User Reviews

More

User comment

31

CommentsWrite a review

2026-01-31 08:04

2026-01-31 08:04

2025-12-31 22:59

2025-12-31 22:59

Score

5-10 years

5-10 yearsRegulated in United Kingdom

Inst Forex Execution (STP)

MT4 Full License

High potential risk

Offshore Regulated

Benchmark

Influence

Add brokers

Comparison

Quantity 42

Exposure

Score

Regulatory Index5.87

Business Index7.72

Risk Management Index0.00

Software Index9.99

License Index0.00

Single Core

1G

40G

More

Warning

Danger

Danger

More

Company Name

Zeal Capital Market (Seychelles) Limited

Company Abbreviation

ZFX

Platform registered country and region

Seychelles

Company website

X

Company summary

Pyramid scheme complaint

Expose

my account is already verified and approved but I don’t know for what reason I can’t seems to withdraw again because the keep asking for another verification but the are not approving it also I have made a lot of profits from my trade already I can’t withdraw

I have been trying to complete a deposit but the account number keep changing almost every minutes it doesn’t even take up 1 hour as the said it just keeps on changing on its on how can I complete a deposit the customer support are not helping matters the haven’t been responding to the issue the keep saying wait for sometime

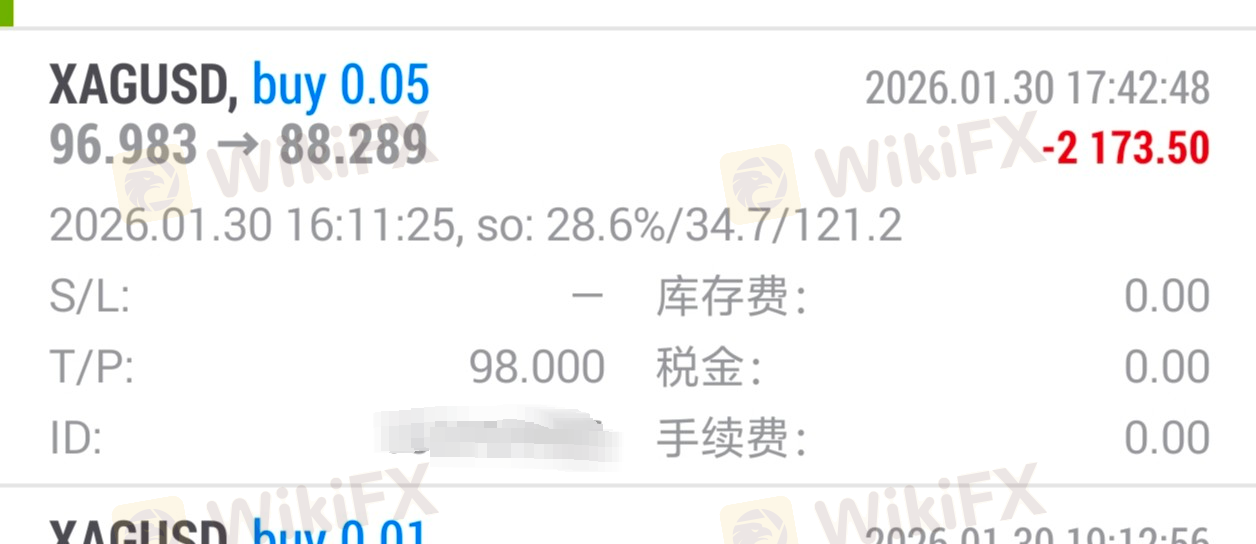

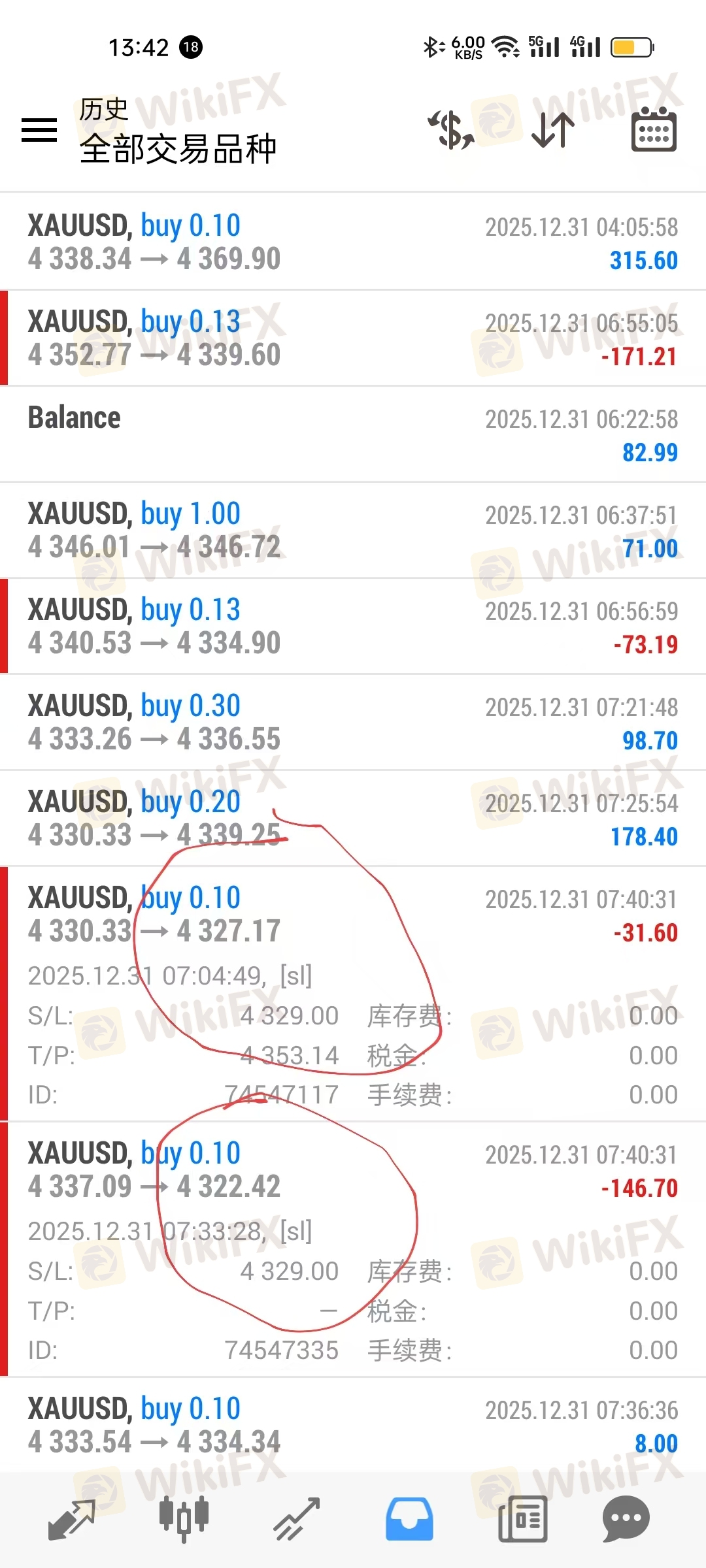

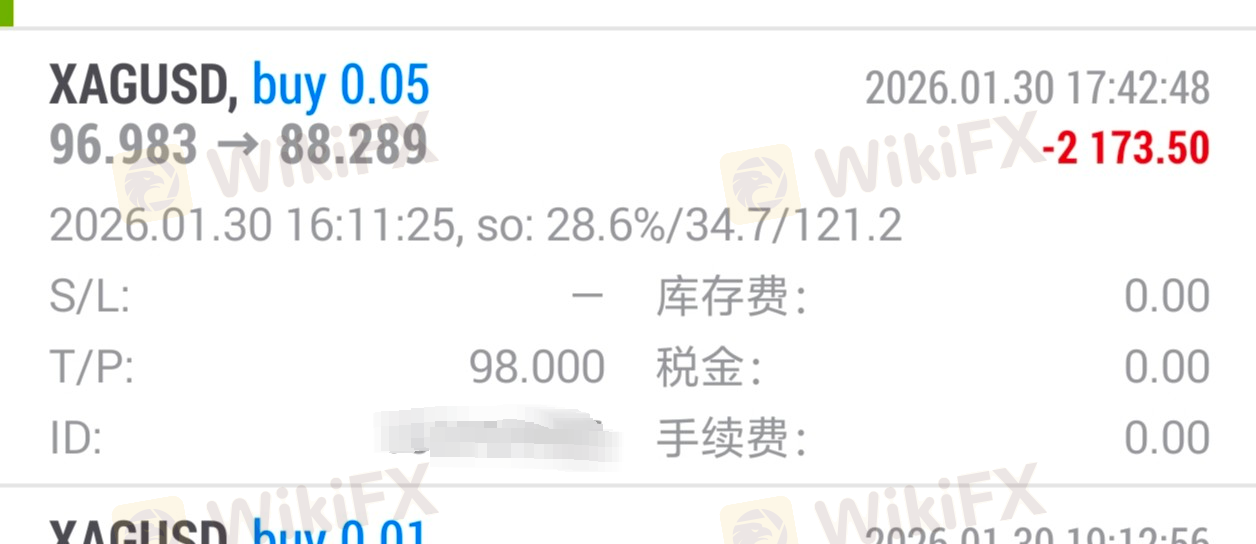

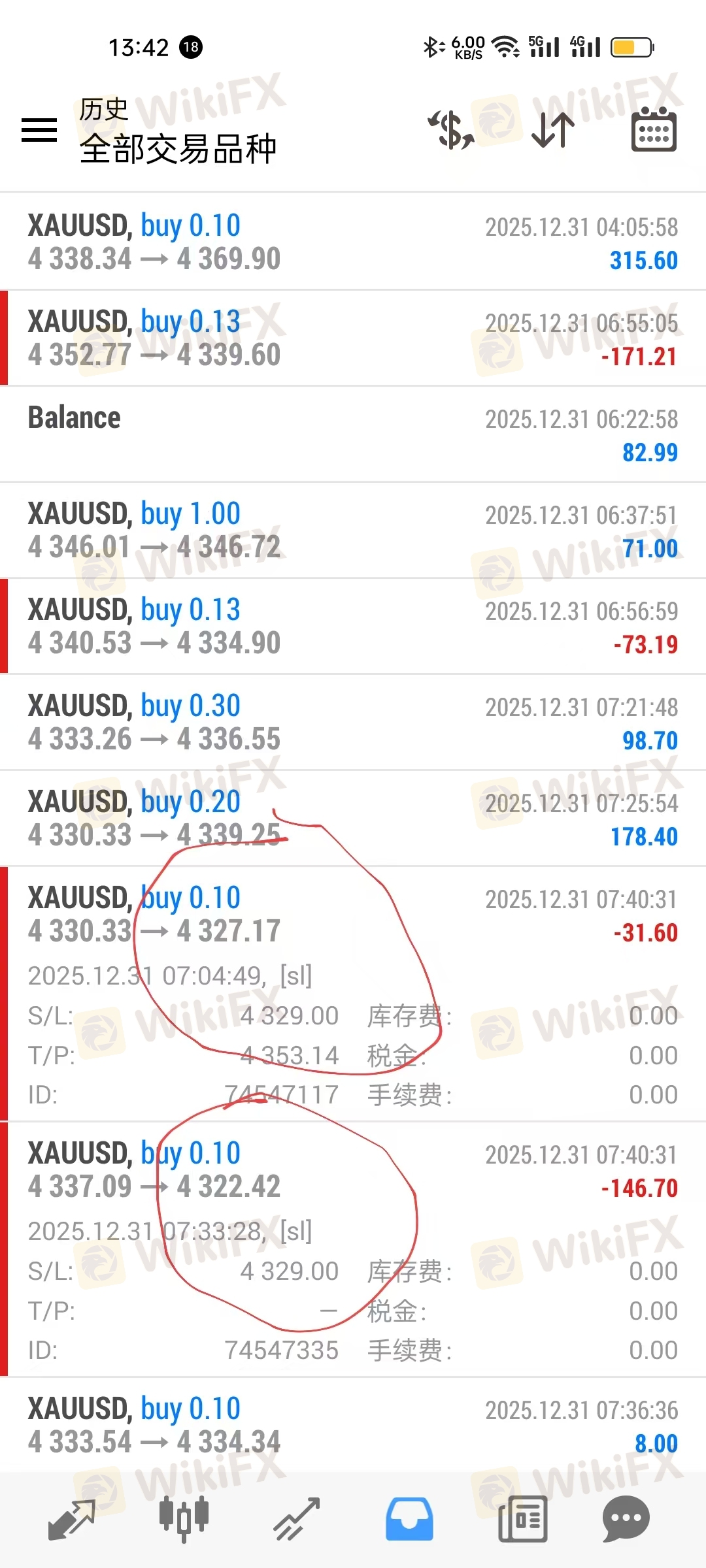

I traded normally with real market strategy and volume. As clearly shown in the attached screenshots of my MT4 terminal All trades were placed manually with realistic volume sizes (0.1 to 0.24). Multiple symbols were traded (e.g., US30, US100, XAUUSD, EURUSD, GBPUSD). Trades include both profits and losses – indicating a real trader, not a bonus exploiter. Over $2,500 was deposited and over $5,000 withdrawn was denied without any valid trading violation cited.

