Eastspringinvest

الملخص:Eastspringinvest is an online trading platform based in the Commonwealth of Dominica. However, it lacks regulatory oversight, which raises concerns about its legitimacy. The broker offers a variety of account types, with a minimum deposit requirement of $250 and leverage of up to 1:100. Spreads vary depending on the account type but can range from 1 to 3 pips. Traders can access the platform via a web-based interface and trade currencies and cryptocurrencies. Notably, the broker does not provide information on demo or Islamic accounts. Customer support is limited to email contact, and no educational resources are offered. Additionally, the website is reported as down and labeled as a scam, raising significant doubts about its credibility and reputation. Traders should exercise extreme caution when considering this broker for their trading activities.

| Aspect | Information |

| Registered Country/Area | Commonwealth of Dominica |

| Founded Year | Not specified |

| Company Name | Eastspringinvest |

| Regulation | None |

| Minimum Deposit | $250 |

| Maximum Leverage | Up to 1:100 |

| Spreads | Varies by account type (e.g., 1-3 pips) |

| Trading Platforms | Web-based platform |

| Tradable Assets | Currencies and cryptocurrencies |

| Account Types | VIP, SILVER, GOLDPLATINUM, PLATINUM |

| Demo Account | Information not provided |

| Islamic Account | Information not provided |

| Customer Support | Email contact (compliance.en@Eastspringinvest) |

| Payment Methods | Credit/debit cards, cryptocurrencies |

| Educational Tools | Not provided |

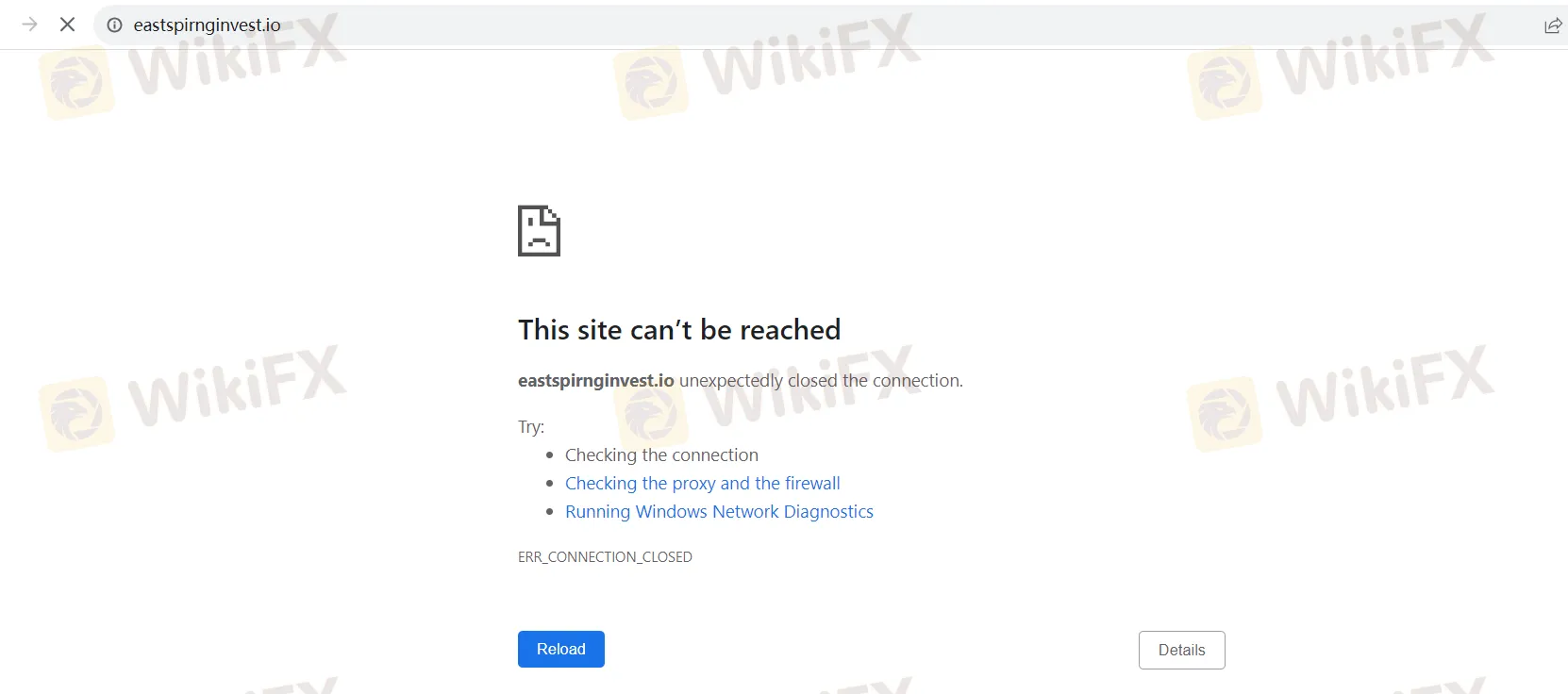

| Website Status | Reported as down and labeled as a scam |

Overview

Eastspringinvest is an online trading platform based in the Commonwealth of Dominica. However, it lacks regulatory oversight, which raises concerns about its legitimacy. The broker offers a variety of account types, with a minimum deposit requirement of $250 and leverage of up to 1:100. Spreads vary depending on the account type but can range from 1 to 3 pips. Traders can access the platform via a web-based interface and trade currencies and cryptocurrencies. Notably, the broker does not provide information on demo or Islamic accounts. Customer support is limited to email contact, and no educational resources are offered. Additionally, the website is reported as down and labeled as a scam, raising significant doubts about its credibility and reputation. Traders should exercise extreme caution when considering this broker for their trading activities.

Regulation

Eastspringinvest is not regulated by any financial authority, raising concerns about its legitimacy. The broker provides contradictory location information, with indications that it may be based in the Commonwealth of Dominica, where forex trading is not subject to specific regulations. Eastspringinvest offers high leverage and bonuses, practices often restricted by regulatory authorities. The absence of regulation means potential risks for traders, including inadequate investor protection and transparency. Additionally, the broker's inactivity fee and bonus terms are not fully disclosed, leading to concerns about withdrawal complications. Traders are advised to exercise caution and consider regulated brokers for increased safety and transparency.

Pros and Cons

Eastspringinvest presents a mixed picture for traders. While it offers diverse market instruments, various account types, leverage options, and deposit methods, it faces significant drawbacks. The lack of regulation, limited educational resources, and inadequate customer support raise concerns. Moreover, the reported website issues, including it being labeled as a scam, add to doubts about its credibility. Traders should exercise extreme caution when considering this broker for their trading activities, taking into account these significant red flags.

