User Reviews

More

User comment

6

CommentsWrite a review

2025-03-20 22:20

2025-03-20 22:20

2024-08-26 10:49

2024-08-26 10:49

Score

Capital Ratio

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index7.83

Business Index8.00

Risk Management Index9.79

Software Index7.05

License Index7.85

Single Core

1G

40G

Sanction

More

Company Name

Daiwa Securities Co. Ltd

Company Abbreviation

Daiwa Securities

Platform registered country and region

Japan

Number of employees

Company website

Company summary

Pyramid scheme complaint

Expose

| Daiwa Review Summary | |

| Founded | 2007 |

| Registered Country/Region | Japan |

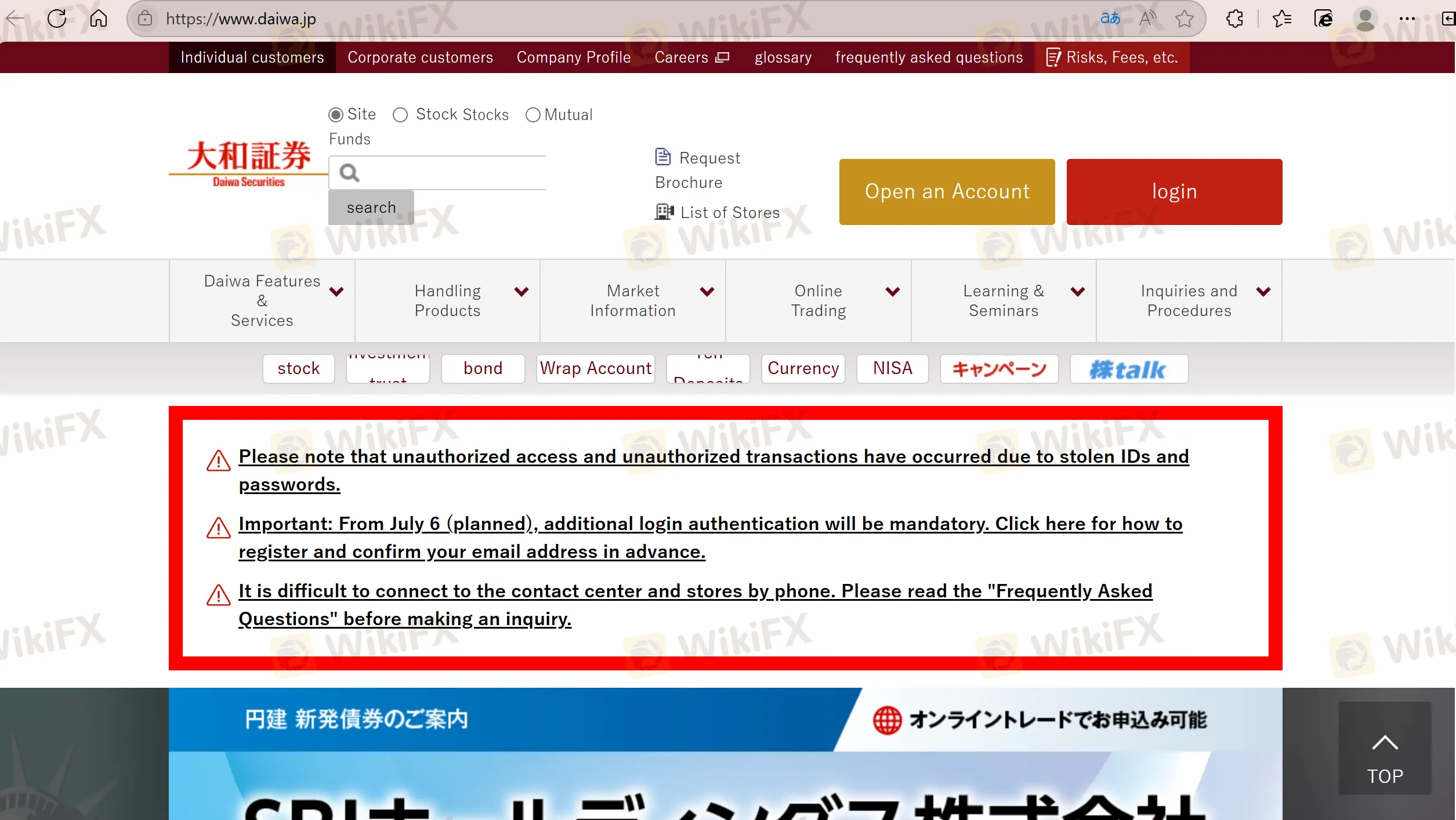

| Regulation | FSA |

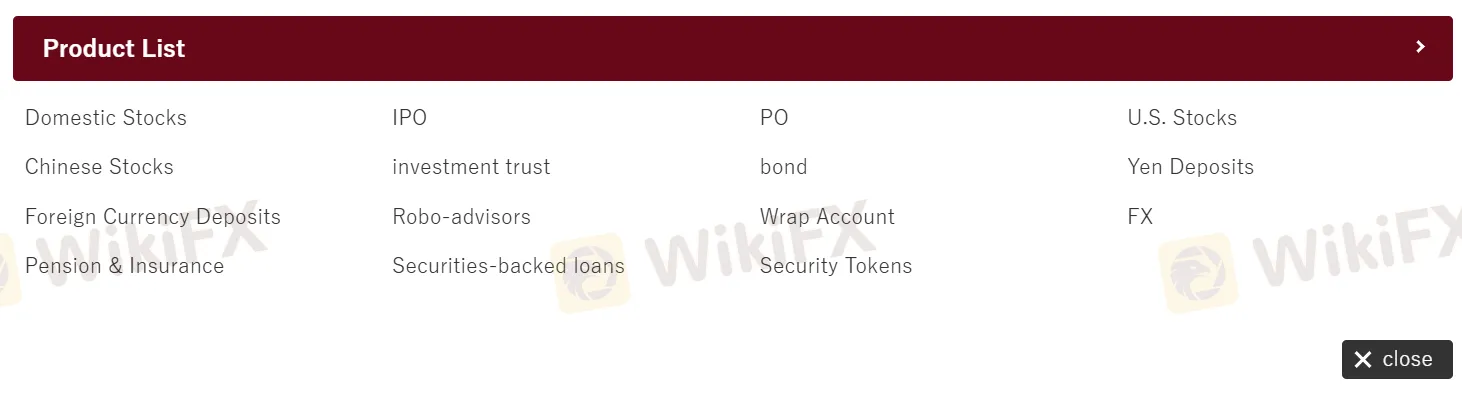

| Products | Stocks, Pension & Insurance, Securities-backed loans, IPO, Investment Trust, Securities, PO, Bonds, FX |

