MHMarkets:The Fed's Brown Book showed that economic activity has slowed down since the last report.

Zusammenfassung:At the end of the Asian market on Thursday (November 30), Cleveland Fed Chairman Mester recently stated that US inflation has cooled, while economic activity and labor markets have slowed down.

At the end of the Asian market on Thursday (November 30), Cleveland Fed Chairman Mester recently stated that US inflation has cooled, while economic activity and labor markets have slowed down. This suggests that she may support maintaining interest rates unchanged at the Fed's December meeting. The Fed's Brown Book released yesterday evening showed that overall, economic activity has slowed down since the last report. Four regions reported moderate growth, two regions reported stable or slightly declining economic conditions, and six regions reported slight declines in economic activity. Consumer spending on non essential goods has decreased, and consumers have shown higher price sensitivity. Recently, the US dollar index has experienced a significant decline in prices due to the impact of fundamentals and market expectations. Yesterday, the US dollar index underwent a structural correction and closed near the intraday high. At the opening of the Asian market today, the US dollar index fluctuated slightly, with a current price around 102.79. Gold has seen a significant increase in price recently due to market fundamentals expectations. Yesterday, the upward trend of gold has eased somewhat, but if the fundamentals do not change, it is difficult to change the trend of gold continuing to rise in the future. At the opening of the Asian market today, gold fluctuated slightly, with the current price around 2043.13. After receiving support below yesterday, US crude oil prices rose sharply and broke through the previously formed resistance level, closing near the intraday high. At the opening of the Asian market today, US crude oil fell first and then rose, with a current price around 78.37.EURUSD encountered resistance previously formed above yesterday, causing price increases to be hindered and subsequently the market began to decline. Overall, considering the fundamentals, the current trend of EURUSD is likely to be a correction and consolidation of the upward trend, and there will still be an upward trend in EURUSD in the future market. At the opening of the Asian market today, EURUSD fluctuated slightly, with a current price around 1.0976. Earlier today, Bank of Japan's deliberative committee member Nakamura Toyotomi stated that he will maintain yield curve control (YCC) and negative interest rates until the price target is expected to be achieved. USDJPY fell first and then rose yesterday, showing an overall downward trend and a pullback trend. At the opening of the Asian market today, USDJPY fluctuated slightly, with the current price around 146.97.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on November 30, Beijing time.

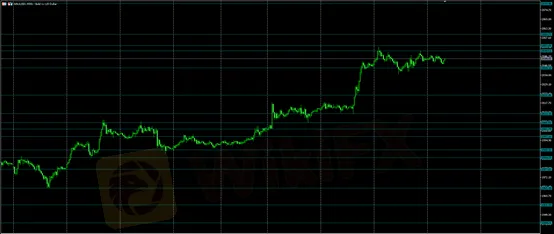

Gold XAUUSD· | |

Resistance | 2049.61 – 2052.89 – 2059.79 |

Support | 2039.12 – 2022.46 – 2011.15 |

The above figure shows the 30 minute chart of gold. The chart shows that the recent upward resistance of gold has been around 2049.61-2052.89-2059.79, and the downward support has been around 2039.12-2022.46-2011.15. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on November 30. This policy is a daytime policy. Please pay attention to the policy release time. | |

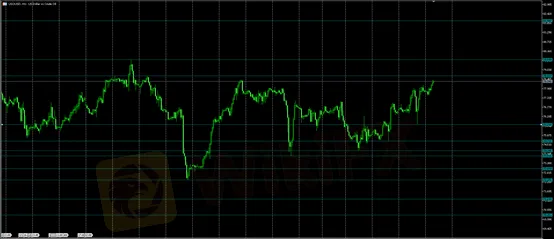

Crude Oil USOUSD· | |

Resistance | 78.66 – 79.64 – 81.99 |

Support | 75.72 – 74.72 – 74.14 |

The above chart shows the 30 minute chart of US crude oil. The chart shows that the recent upward resistance of US crude oil is around 78.66-79.64-81.99, and the downward support is around 75.72-74.72-74.14. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on November 30. This policy is a daytime policy. Please pay attention to the policy release time. | |

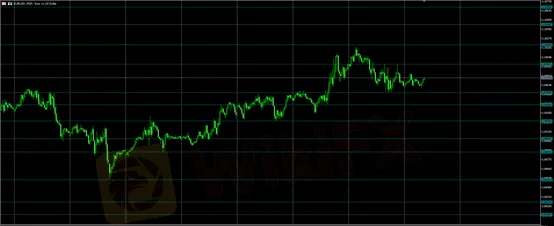

EURUSD· | |

Resistance | 1.0995 - 1.1019 - 1.1044 |

Support | 1.0960 - 1.0945 - 1.0925 |

The above figure shows the 30 minute chart of EURUSD. The chart shows that the recent upward resistance of EURUSD is around 1.0995-1.1019-1.1044, and the downward support is around 1.0960-1.0945-1.0925. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on November 30. This policy is a daytime policy. Please pay attention to the policy release time. | |

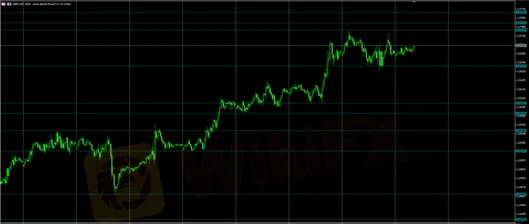

GBPUSD· | |

Resistance | 1.2734 – 1.2747 – 1.2765 |

Support | 1.2671 - 1.2607 – 1.2589 |

The above figure shows the 30 minute chart of GBPUSD. The chart shows that the recent upward resistance of GBPUSD is around 1.2734-1.2747-1.2765, and the downward support is around 1.2671-1.2607-1.2589. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on November 30. This policy is a daytime policy. Please pay attention to the policy release time. | |

WikiFX-Broker

Aktuelle Nachrichten

Datenanalyse: Wirtschaftskrise trifft zunehmend Mittelstand

Marktanteil von E-Autos steigt wieder – Negativtrend nach Förderstopp vorbei, glaubt Experte

Elon Musk wird Nissan nicht retten – der japanische Autobauer braucht eine neue Strategie

US-Aktien unter Druck: Diese drei Gründe stecken hinter dem schlechtesten Börsen-Tag des Jahres

Wechselkursberechnung