User Reviews

More

User comment

19

CommentsWrite a review

2026-03-04 07:10

2026-03-04 07:10

2025-11-19 03:35

2025-11-19 03:35

Score

10-15 years

10-15 yearsRegulated in Australia

Market Making License (MM)

MT4 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Quantity 183

Exposure

Score

Regulatory Index8.22

Business Index8.00

Risk Management Index0.00

Software Index9.81

License Index8.22

Single Core

1G

40G

More

Danger

Danger

Danger

More

Company Name

ACY Securities Pty Ltd

Company Abbreviation

ACY SECURITIES

Platform registered country and region

Australia

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Australia ACY: After setting the stop loss, the slippage was 1,200 pips. The customer service responded that there was a market fluctuation. So what is the use of the stop loss? Who can be in charge of this platform?

ACY Australia is not trustworthy, cheating customers, delaying and not taking responsibility! They say the policy is to report it and make you wait! They also don't say they won't deal with it, they just want the customer to give up. Scoundrels! Shameless!

Australian ACY: The backend directly closed customers' orders, never responded after the promised date, broke promises, and defrauded customers. Pay me back! I can't contact anyone now, and the platform customer service has not responded. It's a black platform and so shameless. Everyone, be careful!

Australia ACY: The background forced liquidation of less than 50% of the positions, and they stole my money to celebrate the 13th anniversary. Please pay me back! Everyone, please stay away from the black platform. I have been a regular customer of ACY. I beared the lag and slowness. They even forced me to liquidate my position. It’s too unscrupulous. You can't keep your word, delaying all the time. You dare not reply! Return my hard-earned money. Return it.

Australian ACY: The current platform is shameless and defrauded me of my money. Now give me a 50% deposit bonus to trick me into depositing money. I can only believe you once. I won’t believe you again. Please stay away.

ACY Securities: The backend automatically closed my locked position, causing a malicious liquidation. I am not the only one. Many people have encountered this problem. Please investigate this kind of platform! You can't cheat people like this. No money for Christmas.

ACY Xiwan International's foreign exchange backend has closed your order, and the problems have not been solved one after another. Now it sends an email saying that the transaction can be rebate. It is so shameless. I can't get the principal. Are you still trading on your platform? ACY is so stupid and has no brains

