Checkout List of 7 "FCA WARNED" Unauthorized Brokers

Abstract:The FCA (Financial Conduct Authority) once again warns forex traders and reveals a new list of unauthorized brokers operating in the forex market without FCA permission. Check the list to stay safe.

The FCA (Financial Conduct Authority) once again warns forex traders and reveals a new list of unauthorized brokers operating in the forex market without FCA permission. Check the list to stay safe.

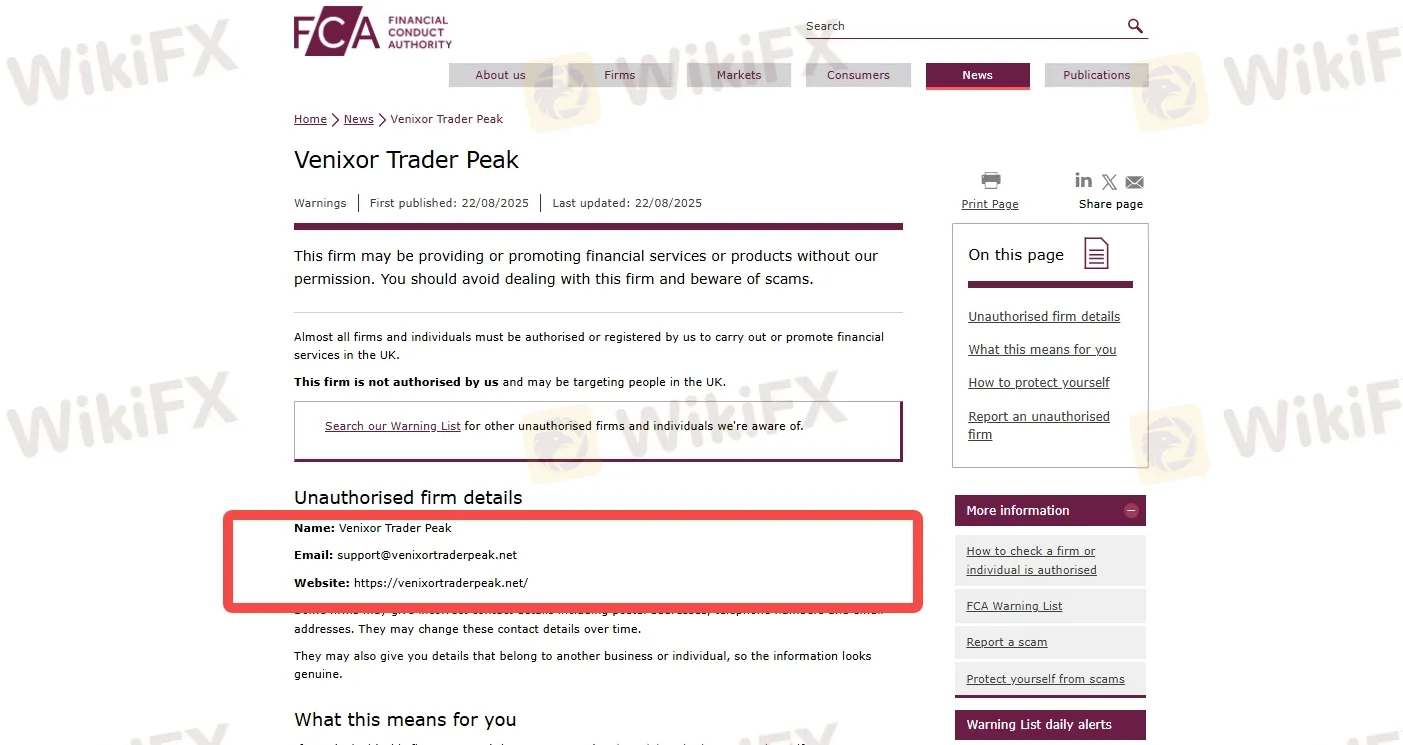

