Mohicans markets:MHM Today’s News

Zusammenfassung:On Wednesday, October 12, the dollar index fluctuated in the 113 range and fell after the release of the Fed minutes, eventually closing flat; the 10-year U.S. bond yield moved higher and pushed 3.98% after the release of PPI data, but turned lower and lost 3.90% after the minutes were released. Spot gold pulled up after the release of the minutes to break through $1678 per ounce, closing up 0.48% at $1673.26 per ounce; spot silver barely held the $19 mark, closing down 0.85% at $19.03 per ounce

![第一篇[英语]](https://wzimg.ruiyin999.cn/fb_article/2022-10-13/638012670970851884/FB638012670970851884_519261.jpg-article598)

In order to further meet the needs of investors for real-time news of the international market and broaden the channels for investors to understand the market, MHMarkets launches heavily “Todays News” to provide investors with real-time market information.

October 13, 2022--Fundamental Reminder

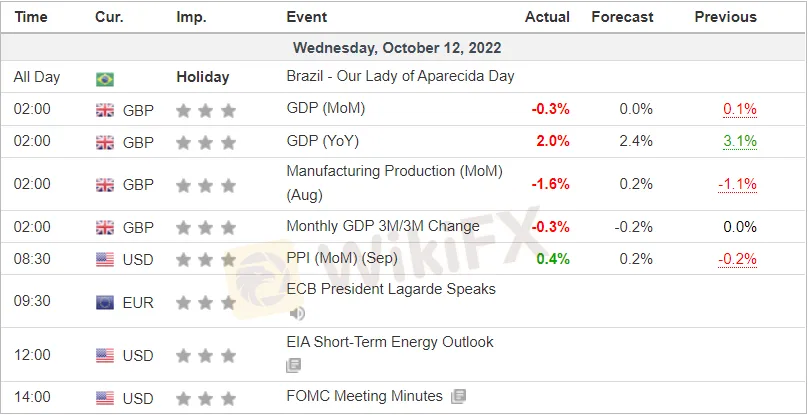

☆ 16:00 IEA releases monthly report of crude oil market. OPEC showed its pessimistic expectations on Wednesday, and was lower its global oil demand growth forecast for 2022 in its monthly report, which was the fourth cut since April and was also lower its oil growth forecast for next year.

☆ 20:30 The U.S. released non-seasonally adjusted annual rate of CPI for September, seasonally adjusted monthly rate of CPI for September; the CPI data is expected to be strong up again, reinforcing the Fed's aggressive rate hike expectations in November. Analysts believe that this CPI data, whether it is lower than expected or higher than expected, may trigger significant volatility in the market sentiment in the coming weeks.

☆ 23:00 EIA crude oil inventories for the week ending October 7 will be released in the US. API crude oil inventories for the week released early Thursday morning recorded an increase of 7.05 million barrels, which was the largest increase since the week of April 8, 2022, compared to an expected increase of 1.75 million barrels and a previous decrease of 1.77 million barrels.

