User Reviews

More

User comment

9

CommentsWrite a review

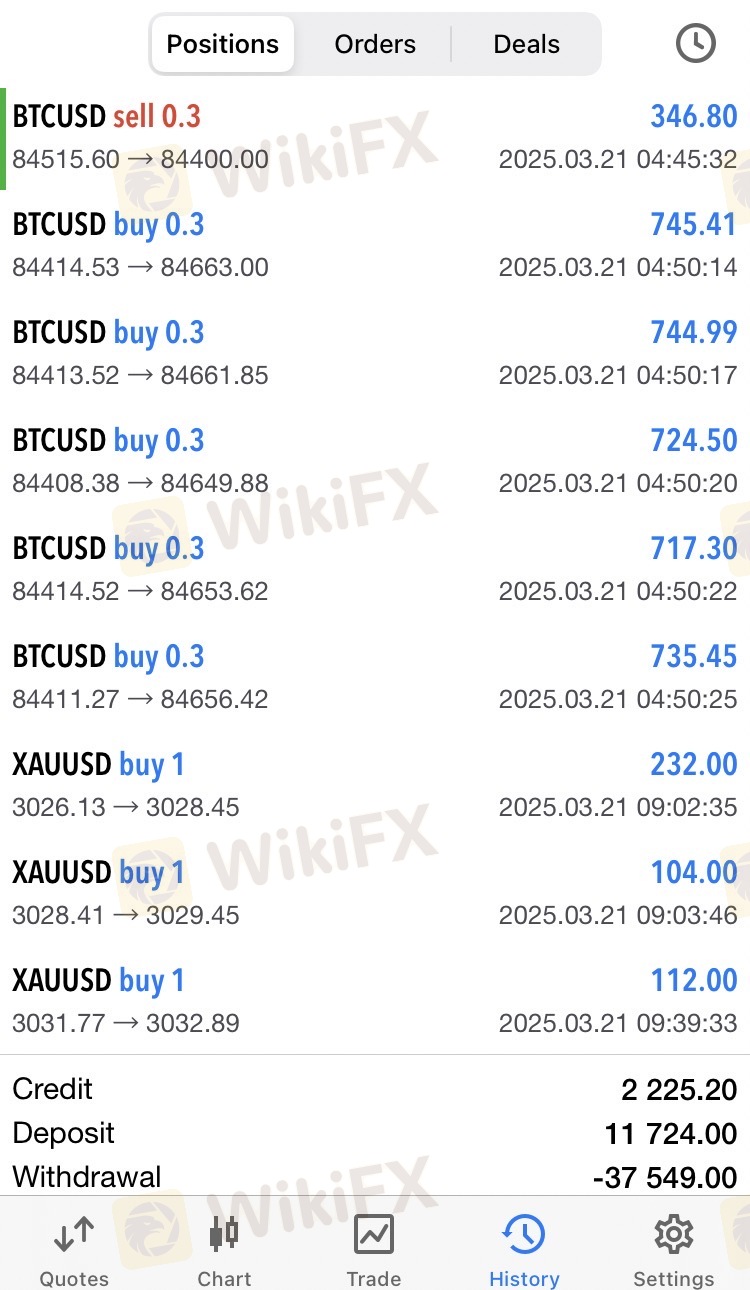

2025-03-21 15:14

2025-03-21 15:14

2025-03-14 14:25

2025-03-14 14:25

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

Suspicious Scope of Business

Medium potential risk

Capital Ratio

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index8.90

Software Index7.05

License Index7.85

Single Core

1G

40G

More

Company Name

Retela

Company Abbreviation

Retela

Platform registered country and region

Japan

Number of employees

Company website

Company summary

Pyramid scheme complaint

Expose

Capital

Higher than 96% Japanese brokers $29,410,853(USD)