| Pros | Cons |

|

|

|

|

|

|

|

|

Market Instruments

Eastspringinvest primarily offers trading instruments in two categories: currencies (forex) and cryptocurrencies. Here's a brief description of the market instruments in each category:

Currencies (Forex):

Forex trading involves the exchange of one currency for another, and it is one of the largest and most liquid financial markets in the world.

Traders can speculate on the price movements of various currency pairs, where one currency is exchanged for another. Common currency pairs include EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), and USD/JPY (US Dollar/Japanese Yen), among others.

Forex trading offers opportunities to profit from both rising (buying) and falling (selling or shorting) currency prices.

Leverage is often available in forex trading, allowing traders to control larger positions with a relatively small amount of capital.

Cryptocurrencies:

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized blockchain technology.

Eastspringinvest likely offers trading in various cryptocurrencies, including well-known options like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as numerous altcoins.

Cryptocurrency trading allows traders to speculate on the price movements of these digital assets.

Unlike traditional currencies, cryptocurrencies are not controlled by any central authority, such as a government or central bank.

Cryptocurrency markets can be highly volatile, with prices subject to rapid and substantial fluctuations.

Some cryptocurrency exchanges offer trading pairs between cryptocurrencies and fiat currencies like USD or EUR.

It's important to note that the availability of specific currency pairs and cryptocurrencies may vary depending on the broker and trading platform. Traders should conduct thorough research and consider their risk tolerance before participating in trading activities in these markets, given their inherent volatility and complexity. Additionally, traders should be aware of the broker's terms and conditions, including leverage and fees associated with trading these instruments.

Account Types

VIP Account:

The VIP Account is the top-tier offering from Eastspringinvest, designed for high-net-worth individuals and professional traders. To open a VIP Account, traders are required to make a substantial minimum deposit of $10,000. This account type offers a maximum leverage of 1:100, providing traders with flexibility in managing their positions. VIP Account holders have access to a diverse range of trading products, including currencies, indices, stocks, and commodities, allowing for a well-rounded trading portfolio. The minimum position size is set at 0.01, providing granularity in trade size. Additionally, this account type supports the use of Expert Advisors (EAs) for automated trading strategies. While specific depositing and withdrawal methods, as well as commission details, are not specified, the VIP Account is tailored to meet the needs of seasoned traders seeking a comprehensive and high-level trading experience.

SILVER Account:

he SILVER Account is an entry-level option for traders looking to start their trading journey with Eastspringinvest. It requires a minimum deposit of $250. While the review does not specify the maximum leverage, it's implied to be lower, potentially at 1:20. The SILVER Account is primarily focused on currency trading. It offers the flexibility to trade currencies with a minimum position size of 0.01. Similar to the VIP Account, it supports Expert Advisors (EAs) for automated trading strategies. Specific depositing and withdrawal methods, as well as commission details, are not provided in the information.

