Mai hui MHmarkets: June 21, 2023-MHM European Perspective

Zusammenfassung:On Wednesday (June 21), spot gold was narrowly oscillating during the Asian session and is currently trading at $1,938.33 per ounce. Traders are avoiding big bets ahead of Federal Reserve Chairman Jerome Powell''s testimony to Congress.

Market Overview

On Wednesday (June 21), spot gold was narrowly oscillating during the Asian session and is currently trading at $1,938.33 per ounce. Traders are avoiding big bets ahead of Federal Reserve Chairman Jerome Powell's testimony to Congress. Powell's testimony is expected to provide further insight into the Fed's plans to raise interest rates.

Powell will testify before Congress on Wednesday and Thursday, and the market will carefully comb through his testimony to understand the outlook for U.S. interest rates.

U.S. crude oil is up slightly and is currently trading near $71.40 per barrel. API crude oil inventories, originally scheduled for release in the early hours of each week, were delayed to Thursday morning due to the Monday holiday, and the EIA inventory series, originally scheduled for release on Wednesday evening, was delayed to Thursday evening. The market is now expecting a decline in U.S. crude oil inventories and gasoline inventories, providing support to oil prices. And Russian production is now down by 212,000 barrels per day from its peak as of May 21, with average seaborne shipments down slightly for the four weeks ended June 18.

However, concerns about the outlook for economic growth and crude oil demand in major countries continue to limit oil price gains.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on June 21, Beijing time.

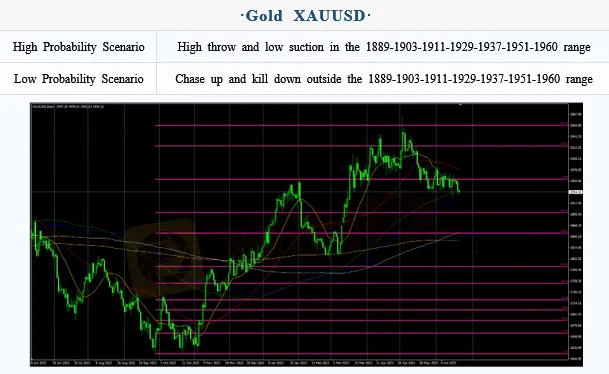

Intraday Oscillation Range: 1889-1903-1911-1929-1937-1951-1960

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1960-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1889-1903-1911-1929-1937-1951-1960 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 21. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 22.3-23.1-23.9-24.5

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 21. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1 In the subsequent period of Crude Oil, 67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 21. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 21. This policy is a daytime policy. Please pay attention to the policy release time.

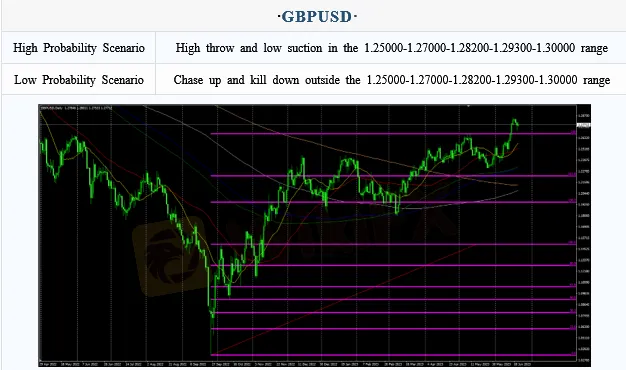

Intraday Oscillation Range: 1.25000-1.27000-1.28200-1.29300-1.30000

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25000-1.27000-1.28200-1.29300-1.30000-1.30600

In the subsequent period of GBPUSD, 1.25000-1.27000-1.28200-1.29300-1.30000 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 21. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX-Broker

Aktuelle Nachrichten

Krypto-Hammer: Ethereum legt plötzlich kräftig zu – kommt jetzt der Angriff auf 5.000 Dollar?

Krypto-Schock um Ethereum: Wale kaufen – Kleinanleger verkaufen, Kurs rutscht ab

Ethereum unter Attacke: Betrüger fluten Netzwerk – Kurs gerät unter Druck

Trump-Drohung schockt Krypto-Markt: Bitcoin, Ether und XRP rutschen weiter ab

XRP unter Verkaufsdruck: Rutscht Ripple jetzt unter die Zwei-Dollar-Marke?

XRP-Schock bei Ripple: Unter 2 Dollar – droht jetzt der Crash?

Gold-Rally, Krypto-Crash: Anleger flüchten in Edelmetalle – Bitcoin verliert Glanz

Krypto-Schock zum Wochenstart: Bitcoin rutscht ab – droht jetzt der nächste Crash?

XRP stürzt unter 2 Dollar – und plötzlich wird es brandgefährlich für Ripple-Anleger

Was gerade am japanischen Anleihemarkt passiert – und warum es Investoren weltweit nervös macht

Wechselkursberechnung