User Reviews

More

User comment

19

CommentsWrite a review

2025-08-12 14:04

2025-08-12 14:04

2025-07-30 15:09

2025-07-30 15:09

Score

Above 20 years

Above 20 yearsRegulated in United Kingdom

Market Making License (MM)

Global Business

Hong Kong Market Making License (MM) Revoked

High potential risk

Capital Ratio

Influence

Add brokers

Comparison

Quantity 32

Exposure

Score

Regulatory Index9.25

Business Index8.00

Risk Management Index0.00

Software Index8.32

License Index9.12

Single Core

1G

40G

More

Danger

Sanction

Warning

More

Company Name

Saxo Bank A/S

Company Abbreviation

Saxo

Platform registered country and region

Hong Kong

Number of employees

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

I have lost my 85000 pkr in this adress

I don’t know how to deal with a liar, do you know this?

I paid a security deposit and asked to pay taxes, but I couldn’t withdraw money at all. I don’t know if I was cheated

Do not allow me withdraw. Firstly let me pay the unfreeze gold, later pay the verification fee,credit enhancement gold, and personal income tax.

I deposited 50,000 but they count it as 30,000

Just 245. But I can't witdhraw it. Is there any other way?

Unable to log in to the webpage, there is a lot of money in the account on the webpage and it is impossible to withdraw it

I trade and buy USDJPY at 135.098 for 0.2 lots. The market reached 135.2, I actually lost 25 dollars, and it fell to 135.07, but I only lost 3 dollars, and I closed the position.

It required taxes and margins before withdrawal.

Unable to withdraw. They don't approve my applications at all. Pls help me

Can't withdraw funds. If you wanna get your money, you must top up the same amount, why not let withdraw funds, deliberately arbitrage

I met someone on a certain platform who pretended to be a firefighter to deceive trust. After a month of phishing guidance, I entered Saxo Financial's website. I was induced to recharge my loan to defraud my trust. I recharged about 10w and now the withdrawal fails. The website has also been hacked and I can't get my money back. I'm ready to report it to the police.

I can't withdraw money from my account, they are theft

Is it a fraud platform? I can't withdraw the money and the web is disabled. How can I get my money back?

The account is frozen first, and then the unfrozen fee must be paid, and another deposit is required after that. How to withdraw money...

1) When the position margin is 70%, SAXO has no reason to liquidate. This is a robbery; 2) and in the event of an unprovoked liquidation, the closing price is as much as 50 times the real-time market price! lead to huge losses. This is a fraudulent transaction, because the minimum price change unit is 0.01 and it needs to be changed gradually, instead of 2 blocks directly changing to 111 blocks! SAXO is a black-hearted trading platform. It gives me the feeling that it uses malicious liquidation to earn money from users' forced liquidation! 3) The official SAXO customer service fabricated the fact that it did not exist. I didn’t place an order to close the position, and said that someone placed the order;

| Quick Saxo Review Summary | |

| Founded | 1992 |

| Headquarters | Hellerup, Denmark |

| Regulation | ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS |

| Market Instruments | Stocks, ETFs, bonds, mutual funds, forex, futures, forex options, listed options |