GOLD Account:

The GOLD Account is positioned as a mid-tier account option with a minimum deposit requirement of $1,000. The maximum leverage is not explicitly mentioned but is likely set at 1:50, offering moderate trading flexibility. This account type focuses on trading currencies and indices. It permits trading with a minimum position size of 0.01 and supports Expert Advisors (EAs) for automated trading. Specific details regarding depositing methods are not outlined.

PLATINUM Account:

The PLATINUM Account is designed for traders looking for a balance between advanced features and accessibility. It requires a minimum deposit of $5,000. The maximum leverage for this account is likely set at 1:80, providing traders with moderate leverage options. The PLATINUM Account offers the opportunity to trade currencies, stocks, and indices. Traders can engage in trading with a minimum position size of 0.01 and utilize Expert Advisors (EAs) for automated strategies. The review does not specify depositing or withdrawal methods or provide commission details for this account type.

Leverage

Eastspringinvest offers a maximum trading leverage of up to 1:100. This means that for every unit of capital you have in your trading account, you can control a trading position up to 100 times larger. While higher leverage can amplify potential profits, it also significantly increases the level of risk in trading. Traders should exercise caution when using high leverage, as it can lead to both substantial gains and losses, and it's important to understand how leverage works and its potential impact on your trading account. Additionally, the availability of specific leverage levels may depend on the type of account and financial instruments being traded with this broker, so traders should review the broker's terms and conditions for precise details.

Spreads and Commissions

Spreads:

VIP Account:

Offers ultra-tight spreads starting from 1 pip on major currency pairs, ideal for high-net-worth individuals and professional traders.

SILVER Account:

Features spreads starting from 3 pips on major currency pairs, providing a cost-effective option for entry-level traders.

GOLDPLATINUM Account:

Provides tighter spreads starting from 2 pips on major currency pairs, enhancing cost-efficiency for experienced traders.

PLATINUM Account:

Offers spreads starting from 1.5 pips on major currency pairs, combining favorable pricing with minimal spread costs for a balanced trading experience.

Commissions:

VIP Account:

May include low or zero commissions, complementing the ultra-tight spreads and enhancing cost-efficiency for high-net-worth individuals and professionals.

SILVER Account:

Features variable commissions that may vary based on specific trades and market conditions, providing flexibility in commission costs for cost-conscious traders.

GOLDPLATINUM Account:

Offers competitive commissions, ensuring cost-effective trading for more experienced traders. These competitive commission rates align with the account's tighter spreads.

PLATINUM Account:

Similar to the VIP Account, it may offer low or zero commissions, further enhancing cost-efficiency for traders seeking a balance between advanced features and accessibility.

Deposit & Withdrawal

Deposit:

Eastspringinvest offers various deposit methods for traders to fund their accounts. The specific deposit methods may include credit or debit card payments, as well as cryptocurrency deposits, such as Bitcoin. The broker typically does not charge deposit fees. Traders can choose a deposit method that suits their preferences and deposit funds into their trading accounts accordingly.

Withdrawal:

Withdrawals from Eastspringinvest accounts are possible using the same methods used for deposits. For example, traders can withdraw funds to their credit or debit cards or opt for cryptocurrency withdrawals if they have funded their accounts using cryptocurrencies. It's important to note that while credit or debit card deposits may allow for chargebacks within a certain period, cryptocurrency transactions are irreversible by default, meaning traders should carefully consider their withdrawal method. Additionally, the review does not specify the withdrawal processing times or any associated withdrawal fees.

Overall, the broker appears to provide multiple options for both deposit and withdrawal processes, with an emphasis on flexibility in choosing payment methods. However, traders should refer to the broker's official website and terms and conditions for precise details on deposit and withdrawal methods, processing times, and any applicable fees.

Trading Platforms

Eastspringinvest provides traders with a web-based trading platform for their trading activities. While the review does not mention a specific trading platform name, it does highlight some of the platform's features. The web-based platform is user-friendly and offers essential tools for traders, including charting and analysis tools. Traders can also set signals and access an integrated economic calendar. However, it is suggested that even beginners may find the platform somewhat limited in functionality. The review advises traders, especially those with more experience, to consider using the popular MetaTrader 5 (MT5) platform for a more comprehensive trading experience. MT5 offers not only user-friendliness but also advanced features like automated trading with Expert Advisors, custom indicators, and access to a community chat for sharing experiences.

In summary, Eastspringinvest offers a web-based trading platform that is user-friendly and equipped with essential trading tools. However, traders seeking more advanced features and functionality may consider using MetaTrader 5 (MT5) for a broader range of trading capabilities.

Please note that the specific name of the broker's proprietary trading platform is not provided in the information, so traders should refer to the broker's official website for precise details on the trading platform and its features.

