CIMB BANK

Zusammenfassung:CIMB BANK, headquartered in Singapore and regulated by LFSA, provides a comprehensive suite of financial services. These encompass loans & financing, investments, insurance, and remittance solutions. The bank also offers a variety of account types, including savings, current, and fixed deposit accounts.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| CIMB BANK Review Summary | |

| Registered Country/Region | Singapore |

| Regulation | Regulated by LFSA |

| Services | Loans & financing, investments, insurance and remittance |

| Minimum Deposit | $100 |

| Customer Support | (9.00 am - 7.00 pm, daily) telephone, email, Twitter, Facebook, Instagram, and Linkedin |

CIMB BANK Information

CIMB BANK, headquartered in Singapore and regulated by LFSA, provides a comprehensive suite of financial services. These encompass loans & financing, investments, insurance, and remittance solutions. The bank also offers a variety of account types, including savings, current, and fixed deposit accounts.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

| Regulated by LFSA | Complex Structure |

| Innovative Security Features | |

| Wide Range of Financial Services | |

| Accessible Minimum Deposit |

Pros:

- Regulated by LFSA: CIMB BANK is regulated by the Labuan Financial Services Authority (LFSA), ensuring it operates under a recognized regulatory framework. This enhances trust and compliance with financial regulations.

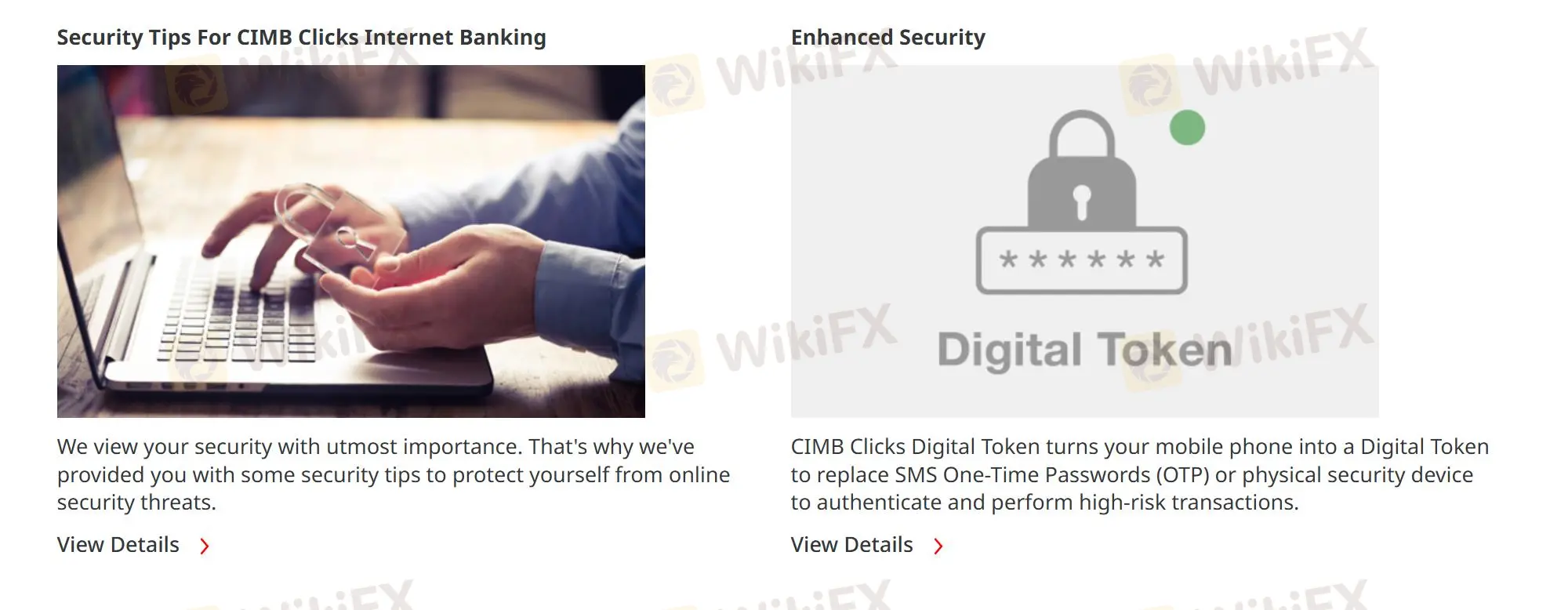

- Innovative Security Features: The CIMB Clicks Digital Token is highlighted for its innovative approach to security, transforming mobile phones into digital tokens for enhanced safety during transactions.

- Wide Range of Financial Services: CIMB BANK offers a comprehensive suite of financial products, covering loans & financing, investments, insurance, and remittance services.

