【MACRO Insight】The Fed turns to the " Trump deal " - the outlook for gold and the dollar amid market

Zusammenfassung:A month ago, the hot topics in the market focused on Trump and his U.S. economic blueprint for boosting economic growth next year and beyond. However, as the Christmas holiday approaches, the hawkish

A month ago, the hot topics in the market focused on Trump and his U.S. economic blueprint for boosting economic growth next year and beyond. However, as the Christmas holiday approaches, the hawkish shift of Federal Reserve Chairman Powell has once again become the focus of the market, bringing inflation back into the investors' sight and triggering the biggest market turmoil since Election Day.

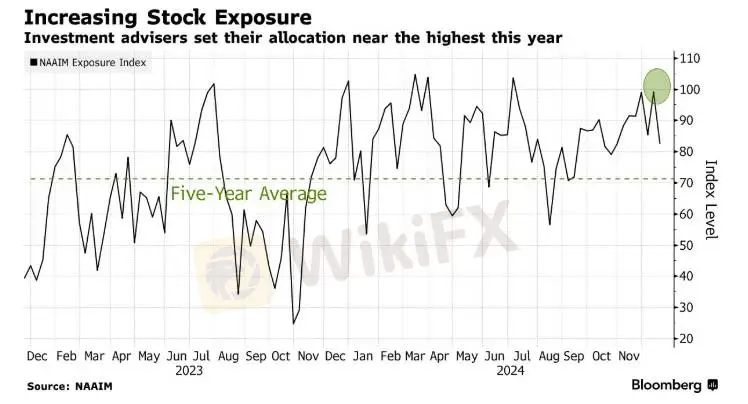

Powell signaled a slower pace of rate cuts, leading to the worst performance in months for stock and bond markets. Two days later, market sentiment improved significantly after the Fed's preferred inflation gauge showed prices rose less than expected, spurring a cross-asset rally that helped the S&P 500 erase some of its weekly losses. Fueling the extreme market volatility is crowded positioning, much of it by investors betting that a Trump deal will further stimulate risk assets.

With exposure to U.S. stocks jumping to record levels, the moves are a reminder that while it was Trump who sent speculation soaring, the trajectory of inflation and Powell's response to it remains difficult for markets where valuation measures have been pushed to extreme levels. Equally important. Benchmark U.S. stock indexes were still down about 2% for the week, while post-election stalwarts such as small-cap and value stocks fell for a third straight week.

