2025-02-06 15:11

In der IndustrieThe role of market makers in trading

#firstdealofthenewyearFateema

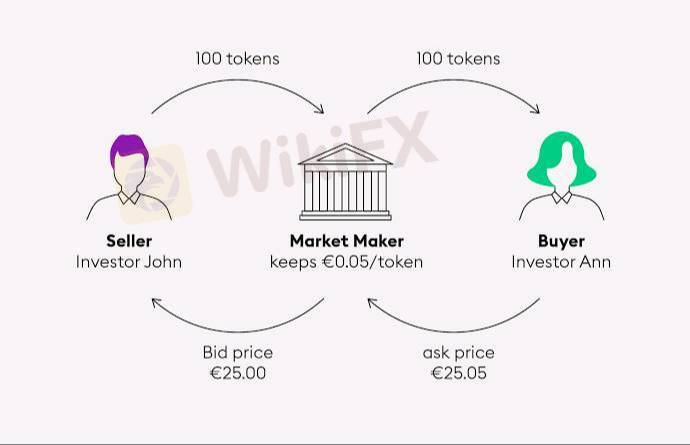

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

Gefällt 0

murphy

Händler

Aktueller Inhalt

In der Industrie

Event-A comment a day,Keep rewards worthy up to$27

In der Industrie

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

In der Industrie

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

In der Industrie

South Africa Event-Come&Win 240ZAR Phone Credit

In der Industrie

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

In der Industrie

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Kategorie

Plattform

Ausstellung

IB

Rekrutierung

EA

In der Industrie

Markt

Index

The role of market makers in trading

Nigeria | 2025-02-06 15:11

Nigeria | 2025-02-06 15:11#firstdealofthenewyearFateema

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

Gefällt 0

Ich möchte auch kommentieren

Einreichen

0Kommentare

Es gibt noch keinen Kommentar. Mach den ersten

Einreichen

Es gibt noch keinen Kommentar. Mach den ersten