XCH

Zusammenfassung:XCH Finance Limited, headquartered in London, UK, claims to operate globally with branches in New Zealand, Canada, Switzerland, Australia, China, and other regions. The company provides futures, options, gold trading, and foreign exchange for both institutional and individual clients. However, the absence of regulatory oversight raises concerns about the platform's transparency and reliability.

| XCH Review Summary | |

| Founded | 2013 |

| Registered Region/Country | Hong Kong |

| Regulation | No regulation |

| Market Instruments | Forex, precious metals, futures, options |

| Demo Account | Available |

| Spreads | Not mentioned |

| Leverage | Up to 1:100 |

| Trading Platform | XCH-MT5 |

| Minimum Deposit | $10,000 |

| Customer Support | Address, email, FAQ |

XCH Information

XCH Finance Limited, headquartered in London, UK, claims to operate globally with branches in New Zealand, Canada, Switzerland, Australia, China, and other regions. The company provides futures, options, gold trading, and foreign exchange for both institutional and individual clients. However, the absence of regulatory oversight raises concerns about the platform's transparency and reliability.

Pros & Cons

| Pros | Cons |

| MT5 Trading Platform | Lack of Regulatory Oversigt |

| High Minimum Deposit Requirements | |

| Lack of Transparency in Trading Conditions | |

| Limited Customer Support Channels |

Pros:

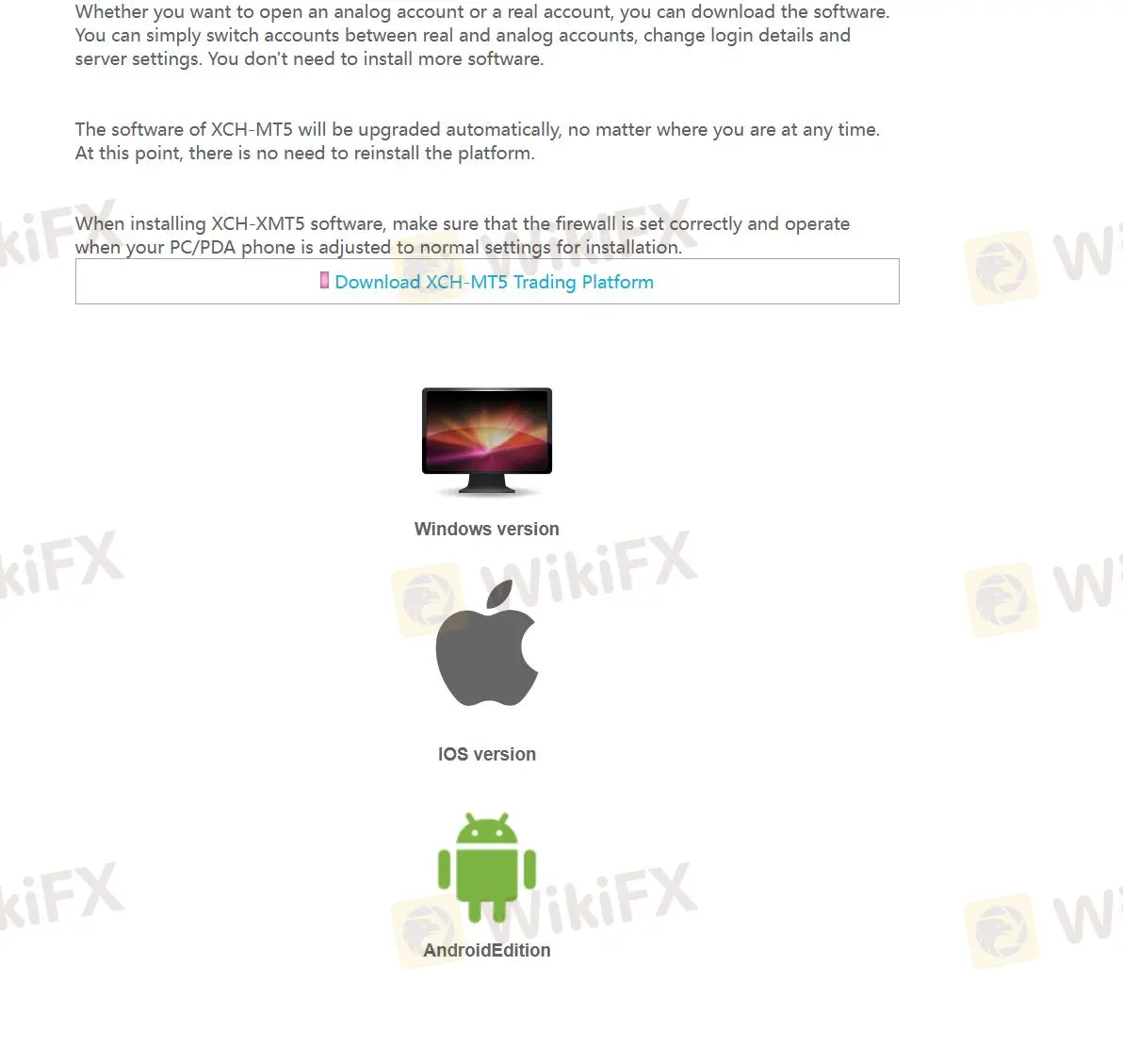

- MT5 Trading Platform: The XCH-MT5 platform is available on various devices, including Windows PCs, Mac OS, iOS, and Android, allowing for flexible trading options.