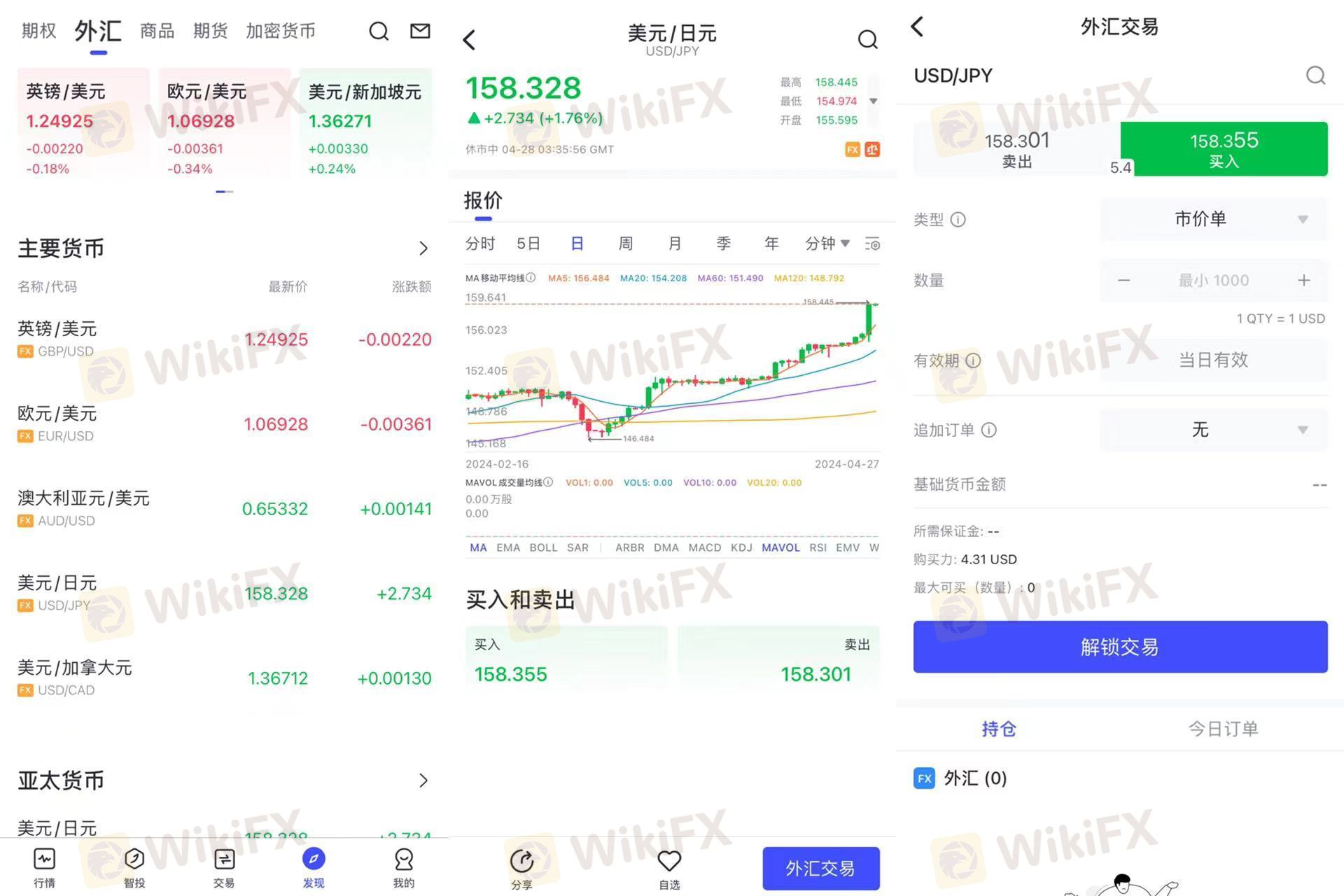

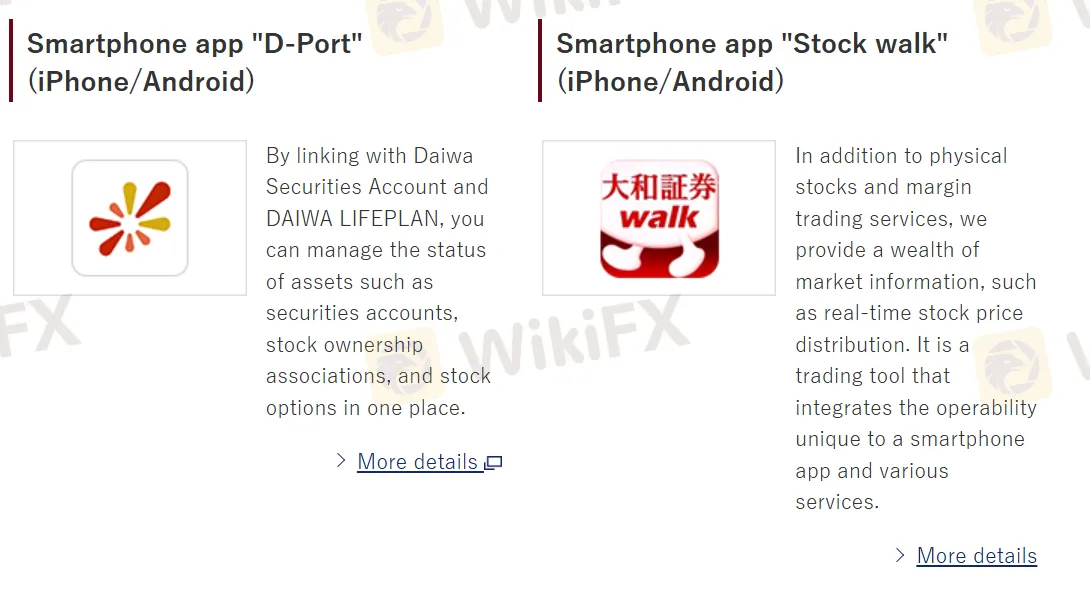

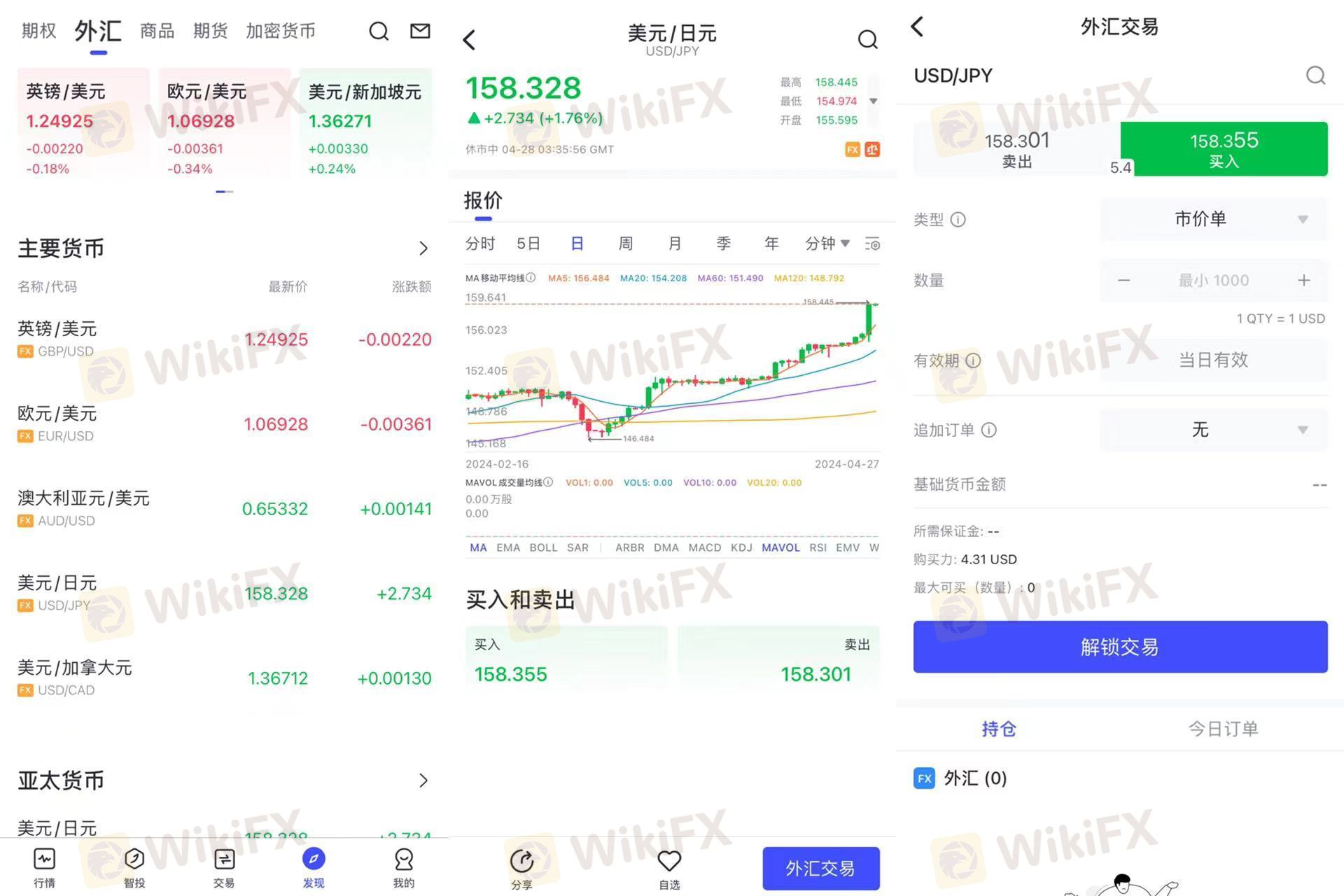

| Trading Platform | D-Port, Stock walk |

| Minimum Deposit | / |

| Customer Support | Tel: 0120 - 010101 |

Daiwa, founded in 2007 and regulated by Japan's Financial Services Agency (FSA), is an online trading platform that offers many financial products and services, mainly including domestic and U.S. stocks, Chinese stocks, IPOs, investment trusts, bonds, foreign currency, yen deposits, robo-advisors, and more. They provide easy-to-use platforms like D-Port and Stock Walk.

