User Reviews

More

User comment

1

CommentsWrite a review

2025-03-18 20:09

2025-03-18 20:09

Score

5-10 years

5-10 yearsRegulated in Mauritius

Securities Trading License (EP)

White label MT4

High potential risk

Offshore Regulated

Benchmark

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index4.62

Business Index7.30

Risk Management Index0.00

Software Index8.07

License Index2.49

Single Core

1G

40G

More

Company Name

CGTrade (Mauritius) Limited

Company Abbreviation

CG FINTECH

Platform registered country and region

Mauritius

Company website

X

Company summary

Pyramid scheme complaint

Expose

| CG FinTech Review Summary | |

| Founded | 2024 |

| Registered Country/Region | Mauritius |

| Regulation | FSC |

| Market Instruments | Forex, Indices, Precious Metals, Cryptocurrency, Energies, Stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0.1 pips |

| Trading Platform | MT4 |

| Min Deposit | $0 |

| Customer Support | Phone:+971 4555 9581 |

| 24/7 service | |

| Physical Address: The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebene, Republic of Mauritius. | |

| Email:marketing@cgfintechfx.com | |

| Social Media: Facebook, Linkedin, Twitter, Instagram. | |

Established in 2024 and registered in Mauritius, CG FinTech operates as a broker offshore regulated by the Financial Services Commission (FSC). The company offers six asset classes: forex, indices, precious metals, cryptocurrencies, stocks, and energies. It also provides access to the MT4 trading platform and supports the use of demo accounts.

CG FinTech says it focuses on enhancing the accessibility of financial services through technological innovation and compliance practices, with operations spanning over 100 countries worldwide. The company supports businesses and traders and offers tailored solutions.

| Pros | Cons |

| Negative Balance Protection | MT5 is not supported |

| Support MT4 | Commission charged on ECN accounts |

| Available demo accounts | slippage may occur during major news announcements |

| 24/7 service | |

| Commission starts at $0 |

CG FinTech is under the offshore regulation of The Financial Services Commission(FSC), holding License number C118023669.

CG FinTech offers six asset classes, including forex, indices, precious metals, cryptocurrencies, stocks, and energies, with access to over 300 popular trading products.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Precious Metals | ✔ |