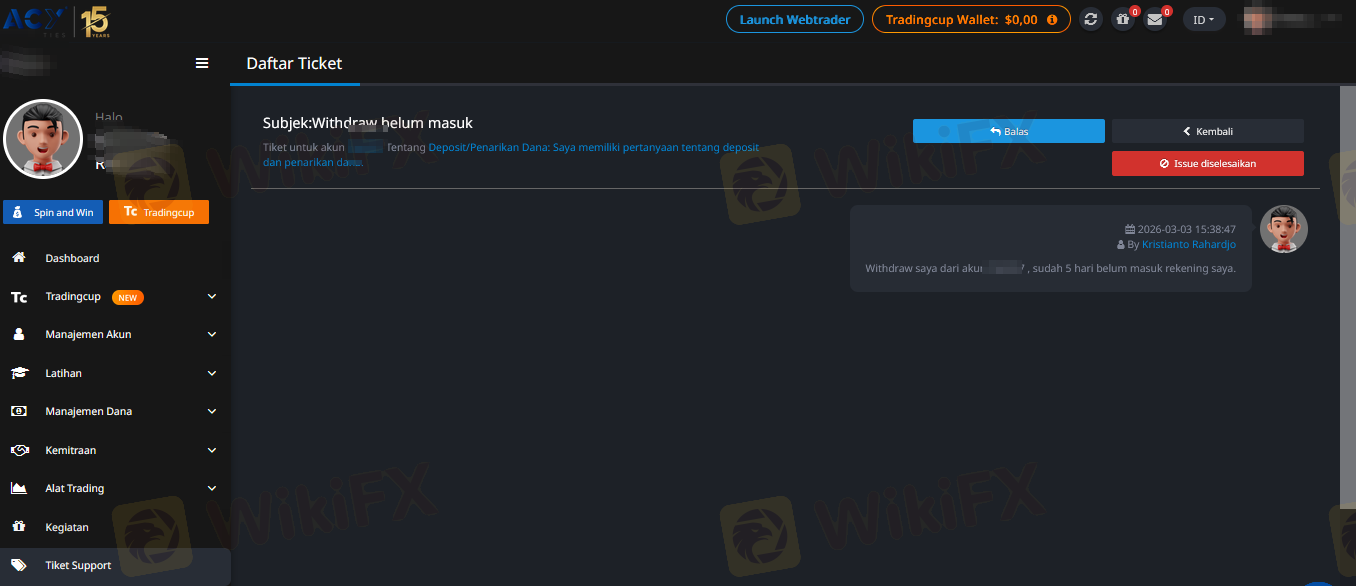

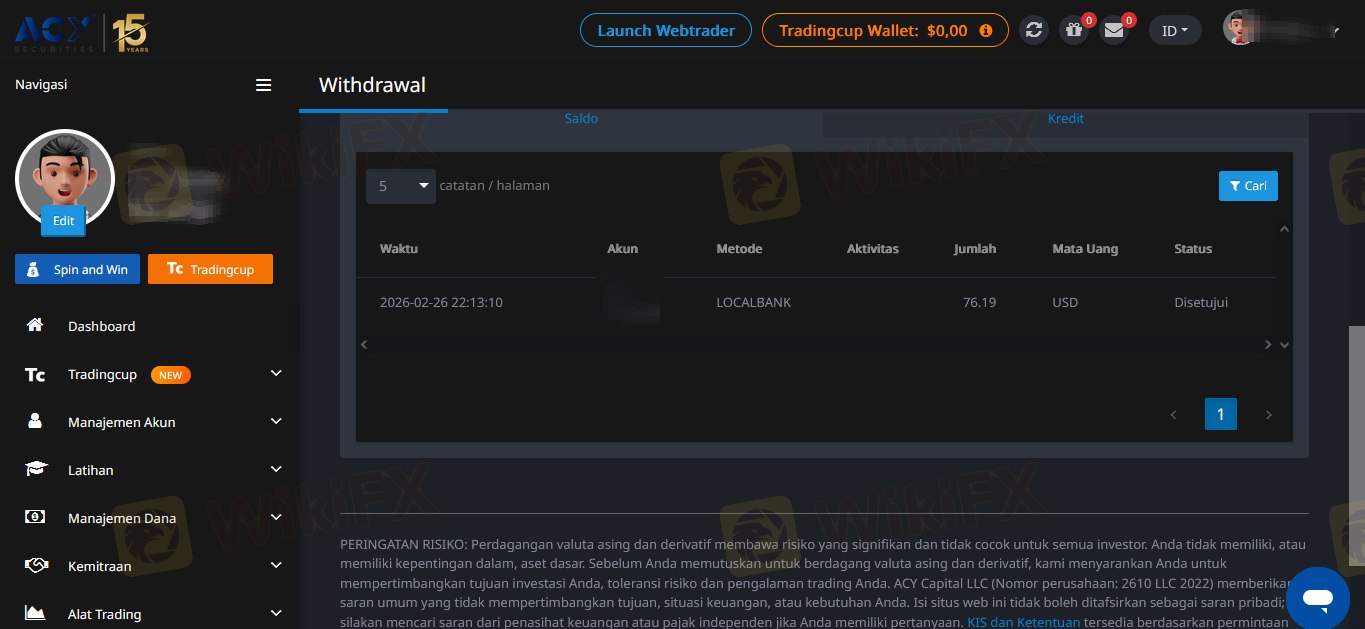

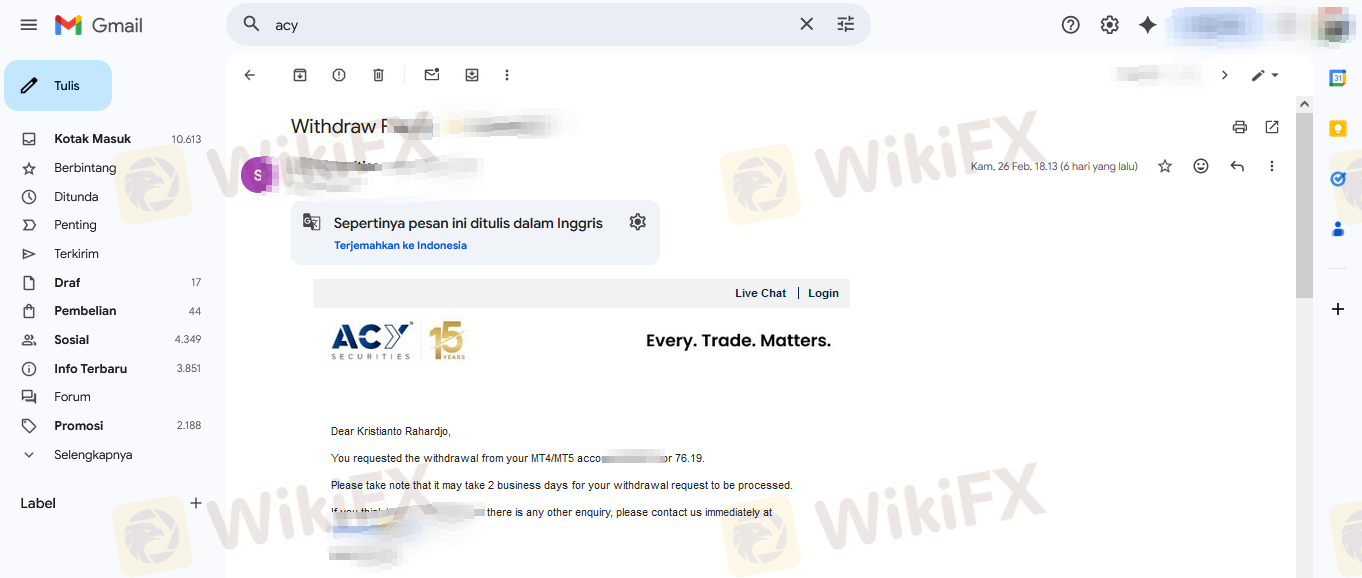

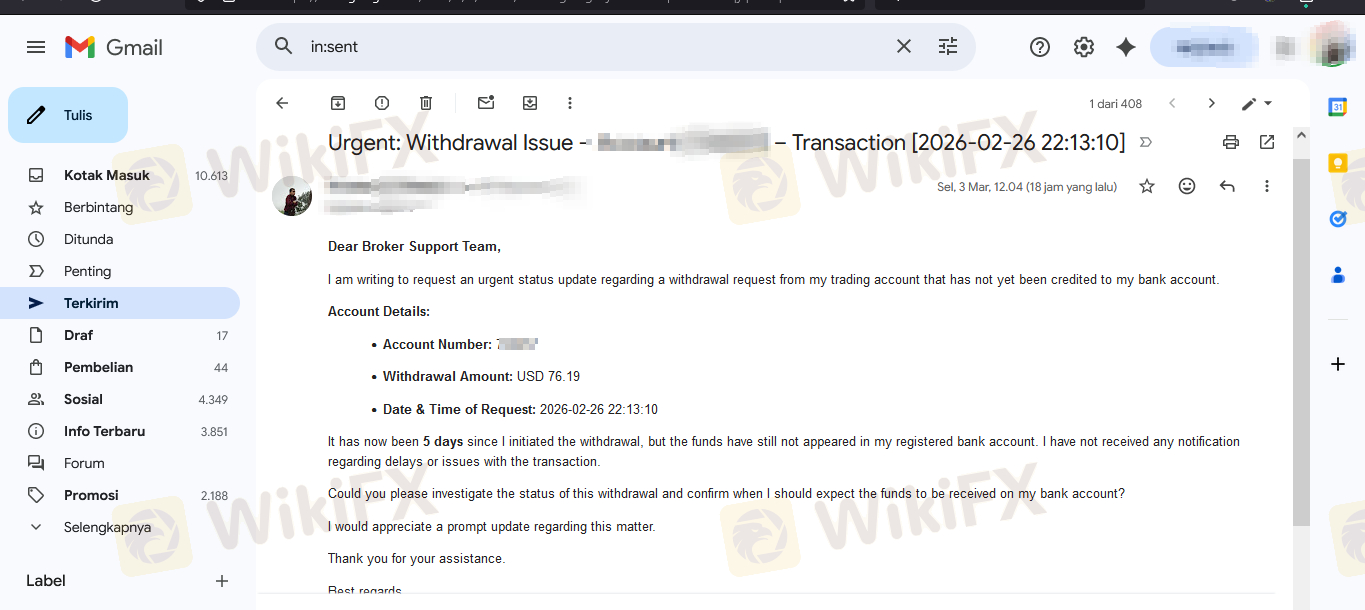

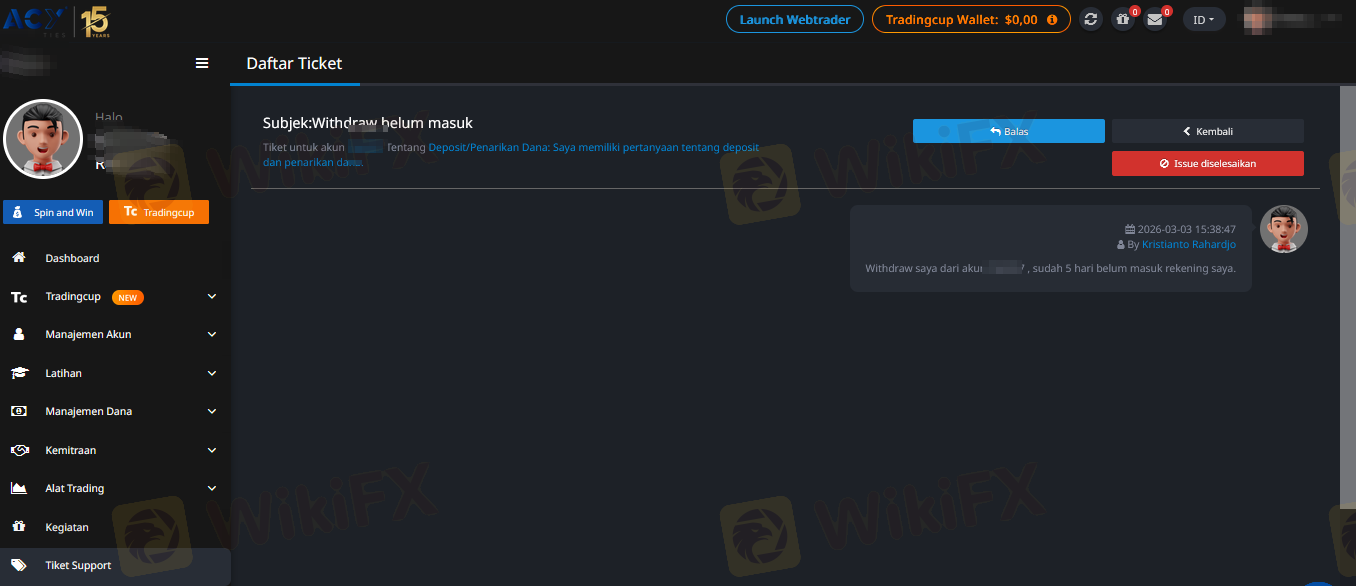

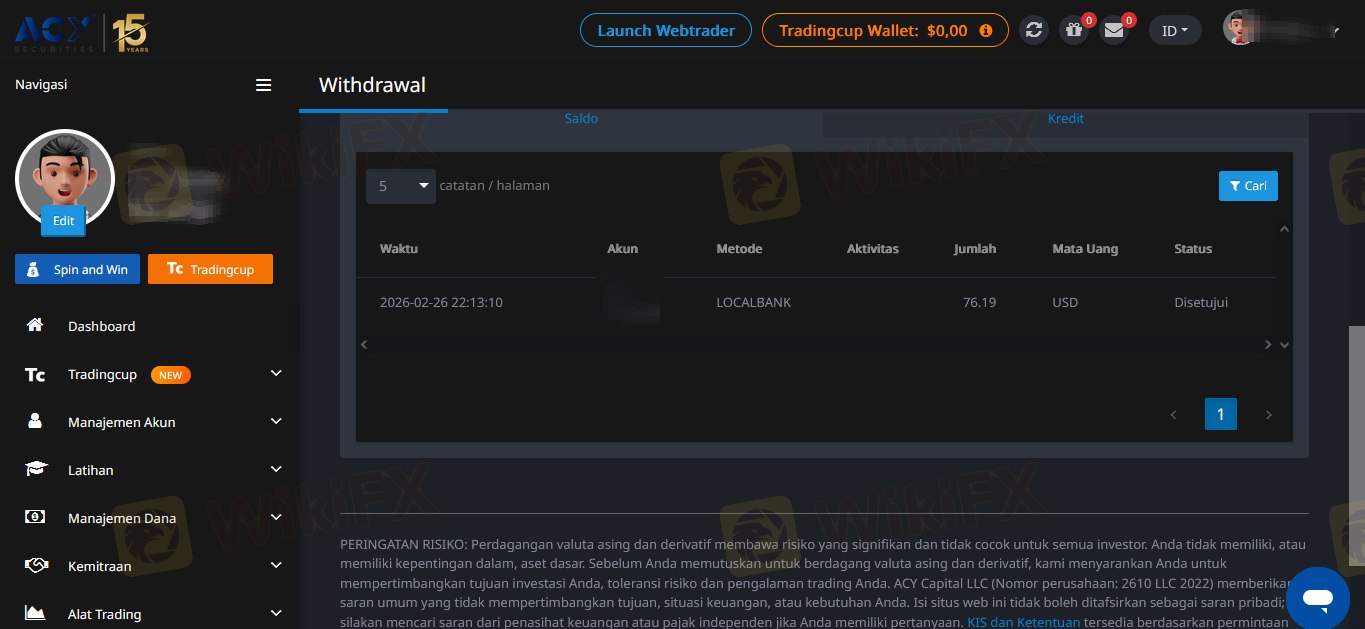

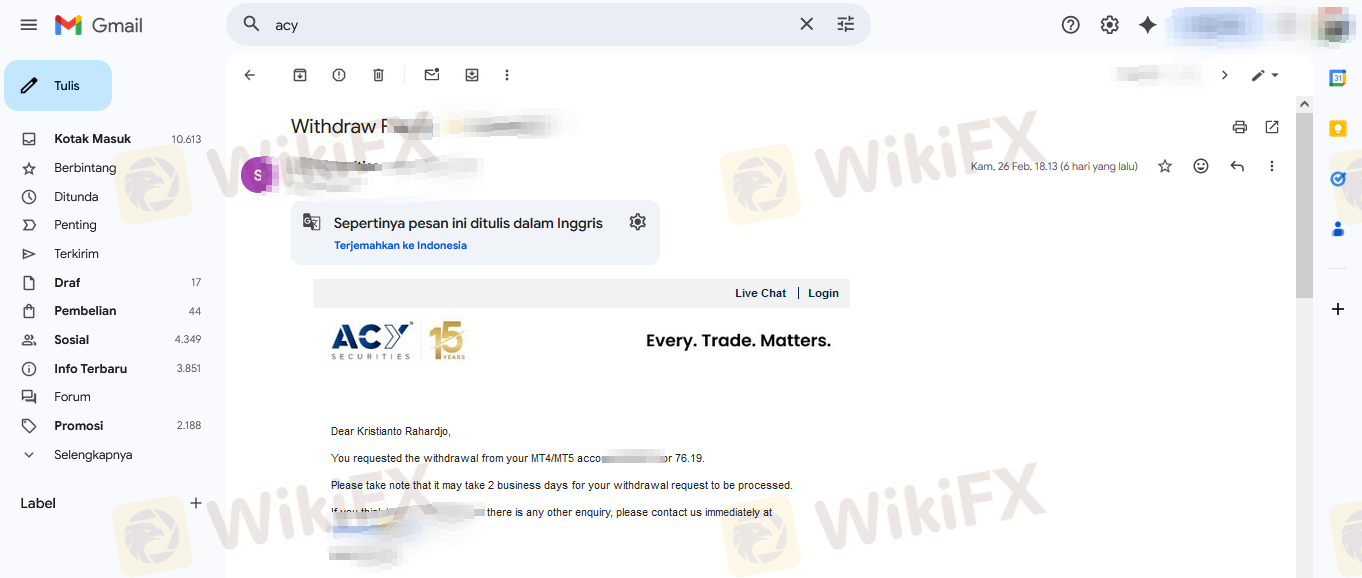

