Mohicans markets :Employment data growth slows down, waiting for the non-agricultural report, Iranian crude oil returns to the market, oil prices are under pressure again

Zusammenfassung:The U.S. dollar index accelerated after the release of the U.S. jobless claims data. U.S. stocks fell below 106 in early trading and closed down 0.59% at 105.75. The 10-year U.S. bond yield fell below the 2.7% mark. Precious metals moved higher, driven by the fall in the dollar. Spot gold broke through $1,790 an ounce, continuing to hit a new high since July 5, and closed up 1.47% at $1,790.98 an ounce; spot silver held steady above the $20 mark and closed up 0.58 %, at $20.17 an ounce. Crude o

Financial Events Today

14:00 Germany's June seasonally adjusted monthly rate of industrial output (%), previous value 0.2, expected value -0.3, published value: to be released

14:00 German June working day adjusted annual rate of industrial output (%), previous value -1.5, expected value -1.4, published value: to be released

14:45 French June trade account (100 million euros), previous value -129.94, expected value -125.6, published value: to be released

20:30 U.S. July non-agricultural employment change seasonally adjusted (10,000), previous value 37.2, expected value 25, published value: to be released

20:30 U.S. July unemployment rate (%), previous value 3.6, expected value 3.6, published value: to be released

20:30 The annual rate of average hourly wages in the United States in July (%), previous value is 5.1, expected value is 4.9, published value: to be released

20:30 Canada July unemployment rate (%), previous value 4.9, expected value 5, published value: to be released

20:30 Changes in employment in Canada in July (10,000), previous value -4.32, expected value 2, announced value: to be released

Risk Warning:☆20:30 The United States announced the unemployment rate in July and the non-agricultural employment population after the seasonal adjustment in July. The closely watched non-farm payrolls report will be the guiding light for the Fed's next move. The agency expects the US non-farm payrolls to grow weakly in July, but still reach a solid level of 250,000, the unemployment rate edged up to 3.7%, and average hourly earnings rose 4.9%. Both initial and continuing applications reported on Thursday showed a clear upward trend, indicating a softening in the U.S. labor market. CITIC Securities said that the core of the substantive recession in the United States may lie in the labor market. The labor market is still relatively strong at present. It is necessary to pay attention to whether the number of new non-agricultural employment will drop to the warning line of 200,000 and 100,000 in the future.

Global Views - List of Major Markets

The U.S. dollar index accelerated after the release of the U.S. jobless claims data. U.S. stocks fell below 106 in early trading and closed down 0.59% at 105.75. The 10-year U.S. bond yield fell below the 2.7% mark. Precious metals moved higher, driven by the fall in the dollar. Spot gold broke through $1,790 an ounce, continuing to hit a new high since July 5, and closed up 1.47% at $1,790.98 an ounce; spot silver held steady above the $20 mark and closed up 0.58 %, at $20.17 an ounce.

Crude oil fell to its lowest level in nearly 6 months. Brent crude oil fell by 4% on the day, breaking below $94/barrel for the first time since February 21, and closed down 3.55% at $93.56/barrel; WTI crude oil It fell below $90 for the first time since the start of the Russia-Ukraine conflict and closed down 3.11% at $88.02 a barrel. The analysis said Americans are driving less than they did in the summer of 2020 due to weaker demand for U.S. crude.

US stocks closed mixed, the Dow closed down 0.26%, the Nasdaq closed up 0.41%, and the S&P 500 closed down 0.09%. Silver and gold stocks were among the top gainers, while oil and gas and vaccine stocks were weak. Alibaba closed up about 2% after the results, Daily Youxian closed up about 51%, and AMTD Digital closed down about 23%. Previously, Changjiang Group stated that its subsidiaries did not directly hold the equity of AMTD Digital and had no business relationship with the company.

European stocks generally rose at the close, Germany's DAX30 index closed up 0.54%, the British FTSE 100 index closed up 0.04%, the French CAC40 index closed up 0.64%, and the European Stoxx 50 index closed up 0.61%

Bitcoin fell back to around $22,000, and Ethereum fell below $1,600 per piece.