- Accessible Minimum Deposit: With a minimum deposit requirement of $100, CIMB BANK ensures its financial services are accessible to a wider range of customers, fostering inclusivity.

Cons:

- Complex Structure: CIMB BANKs organizational or operational structure are complex by some customers, potentially affecting ease of understanding or transparency.

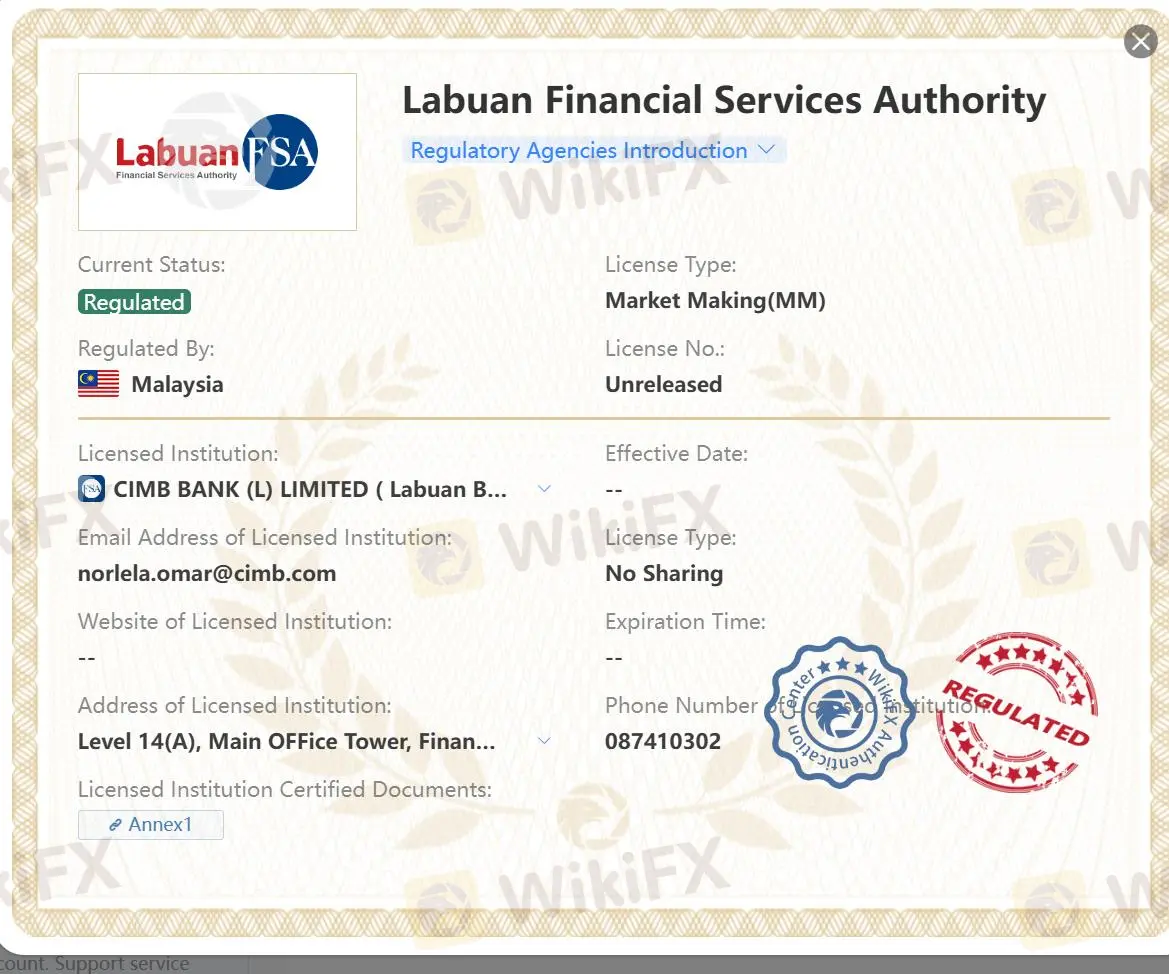

Is CIMB BANK Legit?

CIMB BANK operates under the regulatory oversight of the Labuan Financial Services Authority (Labuan FSA), where it holds a Market Making (MM) license. This regulatory framework ensures that CIMB adheres to established standards and practices, providing a secure environment for financial transactions and customer interactions.

In terms of customer protection, CIMB BANK offers CIMB Clicks Digital Token. This innovative feature transforms a user's mobile phone into a digital token, replacing the traditional SMS One-Time Passwords (OTP) or physical security devices. This digital token serves as a robust authentication tool, enabling customers to securely perform high-risk transactions and access sensitive financial services through CIMB's digital platforms.

Services

CIMB BANK offers loans & financing, investments, insurance and remittance.