| Demo Account | ✅(20 days with $100,000 virtual fund) |

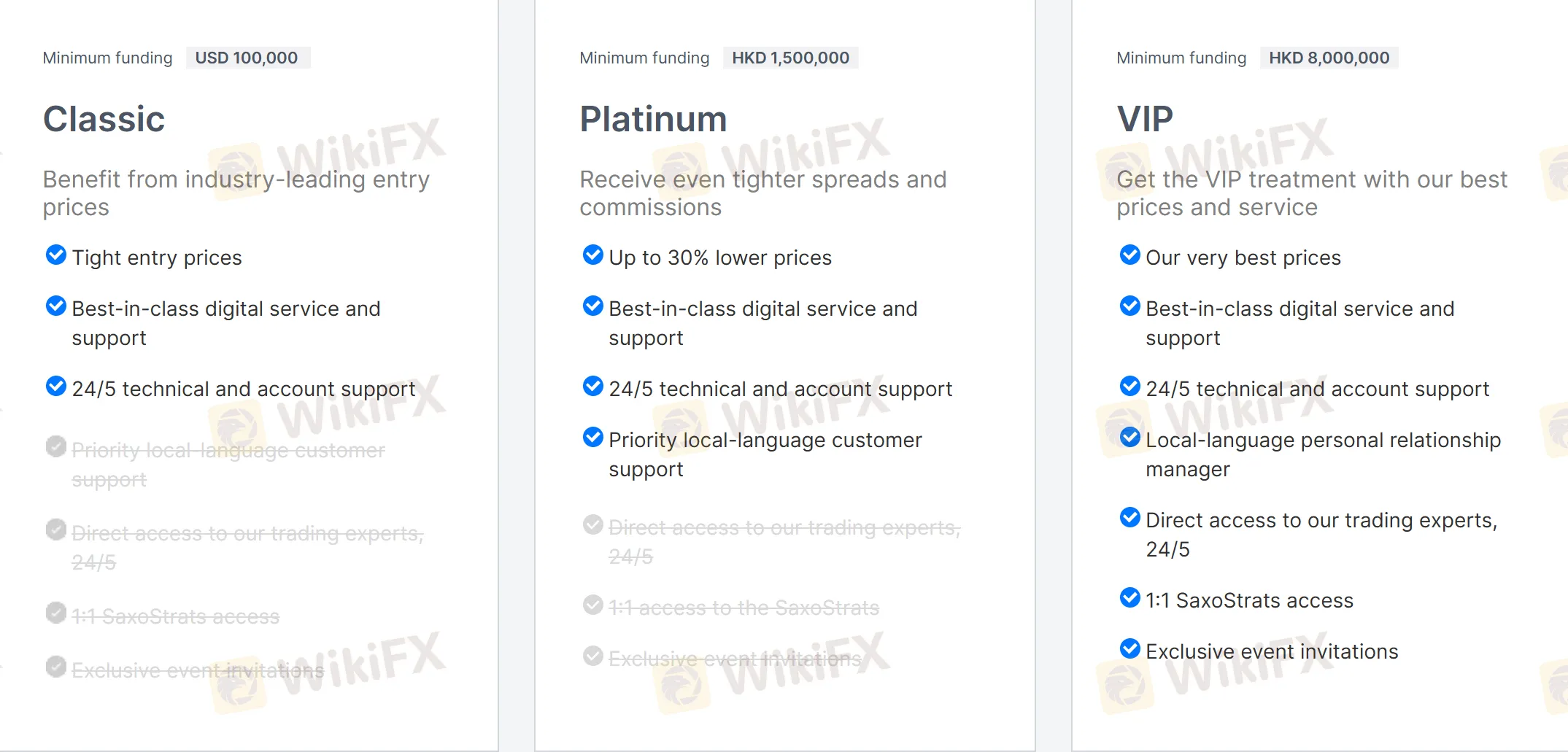

| Account Type | Classic, Platinum, VIP |

| Min Deposit | $0 |

| Leverage | 1:100 |

| Spread | From 0.4 pips (forex) |

| Trading Platform | SaxoTraderGo, SaxoTraderPRO, SaxoInvestor |

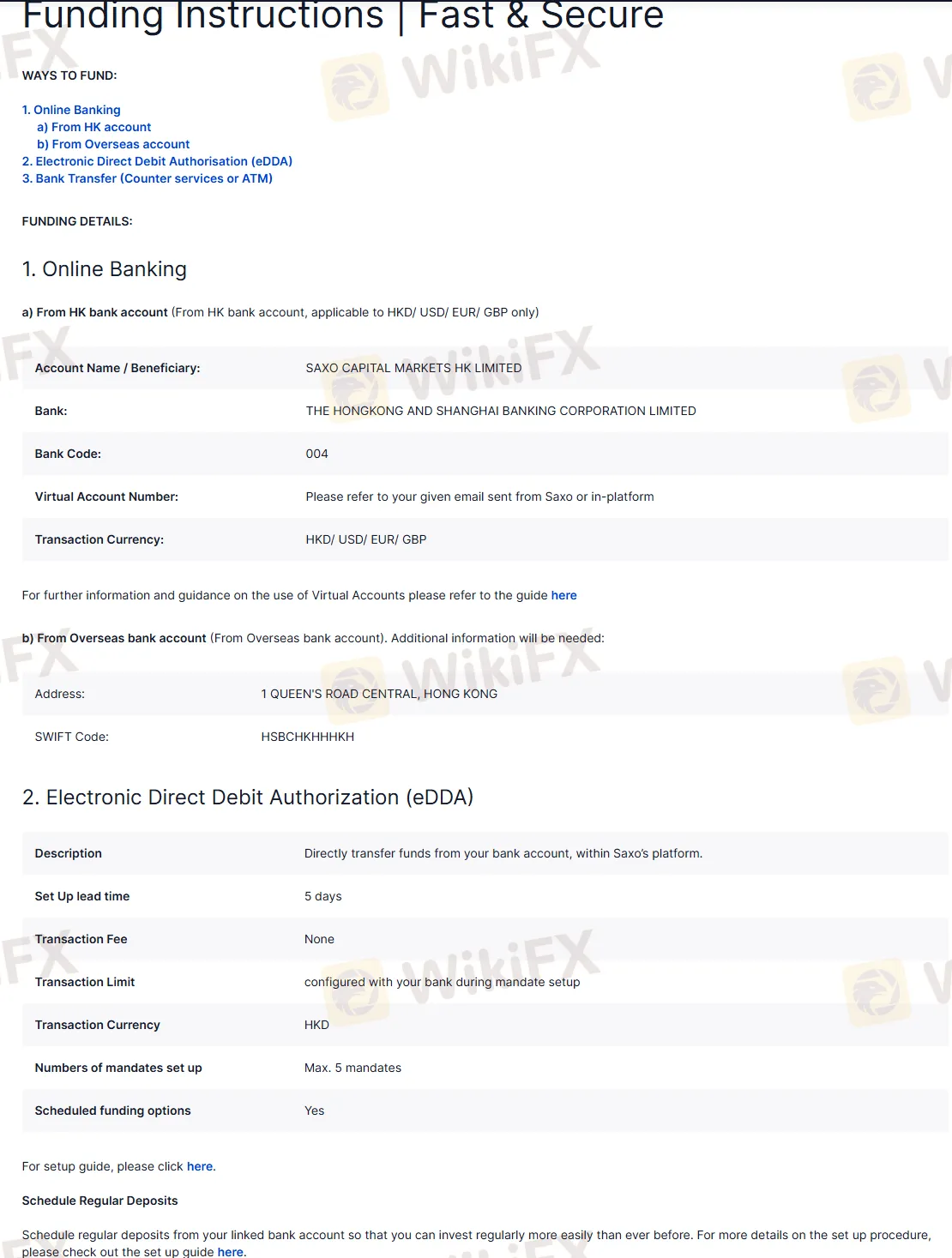

| Payment Methods | Online Banking, Electronic Direct Debit Authorization (eDDA), Bank Transfer (Counter services or ATM) |

| Customer Support | 24/5 - phone, email |

| Regional Restrictions | The United States and Japan |

Saxo is a Danish investment bank founded in 1992. It provides trading in stocks, ETFs, bonds, mutual funds, forex, futures, forex options, and listed options its proprietary trading platforms - SaxoTraderGo, SaxoTraderPRO, and SaxoInvestor. The bank operates in over 100 countries and has offices in major financial centers worldwide, including Copenhagen, London, Singapore, and Tokyo. Saxo Bank is regulated by several financial authorities, including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), AMF (France), CONSOB (Italy), FINMA (Switzerland), and MAS (Singapore). The bank also has a banking license and is a member of the Danish guarantee fund for depositors and investors.