Cons:

- Lack of Regulatory Oversigt: The lack of regulatory oversight at XCH raises concerns about the platforms transparency and reliability.

- Lack of Transparency in Trading Conditions: Specifics regarding such as spreads and exact payment methods are not clearly detailed.

- High Minimum Deposit Requirements: The high minimum deposit amounts for account types from $10,000 is a barrier for some clients.

- Limited Customer Support Channels: Customer service primarily relies on physical addresses, email support, and the FAQ section is basic, which can not fully address all user inquiries.

Is XCH Legit?

When considering the safety of a brokerage like XCH or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

- Regulatory sight: The broker's current operation without legitimate regulatory oversight only fuels concerns about its legitimacy and trustworthiness. These worries are compounded by the broker's inaccessible website.

- User feedback: For a deeper insight into the brokerage, traders should read reviews and feedback from existing clients. These valuable inputs from users, available on trustworthy websites and discussion forums, can provide firsthand information about the broker's operations.

- Security measures: XCH Finance ensures security with robust encryption protocols, safeguarding user data throughout transactions. By employing advanced encryption techniques and digital vouchers for fund transfers, XCH protects real-time transaction visibility.

In the end, choosing whether or not to engage in trading with XCH is an individual decision. We advise you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

XCH offers a diverse array of market instruments for both institutional and individual clients.

Their portfolio includes futures and options, allowing users to hedge against risks or speculate on market movements.

Additionally, XCH provides trading in gold, a popular asset for wealth preservation, and foreign exchange services.

Account Types

XCH Finance offers several account types.

| Account Type | Minimum Deposit | Features |

| MINI Account | $10,000 | / |

| Standard Account | $100,000 | / |

| VIP Account | $1,000,000 | / |

| Analog Account | N/A (Simulation) | Simulation trading with XCH software; expires after 30 days of inactivity |

The MINI account requires a minimum deposit of $10,000, the Standard account $100,000, and the VIP account $1,000,000. Given these significant minimum deposit levels, prospective clients should proceed with serious consideration and ensure they are comfortable with the financial commitment before opening an account.

Additionally, XCH provides a simulation account for practice, available through their XCH simulation trading software, which expires after 30 days of inactivity.

Leverage

XCH provides customers with a default leverage of 1:100, enabling traders to control larger positions with a relatively smaller amount of capital. This leverage allows for increased trading flexibility and the potential for higher returns, though it also involves greater risk, which should be carefully well-understood by traders who decide to use it.

Spread & Commission

XCH charges a fixed commission of 5 points on trades, offering competitive point differences in the market. While they provide transparent commission fees, details about spreads are not disclosed publicly.

For specific information regarding spreads and other potential costs, clients are encouraged to contact the broker directly for clear and predictable transaction costs, thus to better manage their trading expenses.

Trading Platform

XCHs trading platform, XCH-MT5, provides a comprehensive and robust environment for trading across foreign exchange, CFDs, and futures markets.

As a leading global trading terminal, it integrates all necessary functions into one platform, offering powerful tools for market analysis, trade execution, and automated trading via expert advisors.

XCH-MT5 supports over 20 languages, features advanced charting options, and provides real-time data with automatic updates. It ensures secure trading with 128-bit encryption, backup and recovery capabilities, and allows for flexible account management, including mobile trading.

The platform is available for download on various devices such as Windows, Mac OS, iOS and Android, and users can switch between demo and real accounts seamlessly.

Deposit & Withdrawal

XCH offers various payment methods for depositing and withdrawing funds, but details are not avialable on their website.

From their FAQ section, we only get the information that deposits made online typically reflect in your trading account within two hours, though they can take up to seven hours.

Bank wire transfers are slower, with funds arriving in 2-3 working days.

To withdraw funds, users must complete a withdrawal application form. Withdrawals are processed within 1 to 3 working days after submission. For amounts exceeding $100,000, additional documentation, including identity verification and address proof, is required.