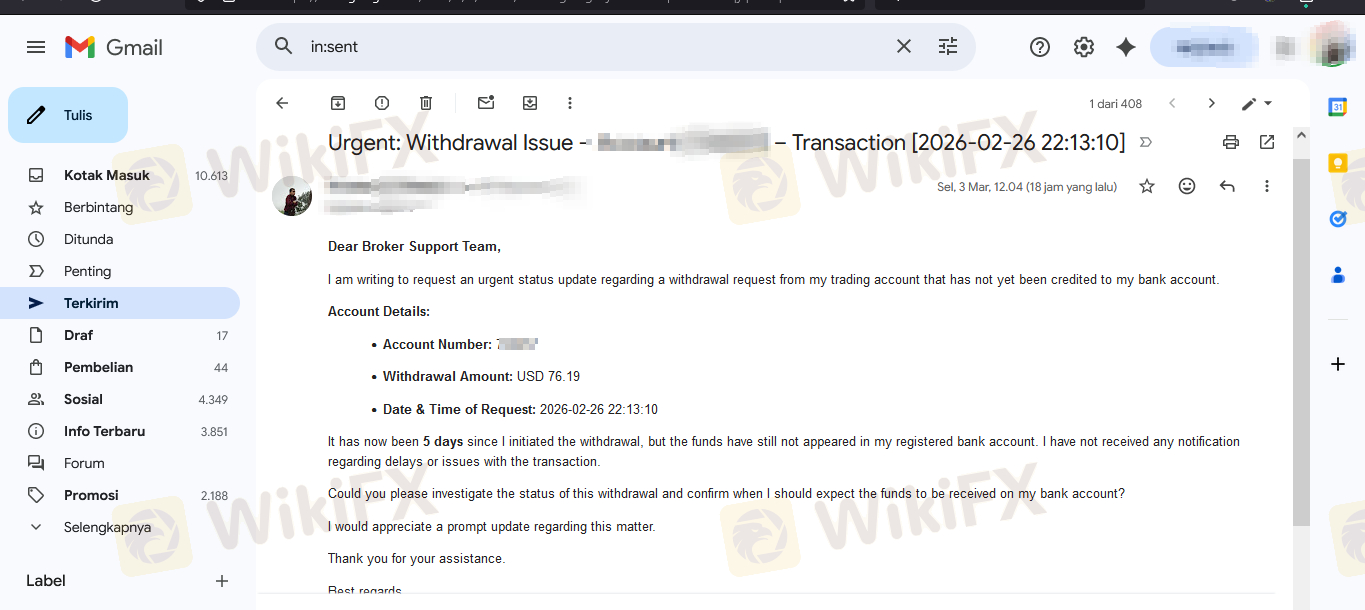

SCAM ALERT: Withdrawal Approved but Funds Never Received I have been waiting for my withdrawal for 6 days now. The status on my dashboard shows "Approved," but the money has never hit my bank account. Withdrawal Date: 2026-02-26 This is a classic sign of a scam broker. They mark it as "Complete" or "Approved" on their website to make it look like they have paid you, but they are holding the funds internally. I have contacted support, but there is no resolution. If you are considering trading with ACY Securities, please stay away. They might let you deposit and trade, but they will not let you withdraw your own money. I request the broker to look into this immediately and release my funds. I will update this review once the money is in my hand, but until then, consider this a warning.

