Capital IM Limited

Zusammenfassung:Capital IM Limited is an unregulated services provider offering a range of trading opportunities in forex, cryptocurrencies, commodities like gold and crude oil, and other assets. It operates with a focus on providing competitive spreads and commission-free trading. Moreover, it provides integrated CFD trading platform.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Capital IM Review Summary | |

| Registered Country/Region | China |

| Regulation | No Regulation |

| Market Instruments | Forex, Gold, Cryptocurrency, Crude oil, and commodities |

| Demo Account | Unavailable |

| Leverage | Not mentioned |

| Spread | Not mentioned |

| Trading Platform | Integrated CFD trading platform |

| Minimum Deposit | Not mentioned |

| Customer Support | 24/7, email: support@capitalimlimitedfx.com |

Capital IM Information

Capital IM Limited is an unregulated services provider offering a range of trading opportunities in forex, cryptocurrencies, commodities like gold and crude oil, and other assets. It operates with a focus on providing competitive spreads and commission-free trading. Moreover, it provides integrated CFD trading platform.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Pros & Cons

| Pros | Cons |

| Multiple Market Instruments | Lack of valid regulatory oversight |

| Competitive spreads and commission-free | No information provided on minimum deposits, leverage, or specific spread details |

| User-friendly integrated CFD trading platform | Customer service limited to email support |

| 24/7 trading availability | Absence of a demo account |

Pros:

Multiple Market Instruments: Offers a diverse range of trading instruments including forex, cryptocurrencies, commodities like gold, and crude oil.

Competitive spreads and commission-free: Cost-effective trading model that can enhance profitability by reducing trading costs.

User-friendly integrated CFD trading platform: The platform is designed to cater to a global clientele, offering ease of use and efficient trade execution across different financial markets.

24/7 trading availability: Allows traders to participate in markets around the clock, taking advantage of global market movements and opportunities.

Cons:

Lack of valid regulatory oversight: Operating without proper regulation raises concerns about client protection, transparency, and adherence to industry standards.

No information provided on minimum deposits, leverage, or specific spread details: Transparency regarding trading conditions such as minimum deposits, leverage options, and spread specifics is lacking, impacting informed decision-making.

Customer service limited to email support: Sole reliance on email for customer service can result in slower response times and less immediate support compared to platforms offering multiple support channels.

Absence of a demo account: Lack of a demo account can hinder new traders from familiarizing themselves with the platform and testing strategies without risking actual capital.

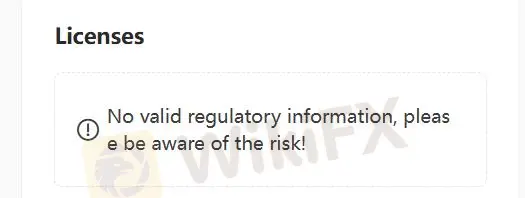

Is Capital IM Legit?

Capital IM currently lacks valid regulation, which raises significant concerns about its safety and legitimacy. Regulatory oversight is crucial for ensuring that a financial services provider operates within established standards and adheres to specific rules and requirements designed to protect investors and clients. Without proper regulation, there is an increased risk of fraudulent activities, scams, and inadequate consumer protection.

Market Instruments

For forex traders, Capital IM provides access to the world's largest trading market with competitive spreads and round-the-clock trading hours. Cryptocurrency enthusiasts can engage in trading CFDs, benefiting from the flexibility to trade without needing a crypto wallet, leverage options, and the ability to capitalize on price movements in a 24/7 market environment.

Additionally, Capital IM supports gold trading, offering both spot and futures margin trading options, ideal for investors seeking a safe haven during economic uncertainties. Furthermore, their commodity offerings include OTC crude oil and other commodities, characterized by low spreads and robust execution.

How to Open an Account?