| Pros | Cons |

| • Wide range of financial instruments available | • US and Japan clients are not accepted |

| • No minimum deposit requirement | • No direct contact channels |

| • User-friendly trading platforms | |

| • Advanced trading tools and research | |

| • Regulated by top-tier financial authorities | |

| • 20 days' demo accounts with $100,000 virtual fund |

Saxo has several entities that operate in multiple jurisdictions, heavily and globally regulated to provide a reassuring trading environment.

| Regulated Country | Regulated Entity | Regulated by | License Type | License Number |

| SAXO CAPITAL MARKETS (AUSTRALIA) LIMITED | ASIC | Market Making (MM) | 280372 |

| Saxo Capital Markets UK Limited | FCA | Market Making (MM) | 551422 |

| Saxo Bank Securities Ltd. | FSA | Retail Forex License | 関東財務局長(金商)第239号 |

| Saxo Capital Markets HK Limited 盛寶金融(香港)有限公司 | SFC | Dealing in futures contracts & Leveraged foreign exchange trading | AVD061 |

| Saxo bank A/S | AMF | Retail Forex License | 71081 |

| BG SAXO SIM SPA | CONSOB | Market Making (MM) | 296 |

| SAXO BANK (SCHWEIZ) AG | FINMA | Financial Service | Unreleased |

| SAXO CAPITAL MARKETS PTE. LTD. | MAS | Retail Forex License | Unreleased |

How are you protected?

