Spring Gold Market

Zusammenfassung:Spring Gold Market, established in China, offering trading on forex, indices, commodities, and shares. Traders can access these assets via the MetaTrader 4 (MT4) trading platform. The minimum deposit requirement to open a live account is USD$200. However, it's crucial to acknowledge that Spring Gold Market operates without regulatory oversight.

| Spring Gold Market Review Summary | |

| Founded | / |

| Headquarters | China |

| Regulation | No regulation |

| Tradable Assets | Forex, commodities, indices, shares |

| Demo Account | / |

| Leverage | Up to 1:200 (retail)/1:500 (professional) |

| EUR/USD Spread | 0 pips |

| Trading Platform | MetaTrader 4 (MT4) |

| Min Deposit | USD$200 |

| Customer Support | Service time: 24/7 multilingual |

| Tel: +1786 628 1209 | |

| Email: info@springgold.net | |

Overview of Spring Gold Market

Spring Gold Market, established in China, offering trading on forex, indices, commodities, and shares. Traders can access these assets via the MetaTrader 4 (MT4) trading platform. The minimum deposit requirement to open a live account is USD$200.

However, it's crucial to acknowledge that Spring Gold Market operates without regulatory oversight.

Pros and Cons

| Pros | Cons |

|

|

|

|

| |

|

Is Spring Gold Market Legit?

No. Spring Gold Market currently has no valid regulations. Please be aware of the risk!