| Cryptocurrency | ✔ |

| Energies | ✔ |

| Stocks | ✔ |

| ETF | ❌ |

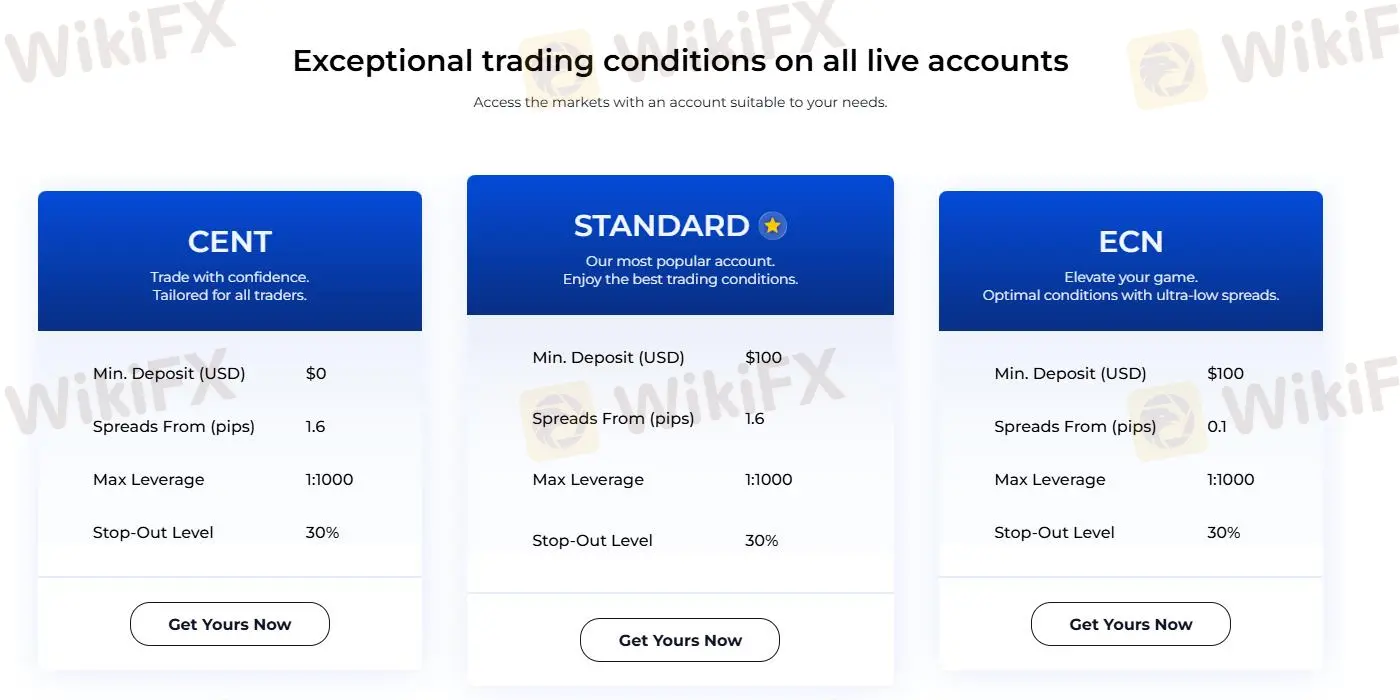

CG FinTech offers three types of accounts: ECN Account, CENT Account, and STANDARD Account. It also offers demo accounts for traders.

The minimum deposit required for an ECN account is $100, spreads start at 0.1 and a commission of $3 is payable. In contrast, CENT and STANDARD accounts require a minimum deposit of $0 and $100 respectively, both of which are commission-free, but with spreads starting at 1.6.

| ECN Account | CENT Accoun | STANDARD Account | |

| Minimum Deposit | $100 | $0 | $100 |

| Spreads Start from | 0.1 | 1.6 | 1.6 |

| Commission: | $3 | 0 | 0 |

| Leverage: | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 |

| Stop-Out Level | 30% | 30% | 30% |

To open an account, There are three steps.

1. Registration: Click on ‘Register’ and fill in your personal details to register for free.

2. Deposit: Open an account and make a deposit through the secure payment gateway.

3. Trading: Download the trading platform and login with credentials to start trading.

ECN Account, CENT Account, and STANDARD Account have a leverage of 1:1000. High leverage means high returns but also high risk.

CG FinTech's spread and commission structure differ across account types.

The ECN Account offers spreads starting from 0.1 and charges a commission of $3, while both the CENT Account and STANDARD Account have spreads starting from 1.6 but do not charge any commission.

Here is the fees comparison table:

| Account Type | Spreads (from) | Commission |

| ECN Account | 0.1 | $3 per trade |

| CENT Account | 1.6 | $0 |

| STANDARD Account | 1.6 | $0 |

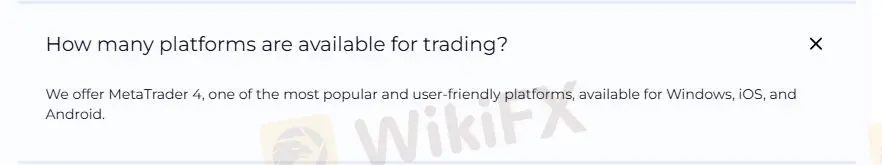

Spring Gold Market offers traders the MetaTrader 4 platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Windows, IOS, Android. | Professional traders andbeginners |

| MT5 | ❌ | / |

CG FinTech offers deposit methods including cryptocurrency, local bank transfers, credit card payments, and wire transfers.

Deposit Policy: CG FinTech offers a zero-fee policy for deposits.

Minimum Withdrawal: $50.00 USD or the equivalent in any supported local currency.

