Zurich Trade Finco

Zusammenfassung:Zurich Trade Finco, a global brokerage based in the United Kingdom, offers a range of market instruments, including Forex, Commodities, Indices, Stocks, and Cryptocurrencies. It's important to note that Zurich Trade Finco currently lacks regulatory oversight, and its website is inaccessible. These factors introduce considerable investment risks associated with the platform.

Note: Zurich Trade Finco official site - https://zurichtradefinco.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| Zurich Trade Finco Review Summary in 10 Points | |

| Founded | 2-5 years |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, Stocks, Cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | Start from 0.1 pips |

| Trading Platforms | MT4, web-based platform |

| Minimum Deposit | $0 |

| Customer Support | Email, Phone |

What is Zurich Trade Finco?

Zurich Trade Finco, a global brokerage based in the United Kingdom, offers a range of market instruments, including Forex, Commodities, Indices, Stocks, and Cryptocurrencies. It's important to note that Zurich Trade Finco currently lacks regulatory oversight, and its website is inaccessible. These factors introduce considerable investment risks associated with the platform.

In the upcoming article, we will conduct a comprehensive review of the broker's features, presenting information in an organized format. If you find this topic intriguing, we recommend you reading further. A concise summary at the end will provide an overview of the broker's distinct characteristics.

Pros & Cons

| Pros | Cons |

| • MT4 trading platforms | • Unregulated |

| • Tiered accounts | • Website dysfunctional |

| • Demo account available | • Limited info on commissions |

| • No minimum deposit | • Negative reviews from their clients |

| • Inactivity/ withdrawal fees charged |

Zurich Trade Finco presents a mix of pros and cons for potential traders.

On the positive side, they offer the widely acclaimed MT4 trading platforms, known for their robust features and user-friendliness. The availability of tiered accounts caters to diverse trading preferences, and a demo account is provided for practice. Also, it offers the advantage of no minimum deposit, providing flexibility for traders with varying capital levels to access their trading services.

However, there are notable drawbacks, including their unregulated status, which raises concerns about client protection. The dysfunctional website adds to usability issues. Limited information on commissions and negative client reviews further detracts from their appeal. Furthermore, the broker imposes inactivity fees on dormant accounts and withdrawal fees associated with various withdrawal methods.

As such, traders should weigh these pros and cons carefully when considering Zurich Trade Finco for their investment needs.

Is Zurich Trade Finco Safe or Scam?

When considering the safety of a brokerage like Zurich Trade Finco or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

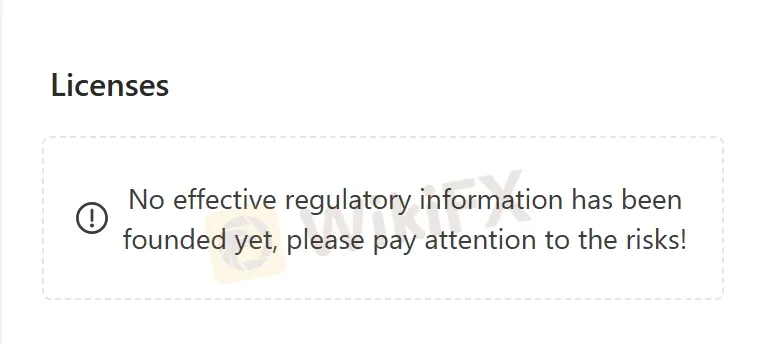

Regulatory sight: The absence of regulatory oversight for Zurich Trade Finco raises significant safety concerns for potential traders.

Furthermore, the unavailability of their official website may indicate a halt in their operations. Together, these factors amplify the potential risks associated with investing through their platform.

