User Reviews

More

User comment

2

CommentsWrite a review

2024-02-19 22:56

2024-02-19 22:56

2023-03-15 14:26

2023-03-15 14:26

Score

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index8.89

Risk Management Index0.00

Software Index7.05

License Index7.68

Single Core

1G

40G

More

Company Name

MITO SECURITIES CO.,LTD.

Company Abbreviation

MITO

Platform registered country and region

Japan

Company website

Company summary

Pyramid scheme complaint

Expose

| MITOReview Summary | |

| Founded | 1997 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Stock,Bond,ETF |

| Demo Account | ❌ |

| Trading Platform | MITO Multichannel Services, MITO Web |

| Customer Support | Tel:0120-310-273 |

MITO, a Japan-based financial services company established in 1997, operates under the regulation of the Financial Services Agency (FSA). The company offers a broad range of trading options, including stocks, bonds, and ETFs. Catering to various investor preferences.

| Pros | Cons |

| regulated | Lack of trading instruments |

| Demo account unavailable | |

| MT4/MT5 unavailable |

Yes. MITO is licensed by FSA to offer services.

| Regulator | Current Status | Regulated Entity | License Type | License No. |

| Financial Services Agency | Regulated | 水戸証券株式会社 | Retail Forex License | 関東財務局長(金商)第181号 |

MITO privide Stock,Bond,and ETF.

| Tradable Instruments | Supported |

| Bonds | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| Trading Platform | Supported | Available Devices | Suitable for |

| MITO Multichannel Services | ✔ | / | / |

| MITO Web | ✔ | / | / |

| MT5 | ❌ | / | Experienced trader |

| MT4 | ❌ | / | Beginners |

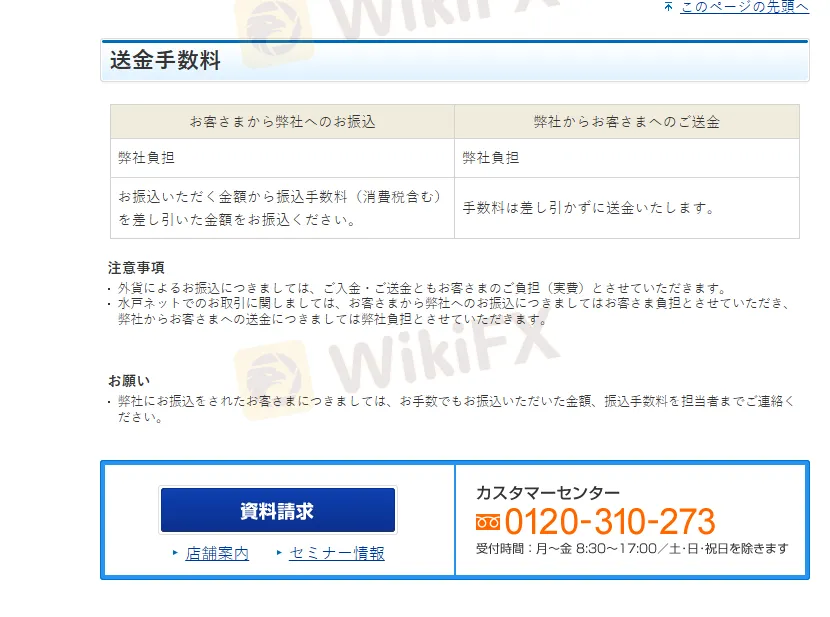

For foreign currency transfers, deposit and remittance fees are borne by the Customer (actual fees).

For transactions through Mito Net, all transfer fees paid by the customer to MITO are borne by MITO, and all transfer fees paid to the customer are borne by MITO.

More

User comment

2

CommentsWrite a review

2024-02-19 22:56

2024-02-19 22:56

2023-03-15 14:26

2023-03-15 14:26