Last week Thursday's data hit hard!

Zusammenfassung:It was surprised that all three major US indices ended in the red on Thursday, after a better-than-expected producer inflation report raised concerns the Fed will further tighten monetary policy.

It was surprised that all three major US indices ended in the red on Thursday, after a better-than-expected producer inflation report raised concerns the Fed will further tighten monetary policy. On the other hand, North American household debt increased by $394 billion to a record $16.90 trillion in the fourth quarter of 2022, the largest increase in two decades, due to rising mortgage and credit card balances due to to inflation and interest rates. Mortgage debt, which accounts for the largest portion of total debt, rose from $254 billion to $11.92 trillion at the end of 2022, as aggressive tightening by the Federal Reserve briefly boosted the average mortgage rate fixed at 30 years. above 7%, a level not seen since 2001.

INDICES

The Dow lost more than 400 points, while the S&P 500 and Nasdaq 100 were down almost 1.4% and 1.8%, respectively. The producer price index, an indicator of the prices of final demand products, rose 0.7%

month in January, the highest since June 2022, while analysts had expected a modest 0.4% rise. At the same time, initial jobless claims, the most timely snapshot of the labor market, were 194,000 lower than expected for the week ending February 11, pointing to a tight labor market. On the corporate side, Shopify plunged 15.9% after the cloud-based commerce platform reported missing-expected first-quarter revenue. Paramount fell 4.2% after the media giant posted earnings that surprised investors on the downside. Tesla lost 5.7% after recalling 362,000 US vehicles over fully self-driving software.

COMMODITIES

SOY: Soybean futures traded around $15.2 a bushel, near their seven-month high of $15.55 hit on February 13, thanks to strong demand expectations, particularly from China after the country lifted its strict controls. pandemics. Meanwhile, Brazil's record harvest and a stronger dollar, helped by higher interest rate projections from the Federal Reserve, are likely to weigh on the market. Brazil's soybean production for the 2022/23 marketing year is forecast to reach a record level of 153.5 MMT, despite fears that heavy rains in key producing regions will affect the harvest. Agribusiness consultancy AgRural has said the Brazilian soybean harvest was 17% complete, while Scoville noted that progress was furthest along in Mato Grosso, Brazil's largest soybean state. On the other hand, the 2022/23 harvest from Argentina has been greatly affected by a drought that began in mid-2022.

FOREIGN EXCHANGE

AND IN: The Japanese yen weakened to $135 per dollar, hitting its lowest levels in almost two months, as better-than-expected US economic data and aggressive comments from officials boosted expectations that the Federal Reserve would continue to raise interest rates. interest to control inflation. Investors also continued to assess the implications of Kazuo Ueda's nomination as the next Bank of Japan governor. Kazuo will be the first academic economist to head the central bank in postwar Japan. He has already declared that the central bank's current ultra-loose stance “is appropriate” and “must continue”, countering speculation about policy normalization. The BOJ kept its ultra-low interest rates and left its yield control policy unchanged at its January meeting. Governor Haruhiko Kuroda reiterated that the 2% inflation target must be achieved in a sustainable manner, accompanied by a healthy increase in wages.

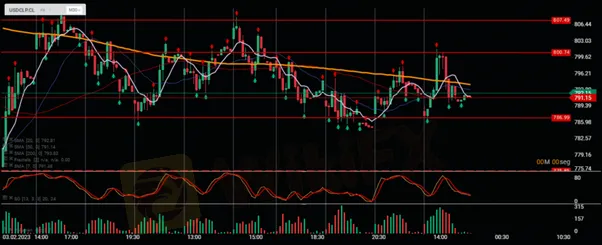

Chilean Peso : The dollar continues to lateralize the peso in the channel of $800 and $786 pesos, for now, while copper continues to recover ground and return above $4.10 usd per pound. The tensions in Peru continue to keep the price of the red metal high while in the United States, uncertainty about the market remains in the sights of investors. We hope that at the end of the week the peso will give a small

sign of wanting to seek new resistance, if it closes above $800 pesos and otherwise, if it closes below $800 pesos, we would see the peso wanting to break the support of $786 and go get the $775.

CRYPTO MARKET

Bitcoin rose to $25,000, the highest level since August, and investors dumped altcoins in favor of bitcoin amid fears of a regulatory crackdown. Earlier this week, the New York State Department of Financial Services told Paxos, a regulated blockchain infrastructure platform, to stop issuing new Binance USD or BUSD stablecoins. SEC Chairman Gary Gensler reiterated last year that the agency views bitcoin as a commodity rather than a security, offering investors hope that the world's most traded cryptocurrency can avoid harsh regulation on digital currencies. . Bitcoin is now up more than 60% from its multi-year low of roughly $15,500 hit in late November

WikiFX-Broker

Aktuelle Nachrichten

Die Top 3 am besten regulierten Forex-Broker weltweit

Krypto-Schock: Ethereum rutscht zweistellig ab – Anleger ziehen Milliarden ab

Die Top 3 am besten regulierten Forex-Broker weltweit

Wenn du ein FX-Trader bist, könnten diese Broker genau das sein, wonach du gesucht hast.

Die besten Plattformen für Forex-Trader, die auch investieren wollen

Die Top 3 am besten regulierten Forex-Broker weltweit

Cardano rutscht weiter ab – droht jetzt der nächste Absturz?

DNeue FX-Trader: Sucht nicht weiter – hier sind die 3 besten Broker für Anfänger

Ripple unter Druck: XRP rutscht ab – Privatanleger ziehen sich zurück

Wechselkursberechnung