2022-09-16 01:30

In der IndustrieWhat I Forex ?

Forex is the short form of “Foreign Exchange”. It is also known as currency exchange, or simply “FX”. Forex is the platform where currencies are traded.

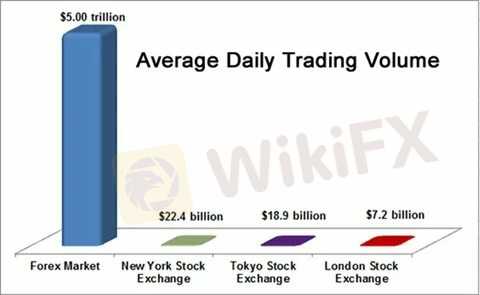

It is the largest financial market in the world with a daily turnover of $5 trillion! It is huge even when compared to the biggest stock exchange markets. Check the chart below.

Of course, the retail forex trading (what you want to do) doesn’t make up the majority of the volume. The daily trade volume of retail traders is around $1.5 trillion.

The biggest players in the forex market

You must know who the big players are in the FX market because they can change the currency rates in a blink of an eye. Traders who understand the main objectives of these players can make reasonable predictions about future currency moves.

Do you know Mario Draghi, Janet Yellen and Angela Merkel? They are a few of the officials who can create chaos in currency rates with just a few words in their speeches.

Forex traders indeed plan their trades by analyzing the most recent economic news and geopolitical developments, as well as the latest announcements from G-7 key officials.

G-7 (Group of Seven) is a forum of the world’s 7 most developed economies: the U.S., Germany, U.K., France, Japan, Canada and Italy.

The main people to follow and listen from these countries are:

Head of the central bank

Prime minister

President of the country

The most traded currency pair is EUR/USD so the most influential persons in forex are:

Chair of the US Federal Reserve Bank

Head of the European Central Bank

Chancellor of Germany

President of the U.S.

1. Governments and central banks

The biggest players of the forex market are governments and central banks that buy and sell currencies to balance the economic growth and price stability of their nations. The amount of money used by central banks is enormous so their actions have a deep impact on the currency markets.

That’s why every forex trader wait with bated breath whenever the chairman of U.S. or European central bank is speaking publicly; one sentence in their speech can create big fluctuations in the market.

Commercial and investment banks

Big banks trade billions of dollars daily. They make transactions with each other, with their customers or they themselves speculate on the forex market.

The 5 biggest banks are:

Wells Fargo & Co.

Industrial & Commercial Bank of China

JP Morgan Chase & Co.

China Construction Bank

Bank of America

2. Large corporations

Large corporations control large amounts of money so when they move their assets in bulk, it can influence the currency rates. For example, when the biggest insurance companies in Japan started to move their assets out of the country because of the decreasing value of yen and decreasing interest rates, the yen fell even more.

3. Individual traders

The most popular forex trader is George Soros who is famous for breaking the Bank of England and earning $1 billion in a day. He also earned $790 million by speculating on the fall of Thai baht. Traders like George Soros usually operate hedge funds with large resources. They can create strong impact on a nation’s economy and currency rate

Gefällt 14

Hans bahadur Gurung

Mga kalahok

Aktueller Inhalt

In der Industrie

Event-A comment a day,Keep rewards worthy up to$27

In der Industrie

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

In der Industrie

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

In der Industrie

South Africa Event-Come&Win 240ZAR Phone Credit

In der Industrie

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

In der Industrie

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Kategorie

Plattform

Ausstellung

IB

Rekrutierung

EA

In der Industrie

Markt

Index

What I Forex ?

Vereinigtes Königreich | 2022-09-16 01:30

Vereinigtes Königreich | 2022-09-16 01:30Forex is the short form of “Foreign Exchange”. It is also known as currency exchange, or simply “FX”. Forex is the platform where currencies are traded.

It is the largest financial market in the world with a daily turnover of $5 trillion! It is huge even when compared to the biggest stock exchange markets. Check the chart below.

Of course, the retail forex trading (what you want to do) doesn’t make up the majority of the volume. The daily trade volume of retail traders is around $1.5 trillion.

The biggest players in the forex market

You must know who the big players are in the FX market because they can change the currency rates in a blink of an eye. Traders who understand the main objectives of these players can make reasonable predictions about future currency moves.

Do you know Mario Draghi, Janet Yellen and Angela Merkel? They are a few of the officials who can create chaos in currency rates with just a few words in their speeches.

Forex traders indeed plan their trades by analyzing the most recent economic news and geopolitical developments, as well as the latest announcements from G-7 key officials.

G-7 (Group of Seven) is a forum of the world’s 7 most developed economies: the U.S., Germany, U.K., France, Japan, Canada and Italy.

The main people to follow and listen from these countries are:

Head of the central bank

Prime minister

President of the country

The most traded currency pair is EUR/USD so the most influential persons in forex are:

Chair of the US Federal Reserve Bank

Head of the European Central Bank

Chancellor of Germany

President of the U.S.

1. Governments and central banks

The biggest players of the forex market are governments and central banks that buy and sell currencies to balance the economic growth and price stability of their nations. The amount of money used by central banks is enormous so their actions have a deep impact on the currency markets.

That’s why every forex trader wait with bated breath whenever the chairman of U.S. or European central bank is speaking publicly; one sentence in their speech can create big fluctuations in the market.

Commercial and investment banks

Big banks trade billions of dollars daily. They make transactions with each other, with their customers or they themselves speculate on the forex market.

The 5 biggest banks are:

Wells Fargo & Co.

Industrial & Commercial Bank of China

JP Morgan Chase & Co.

China Construction Bank

Bank of America

2. Large corporations

Large corporations control large amounts of money so when they move their assets in bulk, it can influence the currency rates. For example, when the biggest insurance companies in Japan started to move their assets out of the country because of the decreasing value of yen and decreasing interest rates, the yen fell even more.

3. Individual traders

The most popular forex trader is George Soros who is famous for breaking the Bank of England and earning $1 billion in a day. He also earned $790 million by speculating on the fall of Thai baht. Traders like George Soros usually operate hedge funds with large resources. They can create strong impact on a nation’s economy and currency rate

Gefällt 14

Ich möchte auch kommentieren

Einreichen

0Kommentare

Es gibt noch keinen Kommentar. Mach den ersten

Einreichen

Es gibt noch keinen Kommentar. Mach den ersten