Market Overview

——Source: jin10 & Bloomberg

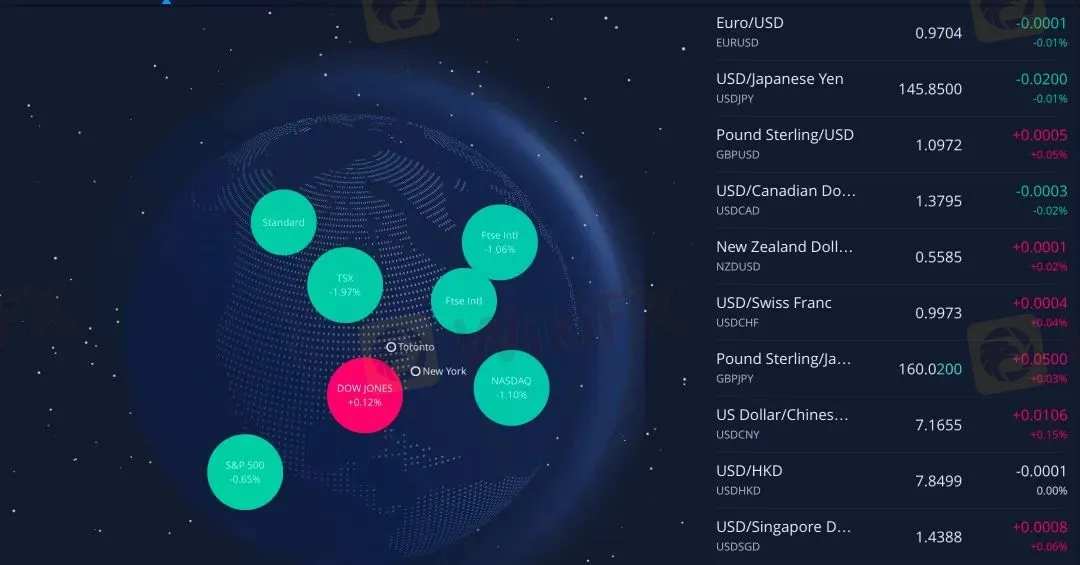

On Wednesday, October 12, the dollar index fluctuated in the 113 range and fell after the release of the Fed minutes, eventually closing flat; the 10-year U.S. bond yield moved higher and pushed 3.98% after the release of PPI data, but turned lower and lost 3.90% after the minutes were released. Spot gold pulled up after the release of the minutes to break through $1678 per ounce, closing up 0.48% at $1673.26 per ounce; spot silver barely held the $19 mark, closing down 0.85% at $19.03 per ounce.

Crude oil plunged 3% at one point during the day, with WTI crude closing down 1.82% at $87.19 per barrel and Brent crude closing down 1.42% at $93.22 per barrel. The decline in WTI crude oil continued after a sharp increase in API crude oil and gasoline inventories. OPEC and the U.S. Energy Information Administration cut their forecasts for global oil demand growth because of recession fears.

U.S. stocks were collectively lower at the beginning of the session and pulled up briefly after the release of the Fed minutes before turning lower in late trading. The Dow closed down 0.1%, the Nasdaq closed down 0.09%, and the S&P 500 index closed down 0.33%. The S&P and Nasdaq recorded a “six consecutive days of low” in Daily Line. Moderna rose more than 8%, after announcing joint development of cancer vaccines with Merck Sharp & Dohme, up more than 4% after the PEP.O.

European stocks generally closed lower, Germany‘s DAX30 index closed down 0.39%; FTSE 100 index closed down 0.86%; France’s CAC40 index closed down 0.25%; Europe‘s Stoxx 50 index closed down 0.26%; Spain’s IBEX35 index closed down 1.30%; Italys FTSE MIB index closed down 1.27%.

Hot Spots in the Market

——Source: jin10&Bloomberg

1. The minutes of the September FOMC meeting of the Federal Reserve showed that officials believed it was necessary to take action to maintain restrictive policies. The Federal Reserve seems to be aware of the risks posed by aggressive rate hikes.

2. The monthly rate of US PPI in September recorded 0.4%, higher than the expected 0.2%, and the annual rate fell from 8.7% to 8.5%.

3. OPEC lowered the growth forecast of global crude oil demand in 2022 by 460000 barrels/day to 2.64 million barrels/day; The growth rate of global crude oil demand in 2023 was lowered by 360000 barrels per day to 2.34 million barrels per day.

4. A major oil pipeline transporting crude oil from Russia to Germany in Poland has leaked.

5. In order to seek new ways for cash, the UK pension fund has made a number of UK enterprises face calls for emergency loans to their employee pension plans.

6. The US government is considering a comprehensive ban on the import of Russian aluminum in response to the escalation of Russian military operations in Ukraine.

7. On October 12 local time, the informal meeting of EU energy ministers was held in the Czech Republic. All participants agreed to jointly purchase natural gas and promote energy conservation before the summer of 2023.