Withdrawal Processing Time:

| Supported Currencies | Fees | Processing Time | |

| Crypto Wallets | BTC / ETH / USDT-TRC20 / USDT-ERC20 / USDT-BEP20 | Deposit : No charge | Instant |

| Withdrawal :BTC : USD 10ETH : USD 10USDT-TRC20 : No chargeUSDT-ERC20 : USD 10USDT-BEP20 : USD 10 | 1 Working day | ||

| International Wire Transfer | USD / EUR / GBP | Deposit : No charge | 2-5 Working days |

| Withdrawal : USD 25 | 2-5 Working days | ||

| Local Transfers | CNY / KRW / IDR / INR | Deposit : No charge | 5 - 30 mins |

| Withdrawal : No charge | 1 Working day | ||

| Credit Card | Visa / MasterCard / American Express | Deposit : No charge | 5 - 15 mins |

| Withdrawal : No charge | 2-5 Working days |

November 19–21 | Shenzhen Convention Exhibition Center | Booth 1045 CG FinTech is excited to announce its participation at the Shenzhen International Finance Expo 2025, one of Chinas most influential

WikiFX

WikiFX

November 19–21 | Shenzhen Convention Exhibition Center | Booth 1045 CG FinTech is excited to announce its participation at the Shenzhen International Finance Expo 2025, one of Chinas most influential

WikiFX

WikiFX

What’s behind CG Fintech’s generous $5,000 bonus? Is it genuine value or something traders should worry about?

WikiFX

WikiFX

CG FinTech Broker Review: Unregulated, low 3.27/10 WikiFX rating, withdrawal issues. Avoid this risky broker; choose regulated alternatives for safe trading.

