U.S. Equities Set for a Pullback in 2024 — Just as We Called for New Highs in April

Zusammenfassung:Equities remain buoyant, but the longer the rally extends, the more concerned we are about downside risks ahead.Back in April, when bearish sentiment was widespread, our call for new highs was rooted

Equities remain buoyant, but the longer the rally extends, the more concerned we are about downside risks ahead.

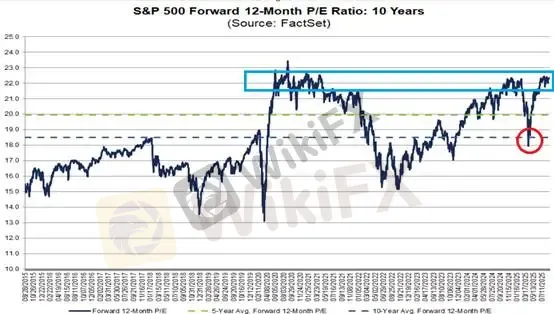

Back in April, when bearish sentiment was widespread, our call for new highs was rooted in valuations. At that time, the S&P 500s forward 12-month P/E ratio had fallen back to its 10-year average, making equities broadly attractive for medium- to long-term allocation.

Today, however, the forward P/E has climbed to 22.4 — its most expensive level since 2021. From a valuation perspective, the risk of a market pullback is increasingly difficult to ignore.

(Chart 1. S&P 500 Forward 12-Month P/E; Source: FactSet)Valuation Alone Doesnt Guarantee a Selloff

Elevated multiples can sometimes persist while corporate earnings catch up, leading to consolidation rather than a broad correction. Unfortunately, the underlying U.S. economic structure suggests this cycle may not play out so benignly.

1. Weak Domestic Demand and Rising Unemployment

U.S. consumption relies heavily on steady income and the wealth effect, which is why employment data is critical.

A closer look at unemployment duration shows concerning trends: the number of workers unemployed for less than 5 weeks and over 15 weeks has reached a three-year high. While the 5–14 week category has declined slightly, last weeks non-farm payrolls showed all three segments rising together — a clear headwind for household spending.

(Chart 2. Unemployment Duration; Source: MacroMicro)2. Why Weak Consumption Matters — Isnt AI Enough to Prop Things Up?

Consumer weakness affects more than just discretionary and staples, which together account for 15–17% of S&P 500 market cap.

Directly Exposed: Consumer Discretionary & Consumer Staples → 15–17% weight

Highly Correlated: Communication Services, Financials, Real Estate → ~20% weight

Indirectly Affected: Industrials, Energy, parts of Tech → spillover impact

In total, at least 5–6 major sectors, representing 35–40% of S&P 500 capitalization, are at risk. With transmission effects, over half the index could ultimately be impacted.

While large-cap blue chips continue to fuel index gains with aggressive capex, the “hollow core” of U.S. growth will eventually show up in broader index performance.

We expect risk assets to correct more broadly in the months ahead. Our outlook for gold will follow in the next commentary.

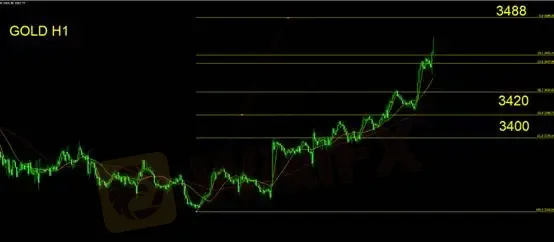

Gold Technical Outlook

Based on Fibonacci extension levels, golds upside projection sits at $3,488. However, we believe prices have already entered overbought territory.

Support: $3,420 / $3,400

Resistance: $3,488

Trading guidance:

Long positions should trail stops higher.

If support breaks, it signals trend reversal.

Resistance is not necessarily a hard ceiling in a bullish trend.

Flat traders should remain on the sidelines; shorts should exit quickly.

Risk Disclaimer: The views, analysis, research, prices, or other information herein are provided as general market commentary and do not constitute investment advice. All readers assume full responsibility for their trading decisions.

WikiFX-Broker

Aktuelle Nachrichten

Krypto-Hammer: Ethereum legt plötzlich kräftig zu – kommt jetzt der Angriff auf 5.000 Dollar?

Krypto-Schock um Ethereum: Wale kaufen – Kleinanleger verkaufen, Kurs rutscht ab

Ethereum unter Attacke: Betrüger fluten Netzwerk – Kurs gerät unter Druck

Trump-Drohung schockt Krypto-Markt: Bitcoin, Ether und XRP rutschen weiter ab

XRP unter Verkaufsdruck: Rutscht Ripple jetzt unter die Zwei-Dollar-Marke?

XRP-Schock bei Ripple: Unter 2 Dollar – droht jetzt der Crash?

Gold-Rally, Krypto-Crash: Anleger flüchten in Edelmetalle – Bitcoin verliert Glanz

Krypto-Schock zum Wochenstart: Bitcoin rutscht ab – droht jetzt der nächste Crash?

XRP stürzt unter 2 Dollar – und plötzlich wird es brandgefährlich für Ripple-Anleger

Wechselkursberechnung