GemForex - Weekly analysis

Zusammenfassung:Recession fears looming across markets

Weve experienced some interesting market moves since the beginning of this year. A savage decline in risk on assets such as equities, particularly those in the tech sector. After hitting its all-time high in November last year, the US NASDAQ 100 lost 34%of its value over the following seven months.

This latest decline came as investors reacted to a sudden hawkish turn from central bankers who finally reacted to headline inflation numbers as they hit multi-decade highs. Developed world central banks had previously insisted that the post-pandemic pick-up in inflation was transitory in nature. The thinking went that the global economy would soon return to normality as supply disruptions were eliminated.

But having delayed tightening monetary policy for so long, now they are doing this as economic growth slows significantly following its post-pandemic surge higher. This has significant effects on the global economic outlook which is still getting priced into financial assets.

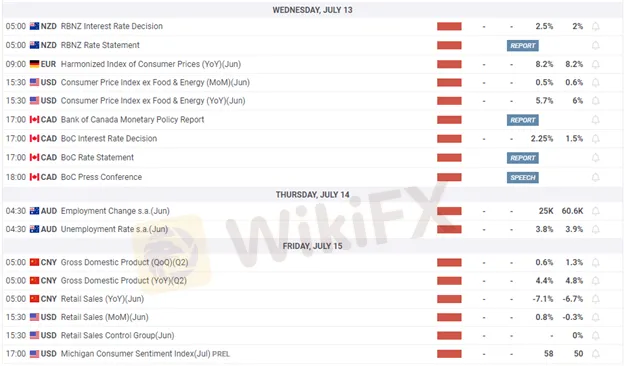

The week aheadsees the latest update on US CPI, the key inflationmeasure as far as investors are concerned. Last month it hit 8.6%, its highest level in forty years. The concern is that it has yet to peak, which has forced the US central bank to undertake an unexpectedly aggressive pace of monetary tightening. This is having a devastating impact on equity markets.

Traders should be awarethat any indication that inflation has peaked, and that the Federal Reserve can ease up on raising rates could ease the downside pressure on equities. Thats why the central bank, and investors everywhere, are fixated on the release of every single scrap of inflation data.

WikiFX-Broker

Aktuelle Nachrichten

Krypto-Hammer: Ethereum legt plötzlich kräftig zu – kommt jetzt der Angriff auf 5.000 Dollar?

Krypto-Schock um Ethereum: Wale kaufen – Kleinanleger verkaufen, Kurs rutscht ab

Ethereum unter Attacke: Betrüger fluten Netzwerk – Kurs gerät unter Druck

Trump-Drohung schockt Krypto-Markt: Bitcoin, Ether und XRP rutschen weiter ab

XRP unter Verkaufsdruck: Rutscht Ripple jetzt unter die Zwei-Dollar-Marke?

XRP-Schock bei Ripple: Unter 2 Dollar – droht jetzt der Crash?

Gold-Rally, Krypto-Crash: Anleger flüchten in Edelmetalle – Bitcoin verliert Glanz

Krypto-Schock zum Wochenstart: Bitcoin rutscht ab – droht jetzt der nächste Crash?

XRP stürzt unter 2 Dollar – und plötzlich wird es brandgefährlich für Ripple-Anleger

Was gerade am japanischen Anleihemarkt passiert – und warum es Investoren weltweit nervös macht

Wechselkursberechnung