User Reviews

More

User comment

2

CommentsWrite a review

2023-12-20 23:52

2023-12-20 23:52 2023-03-28 17:27

2023-03-28 17:27

Score

5-10 years

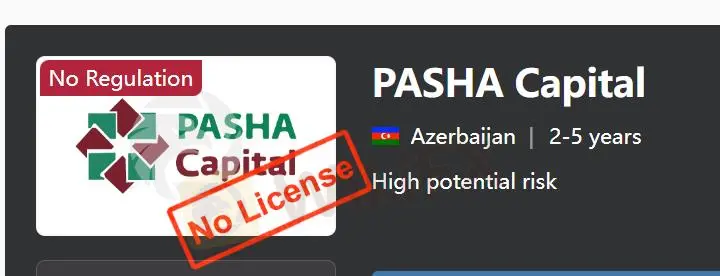

5-10 yearsSuspicious Regulatory License

Self-developed

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.00

Risk Management Index0.00

Software Index4.58

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

PASHA Capital

Company Abbreviation

PASHA Capital

Platform registered country and region

Azerbaijan

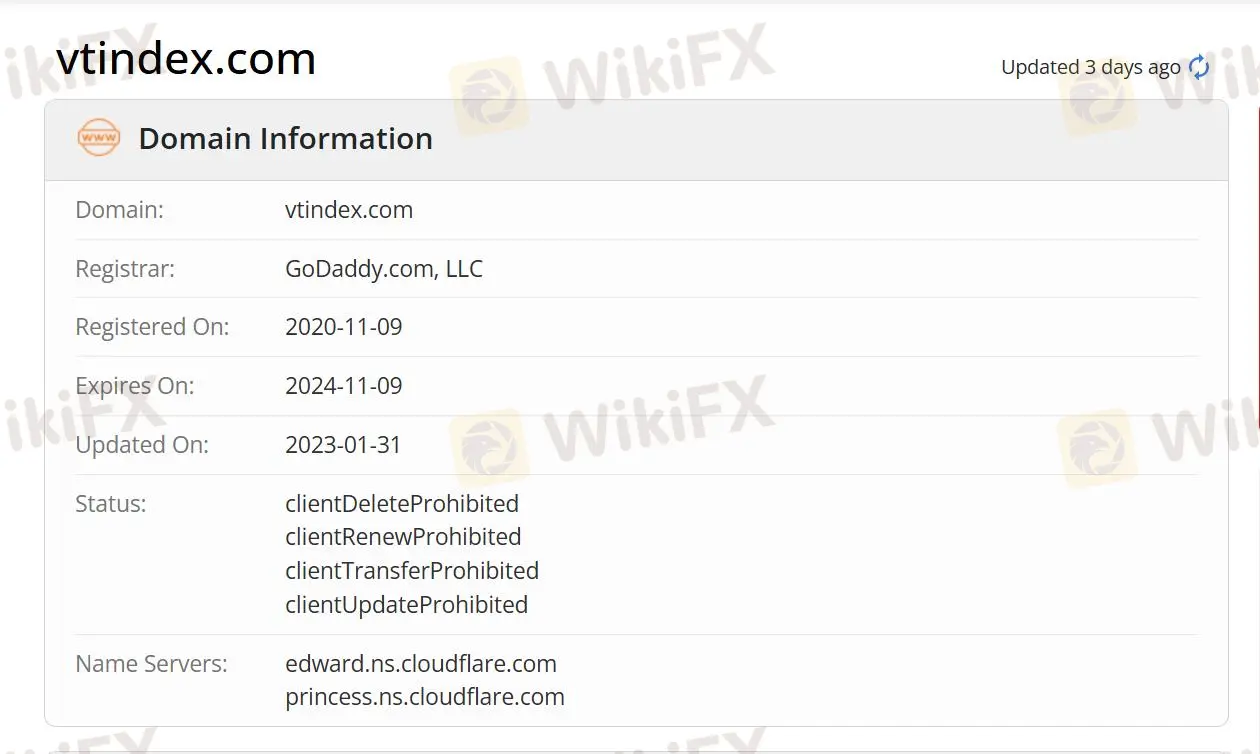

Company website

YouTube

+994 55 226 33 66

Company summary

Pyramid scheme complaint

Expose

| PASHA CapitalReview Summary | |

| Founded | 2012 |

| Registered Country/Region | Azerbaijan |

| Regulation | No regulation |

| Market Instruments | Currency Pairs, Commodities, Precious Metals, Fund Indices, FX, CFDs, futures, indices, metals, energy, share and bond sales |