Zeal Capital Market has held up hundreds of thousands of US dollars in my account and refused to let me withdraw the funds. They asked me to submit a large amount of materials involving personal privacy, such as bank statements, proof of employment, proof of address, etc., and even required me to record videos and send them to the platform for review. After I submitted all these materials, Zeal Capital Market still refused to process my withdrawal. Last month, I filed a complaint with Zeal Capital Market's regulatory authority. In response, Zeal Capital Market sent me an email stating that I needed to have a telephone communication with their staff. I made seven or eight phone calls, but my problem was never fully resolved. Finally, Zeal Capital Market informed me that they would only release my principal, while my hundreds of thousands of dollars in profits were completely wiped out and deemed invalid. Unconvinced, I started exposing Zeal Capital Market's actions on various social med

I was Trading and all of a sudden my account stopped working and was showing Disabled it’s confusing even more when I can’t login to my account anymore using both phone number or Email on the broker web page it’s keeps saying invalid password or login this people are scammers

I was trading XAUUSD as usual, and in the middle of the day, ZFX suddenly closed the Gold markets. Now I’m stuck in a trade that I can’t control anymore, and I have no idea how long this will last. My Account is in huge Loss already but the have been no responses from the customer service or any help rendered from the mails

Dear Wiki I created my trading account on 27th April 2025. Total deposite 46.000 US Dollar Withdraw 8.000 US Dollar I opened SELL 3.0 Lot BTCUSD at the price 103310.02 and another position SELL 2.0 Lot BTCUSD at the price 103570.33. All this position was opened at around 2:00PM - 3:00PM Sunday 18th May 2025 Vietnam time. At 3:00AM 19th May 2025 Vietnam time, ZFX didn’t let me close my position, they said that they was updating their system and market close but I didn’t received any notice about this problems. Exness and other platfrom still open by the time. No email from ZFX about changing of trading session. Customer support Phuc Thao Maze try to let my account liquidated. I have more evidence, video and picture to report.

