BluFX-Overview of Minimum Deposit, Spreads & Leverage

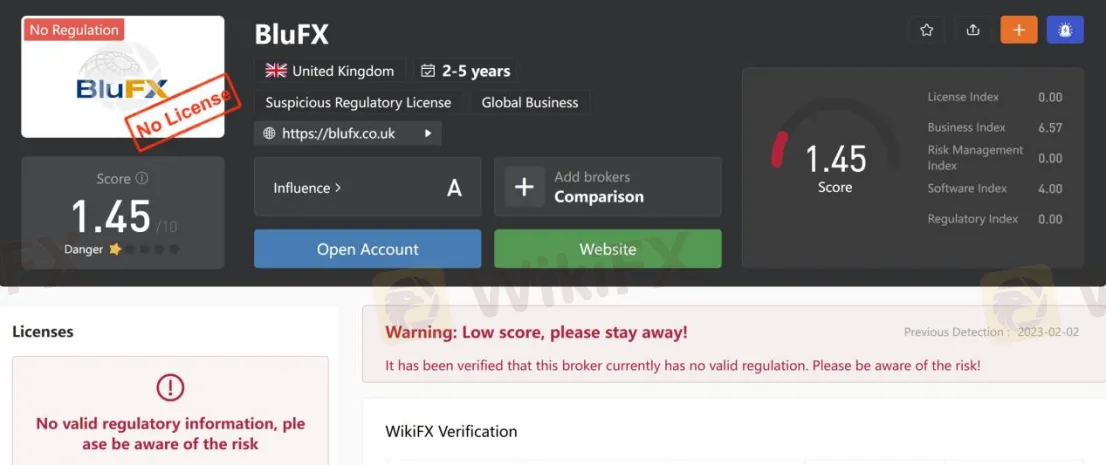

Zusammenfassung:BluFX is an offshore broker, and the firm behind BluFX is called Blueprint Capital Ltd., which is based in the United Kingdom. That being the case, they do not claim affiliation with the Financial Conduct Authority (FCA). This immediately raises suspicion, as dealing with an unregulated company always carries counterparty risk.

Note: BluFXs official site - https://blufx.co.uk/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Information |

| Registered Country/Region | United Kingdom |

| Regulation | unregulated |

| Market Instrument | forex |

| Account Type | Lite, Pro |

| Demo Account | no |

| Maximum Leverage | 1:3 |

| Spread | N/A |

| Commission | N/A |

| Trading Platform | web |

| Minimum Deposit | $25k |

| Deposit & Withdrawal Method | Credit/Debit cards, PayPal, USDT, Flutterwave, WebMoney and PerfectMoney |

BluFX is an offshore broker, and the firm behind BluFX is called Blueprint Capital Ltd., which is based in the United Kingdom. That being the case, they do not claim affiliation with the Financial Conduct Authority (FCA). This immediately raises suspicion, as dealing with an unregulated company always carries counterparty risk.

Note: The screenshot date is February 2, 2023. WikiFX gives dynamic scores, which will update in real-time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

There are only 28 currency pairs as well as Gold available, the currency pairs are EURUSD, EURGBP, EURJPY, EURCAD, EURCHF, USDJPY, USDCAD, USDSCHF, CHFJPY, CADCHF, CADJPY, GBPUSD, GBPJPY, GBPCAD, GBPCHF, EURAUD, EURNZD, GBPAUD, GBPNZD, AUDUSD, AUDNZD, AUDCAD, UADCHF, AUDJPY, NZDUSD, NZDJPY, NZDCHF.

Minimum Deposit

BluFX offers a $25k live Account with a fee of 99€ monthly, and the Profit target is 5% which is 1250$. In the 25k Trading plan, they wont allow you to hold the trading position over the night. Blufx allows you only to trade from 6 AM to 9 PM UK time. So if you take any trade, you have to close it before 9 PM daily. Here comes the scam scheme. If you are an experienced trader, you know that in the forex market, we have to hold some trades over the night or a few days to be in profit because of the volatility. At this moment, limiting your limit, they are trapping you in a big dark hole.

Trading Size

BluFX is giving examples of the $25,000 account and the $50,000 account. The maximum trade size on a $25,000 account is 1 lot, while on a $50,000 account, it is 2 lots. Each currency pair has its maximum trade size based on the margin required when trading it.

Leverage

The leverage ratio provided by BluFX is only 1:3, while traditional forex brokers offer at least 1:100 or 1:200. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.=

Spreads

The costs of trading with the BluFX platform are not disclosed by the company. Given the fact they only facilitate day trading, a slightly higher spread can greatly impact the bottom line of any trader. Usually, forex brokers offer spreads within the range of 1.0 -1.5 pips for the EUR/USD pair.

Trading Platform

It is not surprising that this broker, unconventional as it is, does not support the good old MetaTrader4 (MT4) platform. Instead, it offers its proprietary web-based platform that has most of the functionalities the MT4 offers. There are no demo versions available.

Deposit & Withdrawal

BluFX currently accepts Credit/Debit cards, PayPal, USDT, Flutterwave, WebMoney and PerfectMoney for their payments. With BluFX, you can only withdraw funds from your trading account after you have made a 10% profit (your first withdrawal can be $2,500 if you chose one of the latter two account types and have reached an account balance of $55,000).

Fees

To get access to BluFXs capital, one must pay a monthly fee specified at the beginning of this review, ranging from £99 to £249, according to the account type.

Customer Support

BluFXs customer support can be reached by email: info@blufx.co.uk. You can also follow this broker on social networks such as Instagram and YouTube. Company address: 1A Old Bond Street, London, W1s4PB; Dubai Silicon Oasis, DDP, Building A, Dubai, United Arab Emirates.

Pros & Cons

| Pros | Cons |

| • Multiple funding options | • No regulation |

| • Website inaccessible | |

| • High minimum deposit ($25k) | |

| • Limited trading assets and account types |

Frequently Asked Questions (FAQs)

| Q 1: | Is BluFX regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does BluFX offer the industry-standard MT4 & MT5? |

| A 2: | No. Instead, it offers a web-based trading platform. |

| Q 3: | What is the minimum deposit for BluFX? |

| A 3: | The minimum initial deposit to open an account is $25,000. |

| Q 4: | Is BluFX a good broker for beginners? |

| A 4: | No. BluFX is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website and extremely high initial deposit. |

WikiFX-Broker

Aktuelle Nachrichten

Ozempic bald 80 Prozent günstiger? Hikma Pharmaceuticals will von auslaufenden Patenten profitieren

Bericht über Megaprojekt in Saudi-Arabien: Neom-Manager sollen Finanzberichte manipulieren, um hohe Kosten zu vertuschen

„Viel zu hohe Risiken – Branchenverband für Volksbanken fordert strengere Regeln für die eigenen Banken

Ford Deutschland in den roten Zahlen – jetzt soll eine Milliarden-Finanzspritze des US-Konzerns helfen

Corona-Überflieger Biontech machte einst Milliardengewinne – mittlerweile aber Verluste und kündigt Stellenabbau an

Ich bin 38 und CEO von Trivago: Diese 6 Skills machen euch zu einer guten Führungskraft

Webasto: Angeschlagener Automobilzulieferer braucht 200-Millionen-Finanzspritze

Trotz sinkendem Absatz: VW-Tochter Traton steigert Rendite und erhöht die Dividenden für Anleger

CO₂-Ziele aufgeschoben: So soll die Autoindustrie gerettet werden

VW-Mitarbeiter erhalten Prämie noch einmal ungekürzt

Wechselkursberechnung