Saxo is a regulated broker, with licenses from multiple reputable regulatory authorities and a long-standing history of providing financial services. The broker takes extensive measures to protect client funds, including segregating them from the company's assets and offering negative balance protection.

Additionally, Saxo offers various security features, such as two-factor authentication and encryption, to ensure secure trading.

More details can be found in the table below:

| Security Measures | Detail |

| Regulation | ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS |

| Segregated Accounts | Client funds are held in segregated bank accounts to protect them in case of insolvency |

| Two-Factor Authentication | As an extra layer of security for client accounts |

| SSL Encryption | The Saxo website and platform are secured with SSL encryption to protect user data |

| Investor Compensation Scheme | A member of the Danish Investor Compensation Scheme, which provides additional protection to clients in case of insolvency |

It's important to note that while these measures provide some level of protection for clients, there is always some level of risk involved in trading financial instruments, and clients should always be aware of the risks before making any trades.

Our Conclusion on Saxo Reliability:

Based on the information available, Saxo is a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years.

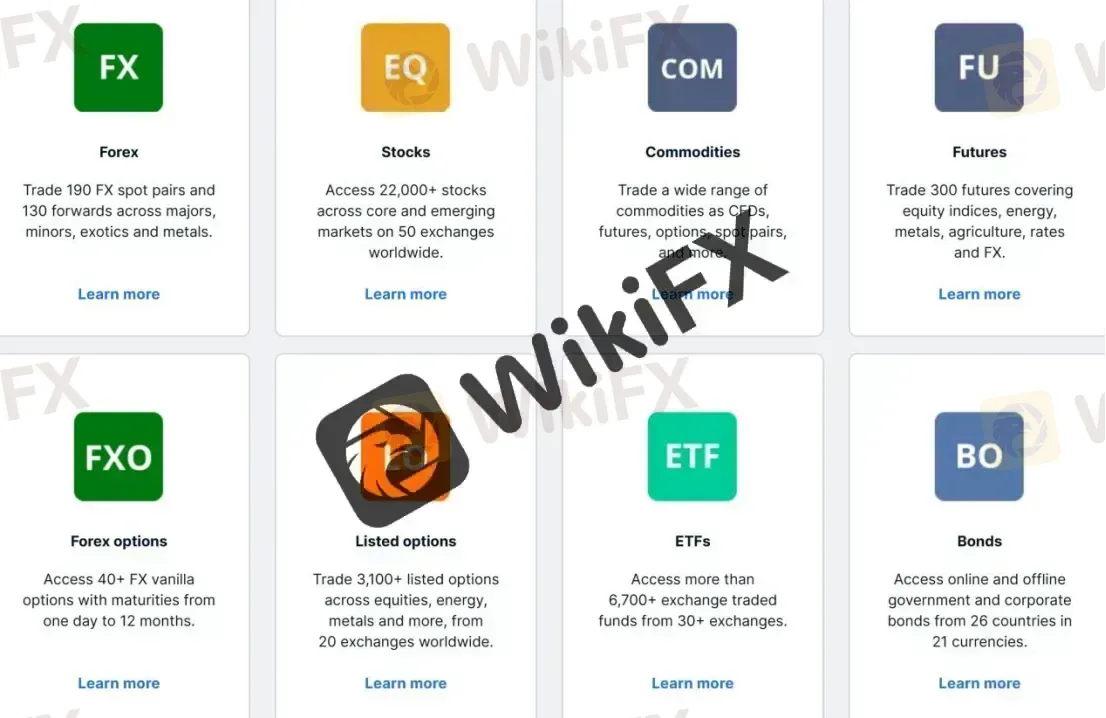

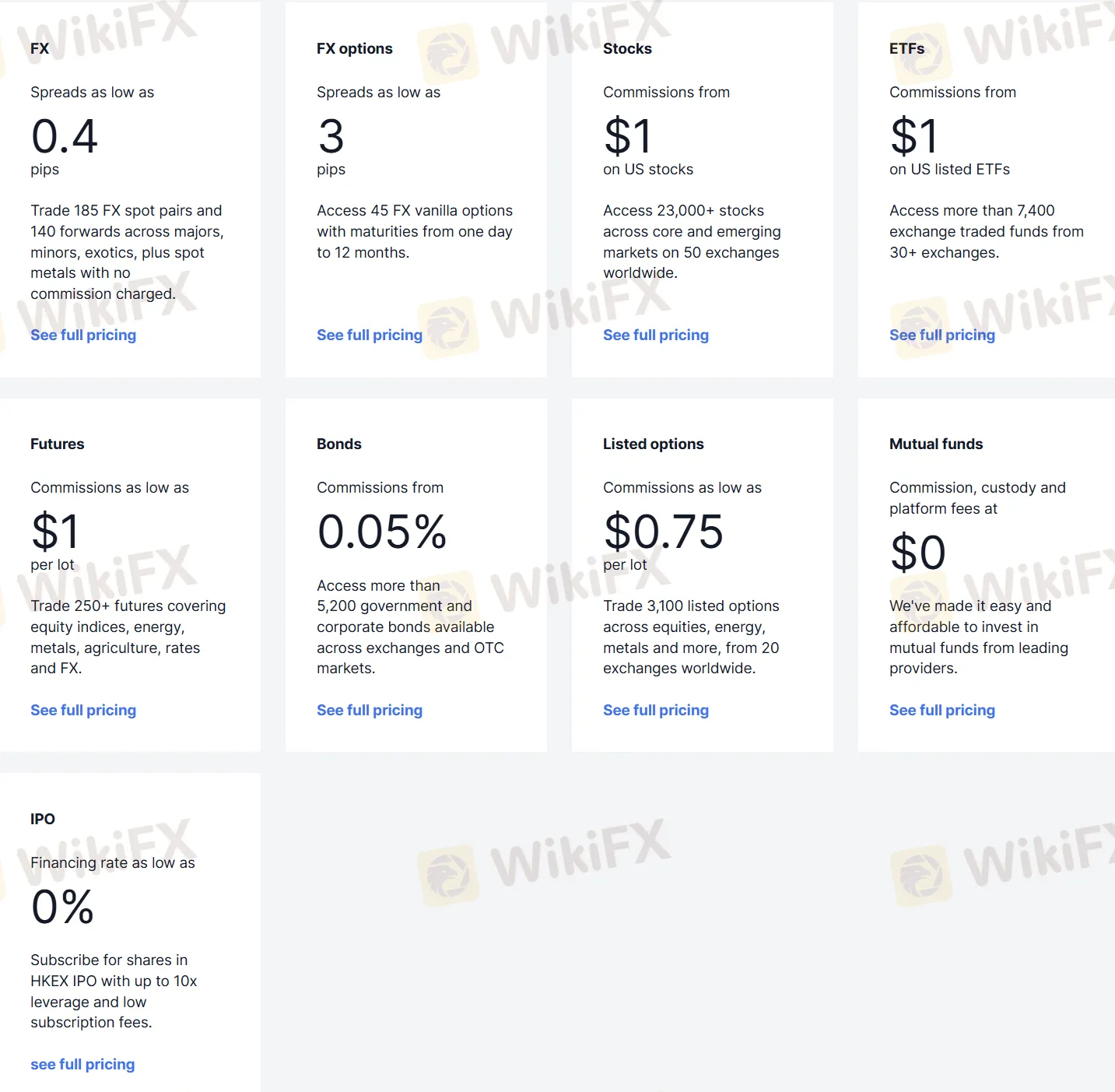

Saxo offers a wide range of trading instruments across multiple asset classes, including

| Asset Class | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| Mutual funds | ✔ |