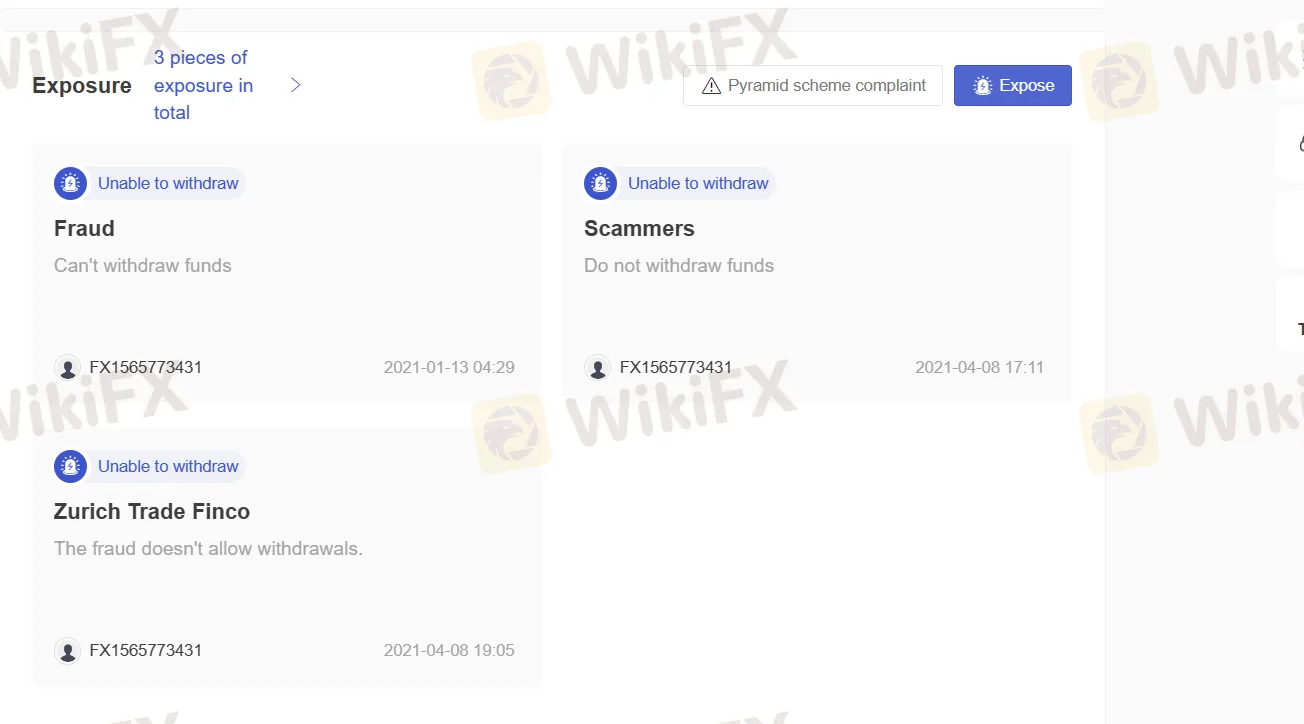

User feedback: The presence of three reports on WikiFX regarding scams, fraud, and withdrawal issues should serve as notable warning signs. Prior to engaging with any broker or investment platform, conducting extensive research and due diligence is essential to prevent making regrettable decisions.

Security measures: So far we cannot find any security measures info on Internet for this broker.

Ultimately, the decision of whether or not to trade with Zurich Trade Finco is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

Zurich Trade Finco presents a diverse array of market instruments, catering to the preferences of a wide range of traders.

With offerings in Forex, Commodities, Indices, Stocks, and Cryptocurrencies, clients have the opportunity to explore various asset classes and trading opportunities. Whether one seeks the volatility of cryptocurrencies, the stability of stocks, or the global reach of forex, Zurich Trade Finco's platform endeavors to provide a comprehensive trading experience across these diverse markets, giving traders the flexibility to pursue their investment goals.

Account Types

Zurich Trade Finco offers a range of account types to cater to the diverse needs of traders.

They provide a demo account, allowing users to practice and familiarize themselves with the platform risk-free.

For live trading, the broker offers Standard, Gold, and VIP Accounts, providing traders with tiered options based on their experience and preferences.

A notable advantage is the absence of a minimum deposit requirement, making it accessible to traders with varying levels of capital.

Leverage

Zurich Trade Finco states that it offers leverage of up to 1:30. Leverage is a double-edged sword in trading, amplifying both potential profits and losses. While higher leverage can enhance the potential for substantial gains, it also increases the risk of significant losses.

Traders should exercise caution and ensure they fully understand the implications of using leverage before employing it in their trading strategies. It's crucial to consider risk management practices and use leverage judiciously to align with one's risk tolerance and trading objectives.

Spreads & Commissions

Zurich Trade Fincos each account type is tailored to different trading preferences and experience levels.

While the broker advertises spreads starting from 1.3 pips for Standard Accounts, 1.8 pips for Gold Account while the VIP Account boasts a particularly competitive spread starting from just 0.1 pips, potentially appealing to more experienced traders.