The withdrawal problem is not solved. I need to make another deposit transaction before I can withdraw the money. I have to complete hundreds of transactions to withdraw my money. There are so many requirements. It is a scam platform.

Australia ACY: My lock order was maliciously closed. It has been several months and it has not been processed yet. They keep saying that it is being processed! Now they are still trying to trick me into depositing money and getting bonuses. ACY liar. You are a scammer.

Australia ACY: The freeze lasted for more than 90 seconds. The customer service responded that it was normal. The platform said the spread was 23 per lot for spot XAU/USD. The spread in real trading was more than 35. The actual situation was different from what was said. The customer service still said it was normal.

I added the ACY Securities platform as a third platform to use, choosing again an Australian platform with over 10 years of history. Unexpectedly, it was a tragedy. On the 1st of October, I was informed that I was violating rules and taking advantage of the price disparity between the base futures market and CFD market, and using technical means to carry out a large number of scalping arbitrage operations. After communication with the account manager and senior management, the boss stated: my orders were placed at the same time as some relevant accounts in Japan, who have admitted to their arbitrage, so ACY determined that we are in collusion, and thus casually labeled me, only willing to return my initial investment? Firstly, where did these Japanese accounts come from? Can you provide relevant proof or even IP location? Secondly, how can you determine collusion with them in the global forex market trading, are all orders placed at this time period colluding? Thirdly, I have not seen any evidence provided by you, however, I have provided various data to your ACY platform to prove that I am a trader who trades autonomously. I am very confused, being an Australian platform like ICMARKETS & FPMARKET that I have traded with for many years, I have never encountered such a situation. How can such a malevolent platform still be deeply planted in the market for more than 10 years, needing to add a large amount of funds before being willing to give customers a withdrawal? They want to give you a withdrawal, they will give you a withdrawal. If they don't want to let you withdraw, they will randomly label you as scalping arbitrage, wiping out your profits. After communication, they restore it, but the conditions for restoration require you to add funds. If you don't add funds, they hide your backend account! Hidden account: 1000033496 The funniest thing is that ACY Securities deems over 5000 USD as a large withdrawal, which must be approved by the boss. If the boss doesn't let you withdraw, they can arbitrarily label you as scalping!

What kind of rogue operation is this? Aren't inventory fees supposed to be fixed? Why am I being told that the inventory fee calculation is incorrect when I try to withdraw? How can one trade under these conditions? Stay away from such garbage platforms.

During the period 2023/12/04 01:28 - 01:33 (GMT+2), the XAU/USD prices provided by ACY are 2185 and 2195. During that time, I checked the prices at other brokers and they were all normal, below 2150. Such an outrageous price caused my account to be liquidated. I lost a total of about $8,940.

Australian ACY deletes the work order record scoundrelly and does not reply! I am helpless when I encounter such a platform. They are not afraid of being exposed, not afraid of being scolded, not worried about public opinion, they don't care about anything, they just want to defraud users of their money! What else can be done? What I can do is to expose them.

Not long ago, a friend said that he lost money while trading forex on ACY and no longer wanted to continue trading. Now he wants to withdraw money, but can't. Many people around me now believe that ACY is a fraudulent platform. The reasons given by the platform are as follows: first, the withdrawal method is wrong, second, the withdrawal information is wrong, and third, the platform's deposit and withdrawal channels are under forex controls. I think ACY did it on purpose. Among the forex fraudulent platforms, this kind is called a Ponzi scheme, which means you get the money and run away. If an investor encounters a forex platform that refuses to withdraw money, the first thing that comes to mind is to contact the regulatory department of the forex platform to lodge a complaint. If the forex platform accepts stricter supervision, investors should be able to get their funds back. But in most cases, such fraudulent platforms are not regulated, and investors can only resolve them through legal channels. But most of the time, nothing happens in the end. For example, on the ACY platform, most investors currently have not withdrawn their funds. Forex is a very popular investment project nowadays. More and more newcomers are blindly entering the investment market, making the forex a target for scammers. The endless emergence of black platforms has turned the forex market into a mess! Moreover, these mixed platforms are constantly using new tricks to deceive investors, so that investors will fall into the trap if they are not careful! Just like my friend's withdrawal from the ACY forex platform was rejected. At first, the platform blamed the agent's account for being abnormal, but the agent seemed to have "disappeared", and then the platform customer service could not be contacted, and even There is no way to open the official website! In the end, investors investigated and found that this was actually a platform that defrauded investors of their funds! In fact, for investors, no matter what investment they make, the choice of platform is the top priority! After all, many investors now go bankrupt because they mistakenly entered the black platform! So in the face of scams under the guise of forex trading platforms, how can we effectively avoid such platforms with unsafe factors when there is no way to identify the platform as a black platform? Nowadays, black platforms use false propaganda to attract investors to deposit money and use any means to obtain their hard-earned money. Can investors just let it be at their mercy? In fact, you can be more careful: first of all, many black platforms currently do not have forex trading licenses. They can only steal the licenses of formal forex platforms, buy a foreign domain name, register a similar broker name, and clone all the information from the formal platform. It is difficult to distinguish between true and false. Secondly, I mentioned above that another type of black platform is purely a case of fraud, which is to register a shell company with a similar name, claiming to be funded by a foreign central bank, or a regular platform, and hook up a number of internationally renowned securities firms. , investment bank investment, subject to state supervision, in fact, this information is false.