International News

Russian President Vladimir Putin will attend this year's Eastern Economic Forum.

U.S. plans to declare monkeypox outbreak a public health emergency

U.S. initial jobless claims rose to 260,000 last week, near the highest level since November last year, indicating a continued slowdown in the labor market, pushing the four-week average to its highest level in eight months, while continuing jobless claims rose to an 1.416 million, the highest level since April.

This year, the FOMC voted to vote, and Cleveland Fed President Mester gave a clue to cut interest rates: once inflation falls back to close to our 2% target, we will cut interest rates.

Russia's central bank wants state firms to abandon 'toxic' currencies from unfriendly countries

Iranian oil minister: Iran ready to return to international crude oil market as soon as possible

U.S. investment-grade funds see $1.22 billion in inflows this week

The Bank of England raised interest rates by 50 basis points to 1.75%, the largest rate hike in 27 years

Institutional View

1. UBS: The dollar can remain strong in the short term, and the volatility will be relatively small in the next 12 months

① Brian Rose, senior analyst at UBS Global Wealth Management, said, “In the longer term, assuming two or three or four years, the dollar may weaken significantly. But in the 12-month time frame, we think the volatility will be relatively smaller”;

②Rose said: “In the short term, we expect the dollar to remain strong, especially against the euro. So we think the euro may fall below parity”

2. ING Bank: Euro pound may continue to trade in the 0.8350-0.8450 range in the next few weeks

① Analysts at ING Group said that the Bank of England raised interest rates by 50 basis points on Thursday, of which 8 voted in favor of raising interest rates by 50 basis points and 1 voted in favor of raising interest rates by 25 basis points. Talks of further strong policy tightening as the economy faces a recession is a “thorny issue” for the growth-sensitive pound;

② GBPUSD remains vulnerable to a strong U.S. dollar and risk environment, but the Bank of Englands aggressive policy tightening and equally pessimistic views on European growth prospects suggest that EURGBP may continue to trade in the 0.8350-0.8450 range in the coming weeks

3. Westpac: AUD/USD outlook 'looks fragile'

① Westpac economist Sean Callow said that the fragility of the Australian economy stems from the fragility of commodity prices and the “divergence” expectations of the RBA;

②Westpac also pointed out that commodity prices supported the Australian dollar with mixed results; the value of these commodities soared after Russias invasion of Ukraine, but commodity prices have been on a downward trend since March; energy prices are still high, This could be beneficial for Australian gas exporters;

③The outlook for AUD/USD remains challenging, especially as the Fed shows no inclination to end the rate hike cycle

4. Commerzbank: The rate hike is still not enough to curb inflation, but the Bank of England is expected to raise rates only slightly in September

① Deutsche Bank analysts said that so far, the Bank of England's cumulative interest rate hikes have not been enough to control inflation. The 1.75% rate may not even be at the “neutral level” at which growth is neither boosted nor suppressed. As a result, analysts continue to expect rates to rise further to 2.75% by early 2023;

② However, after this sharp tightening, the Bank of England is likely to raise rates by only a small 25 basis points at its September meeting against the backdrop of a weakening economy

5. ING Bank: Bank of England may raise interest rates by another 50 basis points before pausing tightening policy

① The Bank of England may raise interest rates by another 50 basis points in September, but this may be the last time to raise interest rates. With only one member voting against a 50-basis-point rate hike at Thursday's meeting and the Bank of England's reiteration of its willingness to take vigorous action to curb inflation, a similar move is likely again in September, analysts at ING Bank said. However, the Bank of England hinted that it may soon pause rate hikes, with inflation expected to be well below target for the next few years;

②The analyst believes that the window for further rate hikes by the Bank of England appears to be closing, especially because outside the labor market, there are signs that some key inflation drivers may start to ease

6. Indian rupee under pressure, Goldman Sachs says it may continue to weaken ahead

①In recent weeks, the Indian rupee has come under intense selling pressure due to a perfect storm of headwinds across the world, which analysts say will continue to hit the rupee in the coming months;

②Analysts believe that the rupee is being hit by multiple areas around the world, including soaring energy prices and deficit issues;

③ Goldman Sachs analyst Sengupta said: “As global capital flows dry up in the Fed's tightening cycle, the risk of a recession in the United States is highlighted, and India's external balance of payments situation becomes more challenging, we may look at the future. The Indian rupee continues to weaken.”