1. Name: Venixor Trader Peak

Email: support@venixortraderpeak.net

Website: https://venixortraderpeak.net/

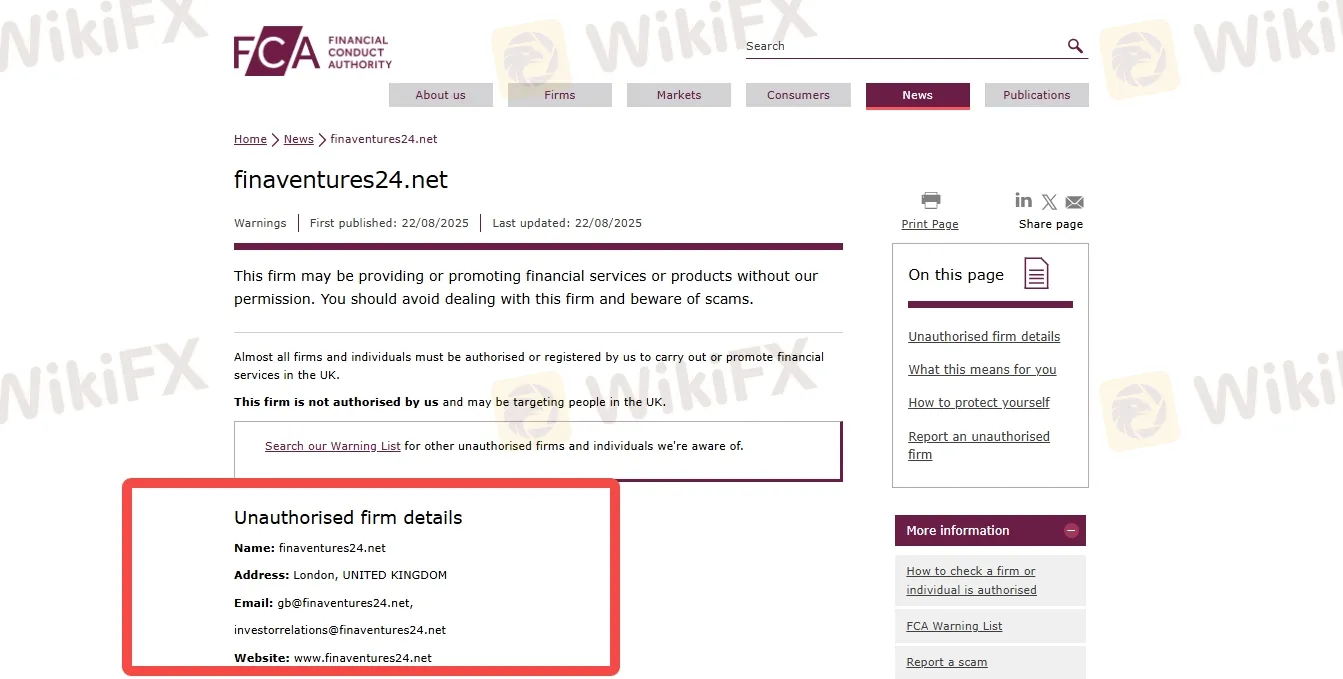

2. Name: finaventures24.net

Address: London, UNITED KINGDOM

Email: gb@finaventures24.net,

investorrelations@finaventures24.net

Website: www.finaventures24.net

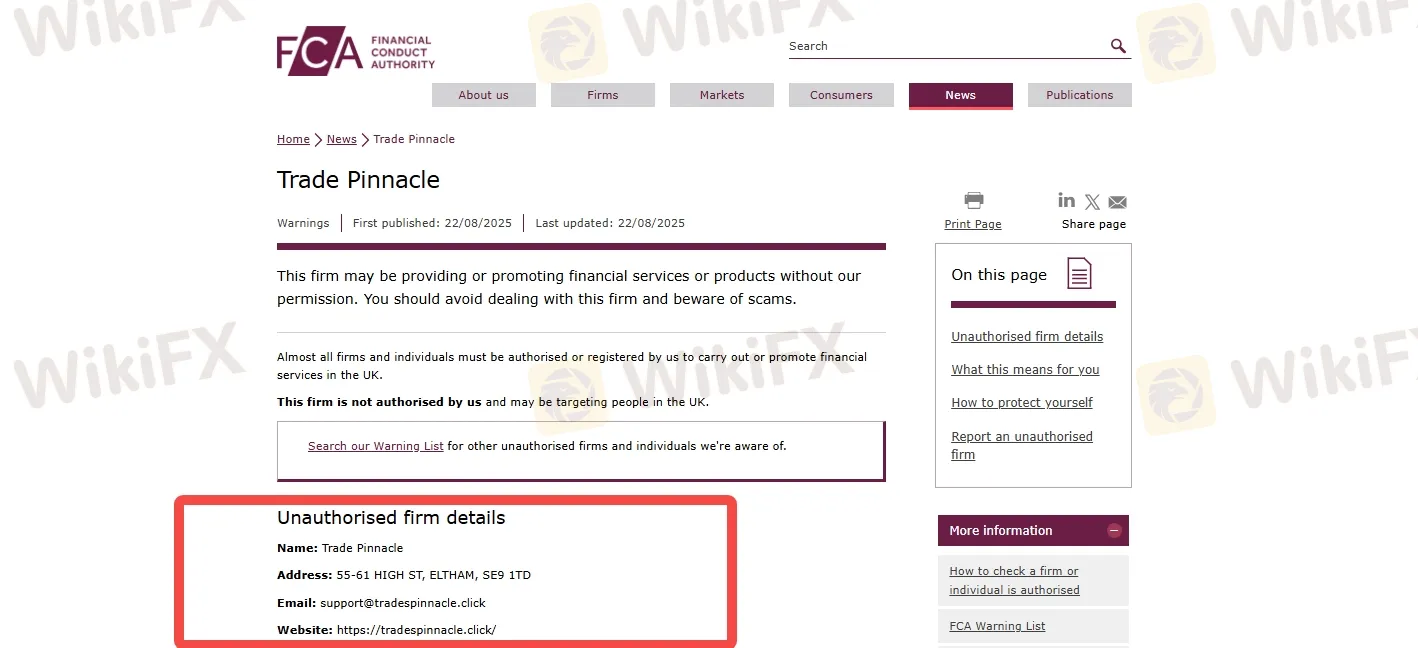

3. Name: Trade Pinnacle

Address: 55-61 HIGH ST, ELTHAM, SE9 1TD

Email: support@tradespinnacle.click

Website: https://tradespinnacle.click/

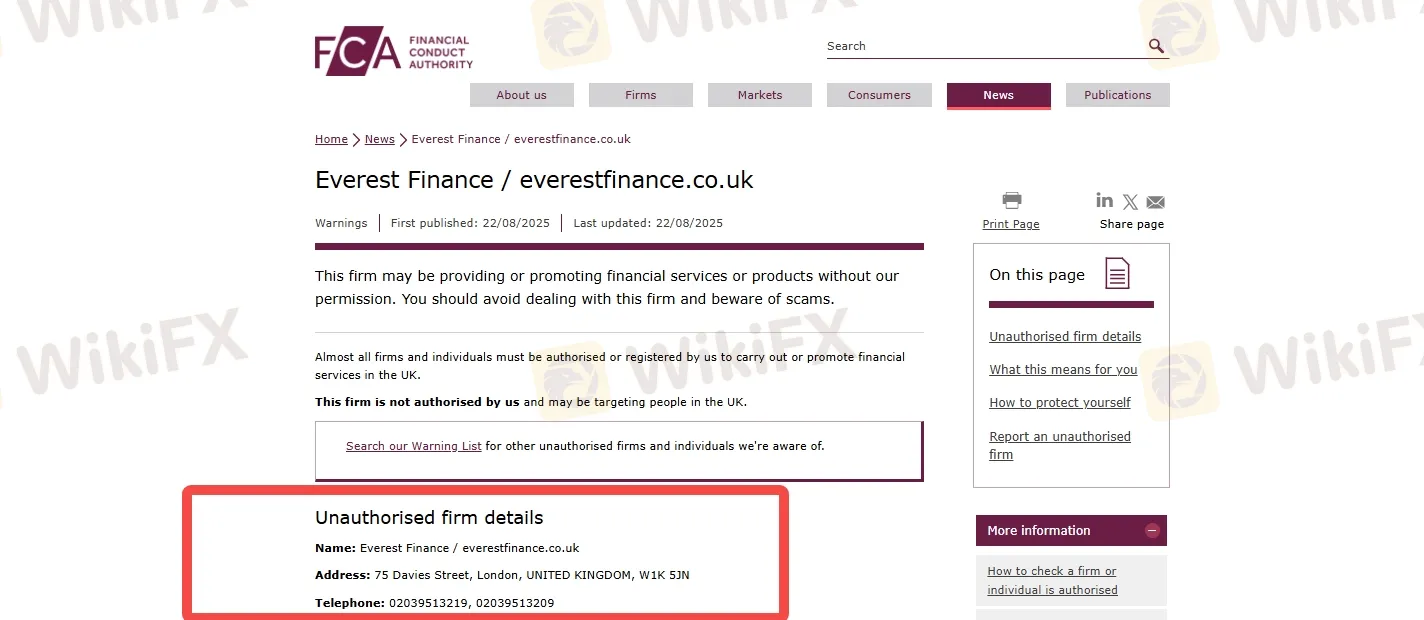

4. Name: Everest Finance / everestfinance.co.uk

Address: 75 Davies Street, London, UNITED KINGDOM, W1K 5JN

Telephone: 02039513219, 02039513209

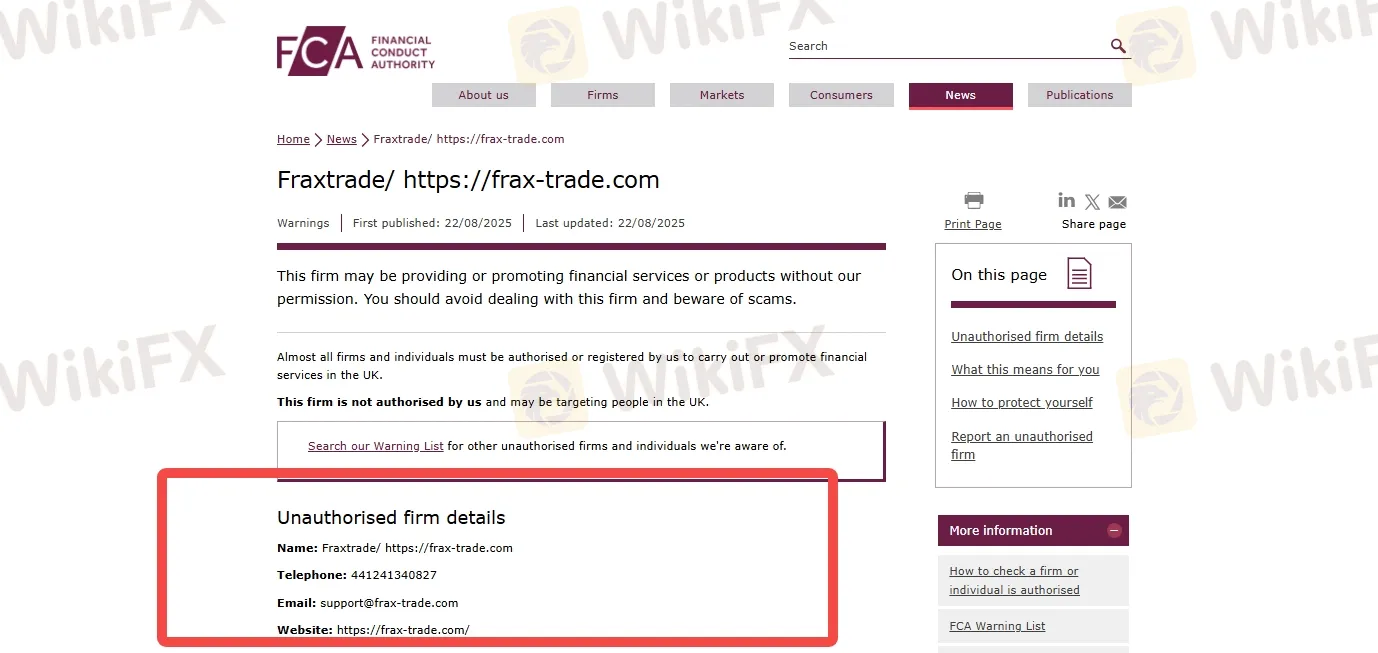

5. Name: Fraxtrade/ https://frax-trade.com

Telephone: 441241340827

Email: support@frax-trade.com

Website: https://frax-trade.com/

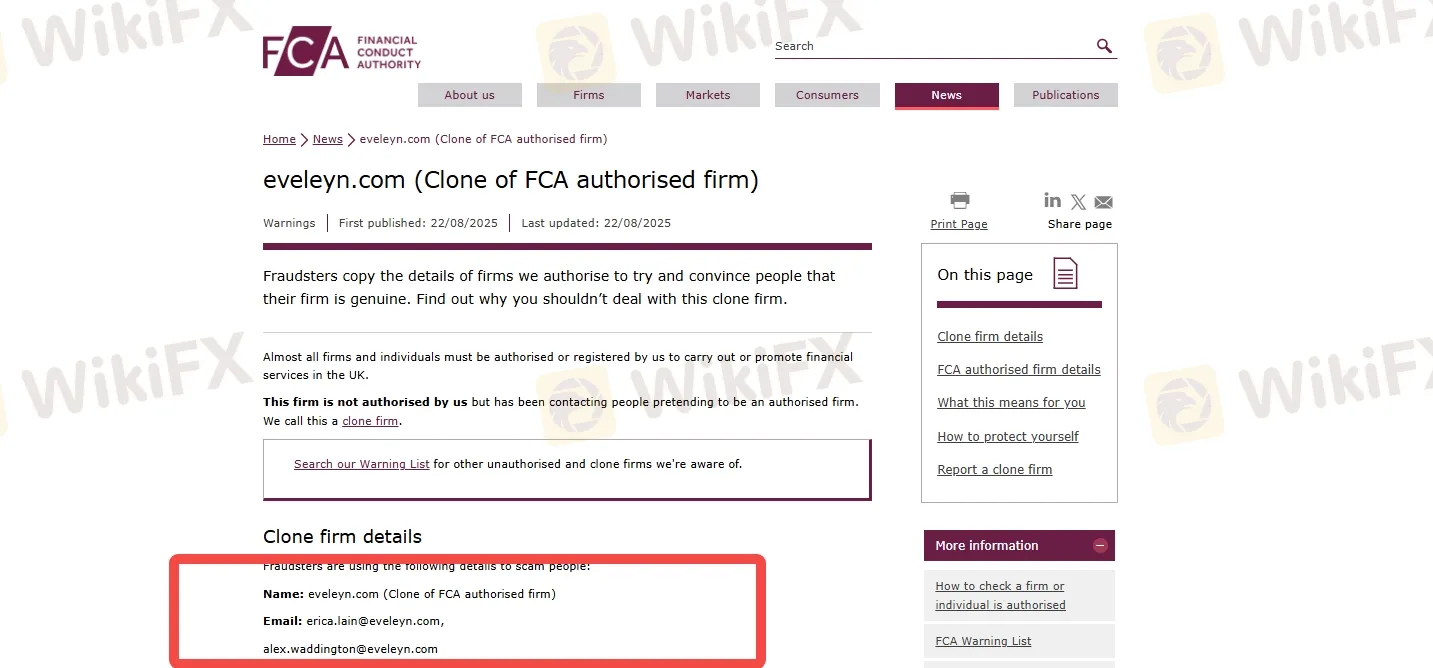

6. Name: eveleyn.com (Clone of FCA authorised firm)

Email: erica.lain@eveleyn.com,

