2025-01-29 17:05

In der IndustrieSwing Trading Strategies

#firstdealofthenewyearFateema

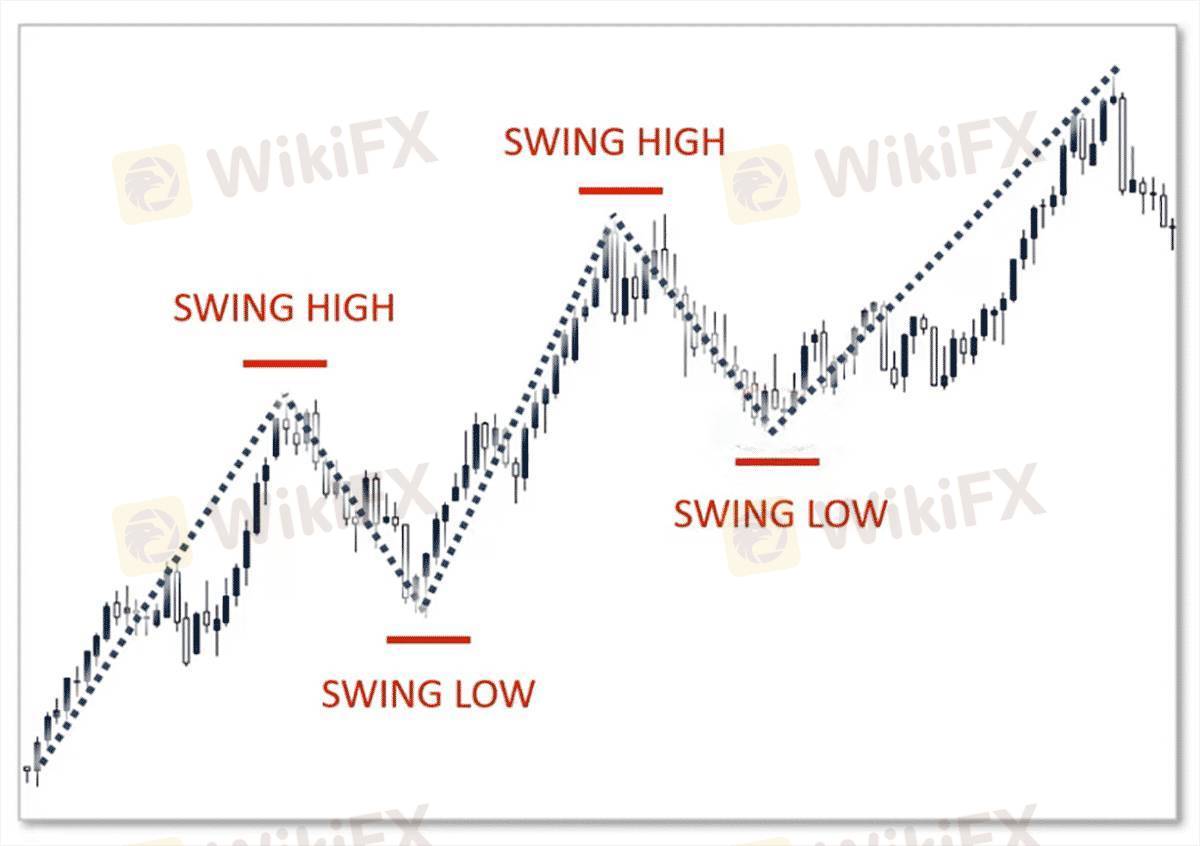

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

Gefällt 0

Veinticinco25

Händler

Aktueller Inhalt

In der Industrie

Event-A comment a day,Keep rewards worthy up to$27

In der Industrie

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

In der Industrie

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

In der Industrie

South Africa Event-Come&Win 240ZAR Phone Credit

In der Industrie

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

In der Industrie

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Kategorie

Plattform

Ausstellung

IB

Rekrutierung

EA

In der Industrie

Markt

Index

Swing Trading Strategies

Nigeria | 2025-01-29 17:05

Nigeria | 2025-01-29 17:05#firstdealofthenewyearFateema

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

Gefällt 0

Ich möchte auch kommentieren

Einreichen

0Kommentare

Es gibt noch keinen Kommentar. Mach den ersten

Einreichen

Es gibt noch keinen Kommentar. Mach den ersten