| Pros | Cons |

|

|

|

|

|

Daiwa has a Retail Forex License regulated by the Financial Services Agency (FSA) in Japan.

| Regulated Authority | Current Status | Regulated Country | Licensed Entity | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | Japan | 大和証券株式会社 | Retail Forex License | 関東財務局長(金商)第108号 |

Daiwa offers different financial products, mainly including domestic and Chinese stocks, IPOs, investment trusts, bonds, foreign currency deposits, robo-advisors, wrap accounts, pension and insurance services, securities-backed loans, U.S. stocks, yen deposits, and security tokens.

| Trading Platform | Supported | Available Devices |

| D-Port | ✔ | iPhone/Android |

| Stock walk | ✔ | iPhone/Android |

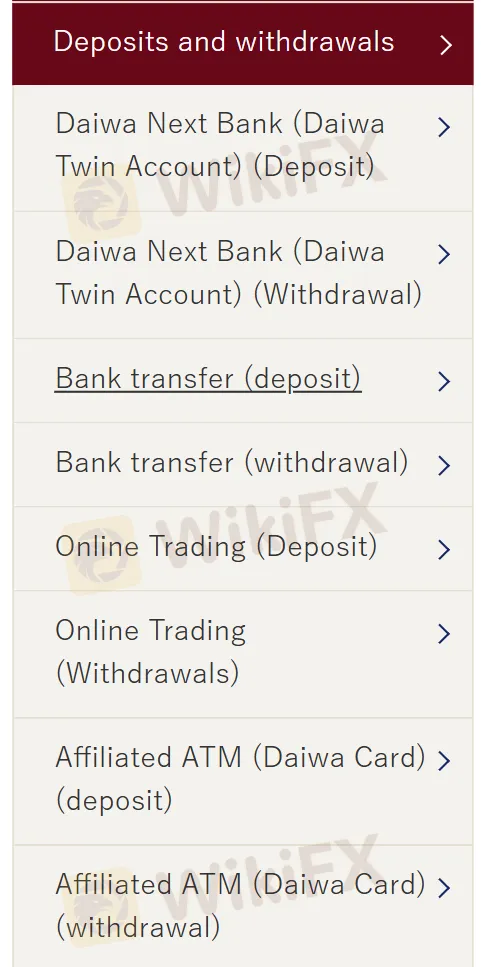

For deposit and withdrawal methods, Daiwa offers different options to make it convenient for customers. Methods include contract facility via Daiwa Next Bank, standard bank transfers, online trading platforms, and transactions from affiliated ATMs in overseas currencies with the use of a Daiwa Card.

More

User comment

6

CommentsWrite a review

2025-03-20 22:20

2025-03-20 22:20

2024-08-26 10:49

2024-08-26 10:49