On October 13, 2023, I found my MT4 account inexplicably closed, rendering me unable to access it. I have video evidence that my account clearly shows profits exceeding $300,000. After multiple attempts to communicate with the platform, my account finally was restored, but as can be seen from the screenshot, ZFX has cleared all my trade orders and profit and loss records. Despite providing all requested documents, including personal identification and financial records, ZFX also required me to film a video logging into my bank account and displaying my balance. This request, which I find a serious invasion of my privacy, was refused. All other required documents have been provided. My request is the return of my principal and profit, $225,100.45 USD. ZFX requests an array of personal documents from investors, which is a clear disrespect of customer rights and privacy. Furthermore, platform even requested users record video, revealing extensive personal details and account trade information, posing a serious threat to user information security. The handling of my case since 2023 has been extremely slow. A clear willful delay! After filing a regulatory complaint last month, the platform contacted me for phone consultations. After four or five calls, the final result presented on May 12 was they would only return my principal and not a penny of my profit! As a customer, I want to know where the transparency and fairness of platform trading is? If you earn a lot, they directly wipe out your profit. With one and a half year's KYC submissions, if the platform doesn't want to allow you to withdraw, they stick it out, letting you abandon your claim!

My account can’t withdraw funds again the withdrawal keep failing each time after making enquiries I was told that I will have to complete a payment verification then what was the use of the initial verification I did the don’t want to give me my money and allow me to withdraw these broker are scammers

I was holding a volume of 0,6 Lot in Sell and 0,48 Lot in Buy, and at rollover time the chart was showing some movements (10 pips up and down) on GBPUSD, but it was going almost in a straight line, and suddenly in a few seconds I lost aprox. 200€ of free margin forcing the closure of all my positions. On normal situation it shouldn't have mattered much if it went upwards or downwards, but suddenly both sides where going against me!

As an ordinary investor, I put a lot of money into forex trading, believing in the supposed “regulated overseas platform.” But up to this day, over three hundred thousand US dollars of mine is still stuck in my ZFX account, entirely unable to be withdrawn. When I tried contacting customer service or lodging complaints with the platform, I received nothing but silence; they even froze my account at will, turning all their previous promises into empty words In the end, over $300,000 of my money was frozen outright, with absolutely no hope of withdrawal. Afterward, I turned to authorities and regulatory bodies, yet the company responded with the attitude of “we’re an offshore company, not subject to domestic oversight—feel free to complain.” There are many other investors like me, whose funds have been trapped inexplicably or who have lost everything to margin calls. I sincerely hope more investors heed this warning

After multiple appeals, the platform sent me an email informing me that my account balance needed to be adjusted. The balance currently displayed in my account is not the actual state. The shocking scene before me was that my account balance was deducted from over three hundred thousand US dollars to tens of thousands of US dollars (see backend screenshot). The customer service at ZFX explained this as a "data synchronization anomaly," yet they have been unable to provide any technical logs or compliance explanations. They even refused to acknowledge the profit records I had created. What's more ironic is that my losing orders were recorded in real-time and forcibly closed, but profit records could be "deleted with one click," revealing the manipulative intent behind this "selective malfunction." Privacy extortion-style "compliance": Recording a video of the bank account as a withdrawal threshold In order to recover the principal and profits (totaling over 300,000 US dollars), I was forced to comply with ZFX' "KYC verification" and submitted the following: - Handheld ID card photo - Utility bills and address proof for the past 3 months - Bank card statements for deposits - Trading account real-name authentication materials However, the platform's demands became increasingly unreasonable—they actually required me to record a video logging into my personal bank account, showing the account balance and transactions, and simultaneously provide screenshots of the bank's app. This request has crossed all financial platform compliance boundaries: ✅ Privacy violation: Bank accounts involve core privacy such as deposit amounts, transaction details, security tokens, etc., and video recording could lead to account theft. ✅ Logical breakdown: Verifying the source of funds only requires providing transaction-related deposit and withdrawal statements, so why demand disclosure of other account information? ✅ Double standards: The platform has never set such strict thresholds for deposits, yet they layer obstacles for withdrawals, clearly intending to delay and make it difficult for investors. The platform repeatedly demanded private information, and it was only then that I realized: they simply do not intend to return the money; they only want to use privacy extortion to force investors to compromise! 600 days of fighting for rights: From data tampering to regional threats, the tactics are outrageous From October 2023 to the present, I have experienced three disgusting operations by ZFX: 1. "Pseudo-negotiation" after regulatory complaints On April 11, 2025, after I complained to regulatory bodies such as the Seychelles FSA and the UK FCA, and planned to publicly fight for my rights on social media, the platform finally sent an email "seeking reconciliation," claiming to be "willing to negotiate over the phone." I had 5 phone calls with them (all recorded and can be made public, below are some screenshots of the call records), each time they delayed citing "complex processes" and "need for senior approval." Even in the final call on May 12, they proposed: "You must come to the Hong Kong office for a face-to-face meeting, otherwise, there will be no discussion."

ZFX Vietnam does not send notifications or emails regarding trading hours to customers or IB. Even ZFX Vietnam's own officers are unaware of the trading hours for ZFX's BTC pair therefore unable to assist customers. This resulted in a critical risk to my account due to ZFX's error, leading to a loss of 43815.23USD.

I opened a buy stop order at price 42870 for US30. It was triggered at 42991, a massive 121 points difference! Even more ridiculous is that my order then TP at 42964.1 This is the first time I've seen such a ridiculous trade execution and I've tried numerous brokers. When I bring this up for them to check, their compliance provided the standard reply of slippage due to high market volatility or news release and won't compensate me.

I had a sell position on XAUUSD for 8.00 Lots (11-11-2024) at the price of 2682.80 I have waited for this trade like 40-45 minutes till the Asian markets opened and the price started to drop and as soon as it crossed my entry price I put a SL at 2682.69 to protect my position. Once I have closed the trade modification the position was already closed even when the candle kept dropping and it reached my desired TP at 2674.5. I have contacted their support for almost a month till I got an answer on this matter yet they claim that when the SL was placed the price came back up to 2682.69 then it dropped again, recently I had a free time to check this out on MT5 strategy tester to check specifically how the candles formed, yet the candle never retraced to my SL and the price it stayed at for a few milliseconds was around 2682.61-2682.63 then it continued dropping. I checked this time stamp with multiple brokers that I trade with yet the price never came back to my SL during that duration.