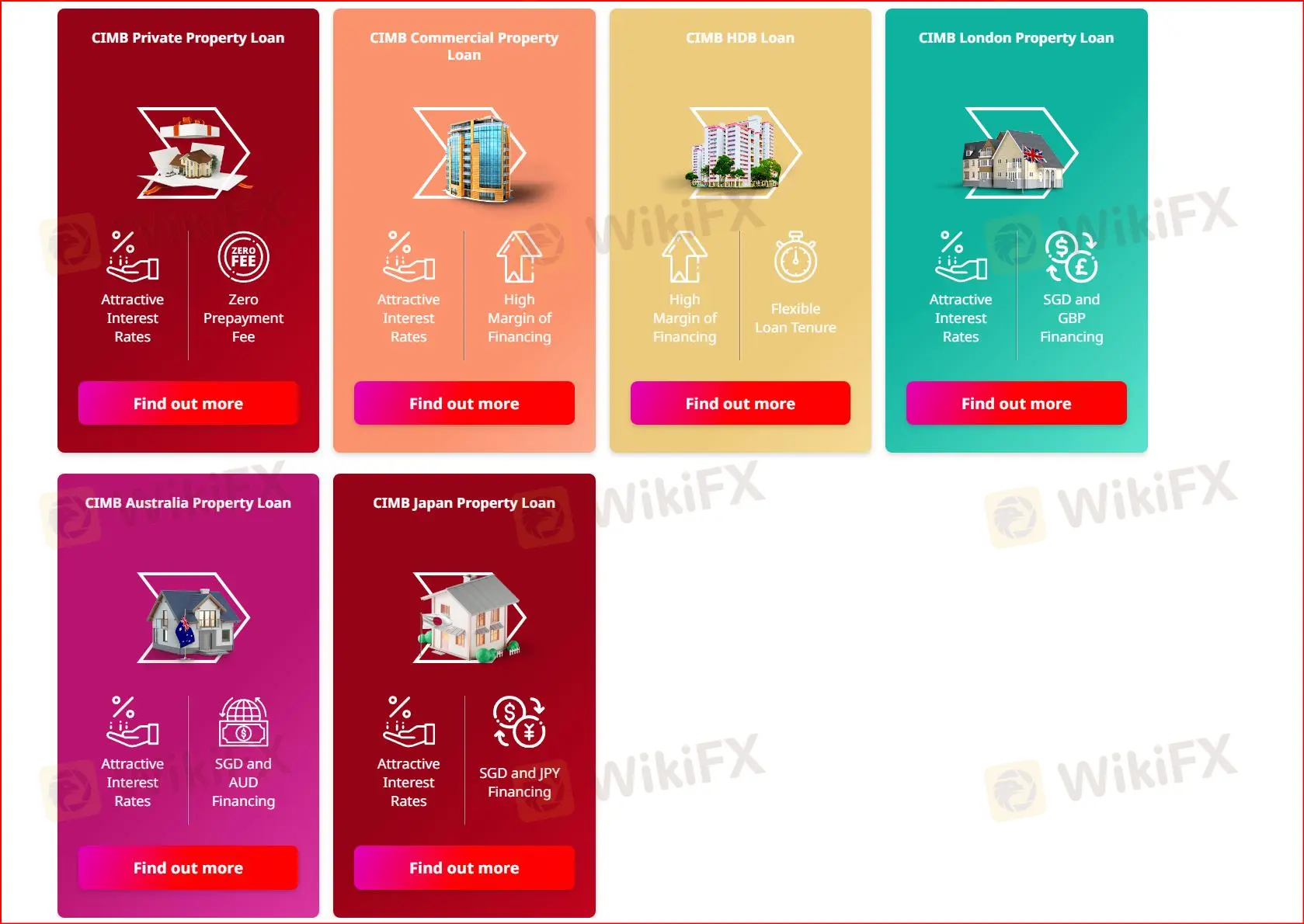

- Loans & Financing:

CIMB Bank provides attractive personal loan options with interest rates starting from as low as 2.80%* p.a. (Effective Interest Rate [EIR] from 5.28%). Customers can also enjoy a waiver on processing fees and up to S$2,000 cashback.

- Investments:

CIMB Bank offers a variety of investment options to help customers grow their wealth. These include:

- Unit Trust Funds: Both conventional and Islamic unit trust funds are available, providing diversified investment portfolios managed by professional fund managers.

- Systematic Investment Process: A tailored investment approach that allows customers to invest regularly in a disciplined manner.

- Tailored Investments: Customized investment solutions based on individual needs and risk profiles.

- Structured Deposits: These deposits offer a 100% principal guarantee and customizable structures, providing a safe and secure way to invest.

- Dual Currency Investments: Investments that allow customers to benefit from currency movements, with a range of currency pairs and flexible tenures.