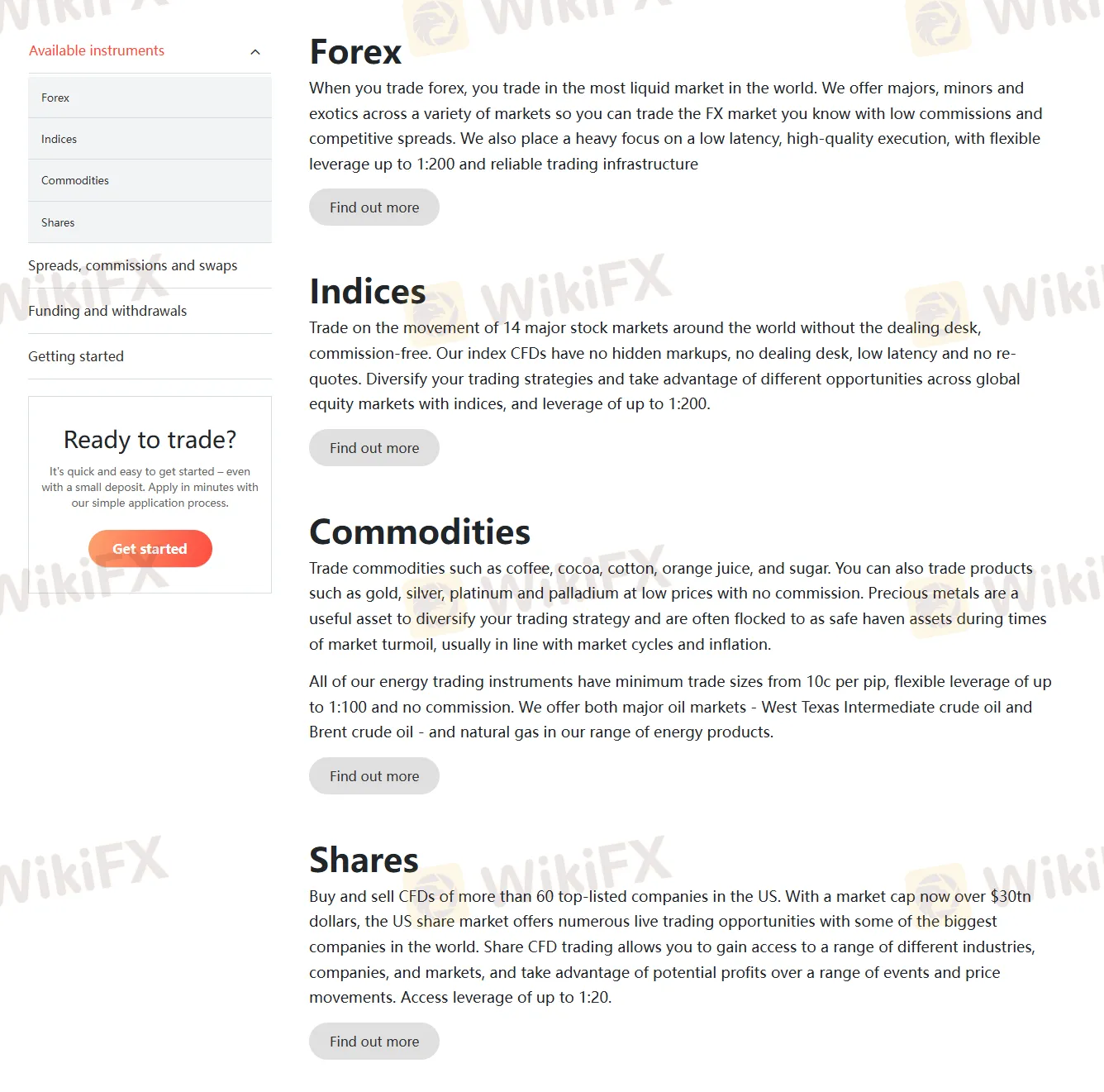

Trading Instruments

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

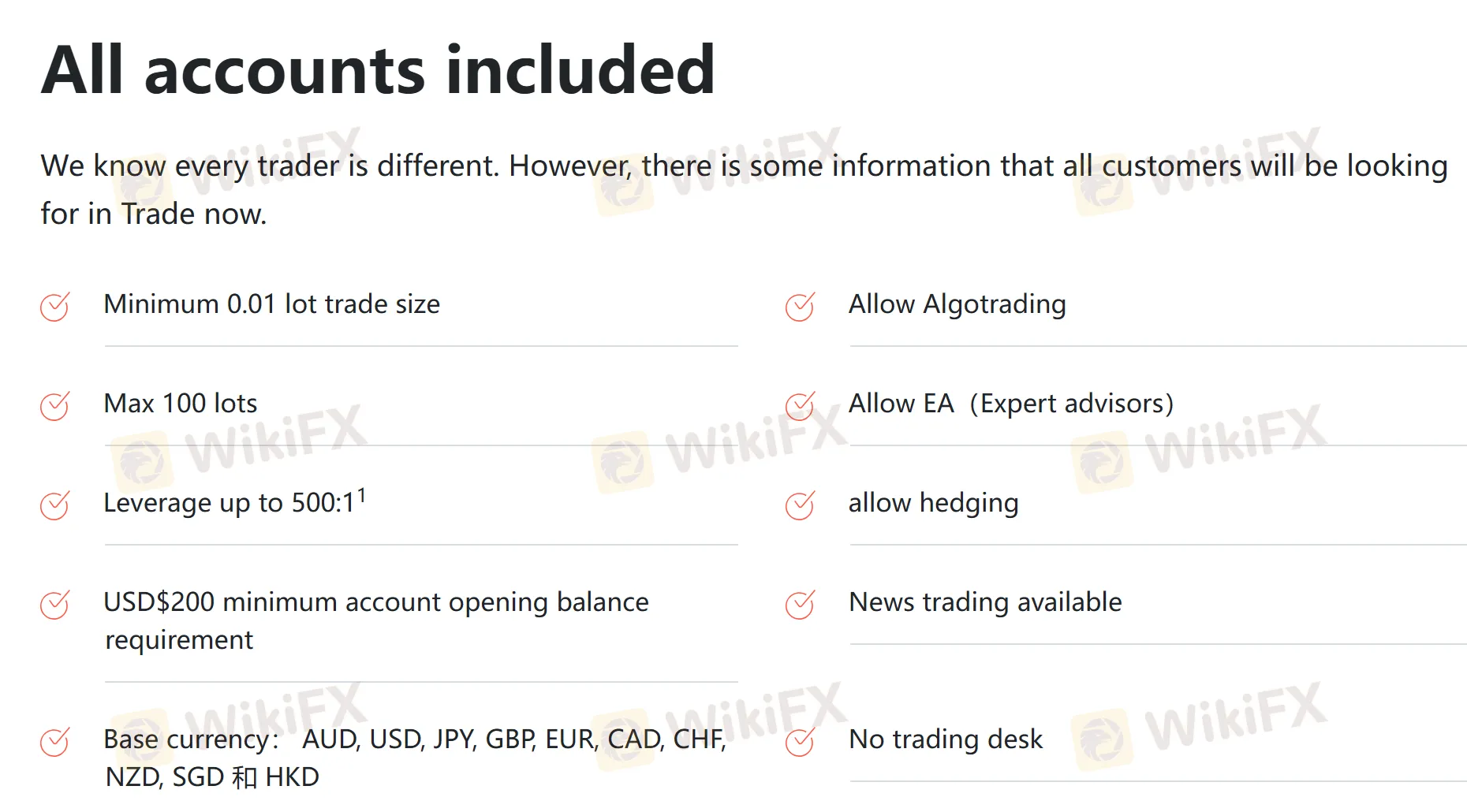

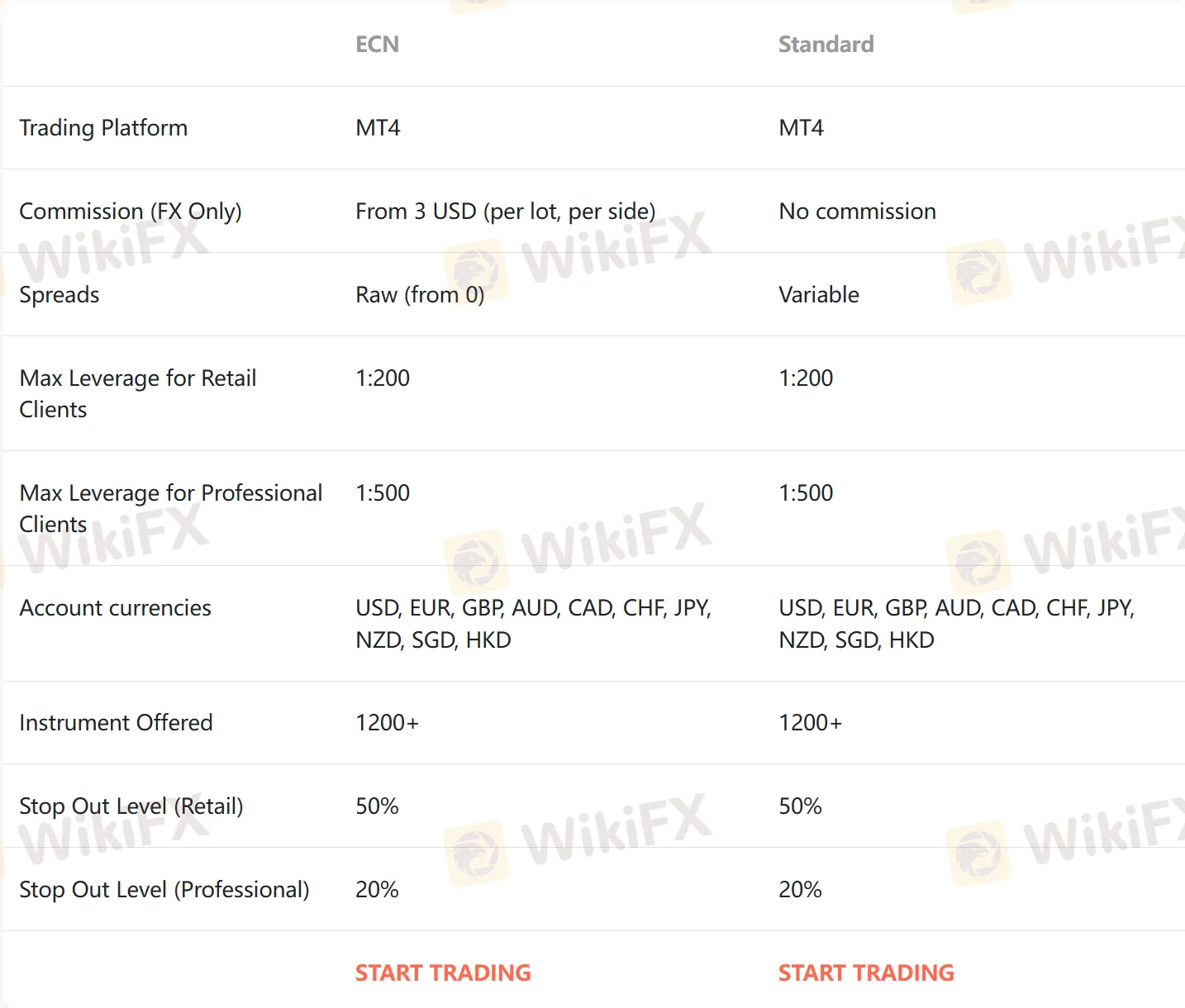

Account Type

Spring Gold Market offers two account types: Standard and ECN. The base currencies are AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD.

| Account Type | Min Deposit |

| Standard | USD$200 |

| ECN | USD$200 |

Leverage

For retail clients, both ECN and Standard accounts come with a maximum leverage of 1:200. While for professional clients, the maximum leverage is higher, set at 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