After multiple appeals, the platform sent me an email informing me that my account balance needed to be adjusted. The balance currently displayed in my account is not the actual state. However, the scene before me was shocking - my account balance was deducted from over three hundred thousand US dollars to tens of thousands of US dollars (see backend screenshot). The customer service of ZFX explained this as a "data synchronization anomaly," yet they have consistently failed to provide any technical logs or compliance explanations, and even refused to acknowledge the profit records I had created. Ironically, while my loss orders were recorded in real-time and forcibly closed, profit records could be "deleted with one click," revealing the manipulative intent behind this "selective malfunction." Privacy extortion "compliance": Recording a video of the bank account as a withdrawal threshold To reclaim my initial investment and profits (totaling more than $300,000), I was compelled to comply with Shanhai Securities' 'KYC Verification', during which I had to submit the following: - Handheld ID card photos - Utility bills and address proof for the past 3 months - Deposit bank card statements - Trading account real-name authentication materials However, the platform's demands became increasingly unreasonable - They actually required me to record a video logging into my personal bank account, showing the account balance and transactions, and simultaneously provide screenshots of the bank's app. This requirement has crossed all financial platform compliance boundaries: ✅ Privacy violation: Bank accounts involve deposit amounts, transaction details, security tokens, and other core privacy information. Video recording may lead to an account being misused. ✅ Logical breakdown: Verifying the source of funds only requires providing transaction-related deposit and withdrawal records. Why demand disclosure of other account information? ✅ Double standards: The platform has never set such strict thresholds for deposits, but layers of obstacles during withdrawals clearly indicate an intention to delay and make it difficult for investors. It was only at this point, after the platform repeatedly demanded private information, that I realized: they simply do not intend to return the money, but rather want to use privacy extortion to force investors to compromise! 600 days of fighting for rights: From data tampering to regional threats, the tactics are outrageous From October 2023 to the present, I have experienced three disgusting operations by ZFX: 1. "Pseudo-negotiation" after regulatory complaints On April 11, 2025, after I complained to regulatory agencies such as the Seychelles FSA and the UK FCA, and planned to publicly fight for my rights on social media, the platform finally sent an email "seeking reconciliation," claiming to be "willing to negotiate over the phone." I had 5 phone calls with them (all recorded and can be made public, below are some screenshots of the call records), each time they delayed citing "complex processes" and "need for senior approval," even proposing in the final call on May 12: "You must come to the Hong Kong office for a face-to-face meeting, otherwise, there will be no discussion."

| Company Name | ZFX |

| Registered Country/Region | London, UK |

| Founded in | 2010 |

| Regulation | FCA, FSA (Offshore) |

| Tradable Assets | Forex, stocks, indices, commodities, cryptocurrencies |

| Demo Account | Available |

| Max. Leverage | 1:2000 |

| Spread | From 1.3 pips (Standard account) |

| Trading Platforms | ZFX mobile app, MT4 Web Trader, MT4 for Windows, Mac and Android & ios |

| Minimum Deposit | $50 |

| Customer Support | Mon - Fri: 24 hours, Sat - Sun: 07:30 AM to the next day 02:00 A |

| Online chat, contact form | |

| Phone: 400-8424-611 | |

| Email: cs@zfx.com | |

| Social media: Facebook, Instagram, LinkedIn, Twitter | |

| Regional Restrictions | Residents of the United States of America, Brazil, Canada, Egypt, Iran, North Korea (Democratic People's Republic of Korea), and EU countries are not allowed. |

Zeal Group of Companies, often referred to collectively as the Zeal Group, is a conglomerate of fintech corporations and regulated financial institutions that trade under the name ZFX. The group specializes in providing liquidity solutions for various types of assets in regulated markets and is backed by exclusive technology. Furthermore, the Zeal Group operates globally, combining with their multi-asset specializations and regulatory frameworks, solidifies their position as a competitive player in the financial industry.

| Pros | Cons |

| • Regulated by the FCA | • No MT5 platform available |

| • Multiple account types available | • No Islamic account option for Muslim traders |

| • Demo accounts available | • Lack of info on deposits and withdrawals |

| • Low minimum deposit requirement for the Mini Trading Account | • Regional restrictions |

| • Wide range of funding options | |

| • MT4 and proprietary trading platform supported | |

| • Copy trading available |

ZFX is a regulated broker. Its company name is Zeal Capital Market (UK) Limited, and it is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the registration No. 768451. The FCA is one of the most reputable regulatory bodies in the world, and its strict regulations ensure that ZFX adheres to high standards of transparency and fairness.

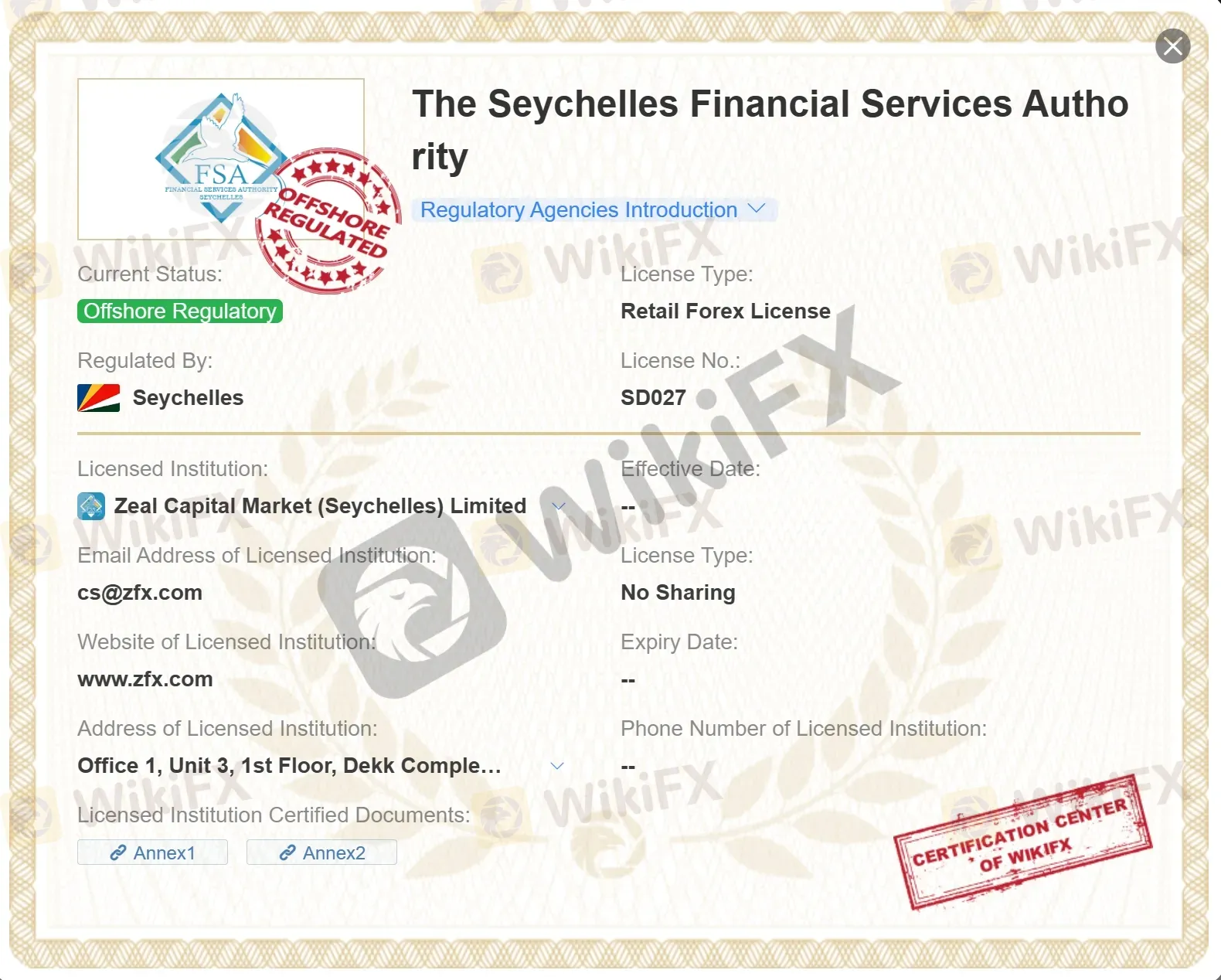

ZFX's other entity, Zeal Capital Market (Seychelles) Limited, is authorized and offshore regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number: SD027.