Precious Metal

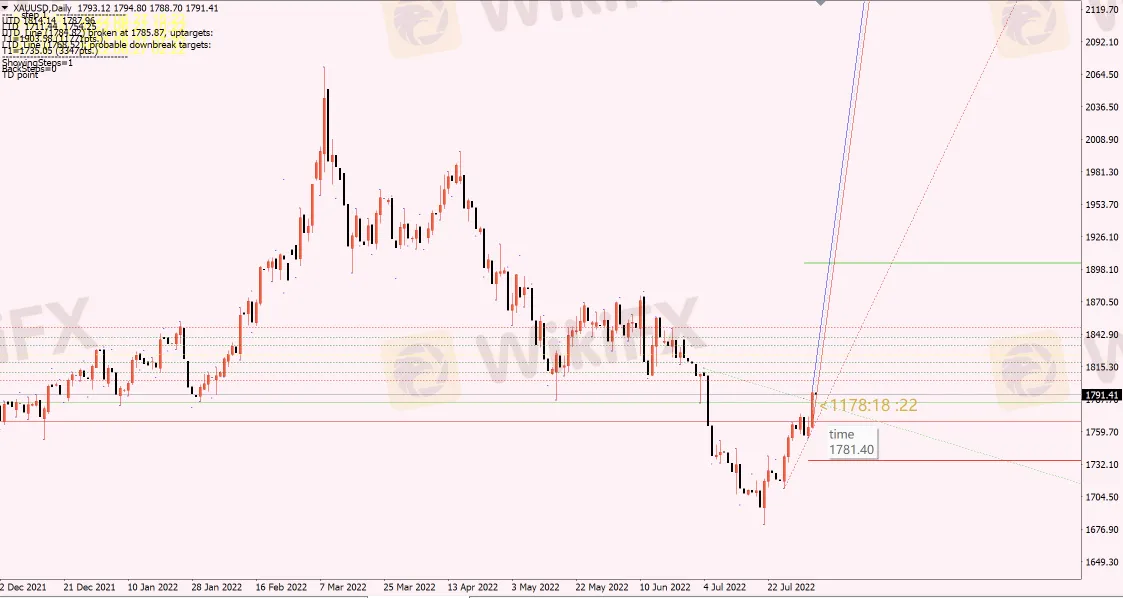

During the Asian session on Friday, August 5, spot gold held near a nearly one-month high set overnight, and is currently trading at $1,790 an ounce, approaching the 55-day moving average. Although the Bank of England raised interest rates by 50 basis points and Fed officials strengthened expectations for further interest rate hikes, which slightly dragged down the performance of gold prices, the number of initial jobless claims in the United States rose to a new high since the end of January, which weakened the US dollar and US bond yields, giving gold prices upward momentum , and the geopolitical situation has become more tense, and safe-haven buying has rebounded significantly, which also provides gold prices with upward momentum. In the short-term, the price of gold is expected to further test the resistance near the Bollinger Line at 1807.62, and the resistance near the high point of 1714.16 on July 4 can also be paid attention to.

Investors are generally concerned about the US non-farm payrolls report for July. Market expectations may be worse than June's performance. The number of new jobs is expected to increase by only 250,000, compared with an increase of 372,000 in June. Before the data is released, it is expected to continue to provide upward momentum to gold prices. In addition, investors need to pay attention to the impact of the geopolitical situation on market sentiment and pay attention to the speech of the Fed officials.

