User Reviews

More

User comment

14

CommentsWrite a review

2023-12-13 21:44

2023-12-13 21:44

2023-12-12 18:00

2023-12-12 18:00

Score

Score

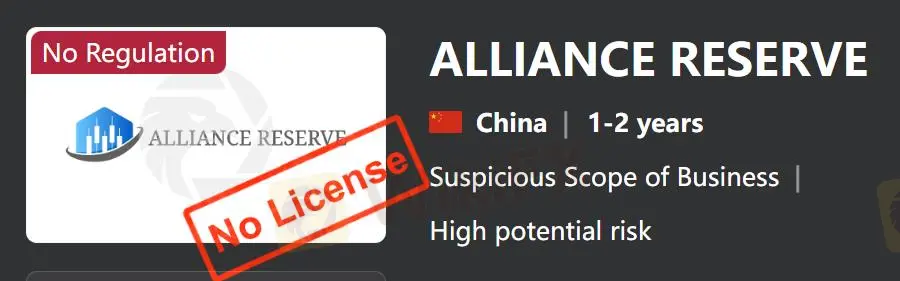

Regulatory Index0.00

Business Index5.83

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

| ALLIANCE RESERVE | Basic Information |

| Company Name | ALLIANCE RESERVE |

| Headquarters | China |

| Regulations | Not regulated |

| Account Types | VIP, Platinum, Gold, Silver,Basic |

| Minimum Deposit | $250 |

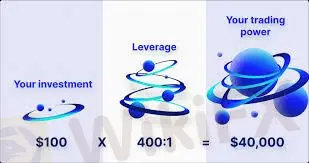

| Maximum Leverage | 1:400 |

| Spreads | From 1.2 pips |

| Customer Support | Email (support@alliancereserve.email) |

ALLIANCE RESERVE, a China-based company, offers a range of account types catering to various client needs, including VIP, Platinum, Gold, Silver, and Basic. While striving to provide quality services, potential clients should note that the company operates without regulatory oversight.

ALLIANCE RESERVE operates without the oversight of regulatory bodies, which may raise concerns about the company's adherence to industry standards and client protection measures. Prospective clients should exercise caution and carefully assess the potential risks associated with engaging an unregulated entity for their financial needs.

ALLIANCE RESERVE provides a range of account types to accommodate various client needs and offers generous leverage for flexible trading strategies. However, the absence of regulatory oversight may expose clients to potential risks, and users might encounter difficulties when trying to access the company's website.

| Pros | Cons |

|

|

|

|

ALLIANCE RESERVE offers five account types with varying minimum deposit requirements: the VIP Account starting at $250,000, the Platinum Account and Silver Account both requiring a $10,000 minimum, the Gold Account with a $50,000 minimum, and the Basic Account accessible with a $250 minimum deposit.

| Account Type | Minimum Deposit | Maximum Leverage | Spreads |

| VIP Account | $250000 | / | / |

| Platinum Account | $10000 | 1:400 | From 1.2 pips |

| Gold Account | $50000 | 1:300 | From 1.9 pips |

| Silver Account | $10000 | 1:50 | From 2.4 pips |

| Basic Account | $250 | 1:30 | From 3.0 pips |

ALLIANCE RESERVE provides varying levels of maximum leverage depending on the account type: 1:400 for the Platinum Account, 1:300 for the Gold Account, 1:50 for the Silver Account, and 1:30 for the Basic Account. However, the maximum leverage for the VIP Account is not specified.

ALLIANCE RESERVE offers competitive spreads that vary based on the account type. The Platinum Account features spreads starting from 1.2 pips, while the Gold Account spreads begin at 1.9 pips. Silver Account holders can expect spreads from 2.4 pips, and Basic Account spreads start at 3.0 pips. However, the spread information for the VIP Account is not provided.

ALLIANCE RESERVE offers customer support via their designated email, support@alliancereserve.email, which clients can contact for help with inquiries or issues related to their accounts or the firm's offerings.

ALLIANCE RESERVE, a China-based company, offers a range of account types with varying minimum deposits, leverage, and spreads to cater to different client needs. While the firm provides customer support via email, potential clients should be aware that ALLIANCE RESERVE operates without regulatory oversight, which may expose them to potential risks. As such, traders should exercise caution and carefully consider the potential drawbacks before engaging with this unregulated entity for their financial needs.

Is ALLIANCE RESERVE a regulated broker?

No, ALLIANCE RESERVE is not regulated by any financial authority, which may expose clients to potential risks.

What types of accounts does ALLIANCE RESERVE offer?

ALLIANCE RESERVE provides five account types: VIP, Platinum, Gold, Silver, and Basic, each with different minimum deposit requirements and trading conditions.

How can I contact ALLIANCE RESERVE's customer support?

You can reach out to ALLIANCE RESERVE's customer support team by sending an email to support@alliancereserve.email for assistance with any questions or concerns.

What leverage options are available at ALLIANCE RESERVE?

ALLIANCE RESERVE offers varying levels of maximum leverage depending on the account type, ranging from 1:30 for the Basic Account to 1:400 for the Platinum Account.

Are there any issues with accessing ALLIANCE RESERVE's website?

Some users have reported difficulties when attempting to access ALLIANCE RESERVE's website, which is one of the potential drawbacks of using this broker.

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

More

User comment

14

CommentsWrite a review

2023-12-13 21:44

2023-12-13 21:44

2023-12-12 18:00

2023-12-12 18:00