| Demo Account | Classic Account, Individual Account |

| Leverage | Up to 1:50 |

| Spread | Competitive Spreads of 0.2 pips |

| Trading Platform | the PASHA Capital Trading Platform |

| Min Deposit | $200 |

| Customer Support | Phone: +994 55 226 33 66 |

| Email: office@pashacapital.az | |

| Physical Address: Caspian Plaza, 44 Jafar Jabbarli street, Baku AZ1065, Azerbaijan | |

PASHA Capital, founded in 2012, is a mature brokerage registered in Azerbaijan. The trading instruments it provides cover Currency Pairs, Commodities, Precious Metals and so on. It has competitive spreads. But it is currently unregulated and lacks security.

| Pros | Cons |

| Competitive Spreads of 0.2 pips | No regulation |

| Various Trading Products | Limited Trading Platform Options (the sole option available) |

| Diversified Services | Limited Leverage Options (1:50) |

| Social Media Presence |

It is clear that PASHA Capital, which was registered in 2012 but is currently unregulated, has high potential risk.

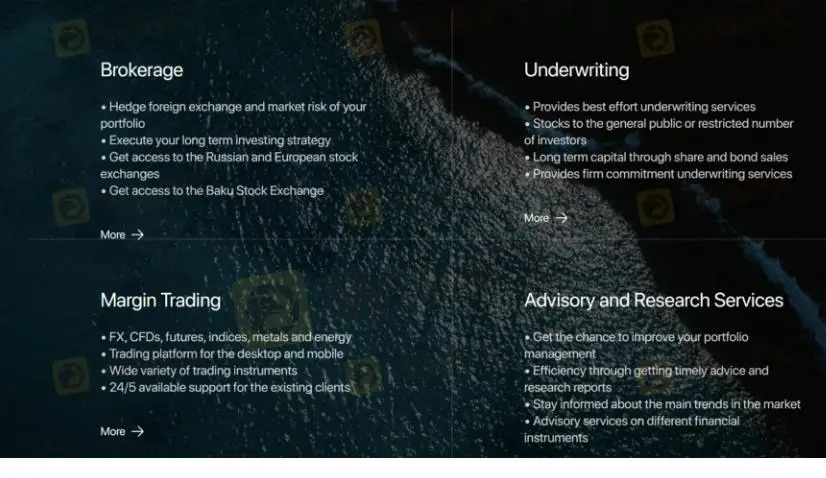

PASHA Capital provides a wide range of services and products to cater to their clients' needs. PASHA offer trading in over 2000 currency pairs and have options in fund indices, which consist of a selection of securities from specific segments of the market.

PASHA also offers consulting and research services. By subscribing, you can get support from a professional team to improve your portfolio management efficiency and stay updated on key trends in the market and specific industries.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Funds | ✔ |

| Bonds | ✔ |

| Indices | ✔ |

| Futures | ✔ |

| Precious metals & Commodities | ✔ |

| Cryptocurrencies | ✔ |

| CFDS | ❌ |

| Derivatives | ❌ |

| Options | ❌ |

PASHA Capital offers two account types with some similarities and key differences:

Classic Account:

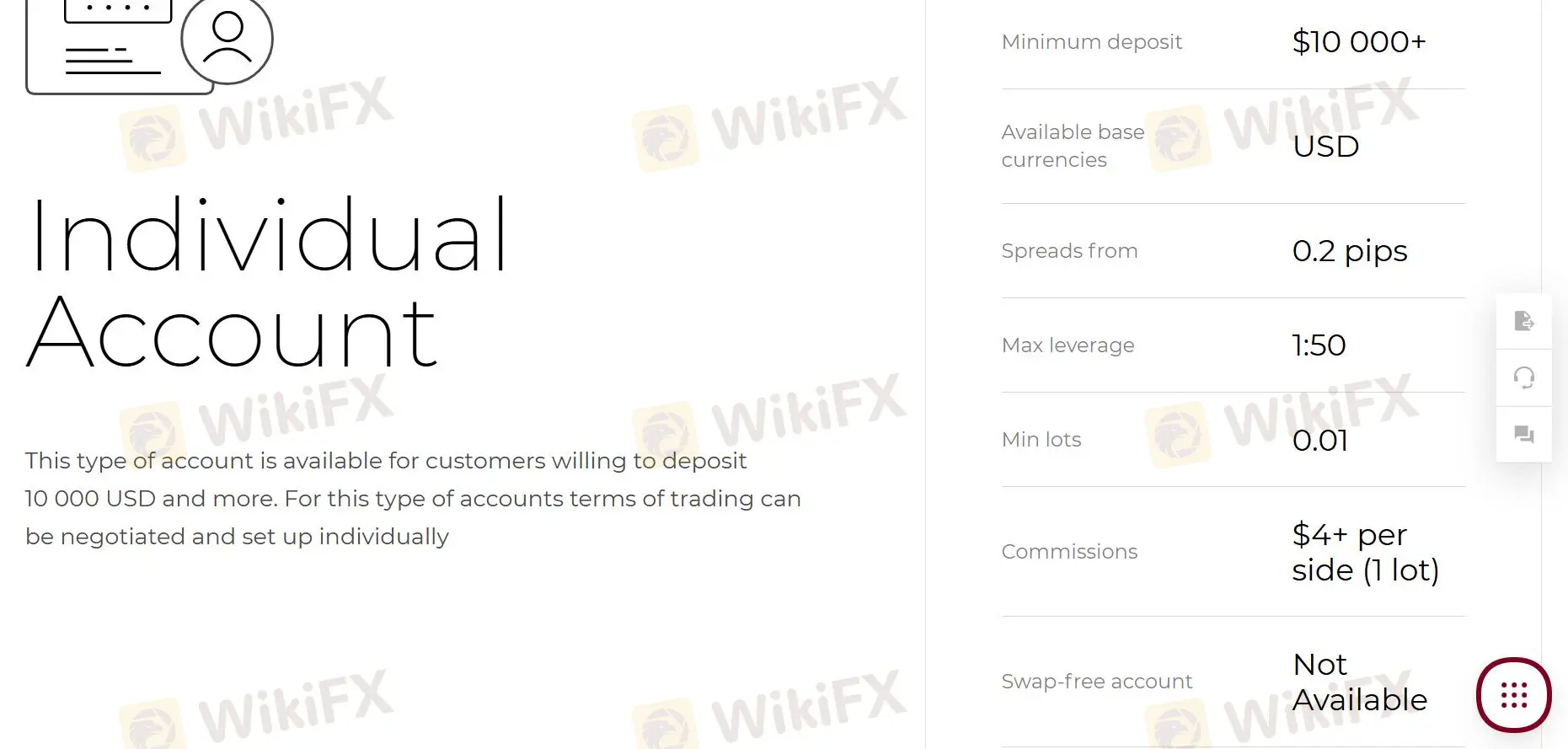

Individual Account:

Both accounts have the same minimum spreads ($200), leverage options (1:50), and swap fees. The classic account is great for newcomers, while the individual account is designed for more experienced investors, providing a more personalized experience and potentially lower commissions.

| Account Types | Classic Account | Individual Account |

| Minimum Deposit | $200 | $10,000 |

| Spread from | 0.2 pips | 0.2 pips |

| Leverage | 1:50 | 1:50 |

| Min lots | 0.01 | 0.01 |

| Commissions | $7+ per side (1 lot) | $4+ per side (1 lot) |

At PASHA Capital, the fees for both account types include spreads, commissions, and swap fees. The minimum spread starts at 0.2 pips.

For commissions:

Both accounts also have swap fees, as outlined in the account details.

PASHA's trading platform is PASHA Capital Trading Platform, which supports traders on the web and desktop.

More

User comment

2

CommentsWrite a review

2023-12-20 23:52

2023-12-20 23:52 2023-03-28 17:27

2023-03-28 17:27