MHMarkets :MHM European Market

Zusammenfassung:Spot gold rebounded slightly during the Asian session on Monday (May 8) and is currently trading around $2021.92 per ounce. On the one hand, gold prices held the 2000 integer mark on Friday, and the influx of low buying supported gold prices; on the other hand, market concerns about the U.S. debt default crisis also provided safe-haven support to gold prices. However, gold prices last week in the history of the high near the resistance, the short term still need to beware of shock retracement ri

Market Overview

Spot gold rebounded slightly during the Asian session on Monday (May 8) and is currently trading around $2021.92 per ounce. On the one hand, gold prices held the 2000 integer mark on Friday, and the influx of low buying supported gold prices; on the other hand, market concerns about the U.S. debt default crisis also provided safe-haven support to gold prices. However, gold prices last week in the history of the high near the resistance, the short term still need to beware of shock retracement risk.

U.S. Treasury Secretary Yellen issued a stern warning on Sunday that if Congress fails to act on the debt ceiling, it could trigger a “constitutional crisis” that would also call into question the credit of the federal government.

Yellen warned that if the debt ceiling is not raised by early June, it could have an impact on financial markets.

U.S. Deputy Treasury Secretary Adeyemo also stressed the danger of a potential default. “A default would be catastrophic for the United States,” Adeyemo said on an MSNBC program. If we were to default on our debt, it would have a terrible impact on interest rates.

U.S. crude oil rose slightly, extending Friday's rally, and is currently trading near $71.75 per barrel as fears of a U.S. recession began to recede. A better-than-expected U.S. jobs report for April, a weaker dollar, and expectations that OPEC+ will cut supply at its next meeting in June are giving oil prices momentum to rally. After bottoming out last Thursday, oil prices rebounded sharply on Friday, increasing the likelihood of a short-term bottom.

In addition, the decline in U.S. crude oil drilling data is also positive for oil prices in the short term.

This trading day, investors need to pay attention to the U.S. monthly wholesale sales rate in March, the Fed's financial stability report, Fed officials' speeches and the U.S. debt ceiling related news.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on May 8, Beijing time.

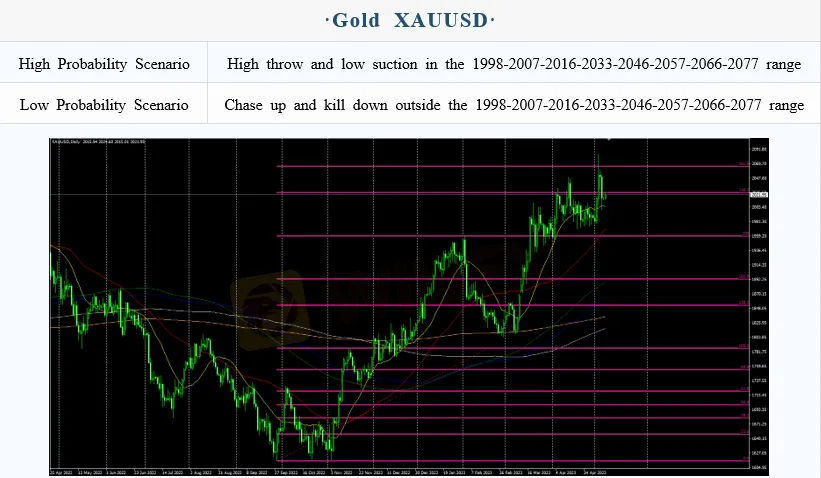

Intraday Oscillation Range: 1998-2007-2016-2033-2046-2057-2066-2077

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1998-2007-2016-2033-2046-2057-2066-2077 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 8. This policy is a daytime policy. Please pay attention to the policy release time.

