MHMarkets:The dollar was weak in a small intraday range, non-U.S. currencies and precious metals were strong intraday, and U.S. crude oil accelerated to the upside!

Zusammenfassung:Spot gold traded in a narrow range during Asian hours on Thursday (August 10), trading around $1,918.21 per ounce, as investors await the US CPI data for July due in the evening.

Market Overview

Spot gold traded in a narrow range during Asian hours on Thursday (August 10), trading around $1,918.21 per ounce, as investors await the US CPI data for July due in the evening. US growth is expected to rise to 3.3% YoY from 3% in June due to the recent rise in oil prices. Core CPI growth is expected to remain unchanged at 4.8%, meaning the Fed will keep interest rates higher for at least longer, weighing on gold prices. Technical shows, gold prices still have a certain short - term downside risk, pay attention to the 1900 mark near the support.

In addition, there are signs of easing labor tightness in the United States. The market is expected to see initial jobless claims rise slightly to 230,000 for the week ended August 5 from 227,000 previously, which provides a bit of support for gold, which needs to watch out for the possibility of a bottom out.

With the Fed widely expected to be near the end of its rate hike cycle, this is still providing support for gold in the medium to long term.

Also on the watch this session are speeches from Philadelphia Fed President Harker and Atlanta Fed President Raphael Bostic.

U.S. crude oil edged higher, hitting a near 10-month high of $84.68 a barrel before trading near $84.31 a barrel after a big drawdown in U.S. oil inventories, output cuts by Saudi Arabia and Russia outweighed concerns about slowing demand from Asian powers and expectations that the Federal Reserve is nearing the end of its cycle of raising interest rates.

However, investors are mindful of changes in market sentiment, and if concerns about the economic outlook rise, it could weigh on oil prices in the short term. Oil prices have risen sharply in the short term, and after breaking above the April high of 83.51, there is also a need for confirmation and even the possibility of a deep correction in the short term.

This trading day, focus on OPEC monthly crude oil market report, pay attention to the USD Inflation Rate (JUL) and USDInitial Jobless Claims (JUL).

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on August 10, Beijing time.

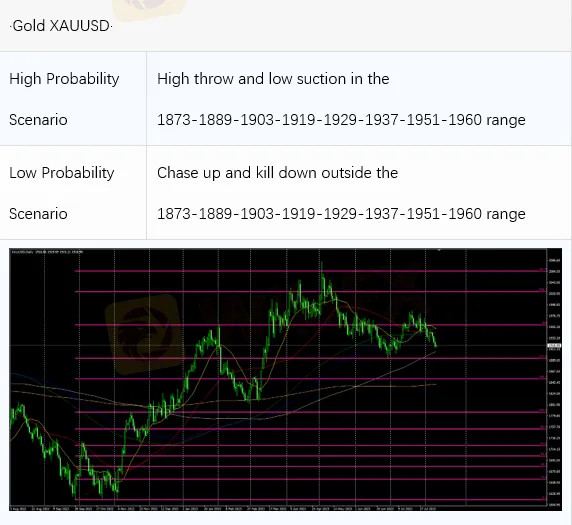

Intraday Oscillation Range: 1873-1889-1903-1919-1929-1937-1951-1960

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1919-1929-1937-1951-1960-1977-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1873-1889-1903-1919-1929-1937-1951-1960 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 20.6-21.5-22.3-23.1-23.9-24.5

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 20.6-21.5-22.3-23.1-23.9-24.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 79.9-80.7-82.3-83.5-85.3-87.3-89.1

Overall Oscillation Range:

62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1-90.7

In the subsequent period of crude oil, 79.9-80.7-82.3-83.5-85.3-87.3-89.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0755-1.0830-1.0950-1.1157-1.1220

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303-1.13340

In the subsequent period of EURUSD, 1.0755-1.0830-1.0950-1.1157-1.1220 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.25460-1.26505-1.27000-1.28200-1.29300

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.25460-1.26505-1.27000-1.28200-1.29300-1.30000-1.30600-1.31000-1.31660-132000

In the subsequent period of GBPUSD, 1.25460-1.26505-1.27000-1.28200-1.29300 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on August 10. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX-Broker

Aktuelle Nachrichten

XRP-Schock nach Mega-Rallye: Droht jetzt der brutale RIPPLE-Absturz?

Krypto-Schock nach US-Jobdaten: Dogecoin rutscht plötzlich ab

Krypto zittern – aber halten! Bitcoin, Ethereum und XRP kämpfen um wichtige Marken

Wechselkursberechnung