【MACRO Alert】The Fed and the bond market are in a tug-of-war - the US dollar benefits from it!

Zusammenfassung:The markets may be volatile in the coming months, but there are ways to avoid the fray and earn solid gains. Although the Federal Reserve has been cutting rates since September, long-term Treasury yie

The markets may be volatile in the coming months, but there are ways to avoid the fray and earn solid gains. Although the Federal Reserve has been cutting rates since September, long-term Treasury yields have bucked the trend and climbed sharply. Treasury yields move inversely to prices, a dynamic that has hit long-term Treasury funds hard. What happens next depends on a number of factors, including the Fed's next move, the U.S. fiscal situation, inflation expectations, and the policies of President-elect Trump. Fed Chairman Powell has already taken a more hawkish stance, preparing for two additional quarterly rate cuts in 2025.

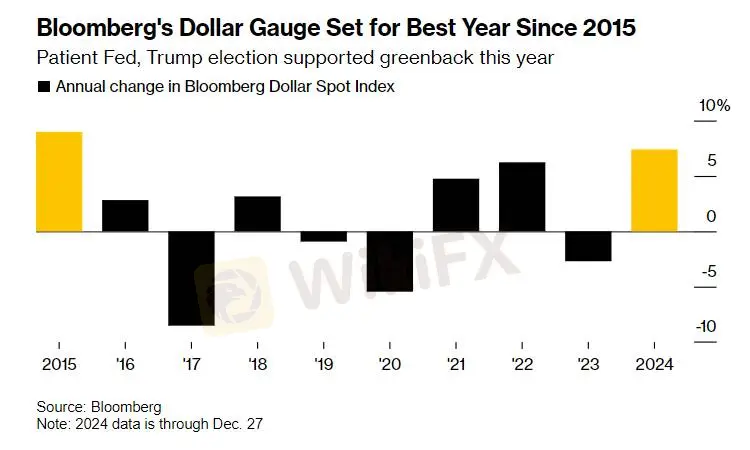

"The dollar's current strength is consistent with incoming data, and we do not believe the market has fully priced in our tariff expectations," Goldman Sachs analysts said. The dollar is heading for its best annual performance in nearly a decade as strong U.S. economic momentum dampens expectations of a Fed rate-cutting cycle, while President-elect Trump's threats of tough tariffs support bullish bets on the greenback. The Bloomberg Dollar Spot Index is up more than 7% so far this year, its best run since 2015.

"The bond market is telling the Fed that its policy is wrong," said Jim Bianco, president of Bianco Research. He added in a post on Christmas Day that monetary easing is unnecessary given the U.S. economic performance and the upcoming "Trump stimulus." "The Fed's easing is raising inflation expectations and pushing up U.S. Treasury yields."

A bear steepening occurs when long-term Treasury yields rise faster than short-term Treasury yields -- a bad sign. If the 5-year Treasury yield breaks above 4.5%, the next target could be 4.61%, Brenner wrote. The 10-year Treasury has support around 4.62%, but if it breaks, the next target could be 4.71%.

Some of the largest bond ETFs have underperformed, ending the year in the red. The Vanguard Long-Term Treasury ETF and the iShares 20+ Year Treasury ETF both fell 0.2% on Thursday. The Vanguard fund has lost 6.3% this year, including interest, while the iShares fund has fallen 7.5%. The broader market has fared better: The iShares Core U.S. Aggregate Bond ETF is up 0.9% this year. That fund is less rate-sensitive than the long-term Treasury ETFs, with about 30% of its holdings coming from corporate issuance.

There is a bright side to the market‘s reorientation toward bearishness: Corporate debt is yielding more than 5% again, and you don’t have to go deep into “junk” territory to capture those gains. For example, the $48 billion Vanguard Intermediate-Term Corporate Bond ETF, the largest of the investment-grade bonds, has a 30-day SEC yield of 5.2%; on a total-return basis, its up 3% this year.

Funds that hold other types of debt have done even better. The Janus Henderson AAA CLO ETF, for example, yields 6% and has gained 7.3% in total returns this year. The Janus Henderson B-BBB CLO ETF, which holds lower-rated securities, yields 7.9% and has gained 10.9% this year. High-yield bonds and preferred stocks have also performed well, supported by higher yields and expectations that the economy will not fall into recession and defaults will remain low. The SPDR Bloomberg High Yield Bond ETF, for example, yields 7%. The iShares Preferred Stock & Income Securities ETF yields 5.8%.

Granted, there isn't a lot of value in corporate bonds, since the "spread" between corporate bonds and Treasuries is in a relatively narrow range. Even so, a 6% to 7% yield provides ample cushion against losses, especially if you stick to funds with shorter maturities that are less sensitive to interest rates. As long as the economy remains stable, corporate bonds should have an advantage over Treasuries, and investors should be able to earn at least a 5% yield. If inflation stays below 3%, that will result in a 2% "real return." Hopefully, inflation will cooperate and the Fed won't be forced to change course and raise rates again.

As of December 27, the yen, Norwegian krone and New Zealand dollar were the worst performers among the G10 currencies in 2024, with declines of more than 10% against the dollar. The euro fell about 5.5% to trade near $1.04, and a growing number of strategists expect the euro may reach parity with the dollar next year. Speculators have steadily increased their bullish bets on the dollar before, during and after the U.S. election. They now hold about $28.2 billion in contracts tied to future appreciation of the dollar, the highest level since May.

At the same time, the strength of the U.S. dollar is related to the strong U.S. economy and expectations of Trump's policies, causing other currencies to depreciate relatively. Among global currencies, the Japanese yen, Norwegian krone and New Zealand dollar performed the worst, while bullish bets on the U.S. dollar increased, and it is expected that the strength of the U.S. dollar may continue.

WikiFX-Broker

Aktuelle Nachrichten

Japanischer Yen hat Schwierigkeiten, bescheidene Gewinne gegenüber dem USD aufgrund von Tarifängsten zu nutzen

Sensations-Startup Loveable: Nimmt die KI uns jetzt wirklich die Jobs weg?

Longevity: Wie Florian Meissner sein Bluttest-Startup skalieren will — und welche Rolle der Gorillas-Gründer dabei spielt

Australischer Dollar steigt, während der US-Dollar vor dem ISM Manufacturing PMI gedämpft bleibt

Sensations-Startup Loveable: Nimmt die KI uns jetzt schon die Jobs weg?

Bitcoin springt auf mehr als 93.000 US-Dollar – das ist der Grund

Wechselkursberechnung