Additionally, ZFX ensures the safety of its clients' funds by keeping them fully segregated in a designated client bank account. This means that the clients' funds are kept separate from ZFX's operating funds. In the event that the company faces financial difficulties or becomes insolvent, the funds in these client accounts cannot be used to meet the liabilities of the company. This measure provides an added layer of security for ZFX clients, ensuring their capital cannot be used for any other purposes aside from their trading activities.

ZFX provides a comprehensive range of market instruments, catering to diverse trading preferences and strategies. This includes major asset classes such as forex, where traders can engage in currency trading across major, minor, and exotic pairs. For those interested in the stock market, ZFX offers the ability to trade stocks from leading global companies, allowing traders to tap into corporate performance and stock market trends.

Additionally, ZFX includes indices trading, which aggregates the performance of a number of stocks representing a segment of the stock market, providing a broader market exposure. Commodities are also available, offering opportunities to trade in essential goods such as oil and gold, which are often used as hedge investments against inflation or currency devaluation.

Furthermore, ZFX has embraced the growing interest in digital currencies by including cryptocurrencies in their offerings, thus allowing traders to speculate on the highly volatile crypto markets. Overall, ZFX's diverse selection of trading instruments ensures that traders have ample opportunities to diversify their portfolios and explore various market dynamics.

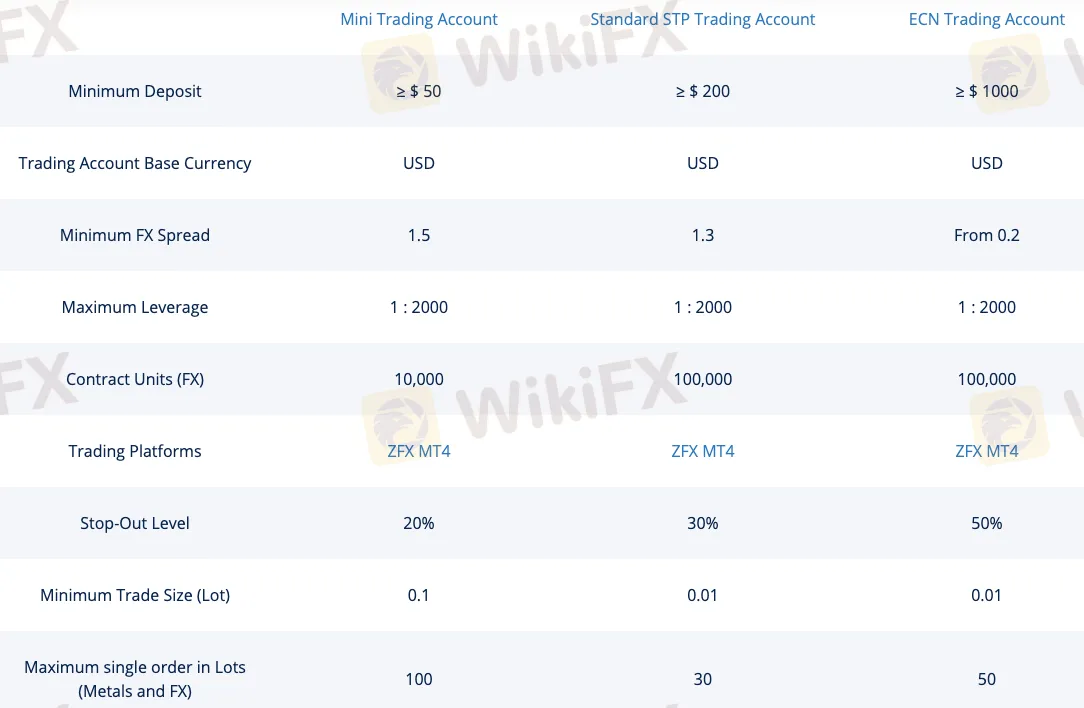

Apart from demo accounts, ZFX offers three types of trading accounts, namely Mini Trading, Standard Trading, and ECN Trading accounts. Each account has its own unique features and advantages, catering to different levels of traders with varying trading styles and preferences.