WikiFX

WikiFX

More

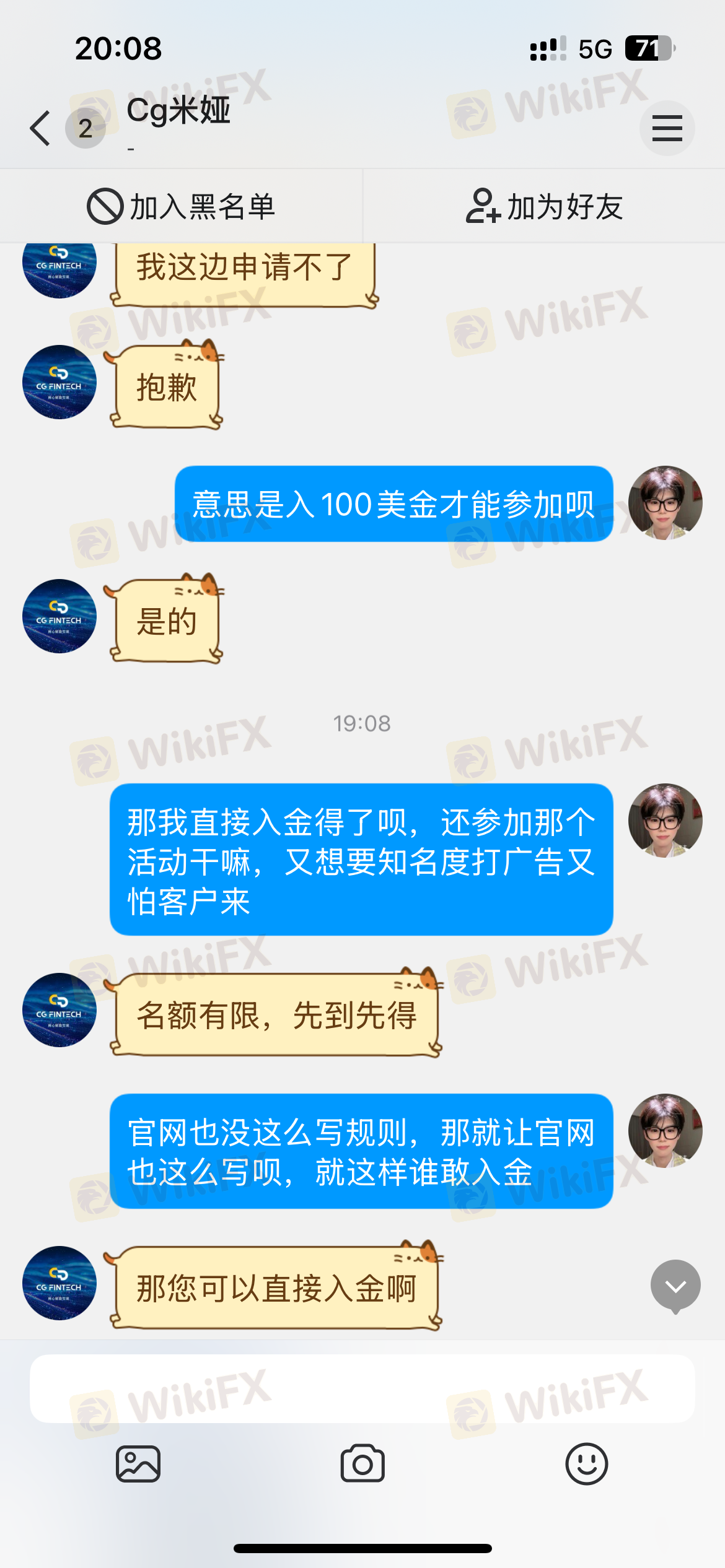

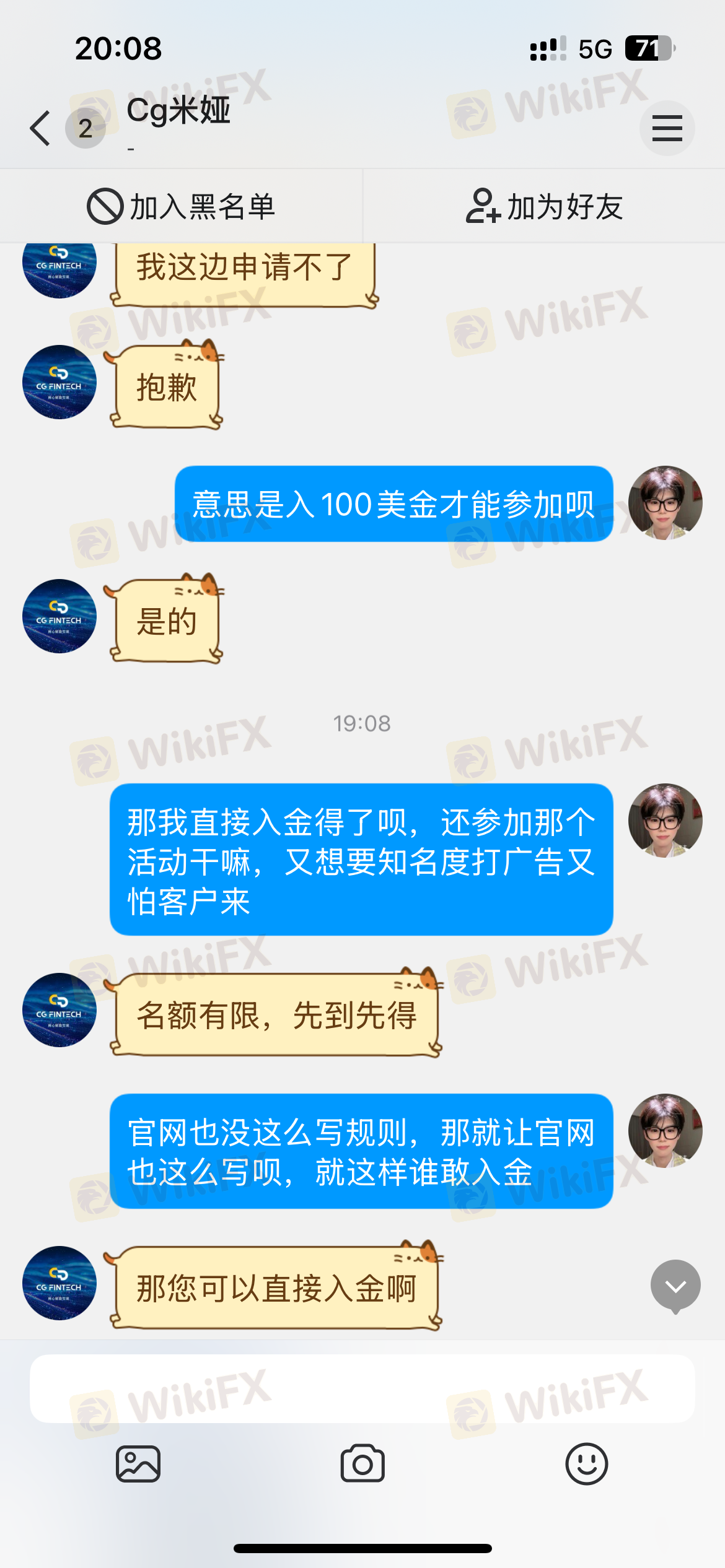

User comment

1

CommentsWrite a review

2025-03-18 20:09

2025-03-18 20:09