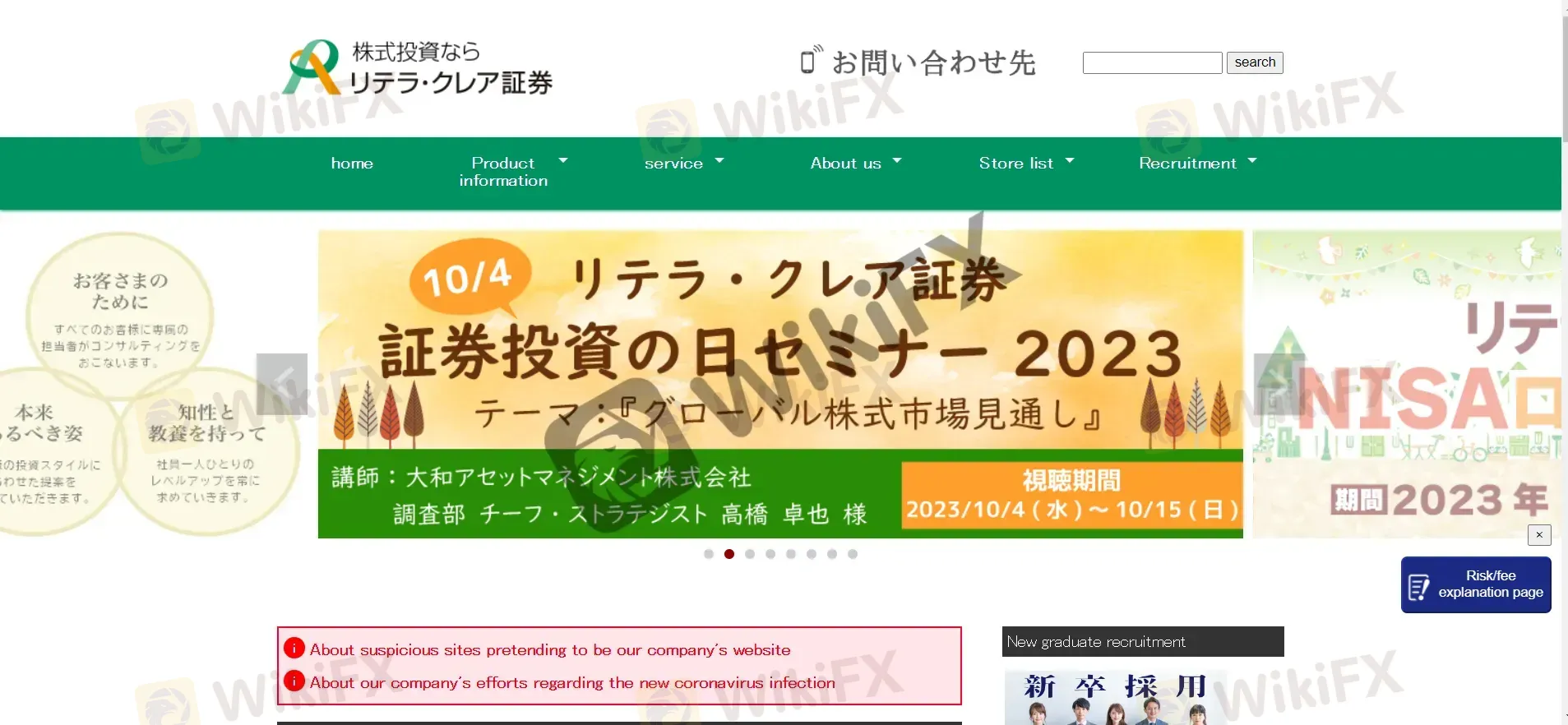

| Company Name | Retela Crea Securities |

| Registered In | Japan |

| Regulation Status | Regulated by the Financial Services Agency (FSA) of Japan |

| Years of Establishment | Founded in 1999 (as Imagawa Misawaya Securities) |

| Trading Instruments | Domestic stocks, foreign stocks, investment trusts, personal government bonds, foreign currency bonds, etc. |

| Account Types | Standard and Premium Accounts |

| Minimum Spread | Competitive spreads; e.g., Forex starting from 0.1 pips |

| Deposit and Withdrawal Method | Bank transfers, credit/debit cards, e-wallets (e.g., PayPal, Skrill) |

| Customer Service | Contact phone; Face-to-face and phone support for personalized guidance. |

Retela Crea Securities, with a robust legacy, provides a reliable platform for investors interested in both domestic and foreign stocks, bonds, and various other financial instruments. With a focus on client-centric services like family assistance and customer referral discounts, Retela strives to offer value-driven services to its clientele. Its regulatory framework under the FSA and a diverse portfolio establish it as a reputable entity in the financial market.