Fundamentals are mostly bullish

[The number of Americans filing for unemployment benefits increased last week, rising to a new high since the end of January]

[The dollar fell 0.6% on Thursday, and the technical bearish signal strengthened]

[Bank of England warns: Britain is facing a recession]

The fundamentals are mainly bearish

[Federal Reserve Mester believes that it is necessary to continue raising interest rates until the middle of next year, and the policy rate should exceed 4%]

[The layoff rate in the U.S. remains low]

[US Nasdaq hits three-month high]

Today's focus will be on the closely watched U.S. jobs report, which is expected to show non-farm payrolls rose by 250,000 jobs in July, compared with a gain of 372,000 in June. Any signs of strength in the labor market could fuel fears of aggressive Fed measures to curb inflation, but if the data underperform, it could give gold further upside momentum.

On the whole, before the release of the non-agricultural data, the price of gold still has the opportunity to fluctuate and rise, and it is inclined to test the resistance near the 1800 integer mark, or even the resistance near the daily Bollinger line at 1807. If the non-agricultural data shows unexpectedly strong performance, the short-term may be It will put pressure on the price of gold, but concerns about the geopolitical situation are still expected to provide support for the price of gold. Below, pay attention to the support near the 5-day moving average at 1775.75.

Crude

In early Asian trading on Friday ,August 6, U.S. crude oil traded around $88.41 per barrel; oil prices fell nearly 3.5% on Thursday, hitting a new half-year low of $87.57 per barrel during the session. I am worried about a possible economic recession at that time, which may take a big hit on energy demand. Iranian crude oil is expected to return to the market to help the bears. The day market is waiting for the non-agricultural data to be released in the evening.

Bullish factors affecting oil prices

[Saudi Arabia raises the price of crude oil shipped to Asia in September to a record high]

[The Nasdaq hits a three-month high as investors focus on the U.S. jobs report]

[NATO's aggressive policy toward Russia has led to tensions in Europe]

Negative factors affecting oil prices

[Iran is ready to return to the international crude oil market as soon as possible]

[U.S. jobless claims increased last week]

On the whole, the increase in the number of Americans applying for unemployment benefits last week announced yesterday highlights that the labor market has softened. Pay attention to the non-agricultural data in the evening. If the data further proves the weakness of the labor market, oil prices may be suppressed again, further In addition, Iranian crude oil is expected to return to the market, which may accelerate the decline of oil prices in the short term; the monkeypox epidemic has spread globally, and the United States has declared monkeypox a public health emergency, the uncertainty risk of the monkeypox epidemic has increased, and multiple bears have helped , oil prices may fall back to 80 US dollars / barrel risk.

