2024-11-07 20:03

In der IndustrieHow to analyze EUR/USD?

Tonight the BOE will announce its November interest rate decision, and I am sticking with my previous view of a 25 basis point cut.

After Trump wins, he will promote policies that will cause economic damage to Europe, which has also been analyzed in my previous article. If at this point the BOE directly indicates that the UK economy is under threat in the press conference, the market may interpret the dovish tone, which will drive EUR/USD down.

In addition, the November FOMC meeting follows, with the market now fully pricing in a 25 basis point cut at this meeting and pricing in a 70% chance of another 25 basis point cut at the December meeting. If the Bank of England press conference indicates that they may cut rates again at the December meeting, then the dollar index has a good chance of falling; Conversely, if it signals no more rate cuts, then the dollar may rise again, driving EUR/USD down.

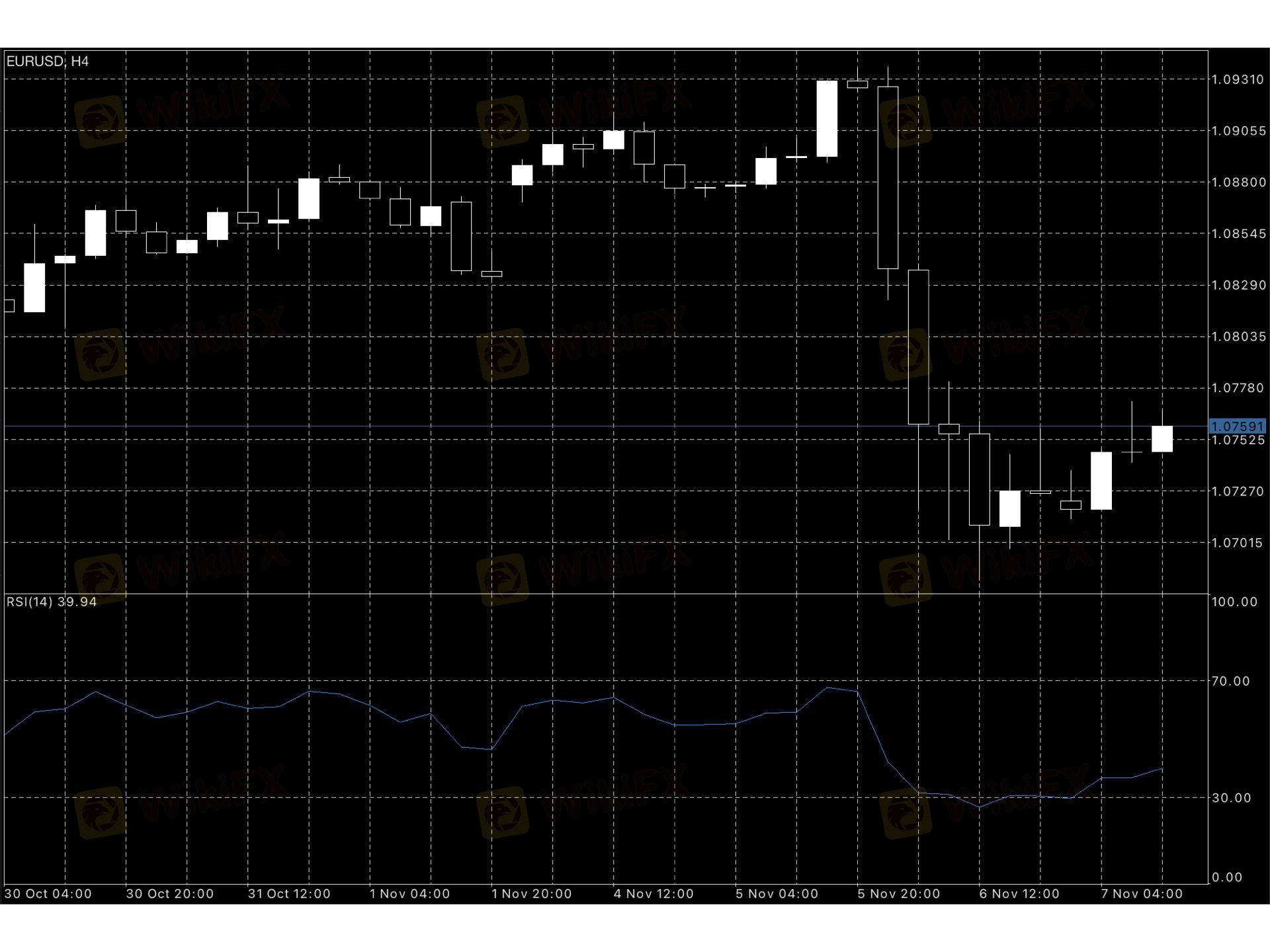

Looking at the chart below, the short-term (4-hour) chart shows the 14-day RSI holding near the neutral 50 axis, indicating that the decline is gradually abating. Here I think EUR/USD will trade between the 100-day and 200-day simple moving average (SMA) 1.2820 and 1.3000 in the short term.

On the upside, if EUR/USD is able to regain above 1.3000, this will be an important support level, with resistance on the upside at 1.3050 and 50-day SMA1.3100. On the downside, temporary support is at 1.2870, but if it breaks below this level, the 200-day SMA1.2820 will become a key support in the short term. A close below this point would attract bears and open up the downside, potentially extending the decline to 1.2760.

Gefällt 0

Steven123

Händler

Aktueller Inhalt

In der Industrie

Event-A comment a day,Keep rewards worthy up to$27

In der Industrie

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

In der Industrie

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

In der Industrie

South Africa Event-Come&Win 240ZAR Phone Credit

In der Industrie

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

In der Industrie

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Kategorie

Plattform

Ausstellung

IB

Rekrutierung

EA

In der Industrie

Markt

Index

How to analyze EUR/USD?

Hong Kong | 2024-11-07 20:03

Hong Kong | 2024-11-07 20:03Tonight the BOE will announce its November interest rate decision, and I am sticking with my previous view of a 25 basis point cut.

After Trump wins, he will promote policies that will cause economic damage to Europe, which has also been analyzed in my previous article. If at this point the BOE directly indicates that the UK economy is under threat in the press conference, the market may interpret the dovish tone, which will drive EUR/USD down.

In addition, the November FOMC meeting follows, with the market now fully pricing in a 25 basis point cut at this meeting and pricing in a 70% chance of another 25 basis point cut at the December meeting. If the Bank of England press conference indicates that they may cut rates again at the December meeting, then the dollar index has a good chance of falling; Conversely, if it signals no more rate cuts, then the dollar may rise again, driving EUR/USD down.

Looking at the chart below, the short-term (4-hour) chart shows the 14-day RSI holding near the neutral 50 axis, indicating that the decline is gradually abating. Here I think EUR/USD will trade between the 100-day and 200-day simple moving average (SMA) 1.2820 and 1.3000 in the short term.

On the upside, if EUR/USD is able to regain above 1.3000, this will be an important support level, with resistance on the upside at 1.3050 and 50-day SMA1.3100. On the downside, temporary support is at 1.2870, but if it breaks below this level, the 200-day SMA1.2820 will become a key support in the short term. A close below this point would attract bears and open up the downside, potentially extending the decline to 1.2760.

Gefällt 0

Ich möchte auch kommentieren

Einreichen

0Kommentare

Es gibt noch keinen Kommentar. Mach den ersten

Einreichen

Es gibt noch keinen Kommentar. Mach den ersten