- FX Margin Trading: High liquidity margin trading in foreign currencies, enabling customers to take advantage of market movements.

- Supplementary Retirement Scheme (SRS): A tax-beneficial retirement scheme offering higher returns on investments.

- Gold Account: An account that allows customers to invest in gold without any fees or charges and no minimum balance requirement.

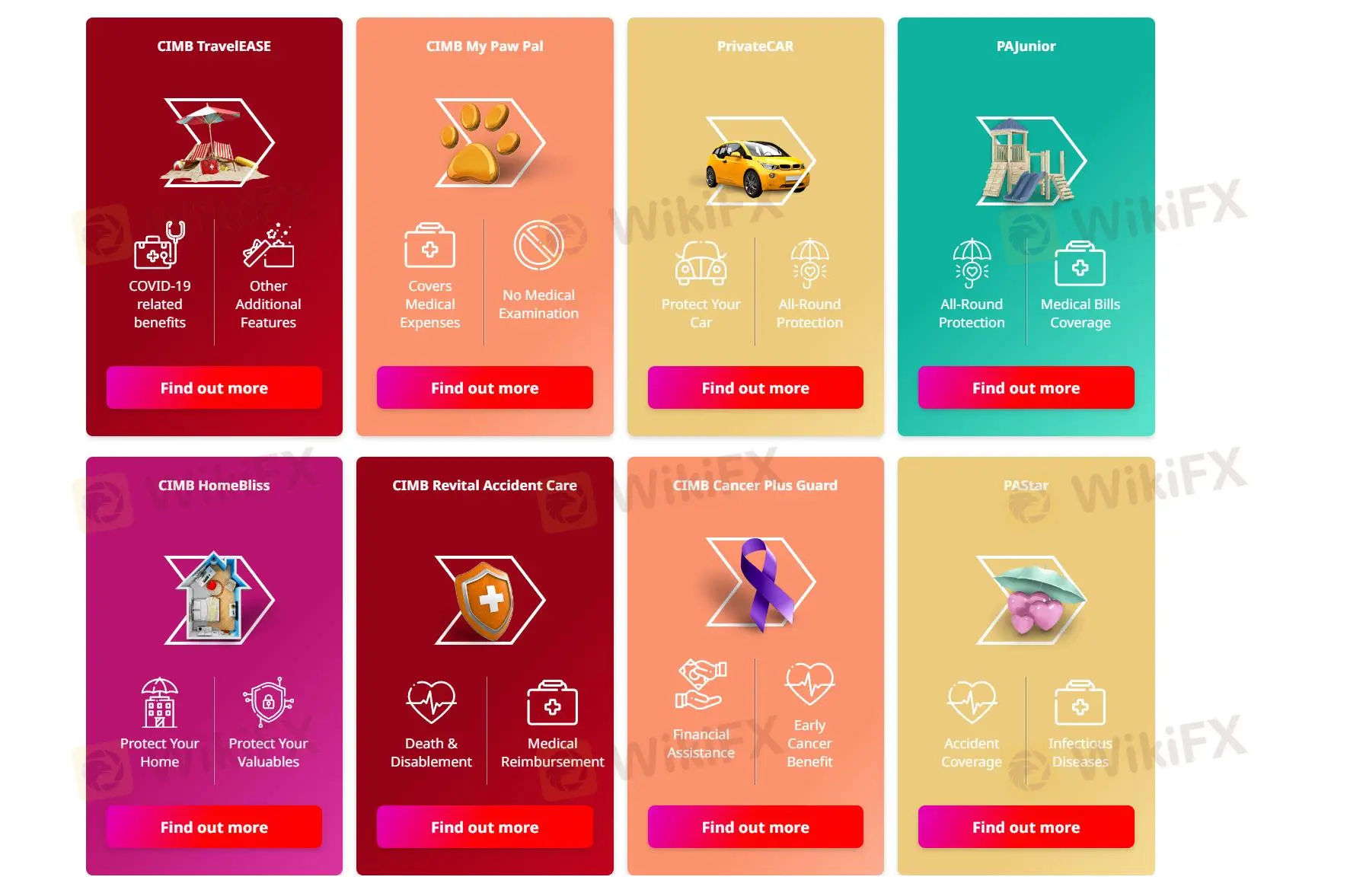

- Insurance:

CIMB Bank also provides a range of insurance products to protect customers and their loved ones. These include:

- CIMB TravelEASE: Travel insurance with COVID-19 related benefits and other additional features.

- CIMB My Paw Pal: Pet insurance that covers medical expenses without requiring a medical examination.

- PrivateCAR: Comprehensive car insurance to protect customers vehicles.

- PAJunior: All-round protection for children, including medical bills coverage.

- CIMB HomeBliss: Home insurance to protect customers homes and valuables.

