2025-01-30 19:39

In der IndustrieTrading Psychology: Overcoming Emotional

#firstdealofthenewyearAKEEL

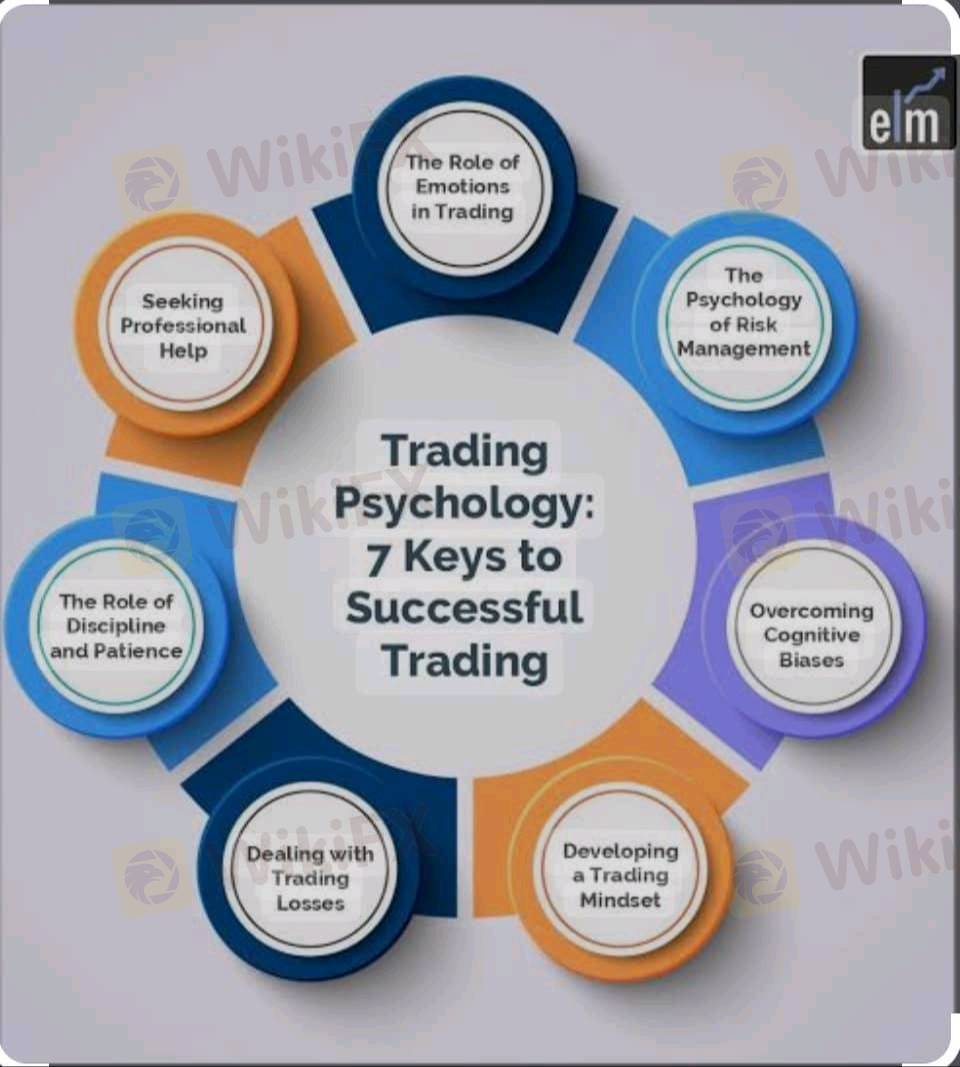

Trading psychology refers to the mental and emotional aspects of trading that can influence decision-making and outcomes. It is important for traders to understand and manage their emotions in order to make rational decisions and avoid impulsive actions that can lead to losses.

One of the key challenges in trading is overcoming emotional biases and impulses. These can arise from fear, greed, and other emotions that can cloud judgment and lead to poor decision-making. For example, a trader may be tempted to take excessive risks in order to make a quick profit, or they may become overly cautious and miss out on potential opportunities.

To overcome these emotional biases, traders can use a variety of strategies. One approach is to develop a clear trading plan and stick to it, regardless of market conditions or emotions. This can help traders stay focused and avoid making impulsive decisions based on fear or greed. Another strategy is to practice mindfulness and self-awareness, which can help traders recognize and manage their emotions in real-time.

It is also important for traders to understand the psychological principles that underlie their behavior and decision-making. For example, they may need to recognize the role of confirmation bias, which is the tendency to seek out information that confirms existing beliefs and ignore information that contradicts them. By understanding these biases and how they can influence their trading decisions, traders can take steps to mitigate their impact and make more rational choices.

Overall, trading psychology is a complex and multifaceted topic that requires ongoing learning and self-reflection. By developing a clear trading plan, practicing mindfulness and self-awareness, and understanding the psychological principles that underlie their behavior, traders can overcome emotional biases and make more rational decisions in the markets.

#firstdealofthenewyearAKEEL

Gefällt 0

Galiya

Broker

Aktueller Inhalt

In der Industrie

Event-A comment a day,Keep rewards worthy up to$27

In der Industrie

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

In der Industrie

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

In der Industrie

South Africa Event-Come&Win 240ZAR Phone Credit

In der Industrie

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

In der Industrie

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Kategorie

Plattform

Ausstellung

IB

Rekrutierung

EA

In der Industrie

Markt

Index

Trading Psychology: Overcoming Emotional

Nigeria | 2025-01-30 19:39

Nigeria | 2025-01-30 19:39#firstdealofthenewyearAKEEL

Trading psychology refers to the mental and emotional aspects of trading that can influence decision-making and outcomes. It is important for traders to understand and manage their emotions in order to make rational decisions and avoid impulsive actions that can lead to losses.

One of the key challenges in trading is overcoming emotional biases and impulses. These can arise from fear, greed, and other emotions that can cloud judgment and lead to poor decision-making. For example, a trader may be tempted to take excessive risks in order to make a quick profit, or they may become overly cautious and miss out on potential opportunities.

To overcome these emotional biases, traders can use a variety of strategies. One approach is to develop a clear trading plan and stick to it, regardless of market conditions or emotions. This can help traders stay focused and avoid making impulsive decisions based on fear or greed. Another strategy is to practice mindfulness and self-awareness, which can help traders recognize and manage their emotions in real-time.

It is also important for traders to understand the psychological principles that underlie their behavior and decision-making. For example, they may need to recognize the role of confirmation bias, which is the tendency to seek out information that confirms existing beliefs and ignore information that contradicts them. By understanding these biases and how they can influence their trading decisions, traders can take steps to mitigate their impact and make more rational choices.

Overall, trading psychology is a complex and multifaceted topic that requires ongoing learning and self-reflection. By developing a clear trading plan, practicing mindfulness and self-awareness, and understanding the psychological principles that underlie their behavior, traders can overcome emotional biases and make more rational decisions in the markets.

#firstdealofthenewyearAKEEL

Gefällt 0

Ich möchte auch kommentieren

Einreichen

0Kommentare

Es gibt noch keinen Kommentar. Mach den ersten

Einreichen

Es gibt noch keinen Kommentar. Mach den ersten