alex.waddington@eveleyn.com

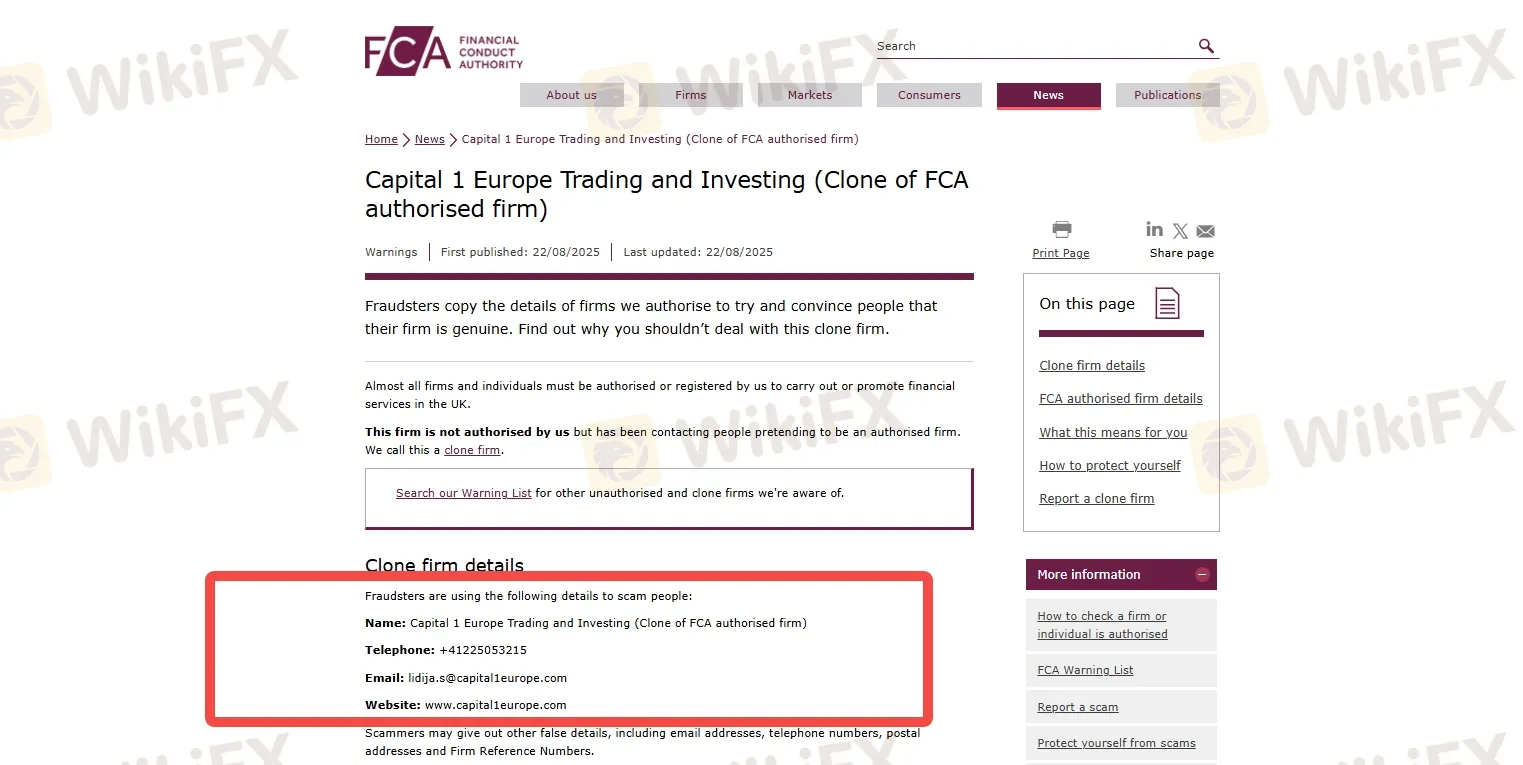

7. Name: Capital 1 Europe Trading and Investing (Clone of FCA authorised firm)

Telephone: +41225053215

Email: lidija.s@capital1europe.com

Website: www.capital1europe.com

FCA Warns the Public Against Unregulated Brokers

FCA regularly updates its warning list to help traders avoid fraudulent platforms posing as legitimate firms. If a forex broker is not listed on the FCA register or appears on the FCAs warning list, it's a red flag. Scam brokers typically use cloned websites, aggressive sales tactics, and unrealistic profit guarantees to trick investors. To stay safe in the forex market, conduct thorough due diligence, use regulated trading platforms, and stay informed about the latest scam alerts. Remember: if it sounds too good to be true, it probably is.

Why FCA Warning Matters?

An FCA (Financial Conduct Authority) warning is a serious alert that a broker or financial service is operating without proper authorization in the UK. The FCA is one of the worlds most respected financial regulators, and its role is to protect investors from fraud, scams, and unethical practices.

If a broker receives an FCA warning, it means:

1. The broker is not licensed or regulated by the FCA.

2. It is not allowed to offer financial services in the UK.

3. Your funds are not protected under UK financial laws.

4. You have no legal recourse if the broker disappears or refuses withdrawals.

How to Protect Yourself from Scam Brokers?