- CIMB Revital Accident Care: Accident insurance providing death and disablement coverage as well as medical reimbursement.

- CIMB Cancer Plus Guard: Financial assistance and early cancer benefit insurance.

- PAStar: Accident coverage that also includes infectious diseases.

- Remittance:

CIMB Bank offers remittance services to help customers send money abroad quickly and securely.

Account Types

CIMB BANK offers three types of accounting including savings, current and fixed deposit accounts.

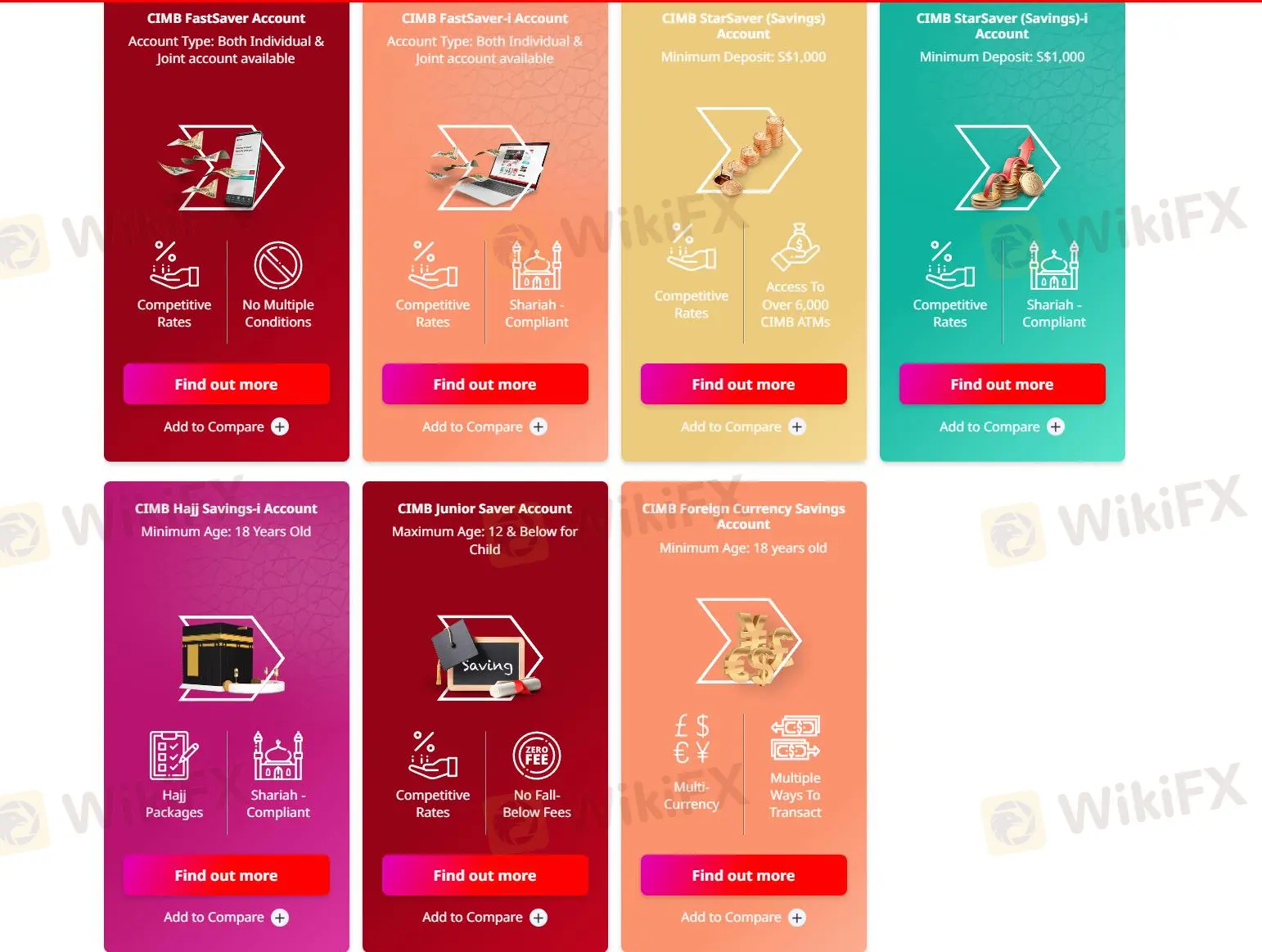

- Savings Accounts:

- CIMB FastSaver Account: Offers competitive rates with no multiple conditions.

- CIMB FastSaver-i Account: Shariah-compliant variant of the FastSaver Account.

- CIMB StarSaver (Savings) Account: Requires a minimum deposit of S$1,000, competitive rates, and access to over 6,000 CIMB ATMs.

