MHMarkets:The U.S. dollar retreated slightly, non-U.S. currencies and precious metals began to rebound, and U.S. crude oil consolidated in a relatively high range!

Zusammenfassung:On Friday (September 8), spot gold rebounded slightly during the Asian session, and is currently trading near $1925.29 per ounce. Although overnight data showed that the number of U.S. initial jobless claims last week unexpectedly fell to the lowest level since February, the number of renewed jobless claims fell to the lowest level since July, and the U.S. dollar index once refreshed nearly six months of highs to 105.16, the dollar index has now retracted all of Thursday's gains. Because the Fed

Market Overview

On Friday (September 8), spot gold rebounded slightly during the Asian session, and is currently trading near $1925.29 per ounce. Although overnight data showed that the number of U.S. initial jobless claims last week unexpectedly fell to the lowest level since February, the number of renewed jobless claims fell to the lowest level since July, and the U.S. dollar index once refreshed nearly six months of highs to 105.16, the dollar index has now retracted all of Thursday's gains. Because the Fed officials' speeches basically solidified the expectations of the suspension of interest rate hikes in September, which gives the gold price rebound to provide opportunities.

U.S. West Texas Intermediate (WTI) crude oil and Brent crude oil futures both closed lower. Oil prices were pressured by a stronger US dollar and the expected prospect of weaker international crude demand.

With less economic data this trading day, the focus continues to be on Fed officials' speeches. The U.S. August CPI data will be released next week, and investors will also need to keep an eye on changes in market expectations. The market currently expects the U.S. core CPI year-on-year growth rate will decline slightly to 4.3%, compared with the previous value of 4.7%.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on September 8, Beijing time.

| ·Gold XAUUSD· | |

| High Probability Scenario | High throw and low suction in the 1892-1903-1919-1931-1945-1951 range |

| Low Probability Scenario | Chase up and kill down outside the 1892-1903-1919-1931-1945-1951 range |

| |

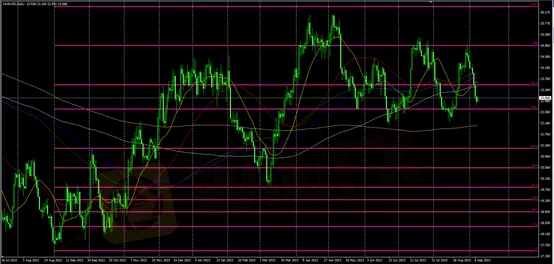

| ·SilverXAGUSD· | |

| High Probability Scenario | High throw and low suction in the 21.5-22.3-23.1-23.9-24.5-25.3 range |

| Low Probability Scenario | Chase up and kill down outside the 21.5-22.3-23.1-23.9-24.5-25.3 range |

| |

| ·Crude OilUSOUSD· | |

| High Probability Scenario | High throw and low suction in the 80.7-82.3-83.5-85.3-87.3-89.1 range |

| Low Probability Scenario | Chase up and kill down outside the 80.7-82.3-83.5-85.3-87.3-89.1 range |

| |

| ·EURUSD· | |

| High Probability Scenario | High throw and low suction in the 1.0570-1.0690-1.0755-1.0830-1.0950 range |

| Low Probability Scenario | Chase up and kill down outside the1.0570-1.0690-1.0755-1.0830-1.0950 range |

| |

| ·GBPUSD· | |

| High Probability Scenario | High throw and low suction in the 1.2250-1.2400-1.2470-1.25460-1.26505-1.27000 range |

| Low Probability Scenario | Chase up and kill down outside the 1.2250-1.2400-1.2470-1.25460-1.26505-1.27000 range |

| |

WikiFX-Broker

Aktuelle Nachrichten

Bitcoin fällt unter 60.000 US-Dollar – psychologische Marken unter Druck

Gold steigt, Silber explodiert: Warum 2026 alles anders wird

Dollar -9%: Steht der größte Währungs-Irrtum vor der Auflösung?

Rätsel um Ripple: Institutionen kaufen, XRP fällt trotzdem

21% Rally bei Ripple (XRP): Startschuss oder gefährliche Falle?

Gold bricht ein – und diese Aktien werden plötzlich zum neuen Wertspeicher

JPMorgan schockt Gold-Fans: Warum Bitcoin jetzt klar im Vorteil ist

Wechselkursberechnung