Foreign Exchange

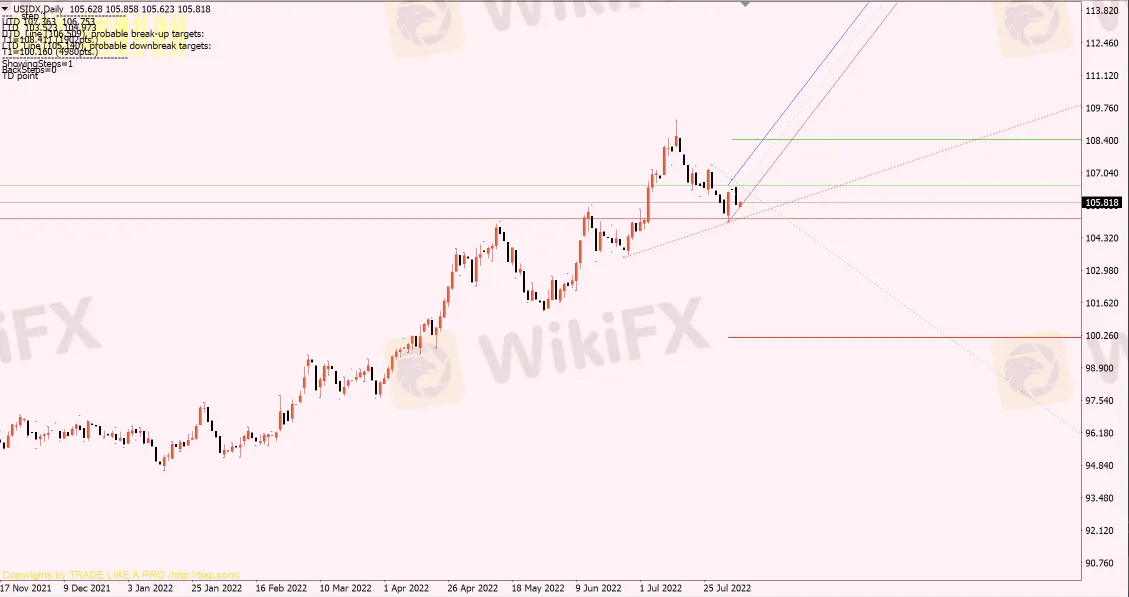

The dollar extended losses after data showed the number of Americans filing for unemployment benefits rose last week. The U.S. dollar index closed down 0.60 percent at 105.75 on Thursday.

The dollar weakened against most major currencies on Thursday, extending losses after data showed that the number of Americans filing for unemployment benefits increased last week, closing down 0.6% at 105.74, following a negative line after Wednesday's rebound was blocked by a doji, suggesting that The dollar bears have re-entered the market, and further downside risks to the short-term dollar have increased significantly.

From the daily chart, the bottom is concerned about the support near the 55-day moving average at 104.96. If this support is lost, the dollar may fall further to the low of 103.66 on June 27.

Investors will see a key indicator of the state of the U.S. economy on Friday, when the Labor Department reports July employment data. Signs of continued strength in the U.S. job market could bolster expectations for tighter monetary policy from the Federal Reserve.

USD/JPY closed down 0.72% at 132.88 on Thursday. Many investment banks are currently bearish on the dollar against the yen.

GBP/USD tumbled nearly 120 points in the short-term. Later, as the dollar fell, the pound recovered some losses and turned higher. Finally, GBP/USD closed up 0.12% at 1.2158. Sterling has fallen more than 10% against the dollar so far this year, raising the cost of imports and dollar-denominated goods, such as oil.

Both the euro zone and Britain are likely to experience energy shortages this winter, with Britain's energy spending expected to rise further in October, fueling an inflation and cost-of-living crisis. In this case, the pound will fall to an all-time low this year.

On Friday, special attention should be paid to the US non-farm payrolls in July. The market is currently expecting an increase of 250,000 from the previous value of 372,000.

Big things to watch on Friday: RBA monetary policy statement, BOE chief economist Peale speaks, Richmond Fed President Balkin speaks.

Declaration|Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Mohicans Markets has made every effort to ensure the accuracy of the information as of the date of publication. Mohicans Markets makes no warranties or representations regarding this material. The examples in this material are for illustration only. To the extent permitted by law, Mohicans Markets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of Mohicans Markets products, including applicable fees and charges, are outlined in the Product Disclosure Statement available on the Mohicans Markets website www.mhmmarkets.com and you should consider before deciding to deal with these products. Derivatives can be risky; losses can exceed your initial payment. Mohicans Markets recommends that you seek independent advice.

Mohicans Markets, (abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

WikiFX-Broker

Aktuelle Nachrichten

PEPE legt 25 % zu: Wird der Widerstand bei $0,000025 jetzt geknackt?

Warren Buffett empfiehlt den Kauf eines S&P 500 Indexfonds: Ein prominenter Tech-Investor warnt vor einer „bösen Überraschung

Ethereum: Potenzial für einen Ether-Boom im Jahr 2025?

FTX beginnt mit Rückzahlungen an Gläubiger: Altcoins BONK, FTM, JUP, RAY und SOL im Aufwind

Wechselkursberechnung