User Reviews

More

User comment

2

CommentsWrite a review

2024-07-01 12:27

2024-07-01 12:27 2023-03-15 10:11

2023-03-15 10:11

Score

15-20 years

15-20 yearsRegulated in Japan

Retail Forex License

Suspicious Scope of Business

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index8.89

Risk Management Index8.90

Software Index7.05

License Index7.83

Single Core

1G

40G

More

Company Name

Fidelity Securities Co., Ltd

Company Abbreviation

Fidelity

Platform registered country and region

Japan

Company website

Company summary

Pyramid scheme complaint

Expose

| FidelityReview Summary | |

| Founded | 2015 |

| Registered Country/Region | Japan |

| Regulation | FSA |

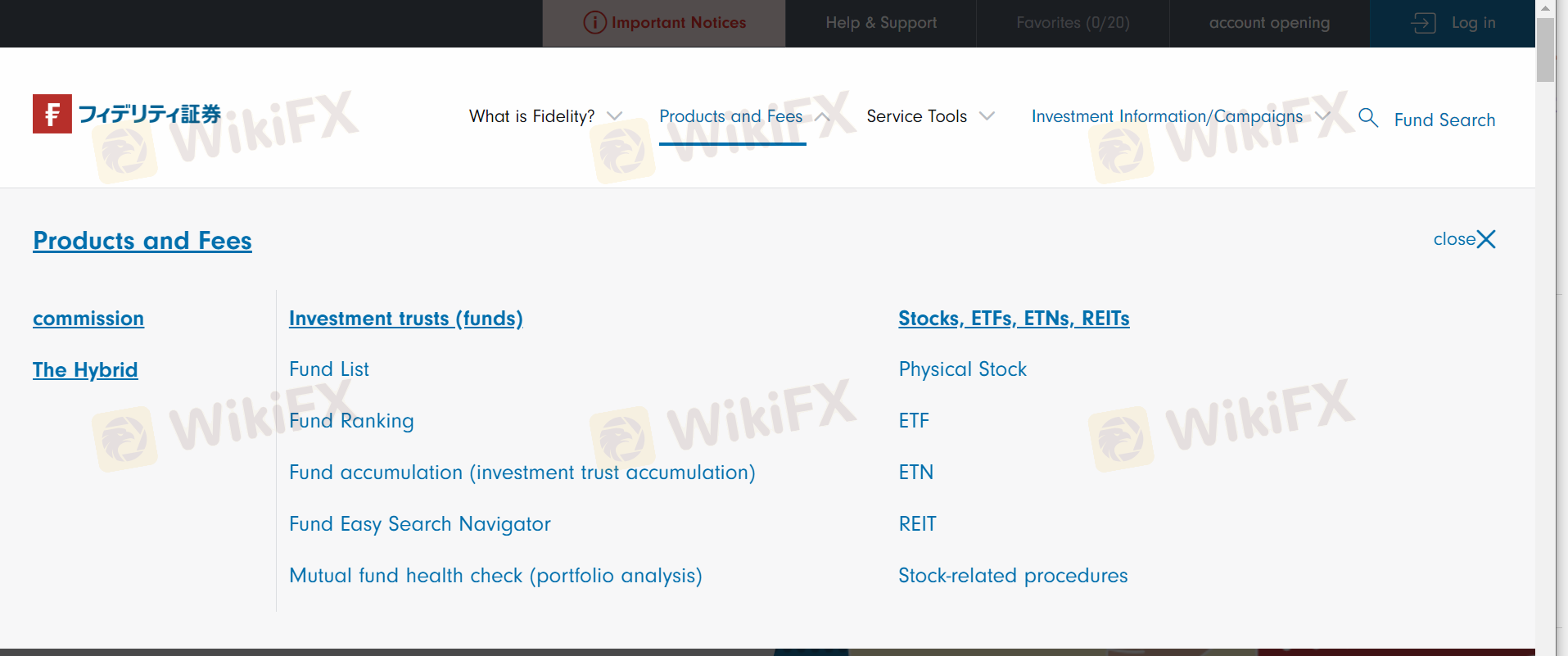

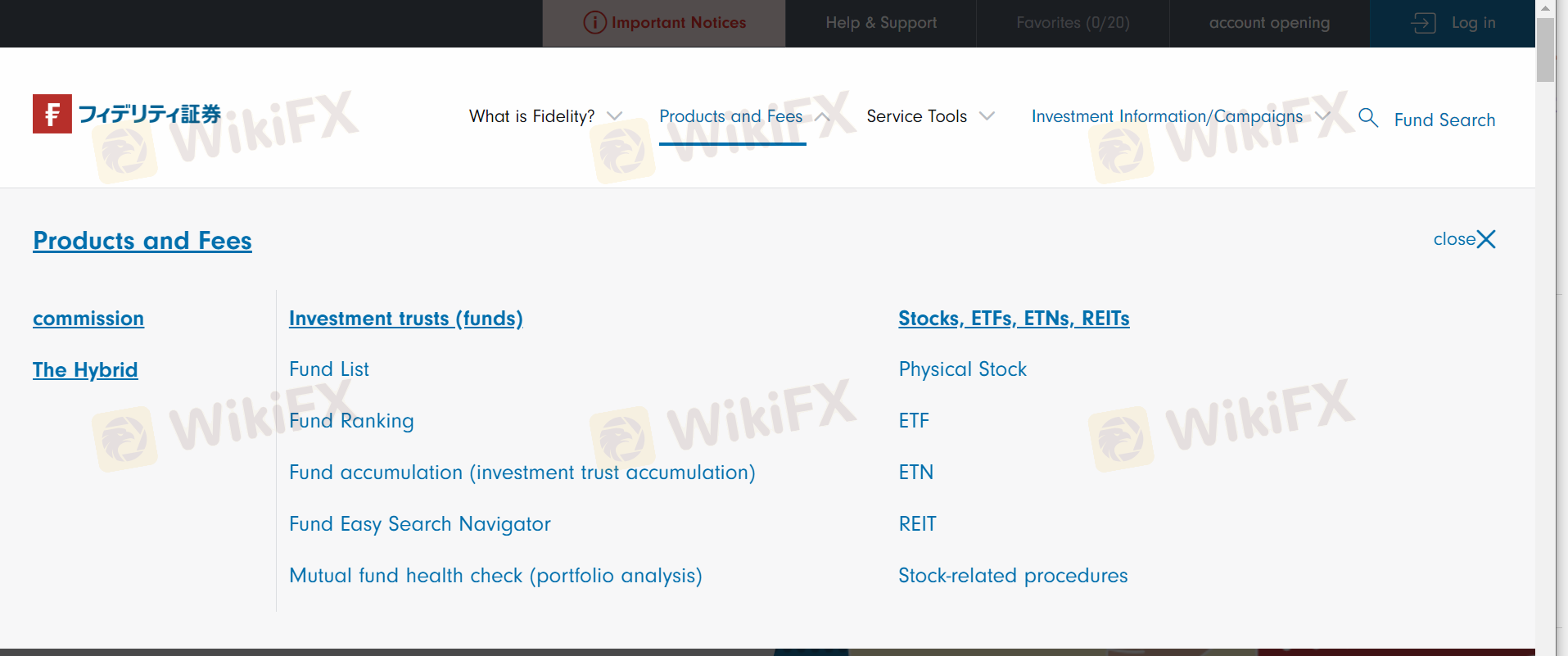

| Trading Product | Mutual funds |

| Customer Support | Tel: 0120-41-1004; 03-6739-3333 |

| Email: cs@fidelity.co.jp | |

| Office: 7-7-7 Roppongi, Minato-ku, Tokyo | |

Fidelity was registered in 2015 in Japan, which mainly focuses on foreign mutual funds. It provides different channels for customer support, including telephone support and email support. More importantly, it is regulated by FSA in Japan.

| Pros | Cons |

| Regulated well | Limited types of trading products |

| Long operation time | Unclear trading conditions |

| Multiple channels for customer support |

Fidelity is regulated by Financial Services Agency (FSA) in Japan.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | フィデリティ証券株式会社 | Japan | Retail Forex License | 関東財務局長(金商)第152号 |

Fidelity mainly focuses on foreign mutual funds. It merely mentions mutual funds and does not reveal if other types of products or services are available or not.

Fidelity Investments tests a stablecoin, joining major financial firms in the booming crypto sector. Discover how this impacts digital payments and blockchain adoption.

WikiFX

WikiFX

The Fidelity Stack was developed on Decentraland, a web application that simulates a city, complete with commerce areas, offices, and event spaces. It is available to everyone, however, the age range is 18-35. Fidelity established the Fidelity Metaverse ETF as part of the "Fidelity Stack," providing investors with access to firms engaged in virtual environments such as the metaverse, where users may work, interact, and play on various devices.

WikiFX

WikiFX

Investing in the stock market is one of the finest methods to build money around the globe. One of the stock market's key advantages is that there are several methods to benefit from it.

WikiFX

WikiFX

The Central Bank of Nigeria’s (CBN) efforts towards actualising $200 billion in Foreign Exchange (FX) repatriation from non-oil exports over the next five years have been given a major boost with a recently held workshop for exporters and investors in Akure, Ondo State.

WikiFX

WikiFX

More

User comment

2

CommentsWrite a review

2024-07-01 12:27

2024-07-01 12:27 2023-03-15 10:11

2023-03-15 10:11