Retela Crea Securities operates under strict regulation by the Financial Services Agency (FSA) of Japan, lending it a high level of credibility. The existence of a regulatory certificate number reinforces its legitimacy. While this does not entirely eradicate the inherent risks associated with financial transactions, it does significantly mitigate concerns of illicit activities or fraudulent practices.

| Pros | Cons |

| Regulated by the Financial Services Agency | Investment risk inherent in financial markets |

| Diverse range of financial instruments | Complex fee structure with various commissions |

| Reputable legacy through mergers | Market focus primarily on the Japanese market |

| Customer-centric services like family assistance and customer referral discounts | Potential language barrier for non-Japanese speakers |

| Educational resources including seminars and video content | Limited online transaction support for busy individuals |

Pros:

Regulated Security: Regulated by the Financial Services Agency, ensuring a secure and compliant environment for investments.

Diverse Investment Options: Offers a wide range of financial instruments, catering to different investment preferences.

Customer-Centric Services: Provides valuable services like family assistance and customer referral discounts.

Educational Resources: Offers educational seminars and video content to empower investors with knowledge.

Cons:

Complex Fee Structure: Features various commissions and fees, which can be confusing for some investors.

Market Focus: Primarily centered on the Japanese market, potentially limiting global investment opportunities.

Language Barrier: Non-Japanese speakers may face language challenges when dealing with the company.

Limited Online Support: The company may not fully support online transactions, which can be inconvenient for busy individuals.

Retela Crea Securities offers a plethora of market instruments encompassing domestic and international stocks, investment trusts, personal government bonds, and foreign currency bonds. This diversity allows investors to have a well-rounded portfolio, ensuring a balance between risk and reward.

Opening an account with Retela Crea Securities is made simple, even for first-time users, with their guidance and support.

Contact Retela: Reach out to Retela Crea Securities by calling 03-6385-0611 to begin the account opening process.

Prepare Documents: Gather identity verification documents, such as a driver's license, passport, or resident card (with personal number), with your name, address, and date of birth.

My Number: Ensure you have your My Number ready, which can be found on documents like the individual number card (back side) or notification card.

Contact Sales Staff: Get in touch with Retela's sales staff to either schedule a visit, visit a branch in person, or send your application by mail.

Complete Application: Depending on your preference, complete the application process face-to-face with their staff or by sending it via mail. During this process, they will guide you through the paperwork, explain terms, and address any questions you may have.

Retela Crea Securities offers competitive leverage options to cater to a diverse range of investors. Depending on the type of account and financial instrument, leverage can vary from 1:50 to 1:500.

This means that with a relatively small initial investment, traders can control larger positions, potentially amplifying both gains and losses. It's important for traders to carefully consider their risk tolerance and trading strategy when selecting their preferred leverage level.

The spreads at Retela Crea Securities are market-competitive, with major currency pairs typically starting as low as 0.1 pips. This low spread structure helps traders minimize their trading costs and potentially enhance their profitability.

Commissions vary depending on the type of account and trading activity. For example, on standard accounts, there are no commissions for forex trading, while on premium accounts, a small commission fee is applied to each trade. Additionally, for other financial instruments like CFDs and indices, Retela charges competitive commission rates.

Retela Crea Securities provides access to a cutting-edge trading platform designed to cater to the needs of both beginner and experienced traders. The platform offers a user-friendly interface with advanced charting tools, technical indicators, and customizable layouts. Traders can execute orders swiftly and efficiently, and the platform is accessible via web browsers, mobile devices, and desktop applications, ensuring seamless trading experiences across various devices.