| Account Type | Minimum Deposit |

| Mini | $50 |

| Standard STP | $200 |

| ECN | $1000 |

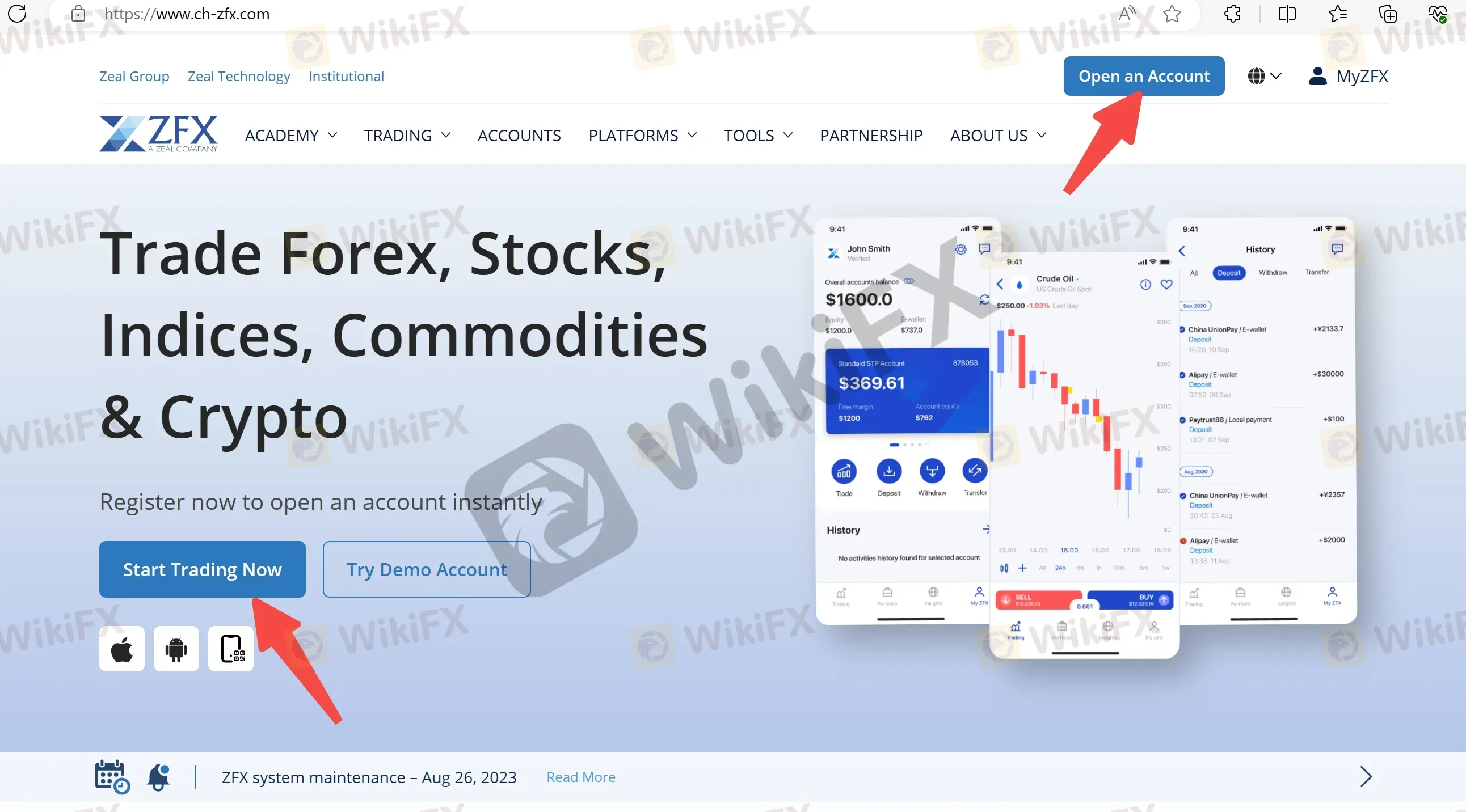

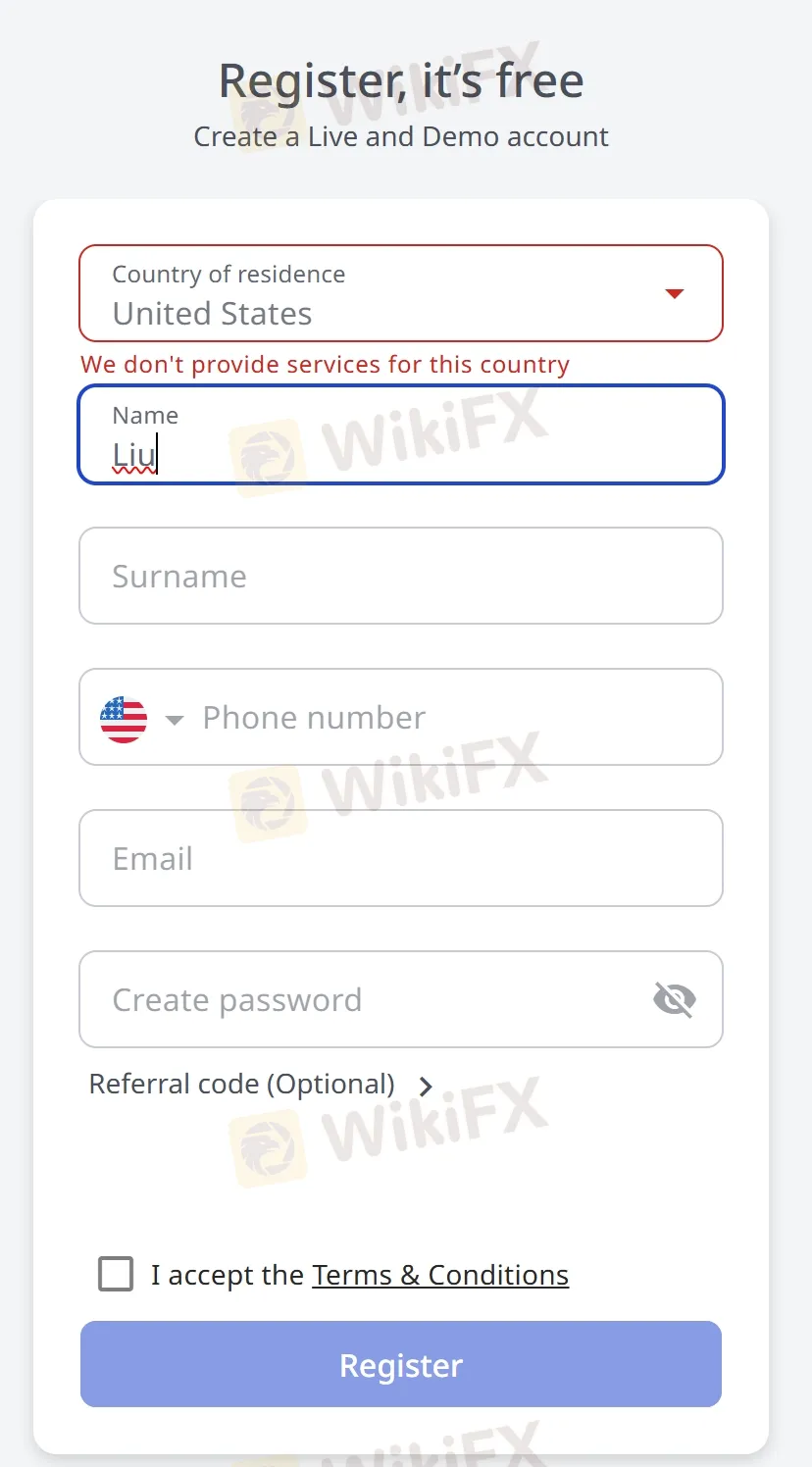

Opening an account with ZFX is a simple and straightforward process that can be completed in just a few steps.

