a presence on LinkedIn for social media interaction.

Q4: Does UniCredit Bank have any valid regulations?

A4: No. UniCredit Bank currently has no valid regulations.

وسيط WikiFX

أحدث الأخبار

شركة Valuta Markets المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

هادي بوم.. الشيطان المُضلِّل لـ Expert Option | كيف يُباع الوهم تحت ستار "الثراء السريع"؟

شركة RallyTrade المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

شركة capital.com المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

جلسة نقاش هامة حول تطورات شركة GLOBTFX بث مباشر علي منصة X – لا تفوّتها!

شركة Cyberex Ltd المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

احتيال بمليارات الدولارات.. كيف تحولت منصة FBC إلى كابوس استثماري؟

شركة Neuron Markets المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

شركة eToro المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

معاينة يوم حماية حقوق الفوركس 2025 من WikiFX: كشف الحقيقة وضمان أمان التداول

حساب النسبة