Retela Crea Securities offers a wide range of secure and convenient deposit and withdrawal options to accommodate the needs of its clients. Clients can fund their accounts via bank transfers, credit/debit cards, and popular e-wallets like PayPal and Skrill.

Withdrawals are processed promptly, typically within 1-2 business days, and are facilitated through the same methods used for deposits. The company places a strong emphasis on the security and integrity of financial transactions, implementing robust encryption and authentication measures.

Retela Crea Securities offers comprehensive customer support through multiple contact points to address various needs. Their main store in Tokyo, Osaka Branch, Himeji Branch, Toyooka Branch, Tsuruga Branch, and Ageo Branch provide in-person assistance and bank transfer details, ensuring accessibility for clients across Japan. The Compliance Department and Recruitment-related inquiries can be directed to the main store as well.

Furthermore, for specific compliance-related concerns, the Compliance Department can be reached directly. In addition to these avenues, clients can contact the Japan Securities Dealers Association Personal Information Consultation Office for matters related to certified personal information protection organizations. This diverse and well-distributed network of support demonstrates Retela Crea Securities' commitment to serving its clients effectively.

Retela Crea Securities, like all financial institutions, is subject to market risks arising from price, interest rate, and exchange rate fluctuations. The possible loss may exceed the investment principal depending on the product or transaction. Additionally, foreign currency bonds involve country risks which might cause losses due to political, economic, and social turmoil in the investee country. Investors should meticulously assess the risks and their risk tolerance before engaging in any financial transactions with Retela Crea Securities.

Retela Crea Securities offers a robust array of educational resources to empower its clients with financial knowledge. Their educational initiatives encompass seminars and video content, designed to demystify the complexities of asset management, making it accessible even to newcomers. Moreover, they provide specialized guidance on NISA (Nippon Individual Savings Account), a tax-efficient investment option in Japan. These resources not only equip investors with essential information but also enable them to make informed decisions, fostering a deeper understanding of financial markets and strategies.

Retela Crea Securities, with its rich history and diverse portfolio of financial instruments, presents a regulated and credible platform for financial trading. The company offers varied financial instruments and is recognized for its customer-centric services. However, potential investors should be cognizant of the inherent risks and should carefully review the fee structure, account types, and leverage offered. For a comprehensive understanding and to address any uncertainties, it is always prudent to refer to the official communications of Retela Crea Securities or directly consult with their customer support representatives.

Q: How can I open an account with Retela Crea Securities?

A: To open an account, please contact our sales staff, visit one of our branches, or send your application by mail. Our team will guide you through the process.

Q: What regulatory authority oversees Retela Crea Securities?

A: Retela Crea Securities is regulated by the Financial Services Agency (FSA) of Japan, ensuring a secure trading environment.

Q: What trading instruments are available at Retela Crea Securities?

A: We offer a diverse range of instruments, including domestic stocks, foreign stocks, investment trusts, personal government bonds, and foreign currency bonds.

Q: What is the minimum initial deposit required to start trading?

A: The minimum initial deposit varies based on the account type. For instance, our Standard Account requires a minimum deposit of $1,000, while our Premium Account necessitates $10,000.

Q: Can you provide information on leverage options?

A: Leverage varies by instrument; for example, Forex trading offers leverage of up to 1:500, while CFDs provide leverage up to 1:100.

Q: What trading platform does Retela Crea Securities offer?

A: Our trading platform is user-friendly and equipped with advanced charting tools. It's accessible via web browsers, mobile devices, and desktop applications for your convenience.

Q: What are the available deposit and withdrawal methods?

A: You can fund your account through bank transfers, credit/debit cards, and popular e-wallets like PayPal and Skrill. Withdrawals are processed promptly using the same methods used for deposits.

More

User comment

9

CommentsWrite a review

2025-03-21 15:14

2025-03-21 15:14

2025-03-14 14:25

2025-03-14 14:25