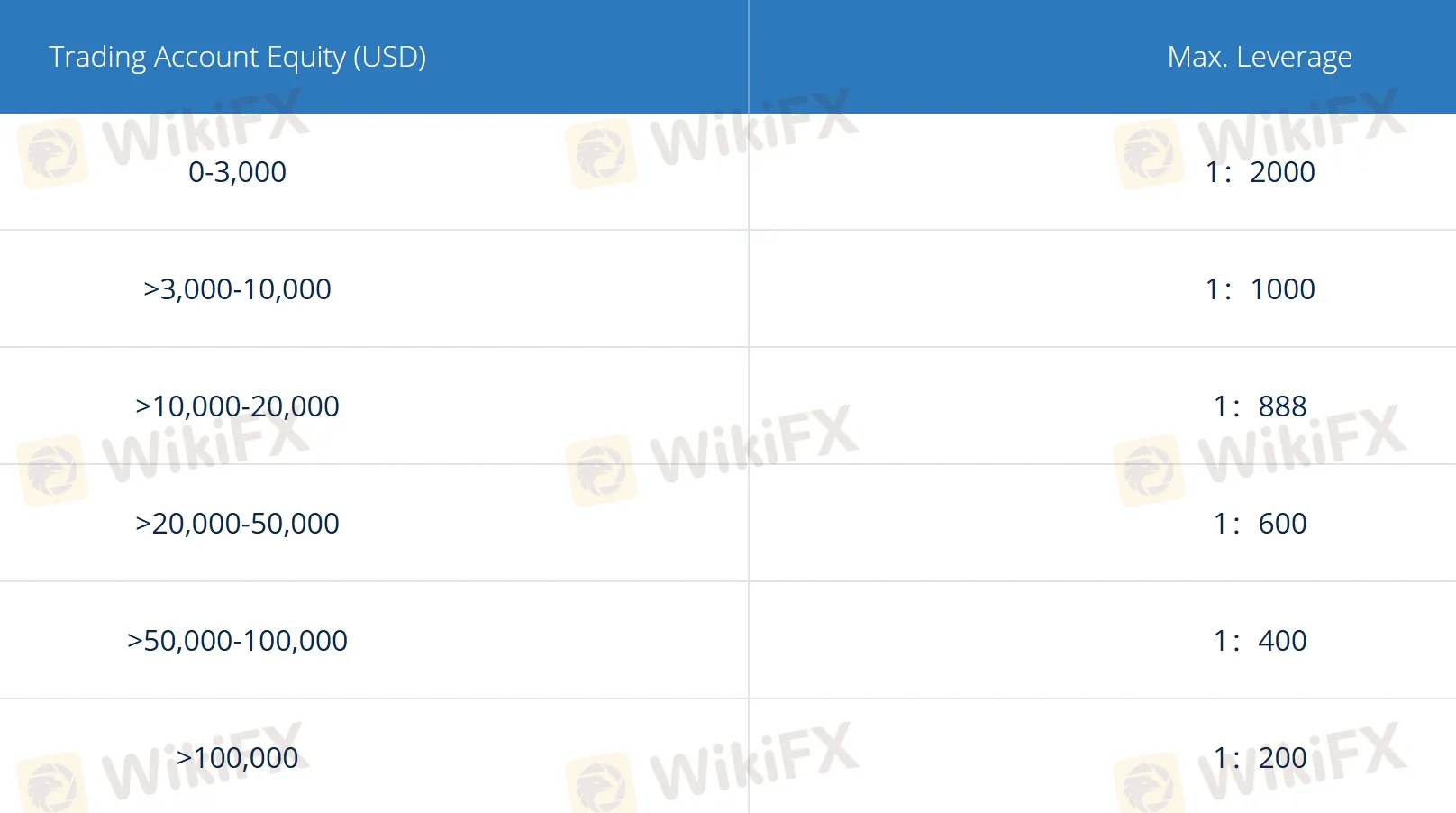

The maximum leverage offered by ZFX is up to 1:2000 and the leverage amount may vary depending on the account type and trading instrument. Additionally, ZFX operates on a tiered margin system, where the leverage is determined based on account equity. For accounts with equity between $0 and $3,000, the maximum leverage is 1:2000. For equity between $3,001 and $10,000, the maximum leverage is 1:1000. More detailed info on leverage can be found in the screenshot below:

ZFX says it offers competitive spreads and commissions on its trading instruments.

| Account Type | Spreads | Commissions |

| Mini Trading | From 1.5 pips | N/A |

| Standard Trading | From 1.3 pips | |

| ECN Trading | From 0.2 pips |

For the Mini Trading account, the minimum spread for forex pairs is 1.5 pips. The Standard Trading account has a minimum spread of 1.3 pips for forex pairs. The ECN Trading account has a minimum spread of 0.2 pips for forex pairs. However, no specific info on commissions is revealed openly.

ZFX offers the popular trading platform MetaTrader 4 (MT4), which is widely recognized in the forex industry for its user-friendly interface and advanced trading tools. MT4 provides access to various order types, technical analysis tools, and customization options, making it suitable for both novice and experienced traders. In addition, ZFX offers mobile versions of the MT4 platform for both iOS and Android devices, enabling traders to access the markets from anywhere, at any time.

ZFX also provides a mobile application for its clients, ensuring they can trade on the go. This ZFX Mobile App offers access to all the major features of the trading platform and enables clients to manage their portfolio, place trades, and monitor the markets from their mobile device.

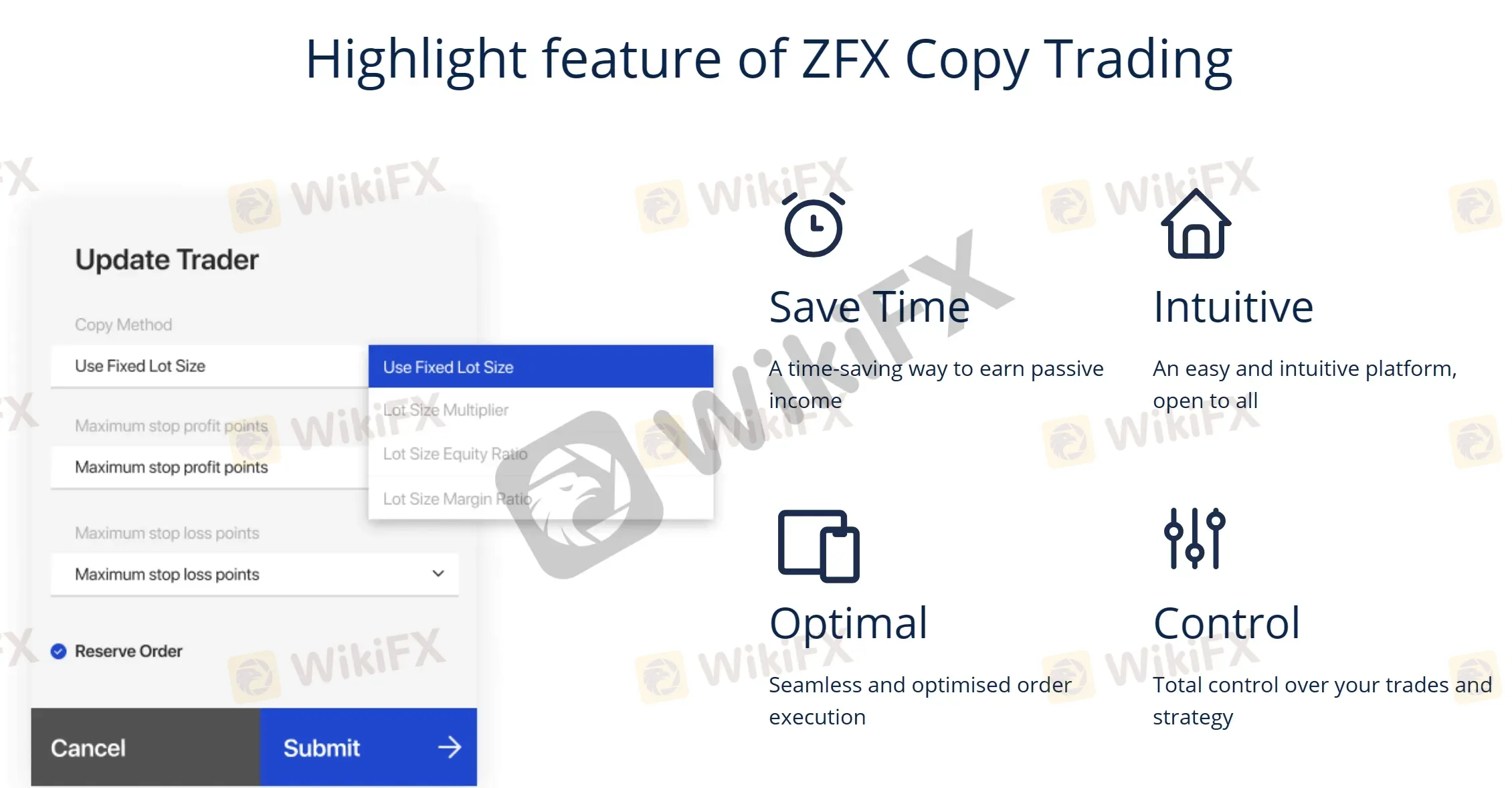

ZFX offers a Copy Trade feature, which is great news for both beginner and busy traders. Copy trading, also known as social trading, allows traders to automatically copy the trades of experienced and successful traders. This can help beginners to learn trading strategies from experienced traders, and help busy traders to automate their trading. By using the Copy Trade feature, you can potentially increase your chances of making profitable trades.

ZFX is committed to providing an extensive educational framework to support both novice and experienced traders through their A-to-Z Academy, which offers comprehensive learning resources designed to master trading from the basics to advanced strategies. This initiative underscores ZFX's dedication to empowering its clients with the knowledge needed to navigate the financial markets confidently.