| ACY SecuritiesReview Summary | |

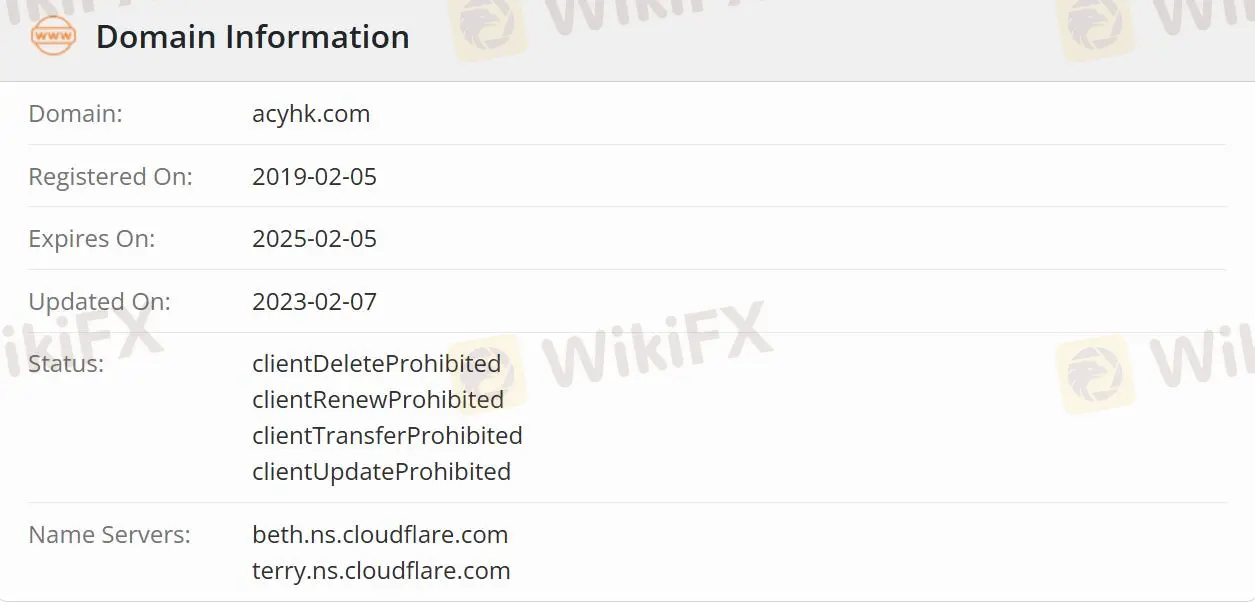

| Founded | 2019-02-05 |

| Registered Country/Region | Australia |

| Regulation | Regulated (ASIC) |

| Market Instruments | Forex, Commodities, Indices, Cryptocurrencies, ETFs, Shares, Precious Metals, Futures |

| Demo Account | ✅ |

| Leverage | Up to 1:5000 |

| Spread | From 0.0 pips |

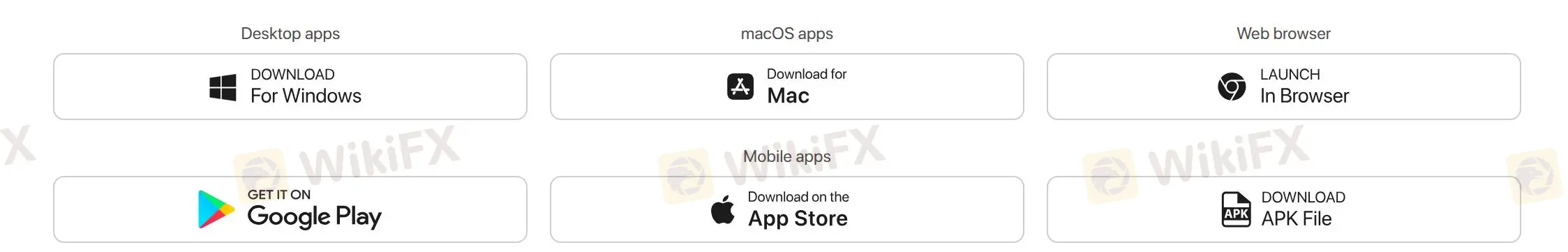

| Trading Platform | LogixTrader(Web-based), MT4/MT5(Desktop, macOS, Web, Mobile) |