- CIMB StarSaver (Savings)-i Account: Shariah-compliant version of the StarSaver Account.

- CIMB Hajj Savings-i Account: Specifically designed for Hajj savings, Shariah-compliant, with associated Hajj packages.

- CIMB Junior Saver Account: Geared towards children with competitive rates and no fall-below fees.

- CIMB Foreign Currency Savings Account: Allows multi-currency transactions, available to individuals aged 18 and above.

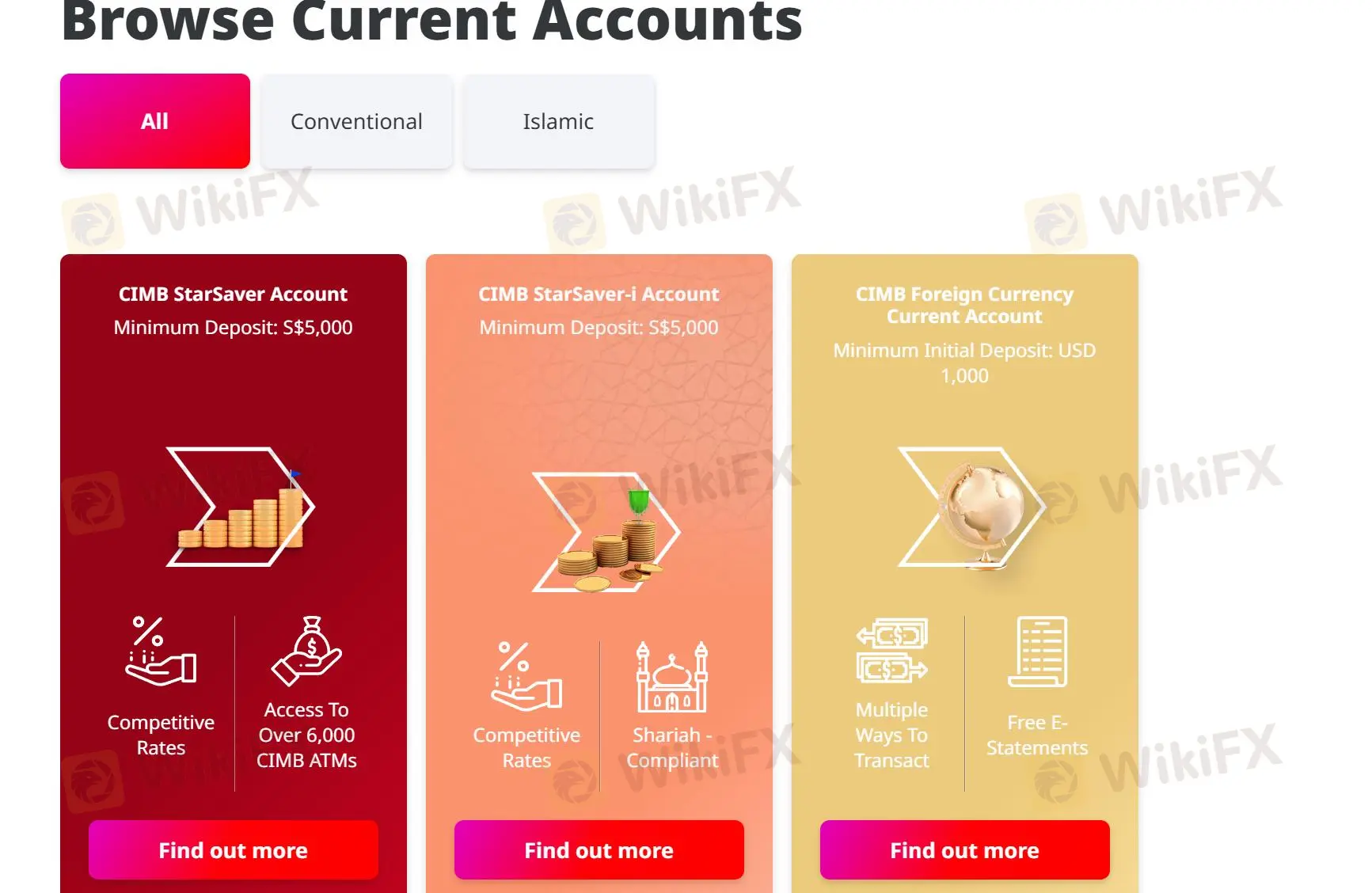

- Current Accounts:

- CIMB StarSaver Account: Requires a minimum deposit of $5,000, offers competitive rates, and access to over 6,000 CIMB ATMs.

- CIMB StarSaver-i Account: Shariah-compliant variant of the StarSaver Account.

- CIMB Foreign Currency Current Account: Designed for multi-currency transactions, with a minimum initial deposit requirement in USD.