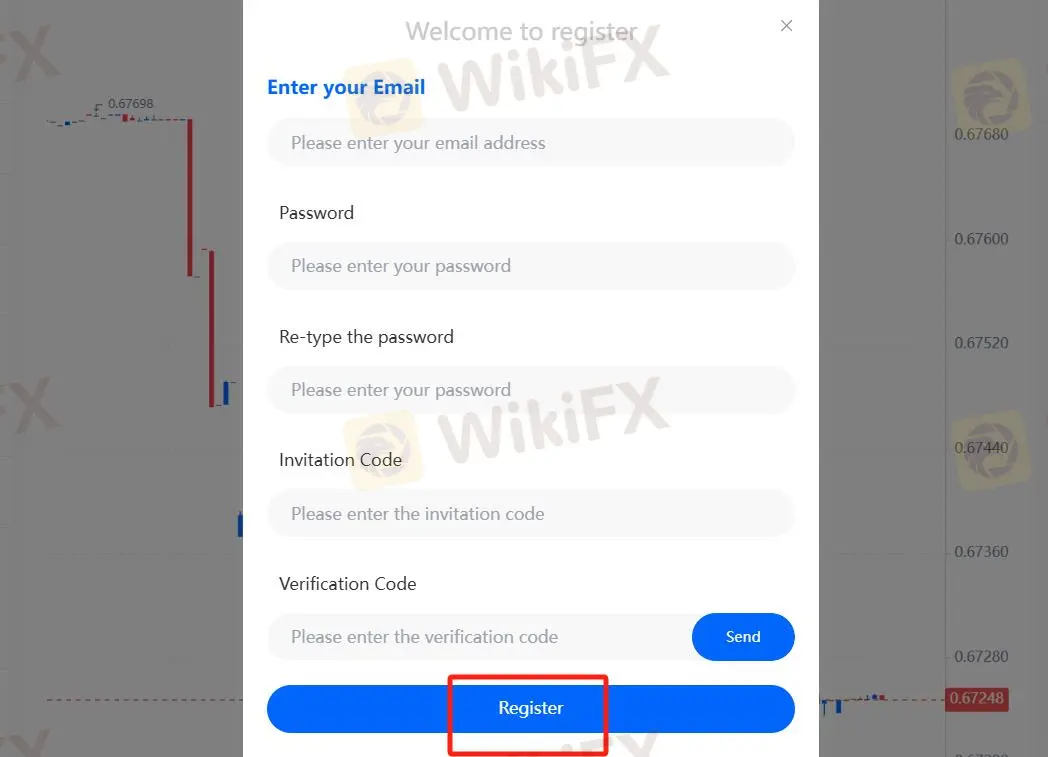

- Step 1: Click the button ''Sign up now'' on the homepage.

- Step 2: Click the button ''Register''.

- Step 3: Follow the on-screen instructions to input your personal and contact details.

- Step 4: Click on the ''Register'' option to finalize the creation of your account.

Spreads & Commissions

Capital IM distinguishes itself in the trading industry by offering highly competitive spreads and commission-free trading on various assets. With a spread as low as 0.4 points on crude oil and other commodities, traders benefit from cost-effective transactions that enhance profitability. This transparent pricing model ensures that clients retain more of their trading capital, enabling them to maximize their returns without the burden of additional commissions.

Trading Platform

Capital IM prides itself on its advanced integrated CFD trading platform, designed to cater to the needs of over 330,000 clients globally. With access to over 100 tradable assets, the platform ensures round-the-clock trading opportunities across various financial markets. Its user-friendly interface facilitates seamless navigation and efficient execution of trades, empowering traders to capitalize on market opportunities with ease.

Conclusion

In conclusion, Capital IM presents itself as a versatile trading platform offering access to a wide range of financial instruments with a user-friendly integrated CFD trading platform catering to over 330,000 clients globally. It provides round-the-clock trading opportunities and competitive spreads without commission fees, which can appeal to traders seeking cost-effective transactions.

However, the absence of regulatory oversight raises significant concerns about the platform's legitimacy and client protection measures. Additionally, the lack of detailed information on trading conditions such as minimum deposits, leverage options, and specific spread details can pose challenges for traders making informed decisions.

Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

Frequently Asked Questions (FAQs)

Is Capital IM regulated?

No. It has been verified that this broker currently has no valid regulation.

Does Capital IM offer demo accounts?

No.

What financial instruments can I trade with Capital IM?

Forex, Gold, Cryptocurrency, Crude oil, and commodities.

What trading platform does Capital IM use?

Capital IM utilizes an integrated CFD trading platform designed to accommodate a wide range of traders with access to over 100 tradable assets.

Is Capital IM a good broker for beginners?

No. It is not a good choice for beginners because of its unregulated condition.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

WikiFX-Broker

Aktuelle Nachrichten

Elon Musk wird Nissan nicht retten – der japanische Autobauer braucht eine neue Strategie

US-Aktien unter Druck: Diese drei Gründe stecken hinter dem schlechtesten Börsen-Tag des Jahres

Wechselkursberechnung