FOMC in Focus: Rate Decision to Steer Market Direction

Zusammenfassung:This week marks an unprecedented “Central Bank Super Week” for global financial markets. Within just 36 hours, the Federal Reserve, Bank of Canada, Bank of England, and Bank of Japan will all release

This week marks an unprecedented “Central Bank Super Week” for global financial markets. Within just 36 hours, the Federal Reserve, Bank of Canada, Bank of England, and Bank of Japan will all release their latest rate decisions, setting the tone for the global economy heading into Q4. These announcements are expected to trigger significant volatility and will be key in shaping investors outlook.

The spotlight will be on the Federal Reserve‘s FOMC meeting. Markets broadly expect the Fed to deliver its first rate cut since the start of Trump’s second term, lowering rates by 25 basis points. While Chair Powell remains cautious about tariff-driven inflation risks, recent signs of weakness in the U.S. labor market provide strong justification for easing. The move also aligns with the White Houses long-standing push for lower borrowing costs, highlighting the delicate balance between economic data and political pressure.

Importantly, this cut is not only a reaction to economic indicators but also a strategic step to preserve the Fed‘s policy independence. Against strong White House influence, the Fed’s decision is viewed as a calculated adjustment to avoid further questions about its autonomy. Ahead of the meeting, U.S. retail sales and jobless claims will serve as critical barometers of economic health.

After a nine-month pause, the U.S. is preparing to restart monetary easing. Weak labor data over the past two weeks, alongside subdued inflation shown in both CPI and PPI, have paved the way for a cut at the September 16–17 meeting. Markets see this as the beginning of a renewed easing cycle, potentially reshaping global capital flows.

Potential Implications for Gold

1. Direct Impact of a Fed Rate Cut

If the Fed delivers the expected 25-bp cut, Treasury yields will fall and the dollar will weaken. Since gold carries no yield, lower rates reduce its opportunity cost, while a weaker dollar enhances its relative value. Together, these factors typically support gold prices, reinforcing its role as a hedge and portfolio diversifier.

2. Scenario: Fed Holds Rates Steady

Should the Fed unexpectedly leave rates unchanged, markets may read it as prioritizing inflation risks over economic softness. That would likely boost the dollar and Treasury yields, pressuring gold in the near term. However, given heavy market positioning for a cut, a hawkish surprise could trigger an initial sell-off followed by a rebound as investors seek safety.

3. Combined Effect of Other Central Banks

Decisions from the Bank of Canada, Bank of England, and Bank of Japan also matter. A broadly dovish stance would add to global liquidity and favor inflows into gold. Conversely, unexpected hawkishness from one or more banks could introduce short-term volatility.

4. Medium- to Long-Term Outlook

With labor markets softening and inflation pressures easing, consensus expects this to be the opening move in a new easing cycle. If sustained, golds role as an inflation hedge and safe-haven asset will strengthen, supporting a continued upward trend.

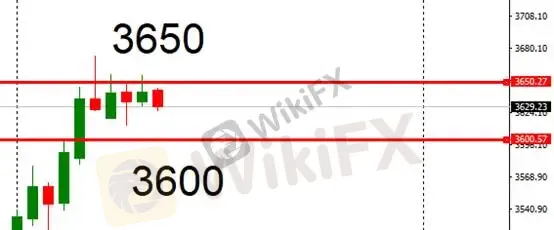

Gold Technical Analysis

Gold is currently consolidating around $3,630/oz. While the long-term outlook remains constructive under a rate-cut scenario, short-term risks of a “buy the rumor, sell the fact” reaction must be monitored. Traders should watch the $3,600 support level closely—stability here could provide a base for long positions ahead of the Feds decision. A break below, however, may suggest bullish momentum has been exhausted.

Resistance: $3,650/oz

Support: $3,600/oz

Risk Disclaimer: The views, analysis, research, prices, or other information provided are for general market commentary only and do not represent the position of this platform. Readers assume all risks and should exercise caution when trading.

WikiFX-Broker

Aktuelle Nachrichten

Krypto-Hammer: Ethereum legt plötzlich kräftig zu – kommt jetzt der Angriff auf 5.000 Dollar?

Krypto-Schock um Ethereum: Wale kaufen – Kleinanleger verkaufen, Kurs rutscht ab

Ethereum unter Attacke: Betrüger fluten Netzwerk – Kurs gerät unter Druck

Trump-Drohung schockt Krypto-Markt: Bitcoin, Ether und XRP rutschen weiter ab

XRP unter Verkaufsdruck: Rutscht Ripple jetzt unter die Zwei-Dollar-Marke?

XRP-Schock bei Ripple: Unter 2 Dollar – droht jetzt der Crash?

Gold-Rally, Krypto-Crash: Anleger flüchten in Edelmetalle – Bitcoin verliert Glanz

Krypto-Schock zum Wochenstart: Bitcoin rutscht ab – droht jetzt der nächste Crash?

XRP stürzt unter 2 Dollar – und plötzlich wird es brandgefährlich für Ripple-Anleger

Wechselkursberechnung