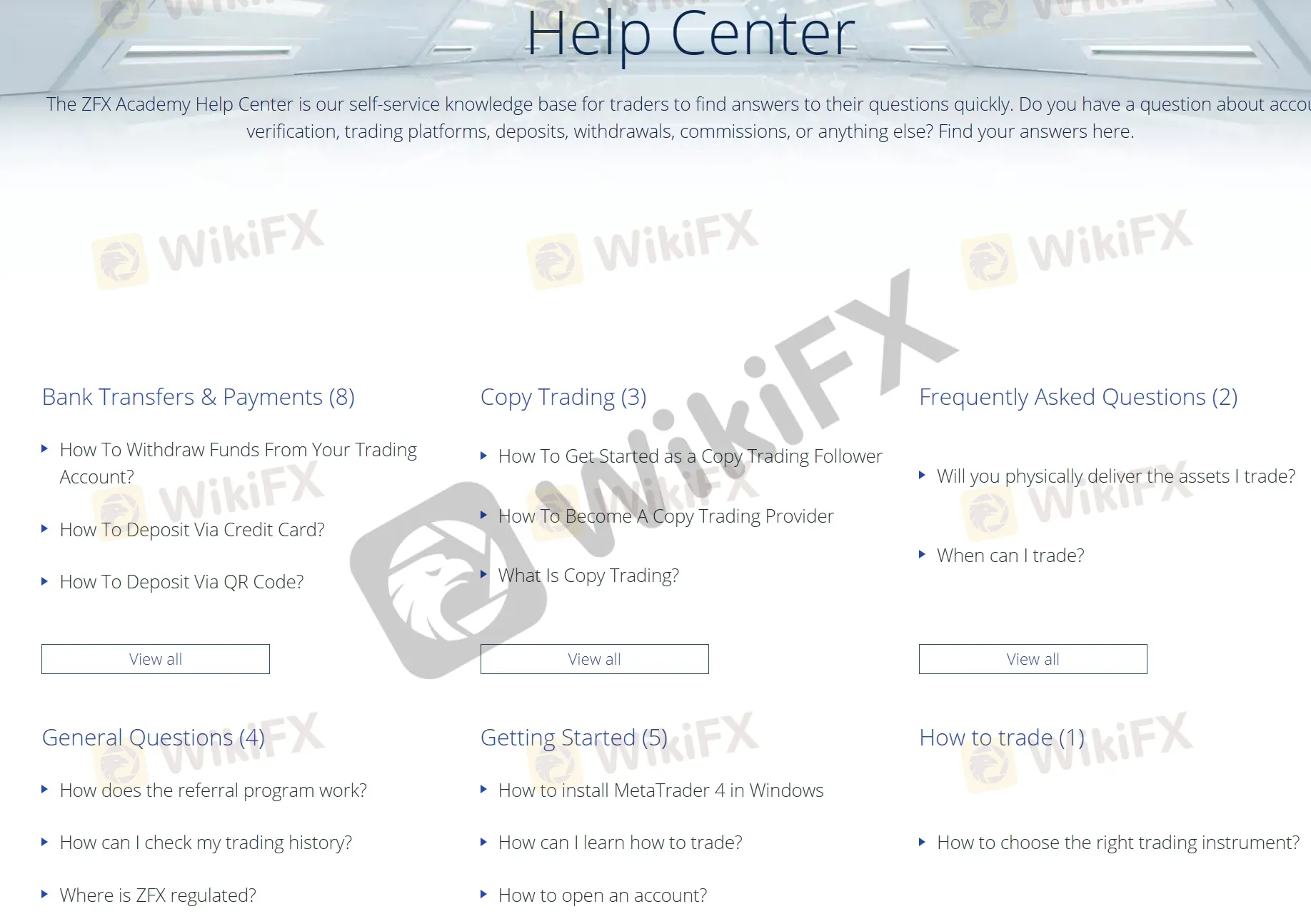

Additionally, ZFX enhances trader support with a 24/7 Help Center, serving as a constant trading support hub where traders can obtain assistance at any time.

The platform also features a detailed Glossary, which acts as a valuable dictionary for demystifying complex trading terminology, making the trading language more accessible to everyone.

Moreover, their FAQ section addresses common queries related to trading mechanics, account management, funding procedures, withdrawals, and specific product details.

Collectively, these educational resources equip ZFX traders with a solid foundation of knowledge and continuous support, facilitating a well-rounded and informed trading experience.

ZFX provides robust customer support with extensive availability and multiple communication channels to ensure that traders can receive assistance whenever needed. Operating hours extend throughout the week, with round-the-clock support from Monday to Friday and extended hours over the weekend from 07:30 AM to 02:00 AM the next day, accommodating traders across different time zones.

Traders can reach out via online chat for immediate responses, or call directly through the phone number 400-8424-611 for personalized assistance. Additionally, ZFX can be contacted through email at cs@zfx.com for comprehensive support.

The broker also maintains a strong presence on several social media platforms including Facebook, Instagram, LinkedIn, and Twitter.

Overall, ZFX is a reputable option for traders looking to access the financial markets. The broker's maximum trading leverage of 1:2000, based on account equity, is one of the highest in the industry and can provide traders with significant opportunities for profit. Additionally, competitive spreads and a choice of popular MT4 trading platforms further strengthen ZFX's position as a reliable broker.

| Is ZFX regulated? |

| Yes. It is regulated by FCA and FSA (Offshore). |

| At ZFX, are there any regional restrictions for traders? |

| Yes. It does not provide services for residents of certain countries such as the United States of America, Canada, Egypt, Iran and North Korea (Democratic People's Republic of Korea). |

| Does ZFX demo accounts? |

| Yes. |

| Does ZFX offer industry leading MT4 & MT5? |

| Yes. It supports MT4 and ZFX Mobile App. |

| What is the minimum deposit for ZFX? |

| $50 for the Mini Trading account, while higher for other account types. |

When you search for a broker like ZFX, the main question you want answered is simple: "Is ZFX legit?" You've probably found mixed information—some people praise their services, while others warn about possible scams. This analysis aims to cut through the confusion and give you a clear, fact-based answer. The truth isn't simple. ZFX works under a parent company called Zeal Group, which has an important license from a top regulator. However, the protection you get as a trader isn't the same for everyone. It depends completely on where you live and which legal company you sign up with. This important difference between strong regulation versus offshore flexibility is the main issue you need to understand. This article takes a deep look at this complexity, helps you tell real facts from dangerous lies, and gives you the power to make a safe, smart decision for yourself.

WikiFX

WikiFX

When traders look for trustworthy brokers in today's busy market, ZFX stands out as a major global company backed by the Zeal Group. The main question for anyone thinking about using them is simple: What is ZFX, and can you trust it? This broker has an interesting but important split personality. It works under a parent company that follows strict UK financial rules, but most regular customers actually sign up through a different offshore company. This creates a gap between how safe people think it is and how much protection traders actually get. The goal of this 2026 review is to give you a complete, fair look at ZFX's safety, costs, and features. We'll give you an honest view of what's good and bad about it, so you can make a smart choice based on facts, not advertising. Our analysis will look at its regulations, trading conditions, fees, and the important risks you need to know about.

WikiFX

WikiFX

When traders research a broker, they always ask the same important question: Will my capital be safe? When looking into ZFX, this question becomes complicated because there are serious scam accusations floating around. This review aims to give you a clear, fact-based answer. Read on!

WikiFX

WikiFX

When checking if a broker is safe, the first and most important step is to look at its regulatory credentials. For traders researching ZFX in 2026, the answer is not simply yes or no. ZFX, a brand under the Zeal Group, which commenced its operations in 2017, works through a complex, dual-license structure. This means the broker is controlled by two separate legal entities under two very different regulators: the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. This dual framework has major effects on a trader's security, available leverage, and overall account terms. Understanding the entity you are dealing with is extremely important for accurately assessing your risk. This guide will break down this structure, providing the clarity needed to make an informed decision.

WikiFX

WikiFX

More

User comment

31

CommentsWrite a review

2026-01-31 08:04

2026-01-31 08:04

2025-12-31 22:59

2025-12-31 22:59