- Fixed Deposit Accounts:

- CIMB SGD Fixed Deposit Account: Allows customers to deposit funds for a fixed term with competitive interest rates.

- CIMB Why Wait Fixed Deposit-i Account: Shariah-compliant fixed deposit option.

- CIMB Foreign Currency Fixed Deposit Account: Fixed deposit option for foreign currencies.

| Account Type | Feature |

| Savings Accounts | |

| CIMB FastSaver Account | Competitive rates, no multiple conditions |

| CIMB FastSaver-i Account | Competitive rates, Shariah-compliant |

| CIMB StarSaver (Savings) Account | Minimum deposit S$1,000, competitive rates, access to CIMB ATMs |

| CIMB StarSaver (Savings)-i Account | Minimum deposit S$1,000, competitive rates, Shariah-compliant |

| CIMB Hajj Savings-i Account | Shariah-compliant, designed for Hajj savings, Hajj packages |

| CIMB Junior Saver Account | Competitive rates, no fall-below fees |

| CIMB Foreign Currency Savings Account | Multi-currency support, available to individuals aged 18 and above |

| Current Accounts | |

| CIMB StarSaver Account | Minimum deposit S$5,000, competitive rates, access to CIMB ATMs |

| CIMB StarSaver-i Account | Minimum deposit S$5,000, competitive rates, Shariah-compliant |

| CIMB Foreign Currency Current Account | Minimum initial deposit USD 1,000, multi-currency transactions, free e-statements |

| Fixed Deposit Accounts | |

| CIMB SGD Fixed Deposit Account | Fixed term deposit, competitive interest rates |

| CIMB Why Wait Fixed Deposit-i Account | Shariah-compliant fixed deposit option |

| CIMB Foreign Currency Fixed Deposit Account | Fixed deposit for foreign currencies |

Fees

CIMB BANK offers a range of accounts and financial products, each with specific fee structures for different customer needs.

For instance, the CIMB FastSaver Account requires a minimum initial deposit of S$1,000 and charges a S$50 fee for early account closure within six months. It doesnt impose a fall-below fee or monthly account fee, making it ideal for those looking to save without worrying about additional charges. On the other hand, the CIMB StarSaver Account requires a higher initial deposit of S$5,000 to earn interest, and includes provisions for incidental overdraft charges if credit limits are exceeded, calculated at SGD Prime Rate + 5% or a minimum of S$20.

Besides, CIMB offers the CIMB Renovation-i Financing and the CIMB Education Loan, each accompanied by specific terms and fees.

The CIMB Renovation-i Financing incurs a processing fee of 1.55% of the approved financing amount, which is deducted at the time of disbursement. A cancellation fee of 1% applies to any portion of the financing amount that is cancelled before disbursement, and a prepayment fee of 1% is charged on any amount prepaid to settle the financing early. Late payments attract a fee of S$80 per occurrence. Additionally, there is a charge of S$10 for each issuance of a cashier‘s order, although this fee is waived for the first three orders. The fee for cancelling or amending a cashier’s order is S$20 per instance.

More details can be learned by clicking: https://www.cimb.com.sg/en/personal/help-support/rates-charges.html.