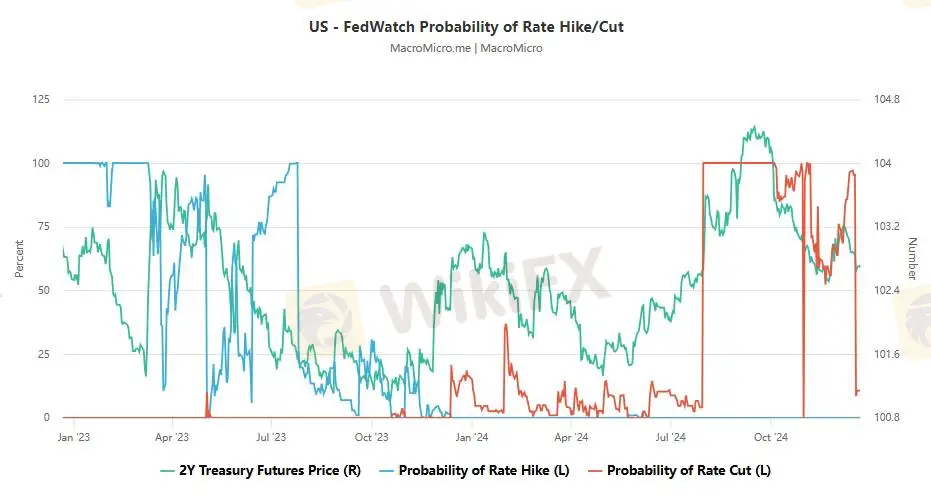

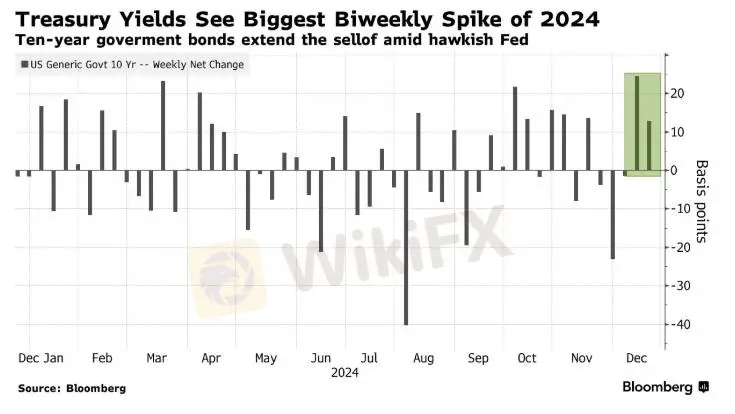

“Investors thought the Fed was going to cut rates anyway,” said Samir Samana, senior global market strategist at Wells Fargo Investment Institute. “What‘s disappointing is that the Fed finally woke up to the fact that inflation has stopped falling.” For now, the final fallout from Trump’s trade is the last thing many investors wanted: rising bond yields. The 10-year Treasury yield jumped to its highest level in seven months, driven by a reduction in bets on a rate cut after the Fed meeting.

Market participants currently expect the Fed to cut interest rates by about 40 basis points by December 2025, and U.S. Treasury yields rose in response. The impact spread across markets, and the U.S. stock market experienced its worst day since August. The Volatility Index (VIX) experienced the second largest single-day jump in history as the market tried to digest the Fed's outlook.

While PCE remained strong, the increase was lower than expected, which helped to alleviate some of the selling pressure on US stocks. Similar trends were seen in foreign exchange markets, with the US dollar generally strengthening and breaking through the 108 mark at one point. Gold prices briefly fell below $2,600 per ounce, but also rebounded back above that level on Friday. The crude oil market continues to feel the pressure of concerns about demand growth, and given the changes in expectations for rate cuts in 2025, the market is more worried that this will continue to affect future demand.

Markets will be relatively quiet next week due to Christmas, although there are still some relatively influential data, but market volatility may become large due to thin liquidity. The Federal Reserve has just concluded its last policy decision in 2024, and market optimism is scarce. Officials predict only two rate cuts of 25 basis points each in 2025, leading market participants to expect the Fed to cut interest rates less than any other major central bank in the next 12 months, with the exception of the Bank of Japan (which is raising interest rates).

Fed Chairman Jerome Powell strongly hinted in his post-meeting press conference that officials are already considering the impact Trump's policies may have on the economy and inflation. This reality check from the Fed dampened market sentiment and unsettled investors before the Christmas holiday, and some analysts even expected that if the incoming Trump administration does not water down its campaign promises on taxes, tariffs and immigration, the rate cuts may even turn into rate hikes.

Gold has fallen sharply over the past week amid rising U.S. Treasury yields and the dollar. If the 10-year Treasury yield continues to remain above 4.50%, gold will struggle to hold the $2,600 level and seems likely to test support at $2,530 again. Many analysts expect gold prices to reach $3,000 an ounce next year, but the metal is not expected to rise until the second half of 2025. Meanwhile, with gold prices consolidating around $2,650 an ounce, next year's target would be about 13% higher than this year's nearly 30% gain.

The Fed's hawkish stance has not been well received by Wall Street, and the sell-off could intensify as U.S. Treasury yields continue to climb. The U.S. Treasury is scheduled to auction two-year, five-year, and seven-year Treasury notes on Monday, Tuesday, and Thursday, respectively, which could add to the upward pressure on yields if demand is sluggish.

WikiFX-Broker

Aktuelle Nachrichten

Bitcoin fällt unter 60.000 US-Dollar – psychologische Marken unter Druck

Gold steigt, Silber explodiert: Warum 2026 alles anders wird

Dollar -9%: Steht der größte Währungs-Irrtum vor der Auflösung?

Rätsel um Ripple: Institutionen kaufen, XRP fällt trotzdem

21% Rally bei Ripple (XRP): Startschuss oder gefährliche Falle?

Gold bricht ein – und diese Aktien werden plötzlich zum neuen Wertspeicher

JPMorgan schockt Gold-Fans: Warum Bitcoin jetzt klar im Vorteil ist

Wechselkursberechnung