User Reviews

More

User comment

6

CommentsWrite a review

2024-05-22 13:34

2024-05-22 13:34

2023-02-15 17:34

2023-02-15 17:34

Score

Above 20 years

Above 20 yearsRegulated in Australia

Market Making License (MM)

Self-developed

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index8.11

Business Index8.00

Risk Management Index9.79

Software Index7.30

License Index8.11

Single Core

1G

40G

More

Company Name

Bank of Queensland Limited

Company Abbreviation

BOQ

Platform registered country and region

Australia

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| BOQ Review Summary | |

| Founded | 1874 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

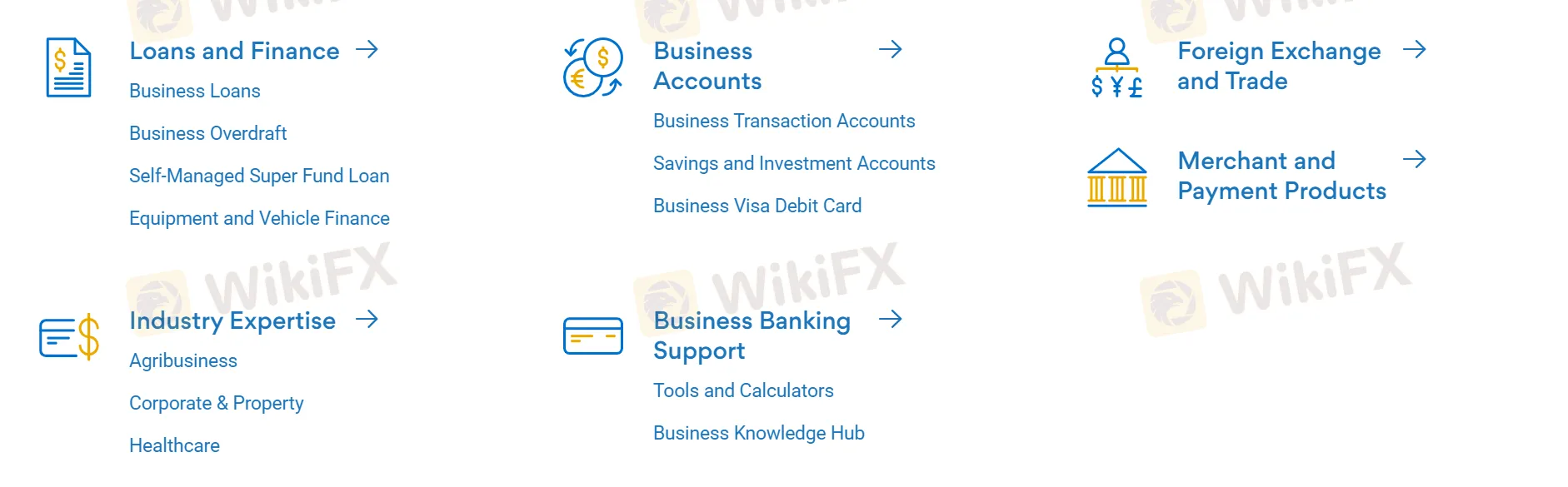

| Financial Services | Bank accounts, home loans, credit cards, personal loans, insurance, business loans, business accounts, foreign exchange and trade services, merchant and payment products |

| Minimum Deposit | 0 |

| Customer Support | Tel: 1300 55 72 72 |

BOQ, established in 1874 and regulated by ASIC, offers diverse financial services for individuals and businesses, including various bank accounts, home and personal loans, credit cards, insurance, and specialized business banking solutions. They are noted for having a zero minimum deposit requirement for some accounts.

| Pros | Cons |

| Regulated by ASIC | Age restrictions on high-yield savings |

| Diverse account types | Limited channels for customer support |

| Zero minimum deposit | |

| Long operation time |

BOQ has a Market Maker (MM) license regulated by the Australian Securities and Investments Commission (ASIC) in Australia with a license number of 000244616.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Australian Securities and Investments Commission (ASIC) | Regulated | Bank of Queensland Limited | Australia | Market Maker (MM) | 000244616 |

Business bank account: BOQ offers various business bank accounts, including Business Transaction Accounts for daily operations and Savings and Investment Accounts to earn interest on business funds. They also provide Industry Specialist Accounts tailored for sectors like Solicitors, Real Estate Agents, and Not-for-Profits.

Personal account: BOQ offers two types of personal accounts, which are the Transaction Account and Savings Accounts.