| Forex | ✔ |

| Futures | ✔ |

| Forex options | ✔ |

| Listed options | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

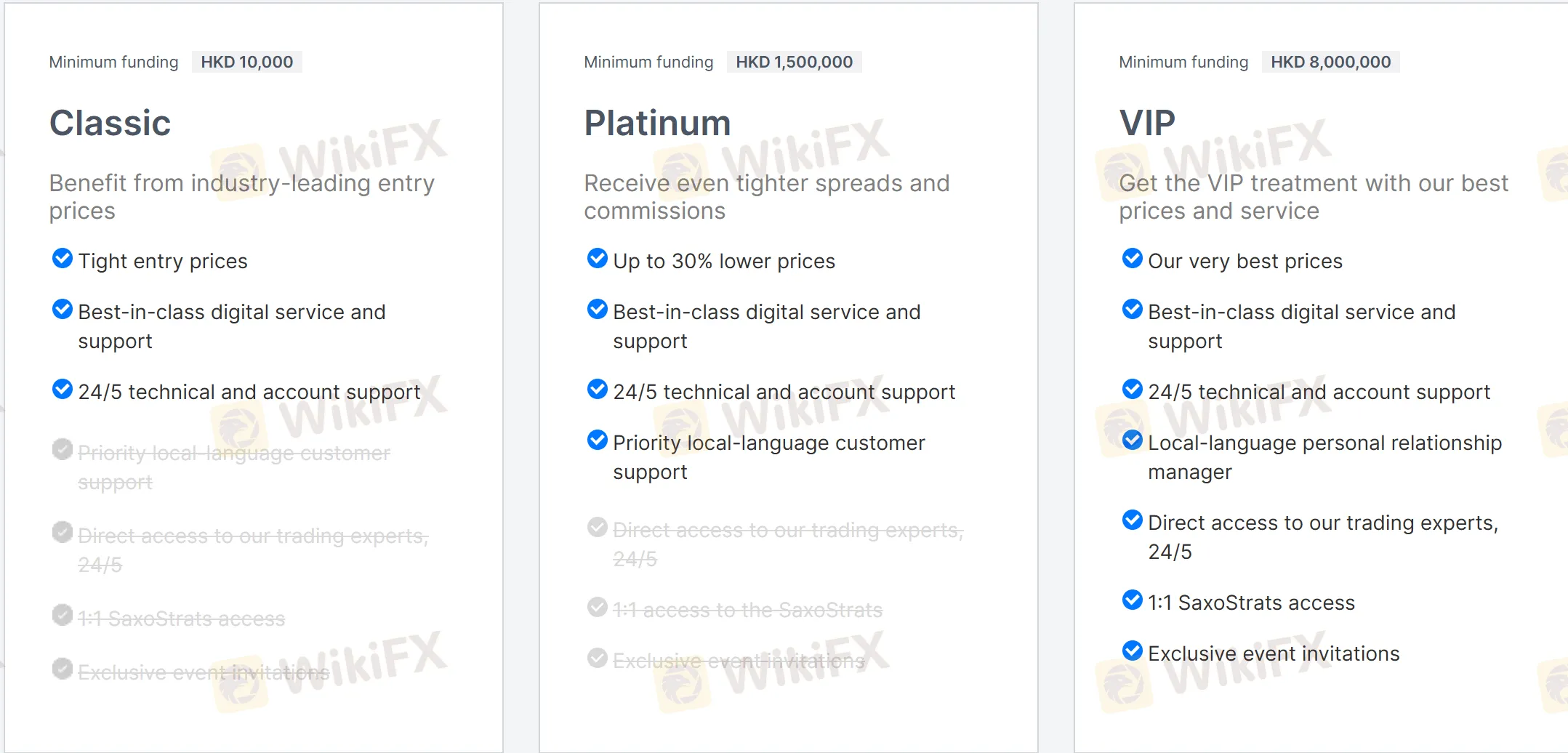

Saxo offers a range of account types designed to suit the different needs of its clients. The account types offered by Saxo are:

| Individual Account Type | Min Deposit |

| Classic | HKD 10,000 |

| Platinum | HKD 1,500,000 |

| VIP | HKD 8,000,000 |

| Corporate Account Type | Min Deposit |

| Classic | USD 100,000 |

| Platinum | HKD 1,500,000 |

| VIP | HKD 8,000,000 |

Each account type has its own unique features and benefits, such as lower pricing, higher leverage, and dedicated account managers. Saxo also offers a free demo account (20 days with $100,000 virtual fund) for clients to practice trading before committing to a live account.

It takes only about five minutes and a short online form to open an account. Clients will need to submit the standard verification documents required by KYC and AML rules, but the procedure should be quick and easy, and they will have access to their account in minutes.

Saxo offers leverage up to 1:100 for forex trading. Professional clients are entitled to leverage of 1:40 for the primary index, 1:33 for the secondary index, 1:33 for gold, 1:10 for equities, and 1:25 for commodities. Retail clients are entitled to leverage of 1:20 for the primary index, 1:10 for the secondary index, 1:20 for gold, 1:5 for equities and 1:10 for commodities.