Customer Support

The customer support provided by compliance.en@Eastspringinvest leaves much to be desired. It is characterized by a lack of responsiveness and transparency. Numerous users have reported difficulties in reaching out to this email address, with delayed or, in some cases, no responses at all.

Moreover, the absence of a dedicated customer support channel, such as a phone number or live chat, further compounds the issue. This means that customers are left with only an email contact, which is not ideal for urgent inquiries or assistance.

Overall, the customer support experience through compliance.en@Eastspringinvest falls short of industry standards, leaving customers frustrated and with limited avenues for seeking help or resolving concerns.

Educational Resources

Eastspringinvest's educational resources are notably lacking, offering little to no support for traders looking to expand their knowledge and improve their skills in the world of financial markets. The absence of educational materials, such as tutorials, webinars, articles, or video lessons, is a significant drawback for both novice and experienced traders.

Traders are left to navigate the complexities of the market without access to educational resources that can provide valuable insights, strategies, and guidance. This lack of educational support can hinder traders' ability to make informed decisions and maximize their trading potential.

In an industry where knowledge is paramount, the absence of educational resources from Eastspringinvest represents a missed opportunity to empower its clients and help them succeed in their trading endeavors.

Summary

Eastspringinvest presents a concerning picture in the world of online trading. With a lack of regulation, contradictory location information, and questionable practices such as high leverage and bonuses, this broker raises red flags about its legitimacy. Traders are left vulnerable to potential risks, including inadequate investor protection and transparency.

The absence of a robust customer support system, limited educational resources, and a website that's reportedly down and labeled as a scam add further disappointment to the overall experience. Traders seeking guidance or assistance are met with delays and a lack of transparency, making it challenging to navigate the complexities of the financial markets.

In summary, Eastspringinvest's regulatory shortcomings, coupled with its inadequate support and educational resources, make it a less-than-ideal choice for traders looking for a secure and informed trading experience. Caution is strongly advised when considering this broker for your trading endeavors.

FAQs

Q1: Is Eastspringinvest a regulated broker?

A1: No, Eastspringinvest is not regulated by any financial authority, raising concerns about its legitimacy and investor protection.

Q2: What market instruments are available for trading with Eastspringinvest?

A2: Eastspringinvest primarily offers trading instruments in two categories: currencies (forex) and cryptocurrencies, providing opportunities to trade various currency pairs and digital assets.

Q3: What is the minimum deposit requirement for a VIP account with Eastspringinvest?

A3: To open a VIP Account with Eastspringinvest, traders are required to make a substantial minimum deposit of $10,000, tailored for high-net-worth individuals and professional traders.

Q4: Does Eastspringinvest provide educational resources for traders?

A4: No, Eastspringinvest's educational resources are notably lacking, offering little to no support for traders looking to expand their knowledge and improve their skills in the financial markets.

Q5: Is there a dedicated customer support phone number or live chat available with Eastspringinvest?

A5: No, Eastspringinvest's customer support primarily relies on an email contact (compliance.en@Eastspringinvest), and there is no dedicated phone number or live chat, which can lead to delays and limited avenues for assistance.

قراءة المزيد

تعرّف على سعر الذهب اليوم في العراق الأربعاء 14 فبراير 2024

حقق سعر الذهب اليوم في العراق، الأربعاء 14 فبراير، انخفاض نسبي في مستهل جلسات التداول، تزامناً مع تراجع سعر الذهب في البورصة العالمية، حيث سجلت العقود الآجلة عند مستوى 1,992.74 دولار للأوقية، ومن خلال السطور التالية سنتعرف على متوسط سعر الذهب اليوم في العراق لجميع أعيرة الذهب بالدينار العراقي (IQD).

سعر الذهب اليوم في العراق 11 يناير 2024

متوسط اسعار الذهب اليوم بأسواق المال في العراق بالدينار العراقي

متوسط اسعار الذهب اليوم بأسواق المال في العراق بالدينار العراقي

سعر الذهب اليوم في العراق

أسعار الذهب مستهل تعاملات اليوم الخميس 23 نوفمبر 2023

ننشر أسعار الذهب مستهل تعاملات اليوم الخميس 23 نوفمبر 2023، حيث سجل جرام الذهب عيار 21 وهو العيار الرئيسي لسوق الذهب في مصر 2725 جنيها، مقابل 2800 جنيها للجرام

وسيط WikiFX

أحدث الأخبار

شركة Valuta Markets المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

هادي بوم.. الشيطان المُضلِّل لـ Expert Option | كيف يُباع الوهم تحت ستار "الثراء السريع"؟

شركة Hantec Financial المراجعة الكاملة 2025

شركة Golden Wave المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

شركة CentFX المراجعة الكاملة 2025

شركة Pocket Option المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

شركة Cyberex Ltd المراجعة الكاملة 2025 : موثوقة أم احتيال ؟

حساب النسبة