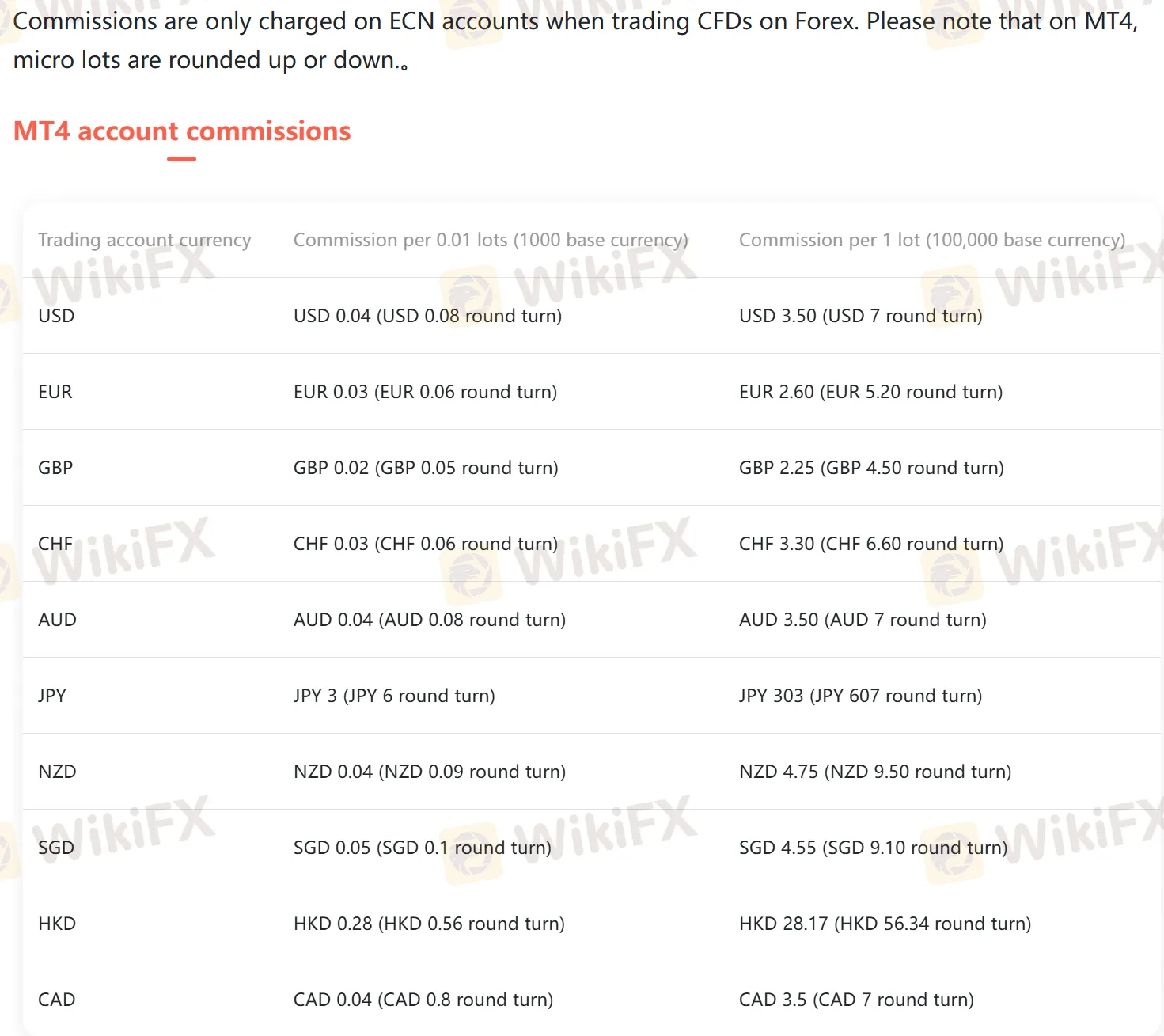

Spread and Commission

| Account Type | Spread | Commission (FX Only) |

| Standard | Variable | From 3 USD per lot per side |

| ECN | Raw (from 0) | ❌ |

You can find more detailed info on spreads and commissions in the screenshot below:

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC, iPhone, Android, iPad | Beginners |