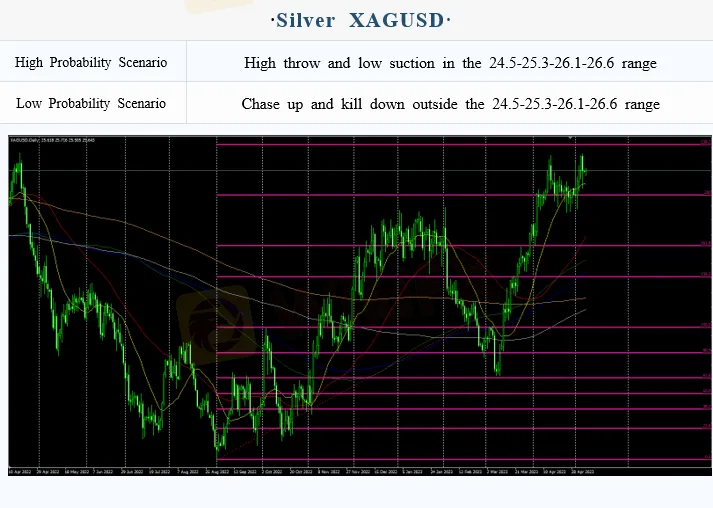

Intraday Oscillation Range: 24.5-25.3-26.1-26.6

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 24.5-25.3-26.1-26.6 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 8. This policy is a daytime policy. Please pay attention to the policy release time.

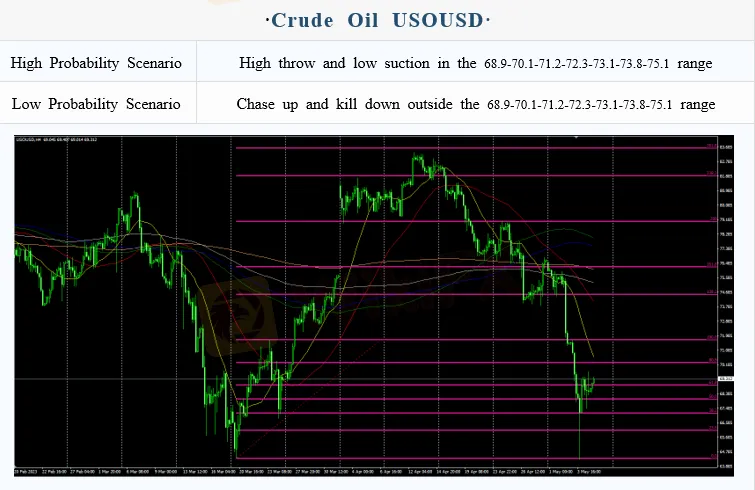

Intraday Oscillation Range:68.9-70.1-71.2-72.3-73.1-73.8-75.1

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 68.9-70.1-71.2-72.3-73.1-73.8-75.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 8. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 8. This policy is a daytime policy. Please pay attention to the policy release time.

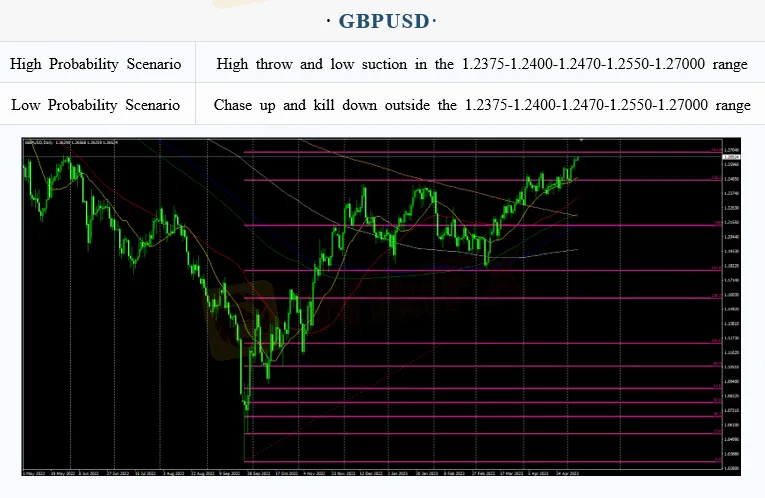

Intraday Oscillation Range: 1.2375-1.2400-1.2470-1.2550-1.27000

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2375-1.2400-1.2470-1.2550-1.27000 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 8. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX-Broker

Aktuelle Nachrichten

XRP-Schock nach Mega-Rallye: Droht jetzt der brutale RIPPLE-Absturz?

Ripple XRP vor der Entscheidung: Wiederholt sich jetzt der Mega-Move von 2017?

Keine Zinssenkungen der Fed 2026: Darum widerspricht JP Morgan den Märkten

Krypto zittern – aber halten! Bitcoin, Ethereum und XRP kämpfen um wichtige Marken

Krypto-Schock nach US-Jobdaten: Dogecoin rutscht plötzlich ab

Ethereum vor Richtungsentscheidung: Käufer übernehmen das Kommando

Cardano unter Druck: Jetzt entscheidet sich alles bei 0,38 Dollar

Wechselkursberechnung