Customer Service

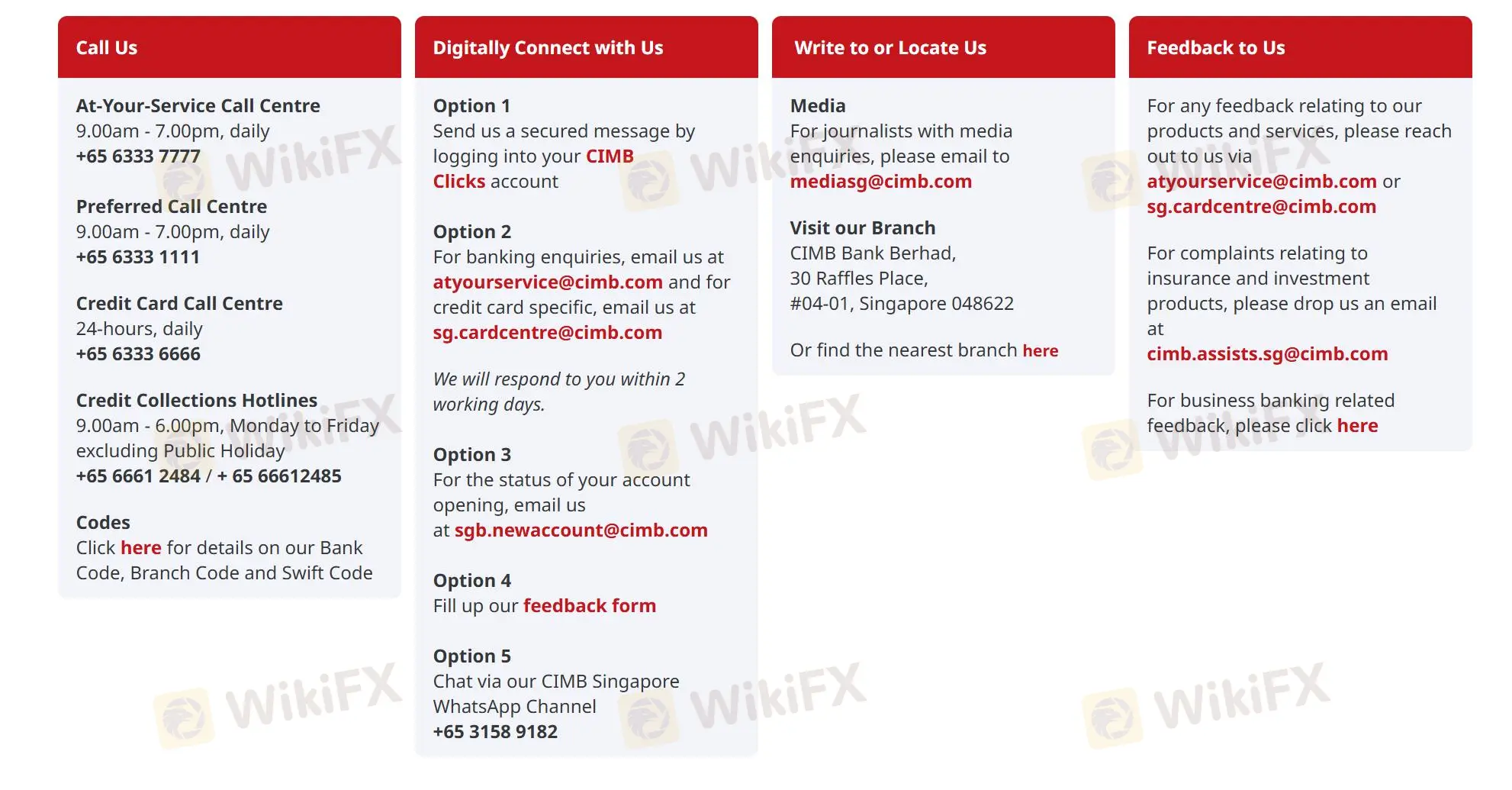

Customers can visit their office or get in touch with customer service line 9.00 am - 7.00 pm using the information provided below:

Telephone: +65 6333 7777

Email: mediasg@cimb.com

Address: CIMB Bank Berhad, 30 Raffles Place, #04-01, Singapore 048622

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, and Linkedin.

Conclusion

In conclusion, CIMB BANK is a regulated financial institution under the supervision of the LFSA. CIMB BANK offers a broad spectrum of financial services, making it a versatile choice for customers seeking loans, investments, insurance, and remittance solutions. However, the complexity in its organizational structure can present challenges for some users.

Frequently Asked Questions (FAQs)

Is CIMB BANK regulated by any financial authority?

Yes. It is regulated by LFSA.

What services and products CIMB BANK provides?

It provides loans & financing, investments, insurance and remittance.

How can I contact CIMB BANK?

You can contact via telephone: +65 6333 7777, email: mediasg@cimb.com, Twitter, Facebook, Instagram, and Linkedin.

What is the minimum deposit for CIMB BANK?

The minimum initial deposit to open an account is $100.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

WikiFX-Broker

Aktuelle Nachrichten

Frauen verdienen im Laufe ihrer Karriere 500.000 Euro weniger als Männer – der Grund überrascht

Führung fest in Männerhand: Neue Zahlen zeigen, wie besorgniserregend der Frauenanteil in deutschen Chefetagen ist

Ozempic bald 80 Prozent günstiger? Hikma Pharmaceuticals will von auslaufenden Patenten profitieren

Bericht über Megaprojekt in Saudi-Arabien: Neom-Manager sollen Finanzberichte manipulieren, um hohe Kosten zu vertuschen

„Viel zu hohe Risiken – Branchenverband für Volksbanken fordert strengere Regeln für die eigenen Banken

Ford Deutschland in den roten Zahlen – jetzt soll eine Milliarden-Finanzspritze des US-Konzerns helfen

Corona-Überflieger Biontech machte einst Milliardengewinne – mittlerweile aber Verluste und kündigt Stellenabbau an

Ich bin 38 und CEO von Trivago: Diese 6 Skills machen euch zu einer guten Führungskraft

Webasto: Angeschlagener Automobilzulieferer braucht 200-Millionen-Finanzspritze

Apple: Einige KI-Verbesserungen an Siri wurden überraschend auf 2026 verschoben

Wechselkursberechnung