User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Self-developed

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.90

Risk Management Index0.00

Software Index4.37

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

| SWISEINVEST | Basic Information |

| Company Name | SWISEINVEST |

| Headquarters | Saint Vincent and the Grenadines |

| Regulations | Not regulated |

| Account Types | PLATINUM, GOLD, SILVER |

| Maximum Leverage | 300:1 |

| Customer Support | Email (support@swiseinvest.com)Phone Number(+44 2030979990/+17 788193093/+49 20176406500) |

SWISEINVEST is a financial services company headquartered in Saint Vincent and the Grenadines, specializing in providing commission-free CFD trading. Although the company offers a variety of account types—Platinum, Gold, and Silver—designed to meet the needs of different investors, it operates without regulatory oversight.

SWISEINVEST seems to function outside the purview of formal regulatory supervision, indicating it is exempt from the stringent protocols and adherence requirements enforced by financial regulatory bodies. This absence of oversight may suggest increased risk exposure for investors, given the company operates without the legal and ethical frameworks established to safeguard consumers and promote transparency in the financial sector. Prospective investors are advised to proceed with caution and undertake comprehensive research before engaging with unregulated entities.

SWISEINVEST offers a variety of account options and generous, adaptable leverage, catering to diverse user needs. However, it operates without regulatory oversight, potentially increasing risk for traders. Additionally, the platform lacks essential details on minimum deposits, spreads, and trading products for each account type, and users may encounter difficulties accessing the website.

| Pros | Cons |

|

|

|

|

|

SWISEINVEST provides three tiers of account types to cater to different investor needs: Platinum, Gold, and Silver. The Platinum account likely provides the most comprehensive range of services and benefits, targeting high-net-worth individuals or experienced investors seeking premium features. The Gold account serves as a mid-tier option, balancing cost and value, suitable for moderately experienced investors. The Silver account is designed for entry-level investors, offering essential services at a lower cost, making it an accessible choice for those new to investing. Each account type is structured to align with varying levels of investment goals and financial commitment.

| Account Type | Maximum Leverage |

| PLATINUM | 300:1 |

| GOLD | 200:1 |

| SILVER | 100:1 |

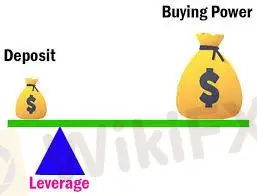

SWISEINVEST offers varied leverage levels tailored to investor experience and risk tolerance across different account types. The Platinum account features the highest leverage at 300:1 for seasoned investors aiming to maximize trading potential. The Gold account provides a moderate leverage of 200:1, ideal for somewhat experienced investors comfortable with higher risks. The Silver account, offering a conservative 100:1 leverage, targeting beginners seeking significant market exposure but with lower risk. Each leverage option is designed to align with the investor's expertise and risk preference.

SWISEINVEST provides comprehensive customer support through multiple channels to ensure client satisfaction and assistance. Investors can reach the support team via email at support@swiseinvest.comfor detailed inquiries and assistance. Additionally, customer support is accessible by phone, offering dedicated lines for different regions: +44 2030979990 for the UK, +17 788193093 for the US, and +49 20176406500 for Germany. This multi-channel approach ensures that clients can receive prompt and effective support tailored to their geographical location.

SWISEINVEST, a CFD trading service provider based in Saint Vincent and the Grenadines, offers differentiated account options—Platinum, Gold, and Silver—with varying leverage levels tailored to investors' experience and risk tolerance. Despite offering robust customer support across multiple communication channels and flexible leverage options, SWISEINVEST's lack of regulatory oversight poses potential risks for traders. Additionally, the platform's deficiency in disclosing key trading conditions such as minimum deposits and spreads could hinder informed decision-making.

What are the different account types offered by SWISEINVEST?

SWISEINVEST provides three account types tailored to various investor needs: Platinum for experienced investors seeking comprehensive features, Gold for mid-level investors balancing cost and value, and Silver for beginners requiring basic services at a lower cost.

What leverage options are available with SWISEINVEST's accounts?

The leverage options vary by account type to suit different risk tolerances and experiences: 300:1 for Platinum accounts, 200:1 for Gold accounts, and 100:1 for Silver accounts, catering respectively to seasoned, moderately experienced, and beginner investors.

Does SWISEINVEST have regulatory oversight?

No, SWISEINVEST operates without formal regulatory oversight, meaning it is not subject to the stringent standards and compliance measures typically enforced in the financial industry, which could pose higher risks for investors.

How can investors contact SWISEINVEST for support?

Investors can reach SWISEINVEST's comprehensive customer support via email at support@swiseinvest.com or by phone, with dedicated lines available for the UK (+44 2030979990), the US (+17 788193093), and Germany (+49 20176406500).

What should potential investors consider before opening an account with SWISEINVEST?

Potential investors should exercise due diligence and consider the risks associated with the lack of regulatory oversight. It's also important to review the account features, leverage options, and the lack of detailed information on trading conditions like minimum deposits and spreads before engaging with SWISEINVEST.

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment