Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

Zusammenfassung:The ECB's consumer expectations survey shows mixed economic signals with slight improvements in unemployment expectations but unchanged growth forecasts. The euro faces pressure from a strong USD, while the GBP shows resilience, contributing to the strength of GBP/USD and the decline of EUR/GBP.

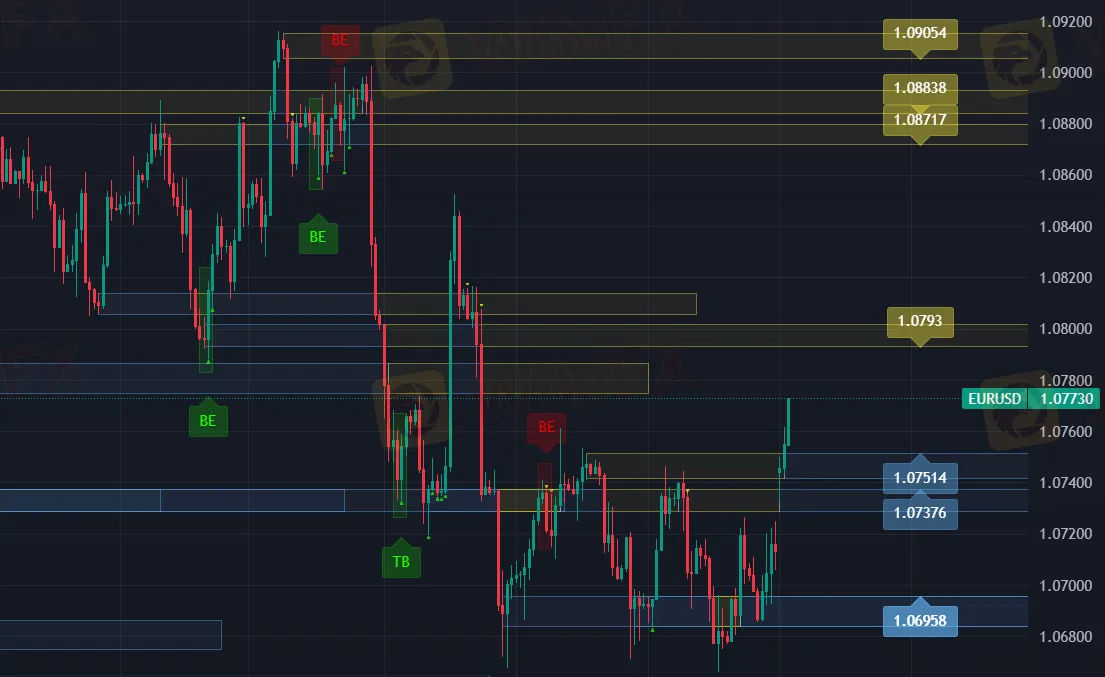

EUR/USD 4H Chart

GBP/USD 4H Chart

EUR/GBP 4H Chart

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

Key Support Levels:

EUR/USD:1.06842

GBP/USD:1.26029

EUR/GBP:0.84158

Key Resistance Levels:

EUR/USD:1.07515

GBP/USD:1.27033

EUR/GBP:0.8500

Recent data from the European Central Bank's (ECB) consumer expectations survey presents a mixed picture for the Eurozone economy. The 12-month ahead unemployment expectation has slightly improved, while the growth expectation remains unchanged at a modest 0.8%. Additionally, the 3-year ahead inflation expectation has slightly decreased, with uncertainty over inflation expectations falling to its lowest level since February 2022. Despite these mixed signals, the euro is facing significant pressure, on track for its largest monthly decline since January, due to the strength of the US dollar.

In contrast, the British pound is showing resilience, heading for its first weekly gain in a month. This gain is supported by improving economic data and market sentiment, contributing to the strength of the GBP against both the USD and the EUR.

Consolidated Impact on EUR/USD, GBP/USD, and EUR/GBP

Overall Sentiment:

EUR/USD:Bearish, driven by mixed economic data from the Eurozone and strong USD performance.

GBP/USD:Neutral to bullish, supported by improving UK economic data.

EUR/GBP:Bearish for EUR, supported by stronger GBP performance.

Key Influences:

EUR/USD:

Improved Eurozone labor market expectations provide limited support.

Unchanged growth expectations and slightly lower long-term inflation expectations.

Significant monthly decline for the euro due to robust USD strength and mixed economic signals.

GBP/USD:

Sterling gains supported by improving UK economic data and market sentiment.

Potential for further GBP strength if UK economic data continues to improve.

EUR/GBP:

Euro weakness against GBP due to mixed Eurozone economic data.

Stronger GBP performance driving EUR/GBP lower.

Potential Movement:

EUR/USD:Likely to remain under pressure with potential downside movement, contingent on further economic data and USD strength.

GBP/USD:Potential upside movement if UK economic data continues to improve.

EUR/GBP:Likely to trend lower with stronger GBP performance against a weaker EUR.

Important Economic Calendar Events for the Eurozone

Eurozone CPI (YoY) (June)– June 30, 2024: A key measure of inflation.

Eurozone Unemployment Rate (May)– June 30, 2024: Indicator of labor market health.

Germany Manufacturing PMI (June)– July 1, 2024: Reflects manufacturing sector activity.

Eurozone Services PMI (June)– July 3, 2024: Indicates health of the services sector.

Germany Industrial Production (MoM) (May)– July 5, 2024: Measures industrial output.

Eurozone Retail Sales (MoM) (May)– July 5, 2024: Indicator of consumer spending trends.

Eurozone Sentix Investor Confidence (July)– July 8, 2024: Measures investor confidence and economic outlook.

UK GDP (MoM) (May)– July 10, 2024: Measure of monthly economic growth.

UK Manufacturing Production (MoM) (May)– July 10, 2024: Reflects manufacturing output.

UK CPI (YoY) (June)– July 17, 2024: A key measure of inflation.

UK Unemployment Rate (May)– July 18, 2024: Indicator of labor market health.

UK Retail Sales (MoM) (June)– July 20, 2024: Measures consumer spending trends.

Important Economic Calendar Events for the UK

WikiFX-Broker

Aktuelle Nachrichten

Abwanderung der Millionäre: Darum kehren die Superreichen Deutschland den Rücken

Schneller in den Urlaub: Scanner am Flughafen könnten bald mit KI funktionieren

Wie der Verbrenner durch diesen Trick in China weiterlebt, aber in der EU verboten wird

Wechselkursberechnung