1. Verify the License of the brokers

2. Avoid Unregulated Brokers

3. Cross-Check Contact Information

4. Do not Fall for “Too Good to Be True” Promises

5. Test with a Demo Account First

6. Read Online Reviews

7. Do Your Research

8. Do not Rush

9. Report Suspicious Activity

10. Keep Records

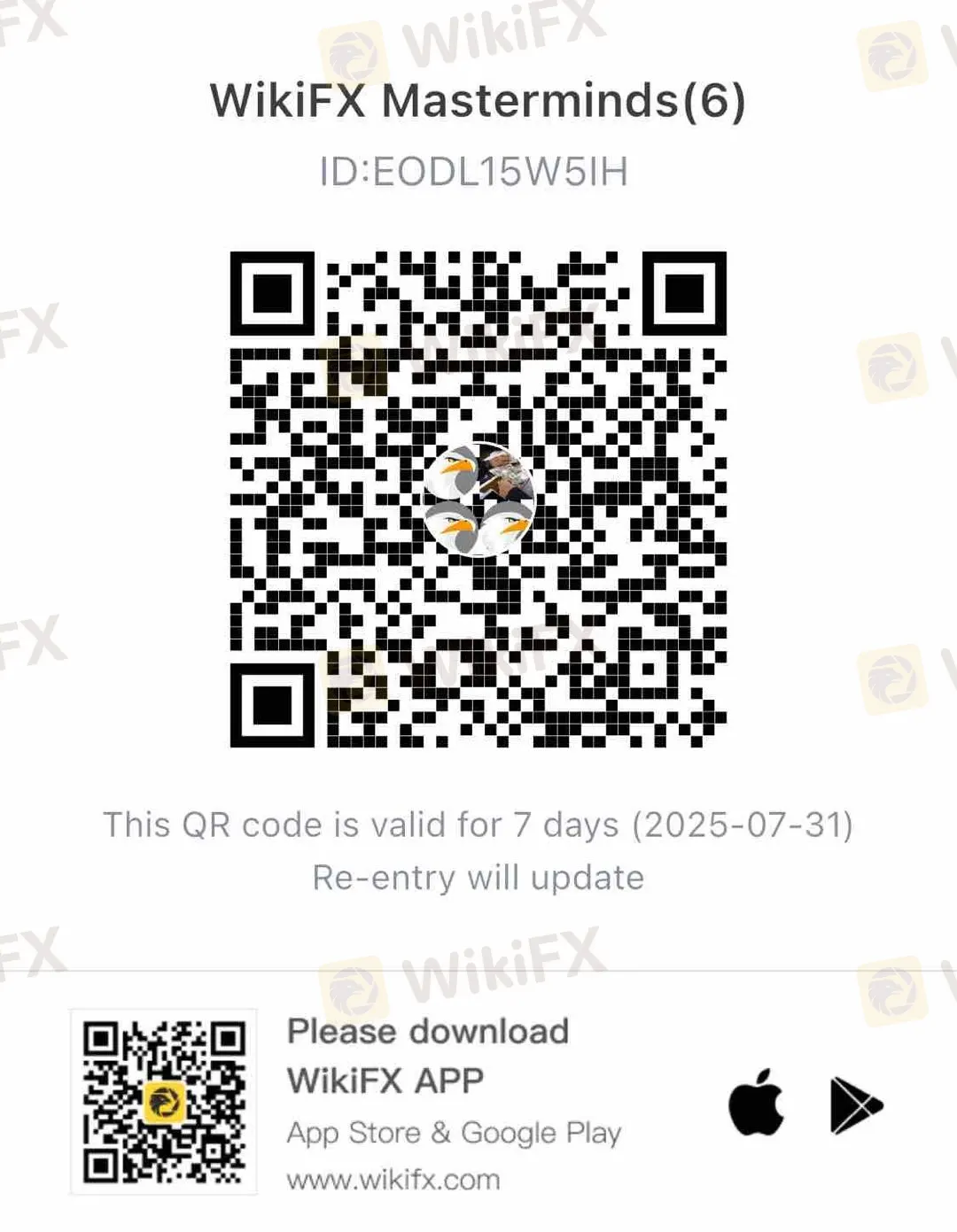

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

WikiFX Elite Club Spotlight | Lê Minh Phươn on Trust as the Invisible Bridge

WikiFX Elite Club Focus is a monthly publication created exclusively for members of the WikiFX Elite Club. It spotlights the individuals, ideas, and actions that are genuinely driving the forex industry toward greater transparency, professionalism, and long-term sustainability.

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Switched to Galileo FX from other brokers, thinking that you would earn profits, but things went the other way round? Did you continue to face losses despite executing constant optimizations on the trading software? Like did you experience issues concerning executing stop-loss orders? Failed to cash in on the positive market wave because of the broker’s trading bot? You are not alone! Many complaints concerning losses due to trading bot deficiencies have been doing the rounds. In this Galileo FX review article, we have demonstrated these complaints. Take a look!

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

EGM Securities has been reported as a scam by many forex traders, as they encountered several problems concerning fund withdrawals. The broker is alleged to have defrauded traders by applying unnecessary restrictions on withdrawals. Also known as FXPesa, the broker seems to have caught traders’ attention, mostly for negative reasons, though. In this EGM Securities review article, we have discussed withdrawal-related complaints made against the broker online. Keep reading!

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

WikiFX Elite Club Focus | Jimmy: Trust is the Most Valuable Asset

Johor Authorities Arrest Eight in Suspected Fraud Call Centre

HIJA MARKETS Scam Alert: Forex Trading & Investment Risk

Rate Calc