Nikkei Soars in a Short Squeeze Rally — Will Capital Flows Shift Next?

Zusammenfassung:Investors have been closely watching the $500 billion “Stargate” AI project, widely seen as critical to securing U.S. dominance in next-generation artificial intelligence. For months, its massive fund

Investors have been closely watching the $500 billion “Stargate” AI project, widely seen as critical to securing U.S. dominance in next-generation artificial intelligence. For months, its massive funding shortfall has cast doubt on the project‘s viability. But a surprise U.S.-Japan trade deal may have provided a game-changing solution. This article breaks down the event’s implications for U.S. tech stocks, Japanese equities, and safe-haven assets like gold.

1. Background: Americas AI Dominance Faces a Funding Dilemma

The Stargate project, spearheaded by SoftBank and OpenAI, aims to build the worlds most powerful AI supercomputer — with an estimated investment of $500 billion. Its success is seen as pivotal to the U.S. retaining its technological edge.

However, financing remains the weakest link:

Limited Initial Contributors: With OpenAI still unprofitable, funding is largely reliant on SoftBank and Oracle — enough to cover only about 20% of the total.

Uncertain Foreign Capital: The remaining 80% (roughly $400 billion) was expected to come from sovereign wealth funds in the Middle East, brokered by SoftBank CEO Masayoshi Son. But this plan carried high uncertainty and would have diluted strategic control.

This funding gap cast a long shadow over the initiatives future.

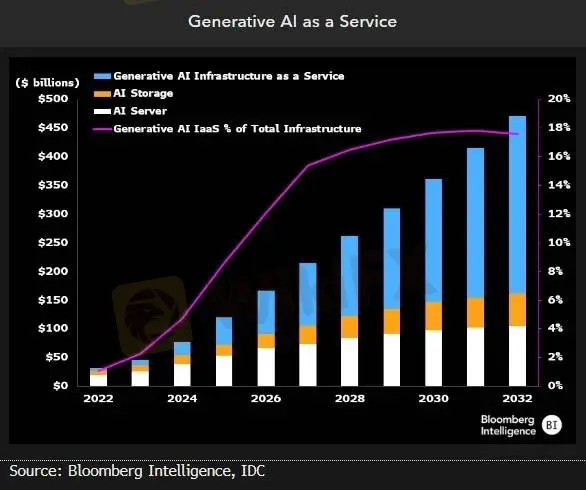

[Chart: Projected AI Market Size — Source: Bloomberg]2. Turning Point: A U.S.-Japan Trade Agreement with Hidden Depths

Just as markets were bracing for delays, a dramatic shift occurred. The U.S. and Japan reached a new trade agreement after multiple negotiation rounds.

Former U.S. President Donald Trump revealed the deal's key terms on social media:

Japan will invest $550 billion into the U.S.

The U.S. will retain 90% of the profits from the agreement.

3. Market Impact Analysis

● U.S. Tech & Semiconductor Sector —

Strong Tailwind (Bullish)Thesis: With funding secured, the U.S. can now go full throttle on AI infrastructure.

Impact: Expect large-scale orders for cutting-edge GPUs, servers, and data center hardware. Companies like NVIDIA, AMD, and Intel, along with cloud service providers, stand to benefit enormously. This removes a major overhang and injects powerful growth momentum into U.S. tech stocks.

● Nikkei 225 —

Mixed Signals, But Tilted BullishThesis: Though the capital outflow appears negative on the surface, Japan is positioned to benefit from strategic returns.

Upside Catalysts:

Embedded in the Supply Chain: Japan remains irreplaceable in semiconductor equipment (Tokyo Electron), specialty chemicals, and advanced components. The projects execution will translate into real demand for these firms.

Strategic Inclusion: By backing this critical U.S. initiative, Japan cements its seat at the table for future AI collaboration.

Yen Weakness Tailwind: Capital outflows may weaken the yen, bolstering export-driven giants in autos and precision machinery.

Downside Risks:

A $550 billion outbound investment could pressure domestic liquidity in the short run.

Conclusion: Overall, the Nikkeis reaction is likely to be net positive. Investors will shift their focus from mere capital outflow to “who gets the contracts,” lifting related Japanese stocks.

● Gold —

Safe-Haven Appeal (Bullish)Thesis: The geopolitical undertone of forced capital alignment may raise global instability fears.

Impact: A major economy (Japan) being nudged into underwriting another nation's strategic agenda reflects rising great-power tensions. Investors may seek shelter in gold to hedge against policy uncertainty and global financial realignment.

Conclusion

📈 Gold Outlook

The numbers are strikingly familiar: $550 billion × 90% = $495 billion — nearly identical to the $500 billion needed for Stargate. This suggests the U.S. has deftly redirected funding responsibility from uncertain Middle Eastern partners to a reliable ally — Japan.

If this interpretation holds, the strategic capital shift will have asymmetric effects across global assets:

On the surface, the U.S.-Japan agreement appears to be a conventional trade pact. But in essence, it may be a carefully orchestrated strategic capital reallocation — resolving Americas AI funding crisis while binding Japan deeper into the U.S. tech value chain. Going forward, capital deployment and contract winners will become the key markers to watch in the global AI race. Investors should monitor the actual execution of this funding and the geopolitical ripple effects across asset classes.

Gold has broken above the critical $3,400 resistance level, showing strong upward momentum. The next price target is $3,452. If prices consolidate above this mark, bulls may aim for a new historical high near $3,500.

⚠️ However, caution is warranted: If gold fails to stay above $3,420 and falls back below $3,400, this could signal a bull trap. In that case, a pullback toward the $3,345–$3,350 support zone becomes likely.

Resistance: $3,400, $3,452

Support: $3,310, $3,345–$3,350

WikiFX-Broker

Aktuelle Nachrichten

US-Börsenaufsichtsbehörde SEC genehmigt Sachausgaben und Rücknahmen für Bitcoin- und Ethereum-ETPs

Top 3: Bitcoin, Ethereum, Ripple – BTC, ETH und XRP bereiten sich nach Fed-Entscheidung auf Volatilität vor

Bitcoin-Preisprognose: BTC konsolidiert sich weiter, da die Zinsentscheidung der Fed bevorsteht

Wechselkursberechnung