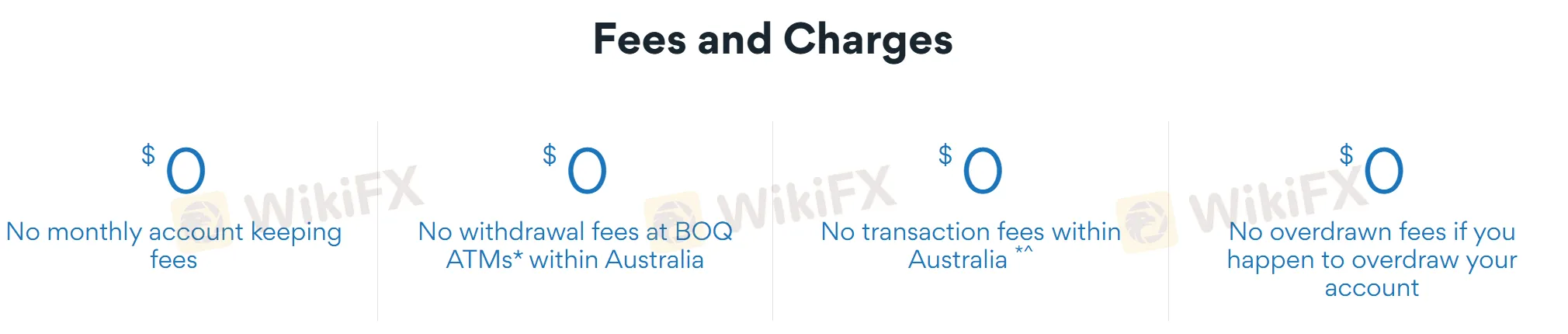

Transaction account: BOQ's transaction accounts generally feature no monthly account-keeping fees, no withdrawal fees at BOQ ATMs within Australia, and no transaction fees within Australia. They also state no overdrawn fees if you happen to overdraw your account.

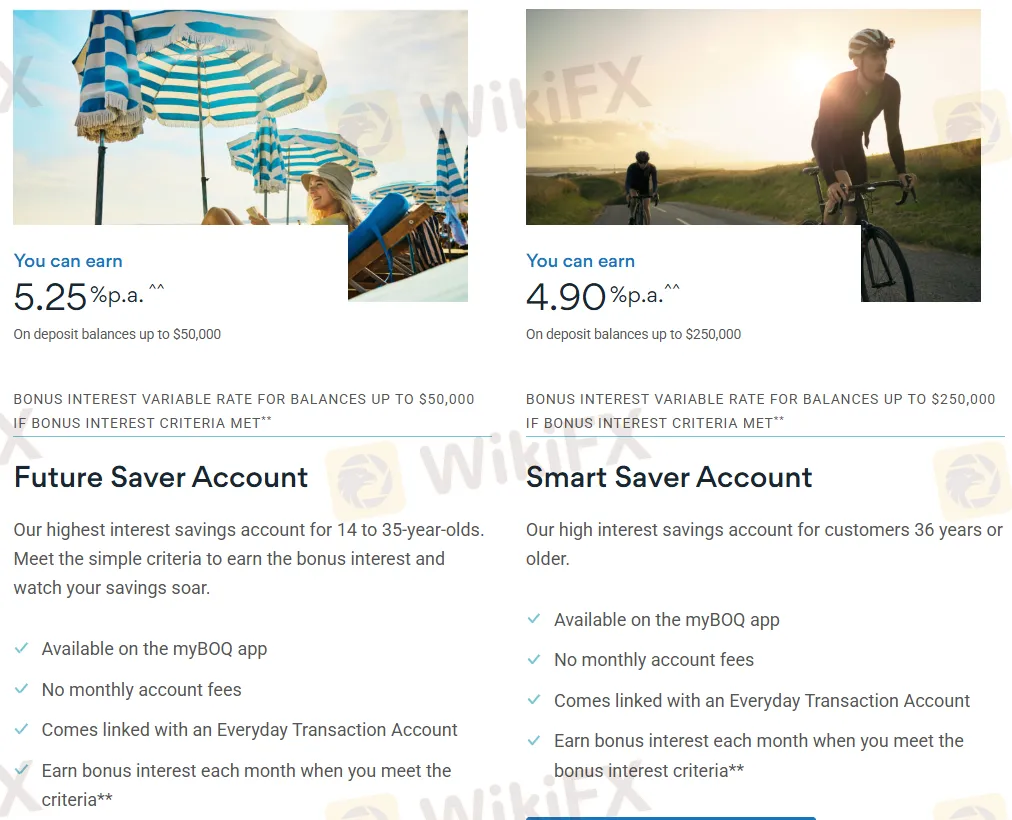

Savings accounts:

| Feature | Future Saver Account (14-35 years old) | Smart Saver Account (36 years or older) | Simple Saver Account | Term Deposits (Balances $5,000 - $249,999, Term 12-24 months) |

| Interest Rate | 5.25% p.a. on balances up to $50,000 | 4.90% p.a. on balances up to $250,000 | 4.55% p.a. on balances up to $5M | 4.00% P.A. |

| Bonus Interest | Variable rate up to $50,000 if criteria met | Variable rate up to $250,000 if criteria met | Get a great, ongoing interest rate | Fixed term interest rates and no account fees |

| Availability | Available on the myBOQ app | - | ||

| Monthly Account Fees | ❌ | ❌ | ❌ | ❌ |

| Minimum Deposit | - | - | 0 | $1,000 |

| Other Features | Earn bonus interest each month when criteria met | Simply sit back and watch your savings grow | Flexible terms from just 1 month, choose interest payment frequency | |

More

User comment

6

CommentsWrite a review

2024-05-22 13:34

2024-05-22 13:34

2023-02-15 17:34

2023-02-15 17:34