However, it's important to note that there is limited available information regarding commissions, which could impact the overall cost of trading.

Traders should carefully consider these factors when selecting the account type that aligns with their trading strategy and objectives.

Trading Platforms

Zurich Trade Finco offers traders a choice between two trading platforms.

The first is the well-established MetaTrader 4 (MT4), known for its robust features, technical analysis tools, and customizable interface. MT4 is favored by many experienced traders for its versatility.

The second option is a simplified, browser-based platform. While this platform may be user-friendly, it might lack the advanced features and depth of analysis that traders accustomed to MT4 seek.

Deposits & Withdrawals

Zurich Trade Finco provides traders with a variety of payment options to facilitate deposits and withdrawals.

These include traditional methods such as bank wire transfers and credit/debit cards, offering convenience for many users. Additionally, the broker supports popular e-wallet services like Skrill and Neteller, known for their speed and security.

Furthermore, Zurich Trade Finco extends its reach to include online payments such as giropay and Trustly, catering to clients who prefer alternative payment solutions.

Fees

Zurich Trade Finco imposes several fees and conditions such as inactivity fees, withdrawal fees etc. that traders should be aware of when trading with Zurich Trade Finco.

| Fee Type | Amount |

| Inactivity Fee | 10% of account balance |

| Minimum Wire Transfer | 250 EUR/USD/GBP |

| Minimum Other Methods | 100 EUR/USD/GBP |

| Wire Transfer Withdrawal Fee | 50 EUR/USD/GBP |

| Credit Card Withdrawal Fee | 25 EUR/USD/GBP |

| Credit Card Processing Fee | $10/7 EUR/5 GBP |

| ePayments Withdrawal Fee | 25 EUR/USD/GBP |

| Levy for Low Turnover | 10% of withdrawal amount |

User Exposure on WikiFX

WikiFX reports three concerning issues, including scams, fraud, and withdrawal problems, which should be a significant cause for concern among potential investors. We strongly advise all traders to engage in extensive and thorough research before committing any financial investments.

Our platform is dedicated to providing comprehensive information to assist in making informed decisions. If you have encountered fraudulent practices or fallen victim to broker scams, we encourage you to share your experiences in our 'Exposure' section. Your input is invaluable, and our dedicated team is committed to addressing these issues and advocating on your behalf to seek resolutions for these complex situations.

Customer Service

Zurich Trade Finco provides multiple customer service options to assist its clients. Customers can reach out to Zurich Trade Finco through various channels to address their queries and concerns as below:

Phone: +6531590722; +447520638686; +41445083233.

Email: support@zurichtradefinco.com.

Conclusion

Zurich Trade Finco, a global online broker headquartered in the United Kingdom, offers a range of trading instruments, including Forex, Commodities, Indices, Stocks, and Cryptocurrencies, as per online sources.

However, its unregulated status raises significant concerns, as reputable brokers typically adhere to industry-standard financial regulations, providing clients with a sense of security and trustworthiness.

The inaccessibility of their operational website, coupled with three reported cases of scams, fraud, and withdrawal issues on WikiFX, further erode their credibility and professionalism.

Therefore, potential investors considering Zurich Trade Finco should exercise extreme caution. It is advisable to explore alternative, regulated brokers that prioritize transparency, security, and maintain a high standard of accountability to ensure a safer trading environment.

Frequently Asked Questions (FAQs)

| Q 1: | Is Zurich Trade Finco regulated? |

| A 1: | No. It has been verified that this broker is currently under no valid regulations. |

| Q 2: | Is Zurich Trade Finco a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of the lack of transparency and reports of scams, fraud and unable to withdraw. |

| Q 3: | Does Zurich Trade Finco offer the industry leading MT4 & MT5? |

| A 3: | Yes, it offers MT4 platform. |

| Q 4: | Does Zurich Trade Finco offer demo account? |

| A 4: | Yes. |

| Q 5: | Whats the minimum deposit Zurich Trade Finco requests? |

| A 5: | No minimum deposit requirement. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

WikiFX-Broker

Aktuelle Nachrichten

Frauen verdienen im Laufe ihrer Karriere 500.000 Euro weniger als Männer – der Grund überrascht

Führung fest in Männerhand: Neue Zahlen zeigen, wie besorgniserregend der Frauenanteil in deutschen Chefetagen ist

Apple: Einige KI-Verbesserungen an Siri wurden überraschend auf 2026 verschoben

Wechselkursberechnung