S&B Broker

Zusammenfassung:S&B Broker is an unregulated brokerage company registered in the xx. While the broker's official website has been closed, so traders cannot obtain more security information.

Note: S&B Broker's official website: https://sandb.forex/en is currently inaccessible normally.

S&B Broker Information

S&B Broker is an unregulated brokerage company registered in the xx. While the broker's official website has been closed, so traders cannot obtain more security information.

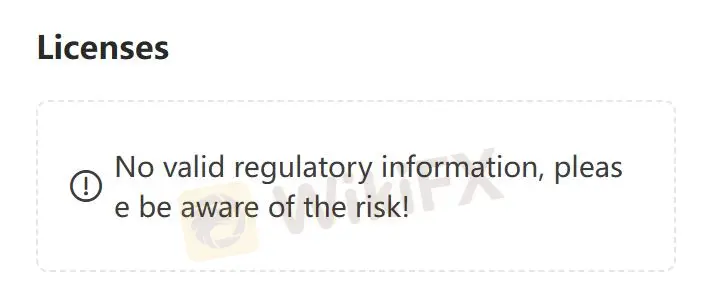

Is S&B Broker Legit?

S&B Broker is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the company.

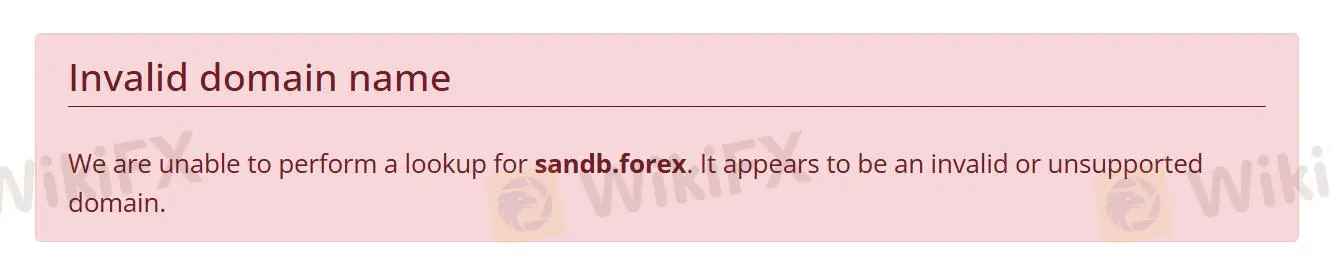

After a Whois query, we found that this company's domain name is invalid, which shows that this company has not registered it securely.

Downsides of S&B Broker

- Unavailable Website

Because of the inaccessible S&B Broker's official website, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since S&B Broker does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

S&B Broker is not regulated, which is less safe than a regulated one.

Conclusion

S&B Broker Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status and invalid domain name indicate that this brokers trading risks are high. It is advisable to choose regulated brokers with transparent operationsto ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

WikiFX-Broker

Aktuelle Nachrichten

Porsche nimmt Ziele zurück – wegen schwacher Nachfrage nach E-Autos

Puma muss deutlichen Rückgang beim Gewinn hinnehmen

KI nimmt doch Jobs weg: Wie ihr in der Tech-Branche trotzdem Karriere machen könnt

Tesla-Aktie fällt an einem Tag um mehr als 15 Prozent – deshalb will Trump jetzt einen Tesla kaufen

Volkswagen in der Krise: So stark kürzt der Konzern die Dividende für seine Aktionäre

Dance: E-Mobility-Startup der Soundcloud-Gründer nimmt weitere 12 Millionen Euro auf

Kaffee-Krise bei Aldi, Edeka und Kaufland: Darum wird euer Lieblingskaffee immer teurer und teurer

Nvidia-Aktie bricht ein – das empfiehlt ein Analyst jetzt Anlegern

Gewinnrückgang bei Puma: Sportartikelhersteller will 500 Stellen streichen

Fast 3 Prozent sichere Rendite auf Bundesanleihen – lohnt sich der Einstieg noch?

Wechselkursberechnung