| Min Deposit | $50 |

| Customer Support | Phone: 1300 729 171(Australia), +612 9188 2999(International) |

| Email: support@acy.com | |

| Facebook, YouTube, Twitter, Instagram, LinkadIn, TikTok | |

| Live Chat | |

ACY Securities is a broker that provides traders access to various opportunities across global financial markets, including forex, commodities, indices, cryptocurrencies, ETFs, shares, precious metals, and futures. The broker also offers up to 5000x leverage and different accounts. The minimum spread is from 0.0 pips, and the minimum deposit is $50. Traders can also access the popular MT4 and MT5 trading platforms through ACY Securities.

| Pros | Cons |

| Regulated (AUS) | No 24/7 customer support |

| MT4/MT5 available | Some negative voices: scams |

| Demo account available | |

| 2200+ instruments |

ACY Securities is authorized and regulated by the Commonwealth of Australia Regulatory Authority(AUS), with License No. 000403863 and 000474738 and the License Type Market Making(MM) and Straight Through Processing(STP), making it safer than unregulated.

ACY Securities offers 2,200+ instruments, including 60 FX pairs, 20 Indices, 12 Metals, 9 Cryptos, 6 Commodities, 2 Oil, over 1600 share CFDs, and more.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ✔ |

| Shares | ✔ |

| Precious Metals | ✔ |

| Futures | ✔ |

ACY Securities has 3 account types: Standard, ProZero, and Bespoke. Traders who want low spreads and deposits can choose a ProZero account, while those with a sufficient budget can open a Bespoke account.

In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only. Swap-Free Account, or Islamic Account, tailored for traders adhering to Islamic principles against interest.

| Account Type | Standard | ProZero | Bespoke |

| Initial Minimum Deposit | $50 | $200 | $1000 |

| Minimum Trading Volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

| Spreads From | Variable | 0.0 Pips | 0.0 Pips |

| Commission starts from | Zero | $3/Lot Per Side | $2.5/Lot Per Side |

| Leverage up to | 1:5000 (via LogixTrader) | 1:5000 (via LogixTrader) | 1:500 |

| Swap Free Account | Yes | No | No |

The spread starts from 0.0 pips and the commission starts from zero. The lower the spread, the faster the liquidity.

The maximum leverage is 1:5000 meaning that profits and losses are magnified 5000 times.

ACY Securities offers a Web-based LogixTrader. Traders can also access MT4 and MT5 compatible Desktop, macOS, Web, and Mobile versions through ACY Securities.

Copy trading is also available, a way for inexperienced traders or followers who dont have the time to do extensive research or want to diversify their portfolio to copy the trades of experienced traders (also known as money managers or copy trading gurus).

| Trading Platform | Supported | Available Devices | Suitable for |

| LogixTrader | ✔ | Web-based | All |

| MT4 | ✔ | Desktop, macOS, Web, Mobile | Junior traders |

| MT5 | ✔ | Desktop, macOS, Web, Mobile | Experienced traders |

The initial Minimum Deposit must be $50 or above. ACY Securities accepts MasterCard, VISA, NETELLER, UnionPay, Skrill, and more for deposit and withdrawal. Traders get three free withdrawals per month. After their third withdrawal in the calendar month, traders will be charged $25 in your base currency per withdrawal. Withdrawal processing time within 24 hours.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

WikiFX

WikiFX

Our investigation into ACY Securities reveals alarming patterns of arbitrary profit deductions and abnormal price spikes triggering forced liquidations. While holding Australian licenses, the broker faces unauthorized warnings from European regulators and severe complaints regarding access restrictions and withheld funds.

WikiFX

WikiFX

ACY Securities froze a Singapore trader’s $40k profits over “arbitrage.” Read the full case and check if your funds are safe. Learn more now.

WikiFX

WikiFX

ACY Securities expands into Colombia, boosting its LatAm presence with instant crypto withdrawals and FSCA-backed growth in South Africa.

WikiFX

WikiFX

More

User comment

19

CommentsWrite a review

2026-03-04 07:10

2026-03-04 07:10

2025-11-19 03:35

2025-11-19 03:35