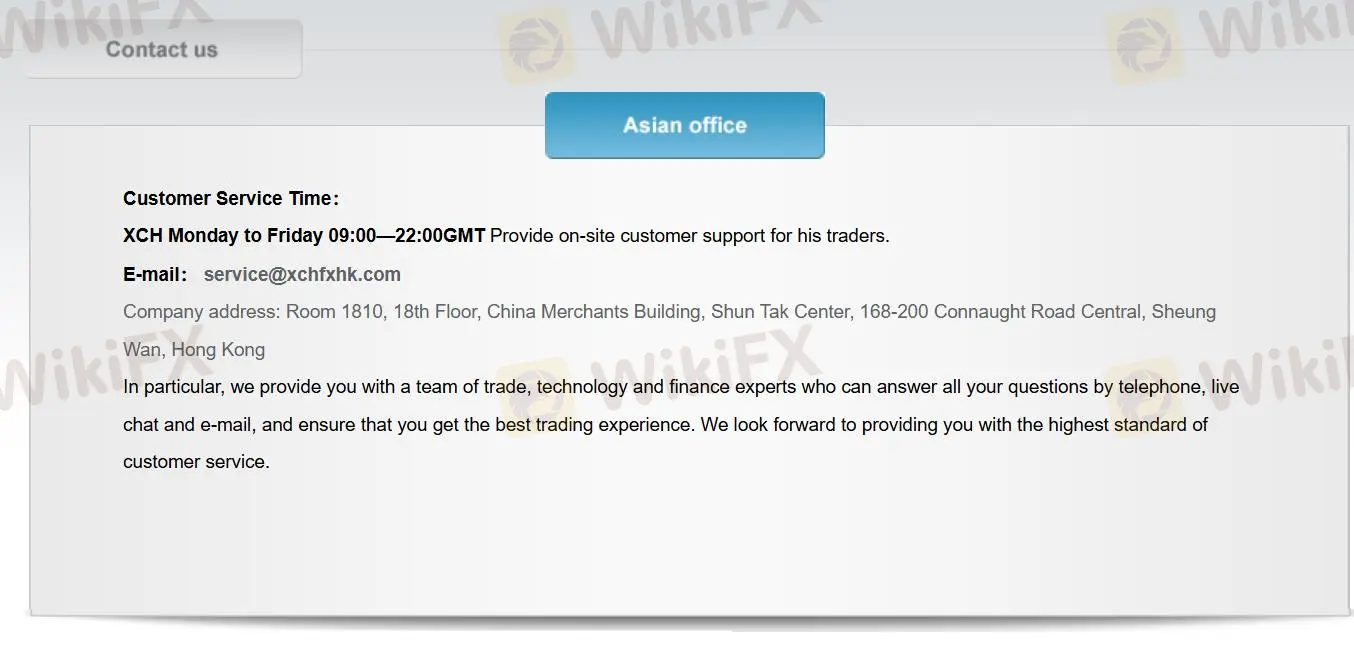

Customer Service

XCH Finance's customer service channels are limited and lack comprehensive support. Contact is primarily available through their physical address and email support.

The FAQ section is basic and does not address all issues.

Address: Room 1810, 18th Floor, China Merchants Building, Shun Tak Center, 168-200 Connaught Road Central, Sheung Wan, Hong Kong.

Email: service@xchfxhk.com.

Conclusion

In conclusion, XCH offers trading services in forex, precious metals, futures, options to its clients. However, the lack of regulatory oversight raises doubts about the broker's transparency and security. For those who prioritize regulatory compliance and reliable customer service, considering alternative platforms with robust regulatory standards and transparent practices is recommended to ensure a more secure and trustworthy trading experience.

Q&A

- Is XCH regulated?

No. The broker is currently under no valid regulation.

- Is XCH a good broker for beginners?

No. It is not a good choice for beginners. The company is not regulated by any recognized authorities, plus its extremely high minimum deposit from its live accounts can deter beginners with limited initial capitals.

- Does XCH offer industry leading MT4 & MT5?

Yes, it offers both MT5 on Windwos, MacOS, iOS and Android.

- What is the minimum deposit does XCH request?

$10,000.

- Does XCH offer demo accounts?

Yes.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

WikiFX-Broker

Aktuelle Nachrichten

Dogecoin Preisprognose: Der bärische Trend von DOGE hält trotz Musks Unterstützung an

Bitcoin Preisprognose: BTC fällt unter 84.000$ - Hype um die strategische Krypto-Reserve der USA lässt nach

Sondervermögen: Wegen dieser Mehrheiten kommt der alte Bundestag in zwei Sondersitzungen nochmal zusammen

BVG: Die Berliner Verkehrsbetriebe haben in 2024 fast 56 Millionen Euro verloren

Dieses Unternehmen verlost Prämie unter Mitarbeitern, die am wenigsten krank sind

„Meine Eltern hielten mich für verrückt: Warum ich meinen Konzern-Job kündigte, um in Immobilien zu investieren

Dividenden: Diese 6 Unternehmen schütten bald aus – wenn ihr die Aktie jetzt kauft

Entlassungswelle rollt durch die Tech-Branche: So findet ihr schnell einen neuen Job

354-Millionen-Deal: Pharma-Riese Novo Nordisk und KI-Startup Gensaic arbeiten künftig zusammen

Diese Branchen geraten jetzt besonders unter Druck

Wechselkursberechnung