User Reviews

More

User comment

1

CommentsWrite a review

2024-01-09 18:13

2024-01-09 18:13

Score

5-10 years

5-10 yearsRegulated in Taiwan

Forex Trading License (EP)

Self-developed

Suspicious Scope of Business

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.15

Business Index7.45

Risk Management Index9.69

Software Index6.43

License Index7.15

Single Core

1G

40G

Sanction

More

Company Name

國泰期貨股份有限公司

Company Abbreviation

Cathay Futures

Platform registered country and region

Taiwan

Company website

Company summary

Pyramid scheme complaint

Expose

| Cathay Futures Review Summary | |

| Founded | 1993 |

| Registered Country/Region | Taiwan |

| Regulation | Taipei Exchange (TPEx) |

| Market Instrument | Futures |

| Trading Platform | / |

| Customer Support | Tel: 02-7752-1699 |

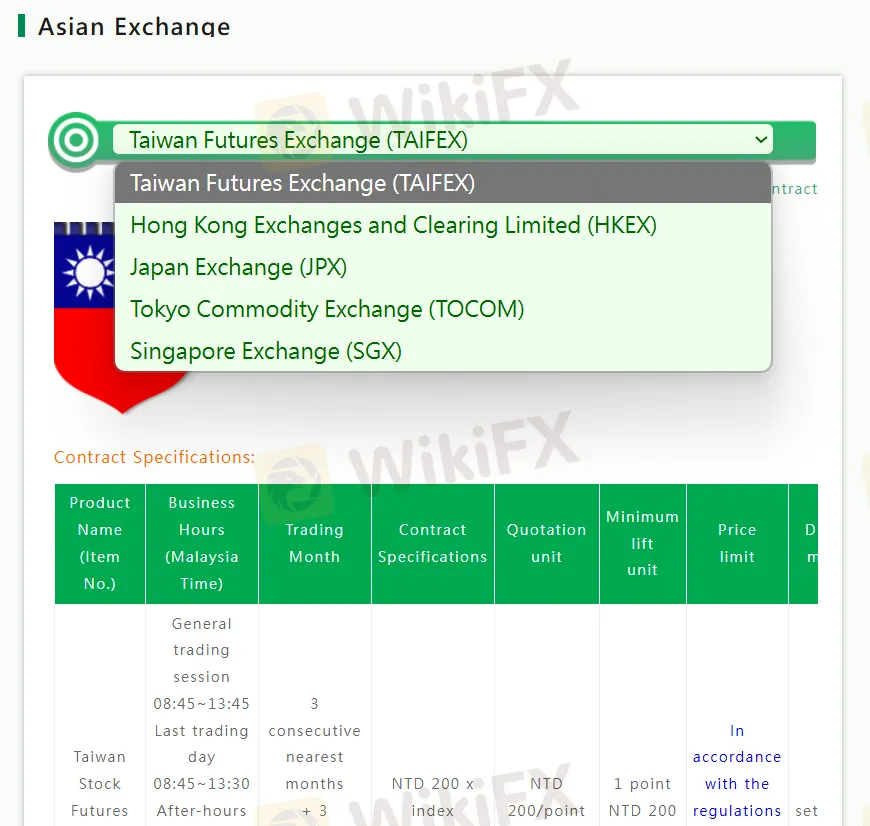

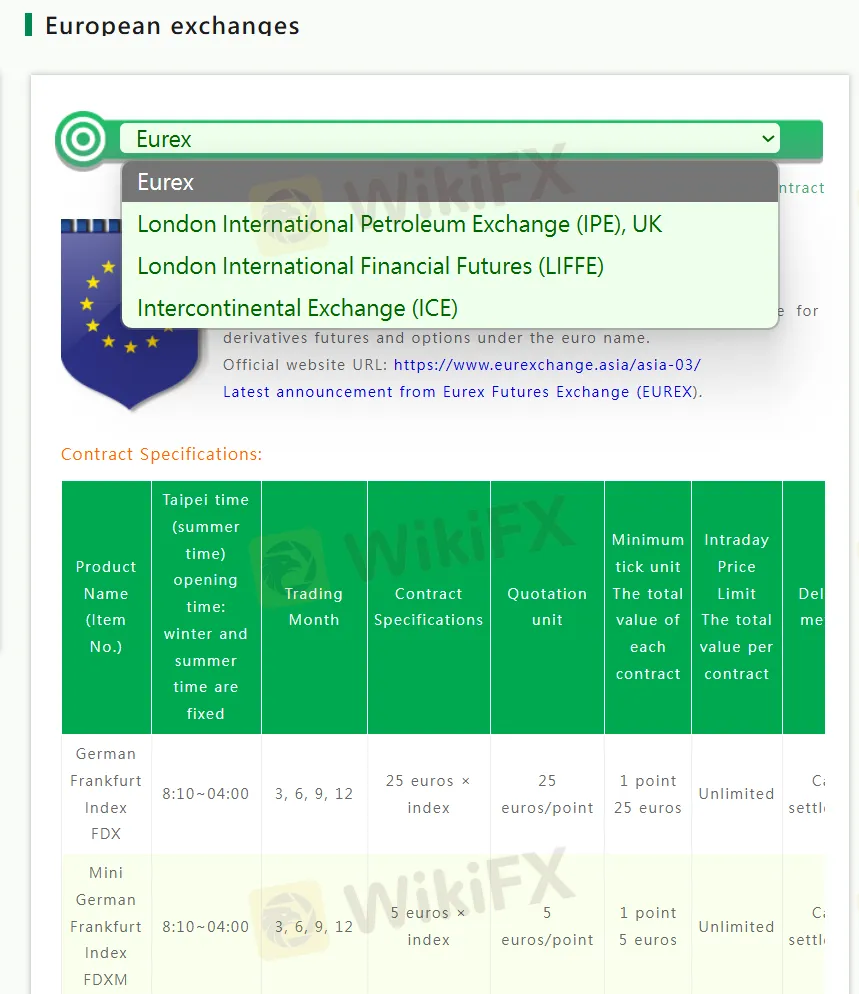

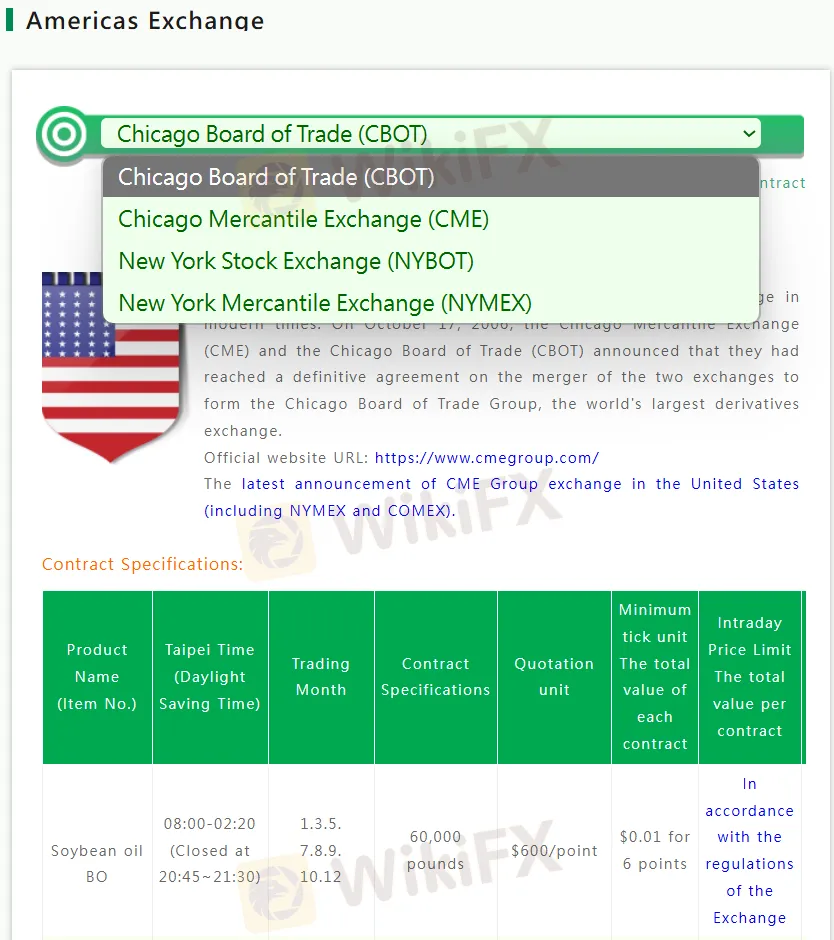

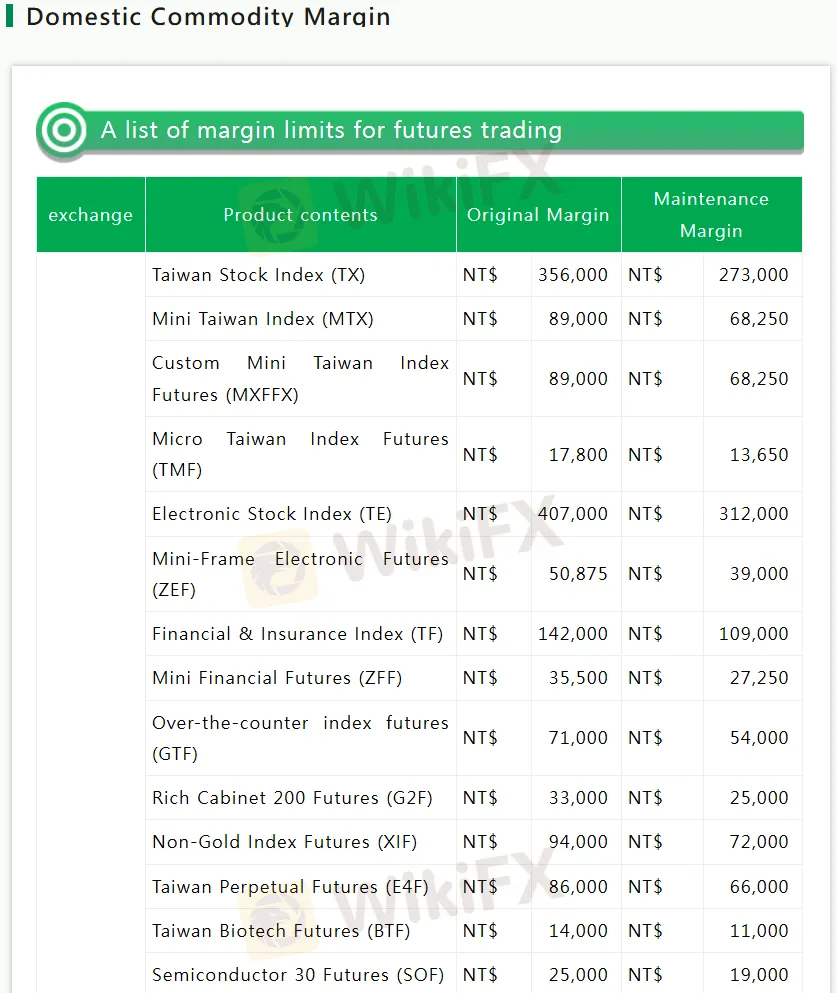

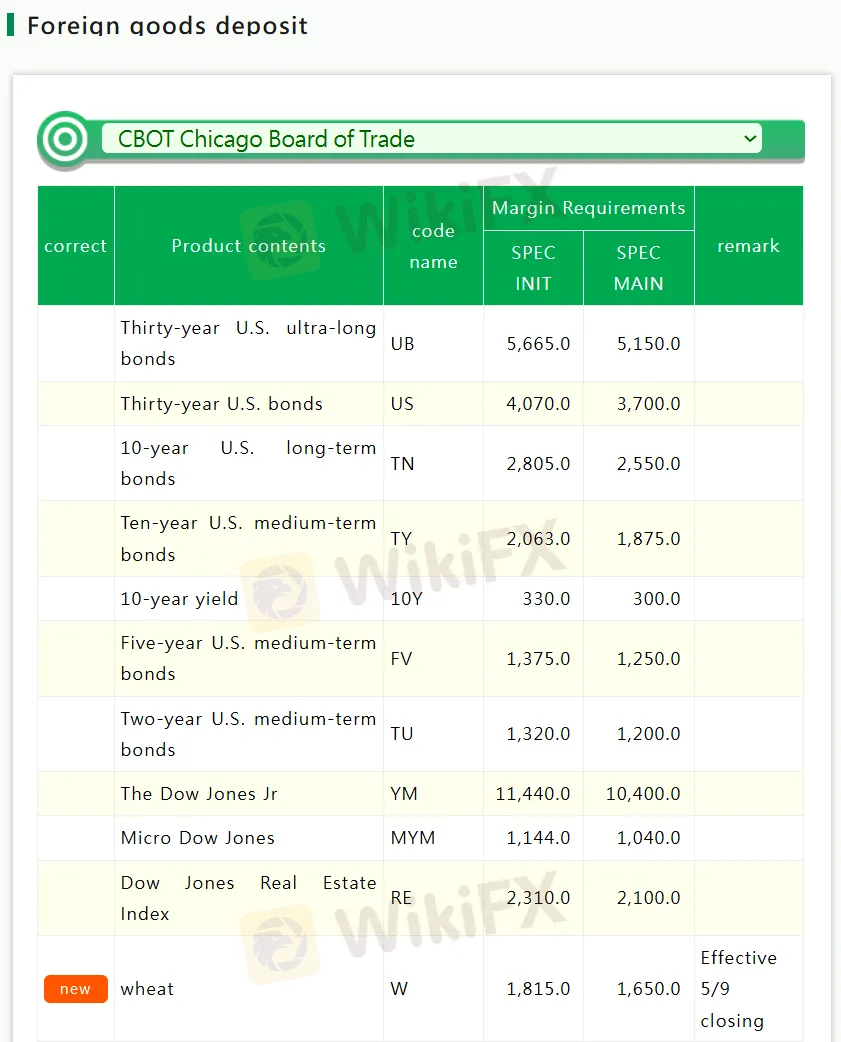

Cathay Futures, established in Taiwan in 1993 and regulated by the Taipei Exchange, is a company offering margin trading for both domestic and foreign commodities. The company provides access to futures trading on major international exchanges across Asia, Europe, and the Americas.

| Pros | Cons |

| Regulated by the Taipei Exchange | Unclear fee str |

| Access to major global exchanges | Limited contact channels |

| Long operation time |

Cathay Futures has a “Dealing in futures contracts & Leveraged foreign exchange trading” license regulated by the Taipei Exchange in Taiwan.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Taipei Exchange (TPEx) | Regulated | China (Taiwan) | Dealing in futures contracts & Leveraged foreign exchange trading | unreleased |

More

User comment

1

CommentsWrite a review

2024-01-09 18:13

2024-01-09 18:13