8. The missile attacked the Khor Mor gas field in the Kurdistan region of Iraq.

9. According to Interfax News Agency, Russia will increase the port throughput of 40 million tons for oil exports.

10. EIA short-term energy outlook report: the average prices of WTI crude oil and Brent crude oil in 2022 are expected to be 95.74 dollars/barrel and 102.09 dollars/barrel respectively, compared with 98.07 dollars/barrel and 104.21 dollars/barrel previously.

11. European Central Bank President Christine Lagarde said on Wednesday that the euro zone has not fallen into recession and the economy is still growing.

Institutional Perspective

—— MHMarkets ETA

1. Standard Chartered Bank: It is expected that the Bank of Korea will keep pace with the rate increase of the Federal Reserve, and increase the interest rate by 50 basis points today;

2. Deutsche Bank: Market strengthening is expected to continue to weaken when the Federal Reserve raises interest rates;

3. Morgan Asset Management: The sharp rise of the US dollar may lead to the next crisis;

4. The IMF lowered the global economic growth forecast for next year to 2.7%;

5. Netherlands International: There are two expectations for the Bank of England to raise interest rates, depending on market conditions;

6. JPMorgan Chase: If the CPI released on Thursday is too high, it may cause the US stock market to fall 5% a day;

7. Bank of America believes that the net supply of European government bonds will reach a record 400 billion euros in 2023;

8. Credit Suisse: The target prices of Meta Platforms, Pinterest and Snap have been lowered due to the decline of digital advertising budget;

9. Societe Generale: If this range is not maintained, the pound may hit parity against the dollar;

10. Institutional analysis: the Bank of England's terminal interest rate is expected to be above 6%;

11. Brown Brothers Harriman Bank: Yellen gave the green light for the strengthening of the US dollar;

12. Morgan Asset Management: The sharp rise of the US dollar may trigger the next crisis.

Risk warning: The margin trading of financial derivatives and other products has high risks, so it is not suitable for all investors. The loss may exceed the initial investment. Please ensure that you fully understand the risks and properly manage your risks. Any opinion, news, research product, analysis, quotation or other information in this article does not constitute the following behavior: (1) In any case, MHM will not provide investment advice or recommendation to clients, nor will it express opinions on whether clients rely on or not to make investment decisions. MHM will never provide investors with trading advice or order trading business through WeChat, QQ or other channels; (2) In any case, any materials, information or other functions provided by MHM to clients through websites, investment platforms, marketing, training activities or other means are general information, which cannot be considered as suitable for clients or suggestions based on clients' personal conditions, and MHM will not bear any responsibility for losses caused by investment based on the above information; Investors should pay attention to the official article logo of MHM and the official channel of the brand, and pay attention to identifying fake websites.

WikiFX-Broker

Aktuelle Nachrichten

Ozempic bald 80 Prozent günstiger? Hikma Pharmaceuticals will von auslaufenden Patenten profitieren

Bericht über Megaprojekt in Saudi-Arabien: Neom-Manager sollen Finanzberichte manipulieren, um hohe Kosten zu vertuschen

„Viel zu hohe Risiken – Branchenverband für Volksbanken fordert strengere Regeln für die eigenen Banken

Ford Deutschland in den roten Zahlen – jetzt soll eine Milliarden-Finanzspritze des US-Konzerns helfen

Corona-Überflieger Biontech machte einst Milliardengewinne – mittlerweile aber Verluste und kündigt Stellenabbau an

Ich bin 38 und CEO von Trivago: Diese 6 Skills machen euch zu einer guten Führungskraft

Webasto: Angeschlagener Automobilzulieferer braucht 200-Millionen-Finanzspritze

Trotz sinkendem Absatz: VW-Tochter Traton steigert Rendite und erhöht die Dividenden für Anleger

CO₂-Ziele aufgeschoben: So soll die Autoindustrie gerettet werden

VW-Mitarbeiter erhalten Prämie noch einmal ungekürzt

Wechselkursberechnung