However, the maximum leverage may vary depending on the instrument being traded and the client's location. It is important to note that trading with high leverage carries a higher level of risk, and traders should always exercise caution and use risk management strategies.

Saxo offers variable spreads, which means that the spreads can change depending on market conditions. The typical minimum spreads for popular instruments are as follows:

EUR/USD: 0.4 pips

USD/JPY: 0.6 pips

GBP/USD: 0.9 pips

AUD/USD: 0.6 pips

USD/CHF: 1.2 pips

USD/CAD: 1.5 pips

Saxo also charges commissions on some products, including stocks, ETFs, and futures. The commission fees vary depending on the specific market and the size of the trade. Commissions start from $1 on US stocks, US listed ETFs and futures. Bonds commissions start at 0.05%, listed options commissions start as low as $0.75 per contract, and mutual funds commissions are $0 for custody and platform fees.

Saxo offers its own proprietary trading platform called SaxoTraderGO. It is a web-based platform that can be accessed from any device with an internet connection. In addition, Saxo also offers SaxoTraderPRO, a desktop-based trading platform that is designed for advanced traders who require additional functionality.

SaxoTraderGO is highly customizable, allowing traders to arrange the interface to suit their preferences. It provides access to a wide range of trading tools and features, including charting tools, technical analysis indicators, and news feeds. The platform also includes a comprehensive range of order types, including market, limit, stop, and trailing stop orders.

SaxoTraderPRO is a professional-grade trading platform that offers advanced trading tools and features. It is designed for active traders and includes a range of tools that allow traders to monitor multiple markets and instruments simultaneously. The platform also includes advanced charting tools and a range of order types, including conditional orders and algorithmic trading capabilities.

Saxo also offers SaxoInvestor, which is a user-friendly trading platform suitable for beginner investors who are interested in a wide range of asset classes. It provides a simple and intuitive interface with basic research tools and features, making it easy for investors to buy and sell stocks, ETFs, bonds, and mutual funds. However, advanced traders may find the platform's lack of advanced tools and customization options limiting.

Saxo Bank supports several deposit and withdrawal methods, including Online Banking, Electronic Direct Debit Authorization (eDDA), and Bank Transfer (Counter services or ATM).

Overall, Saxo is a multi-asset broker that offers a comprehensive suite of trading tools and services to help traders achieve their investment goals. However, potential clients should carefully consider the fees before opening an account. Also, dont forget check their user reviews on the Internet.

Is Saxo legit?

Yes. It is regulated by ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), AMF (France), CONSOB (Italy), FINMA (Switzerland), and MAS (Singapore).

Does Saxo offer demo accounts?

Yes.

Does Saxo offer the industry-standard MT4 & MT5?

No. Instead, it offers SaxoTraderGo, SaxoTraderPRO, and SaxoInvestor.

What is the minimum deposit for Saxo?

There is no minimum initial deposit to open an account.

Is Saxo a good broker for beginners?

Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Saxo Bank was fined nearly $50M by Denmark’s FSA for anti-money laundering control failures, marking its largest penalty in years.

WikiFX

WikiFX

Saxo Bank holds a strong WikiFX score of 7.76 and maintains top-tier regulation from the UK's FCA and Japan's FSA, confirming its status as a legitimate financial institution. However, a recent spike in 26 complaints suggests traders should be mindful of potential service bottlenecks or strict compliance procedures.

WikiFX

WikiFX

Saxo Bank, established in 2001, is a prominent financial services provider with a significant global footprint. With a high WikiFX Score of 8.02 and an Influence Rank of AA, the broker is one of the more established players in the market. The company operates with a heavy focus on multiple jurisdictions, offering support in over 38 languages.

WikiFX

WikiFX

Copenhagen-based multi-asset online broker SAXO Bank has introduced Margin Financing Accounts (also known as margin lending accounts) in its Singapore entity, SAXO Capital Markets. This new feature allows clients to manage investments purchased via margin lending separately from their other trading and investment assets—bringing enhanced flexibility, transparency, and control to active investors and long-term portfolio builders.

WikiFX

WikiFX

More

User comment

19

CommentsWrite a review

2025-08-12 14:04

2025-08-12 14:04

2025-07-30 15:09

2025-07-30 15:09