| MT5 | ❌ | / | Experienced traders |

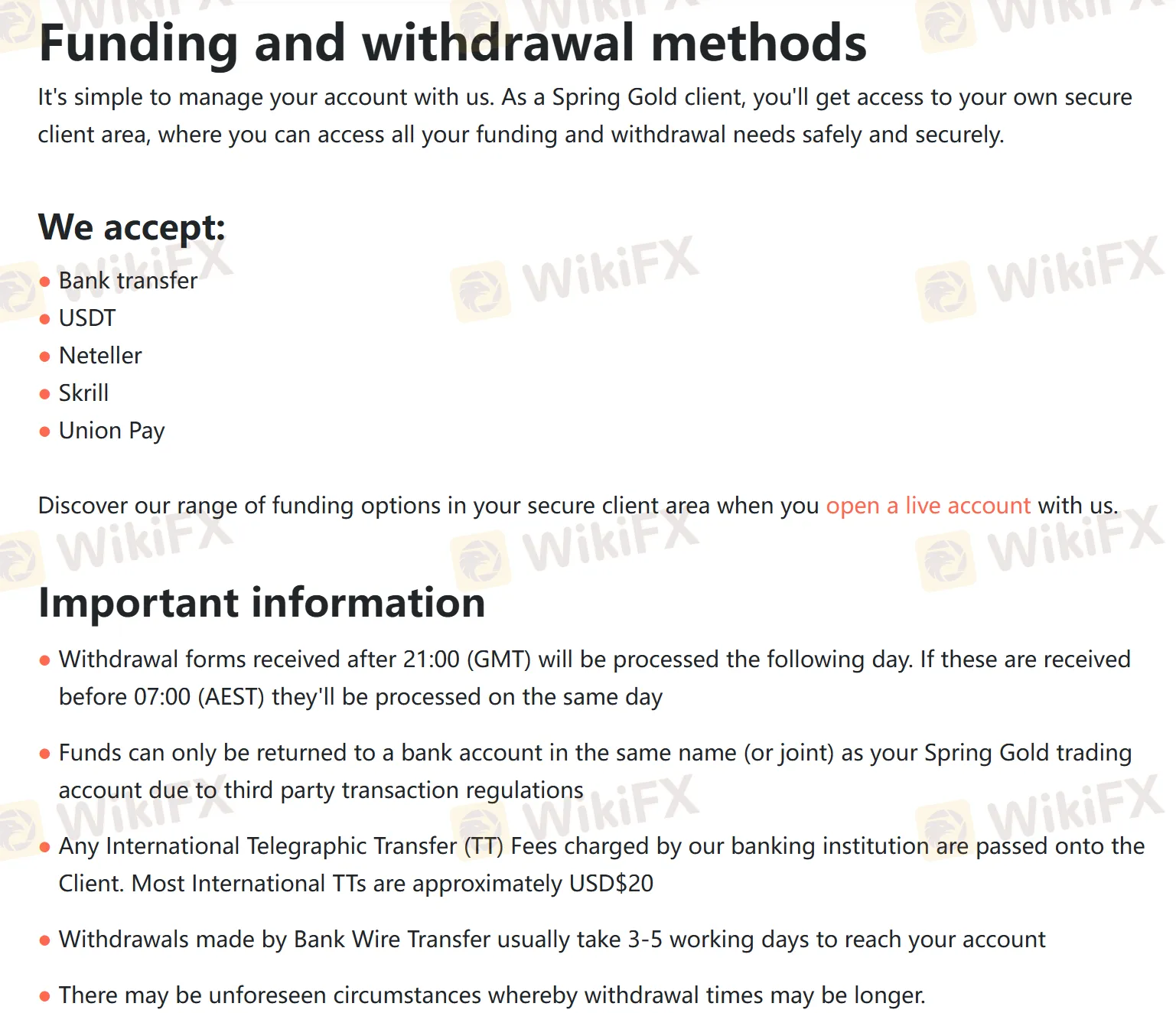

Deposit and Withdrawal

Spring Gold Market accepts some popular payment methods, including Bank transfer, USDT, Neteller, Skrill, and Union Pay.

Note that any International Telegraphic Transfer (TT) Fees charged by the banking institution are passed onto the Client. Most International TTs are approximately USD$20.

Withdrawal forms received after 21:00 (GMT) will be processed the following day. If these are received before 07:00 (AEST) they'll be processed on the same day. Withdrawals made by Bank Wire Transfer usually take 3-5 working days to reach your account.

WikiFX-Broker

Aktuelle Nachrichten

Porsche nimmt Ziele zurück – wegen schwacher Nachfrage nach E-Autos

Puma muss deutlichen Rückgang beim Gewinn hinnehmen

KI nimmt doch Jobs weg: Wie ihr in der Tech-Branche trotzdem Karriere machen könnt

Tesla-Aktie fällt an einem Tag um mehr als 15 Prozent – deshalb will Trump jetzt einen Tesla kaufen

Volkswagen in der Krise: So stark kürzt der Konzern die Dividende für seine Aktionäre

Dance: E-Mobility-Startup der Soundcloud-Gründer nimmt weitere 12 Millionen Euro auf

Kaffee-Krise bei Aldi, Edeka und Kaufland: Darum wird euer Lieblingskaffee immer teurer und teurer

Nvidia-Aktie bricht ein – das empfiehlt ein Analyst jetzt Anlegern

Fast 3 Prozent sichere Rendite auf Bundesanleihen – lohnt sich der Einstieg noch?

Gewinnrückgang bei Puma: Sportartikelhersteller will 500 Stellen streichen

Wechselkursberechnung