U.S. Q2 GDP Surge Becomes a Thing of the Past — Dollar Index Emerges as the Safe-Haven of Choice

Zusammenfassung:On September 25, the U.S. reported Q2 GDP figures showing an annualized growth rate of 3.80% QoQ and 2.1% YoY. The data aligned with our April–July forecasts, driven primarily by tariffs that front-lo

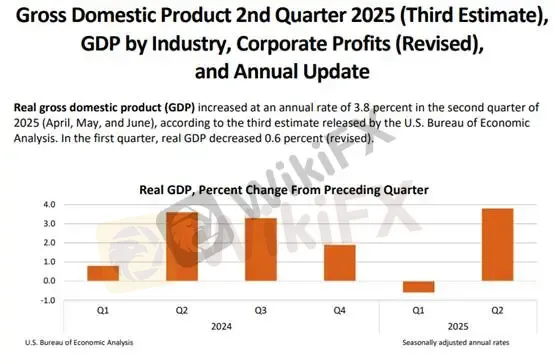

On September 25, the U.S. reported Q2 GDP figures showing an annualized growth rate of 3.80% QoQ and 2.1% YoY. The data aligned with our April–July forecasts, driven primarily by tariffs that front-loaded demand from both corporates and consumers. This “pull-forward” effect of inventory restocking pushed Q2 GDP to its peak.

(Figure 1. U.S. Q2 GDP Annualized QoQ Growth; Source: BEA)

Breaking down the nominal contribution by component:

Consumption: +1.68%

Residential Investment: -0.21%

Non-Residential Investment: +0.98%

Inventory Changes: -3.44%

Government Spending: -0.01%

Exports: -0.20%

Imports: +5.03%

The most critical signal—inventory drawdown—already materialized in Q2.

In Q1, imports contributed -4.70%, while inventories added +2.58%. This reflected imports being absorbed as stockpiles. However, in Q2, imports surged to +5.03%, while inventories subtracted -3.44%, confirming that the inventory restocking cycle had ended.

(Note: Imports are a leading indicator of future inventory adjustments.)

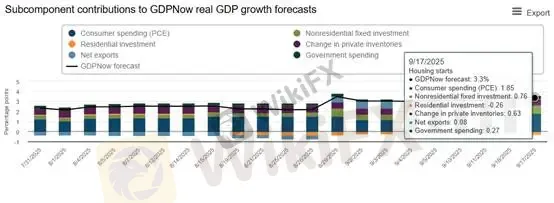

(Figure 2. Real GDP Contribution by Component; Source: MacroMicro)

Looking ahead, the review of past patterns helps infer potential paths. Other macro indicators suggest the pull-forward effect continues into Q3. For instance, real retail sales grew 2% in August. According to the Atlanta Fed, Q3 GDP is still expected to expand at 3.3%, with contributions as follows:

Consumption: +1.85%

Non-Residential Investment: +0.76%

Residential Investment: -0.26%

Inventories: +0.63%

Government Spending: +0.27%

Net Exports: +0.63%

(Figure 3. Atlanta Fed Q3 GDP Estimate; Source: Atlanta Fed)

The U.S. economys resilience has underpinned dollar strength, offsetting concerns about tariff-driven inflation and fiscal deficits. Viewing the issue from a stock perspective—i.e., rising fiscal deficits—can appear overly pessimistic. A more objective lens is the public debt-to-GDP ratio, which stood at 118.78% in Q2 2025, the lowest level in seven consecutive quarters. This indicates that debt dynamics are insufficient to justify the prior excessive selloff in the dollar.

Returning to our main theme: the dollar index has reasserted itself as the safe-haven of choice. With broad overvaluation across asset classes, we caution that a “cash is king” risk-aversion mindset could resurface. Even after Fed rate cuts, long-end yields have not meaningfully declined. This reinforces the case that U.S. Treasuries and the dollar will remain key safe-haven assets. In our view, this dynamic will continue to provide upward momentum for the dollar. Meanwhile, precious metals, which enjoyed strong rallies in the first three quarters, may now be entering a new downward trajectory.

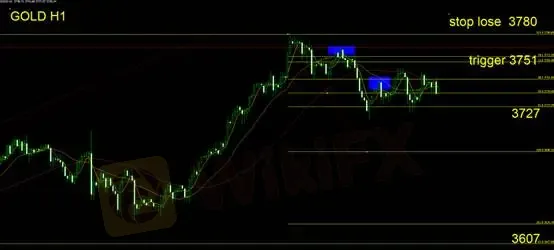

Gold Technical Outlook

Extending from yesterdays technical view: 3751 remains the Fibonacci resistance level. A confirmed reversal engulfing pattern emerged after testing this level. Traders should continue to favor short positioning. Key levels to watch:

Support: 3727 / 3607

Resistance: 3751 / 3780

As long as 3727 holds, the market may remain in sideways consolidation. A decisive break below 3727 would confirm a bearish trend, with downside targets in the 3607–3624 range. Suggested stop-loss: 3780.

⚠️ Risk Disclaimer: The above views, analysis, and price references are provided for general market commentary only. They do not represent the official stance of this platform. All readers should bear their own trading risks. Please exercise caution.

WikiFX-Broker

Aktuelle Nachrichten

Ripple unter Beschuss: Diese Prognose für 2026 macht XRP-Anleger nervös

XRP wie vor dem Mega-Run? Ripple-Chart schockt Anleger

Ethereum trotzt Verkaufsdruck: ETH hält 2.900 Dollar – US-Anleger verkaufen, Wale bleiben ruhig

Dogecoin unter Druck: Schwacher Derivatemarkt belastet Kurs über 0,13 Dollar

BitMine setzt Ethereum-Käufe trotz Feiertagsflaute fort – ETH-Markt bleibt angespannt

Zcash vor nächstem Kursschub? Treasury-Kauf für 29 Millionen Dollar sorgt für Aufmerksamkeit

Wechselkursberechnung